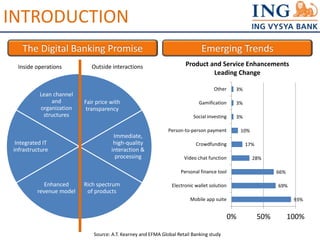

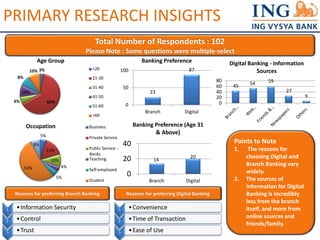

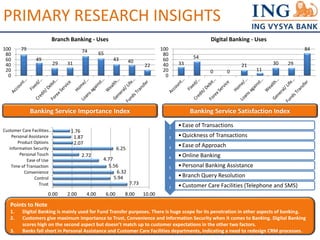

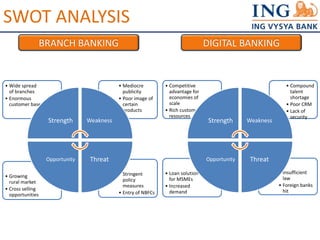

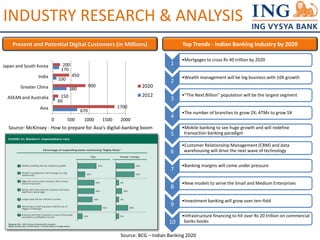

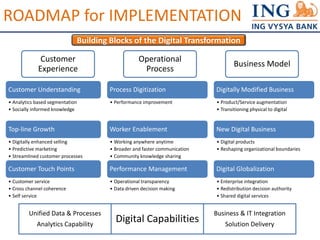

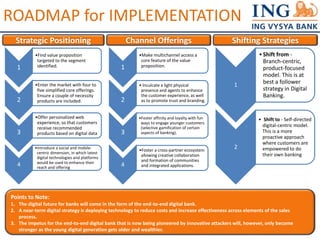

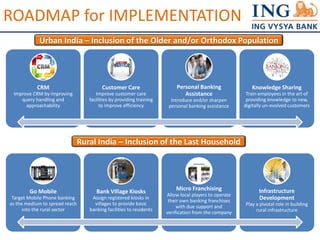

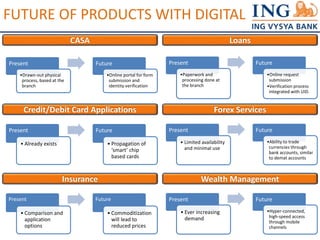

The document discusses strategies for digital banking transformation at a bank. It provides an analysis of primary research findings on customer preferences and usage of digital vs branch banking. A SWOT analysis identifies strengths and weaknesses of both approaches. Industry research shows growth of digital banking in Asia. The roadmap proposes a strategic shift to a digital-centric model and building blocks for digital transformation including customer understanding, process digitization, and analytics capabilities. It concludes that Indian banks must bridge the digital divide and adopt digital banking through improved CRM, customer support, and knowledge sharing.