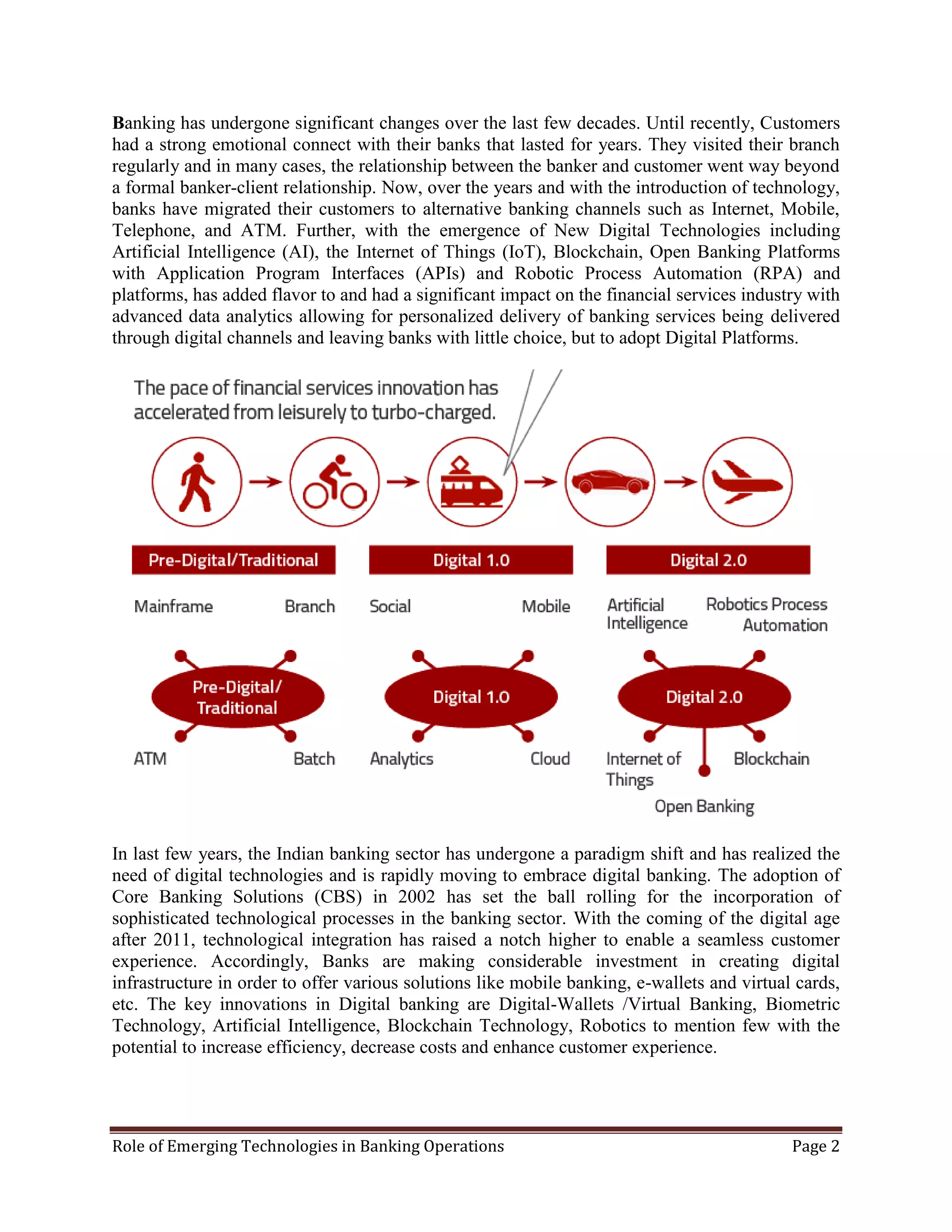

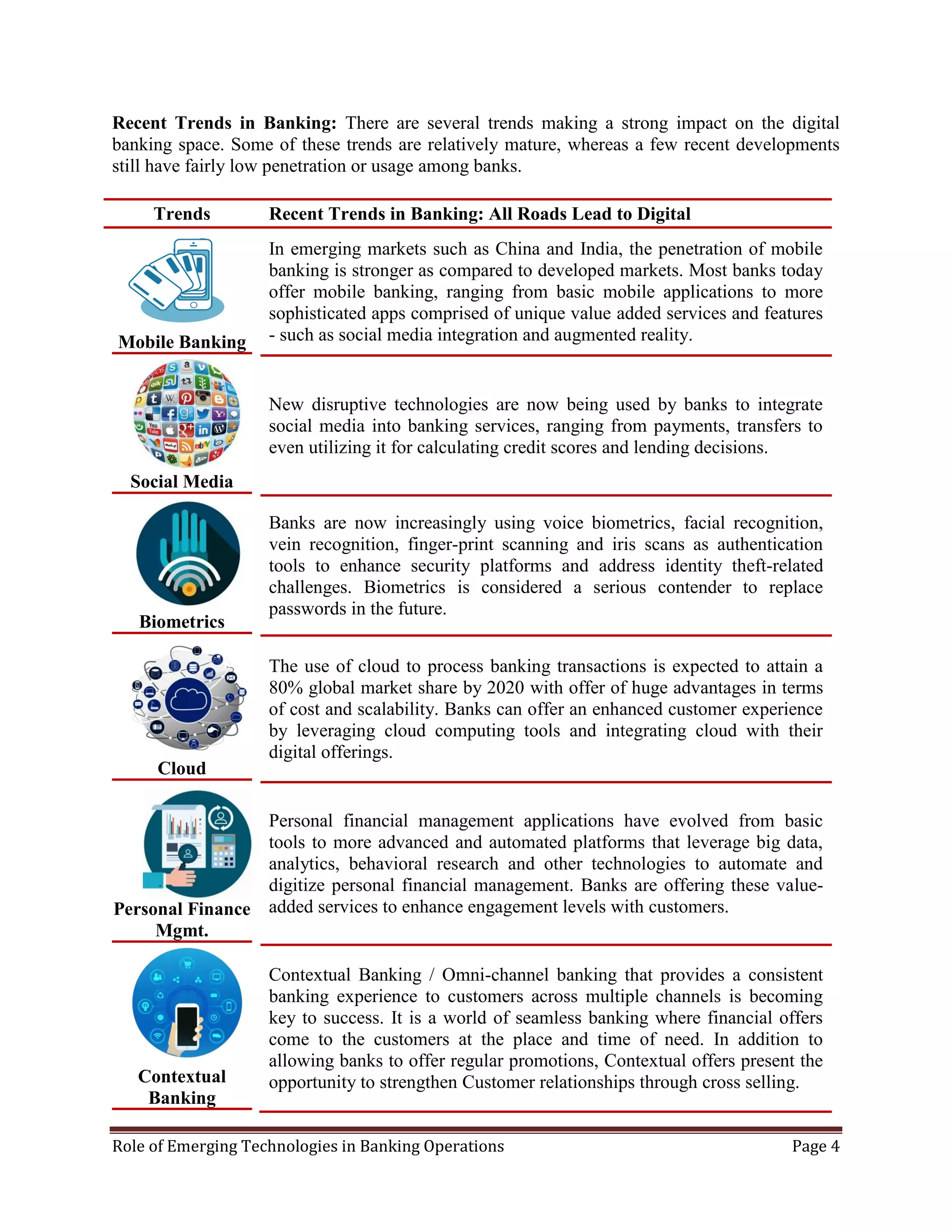

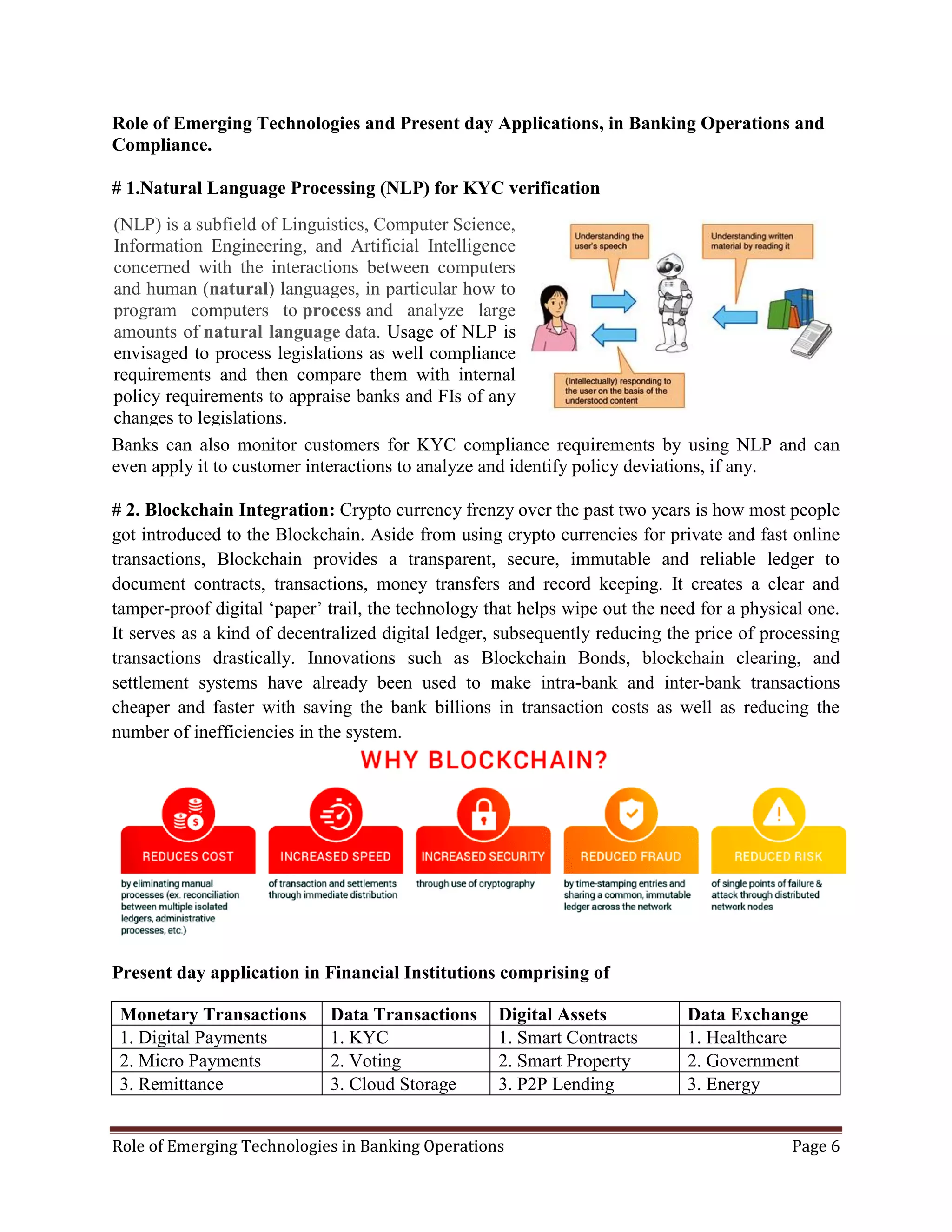

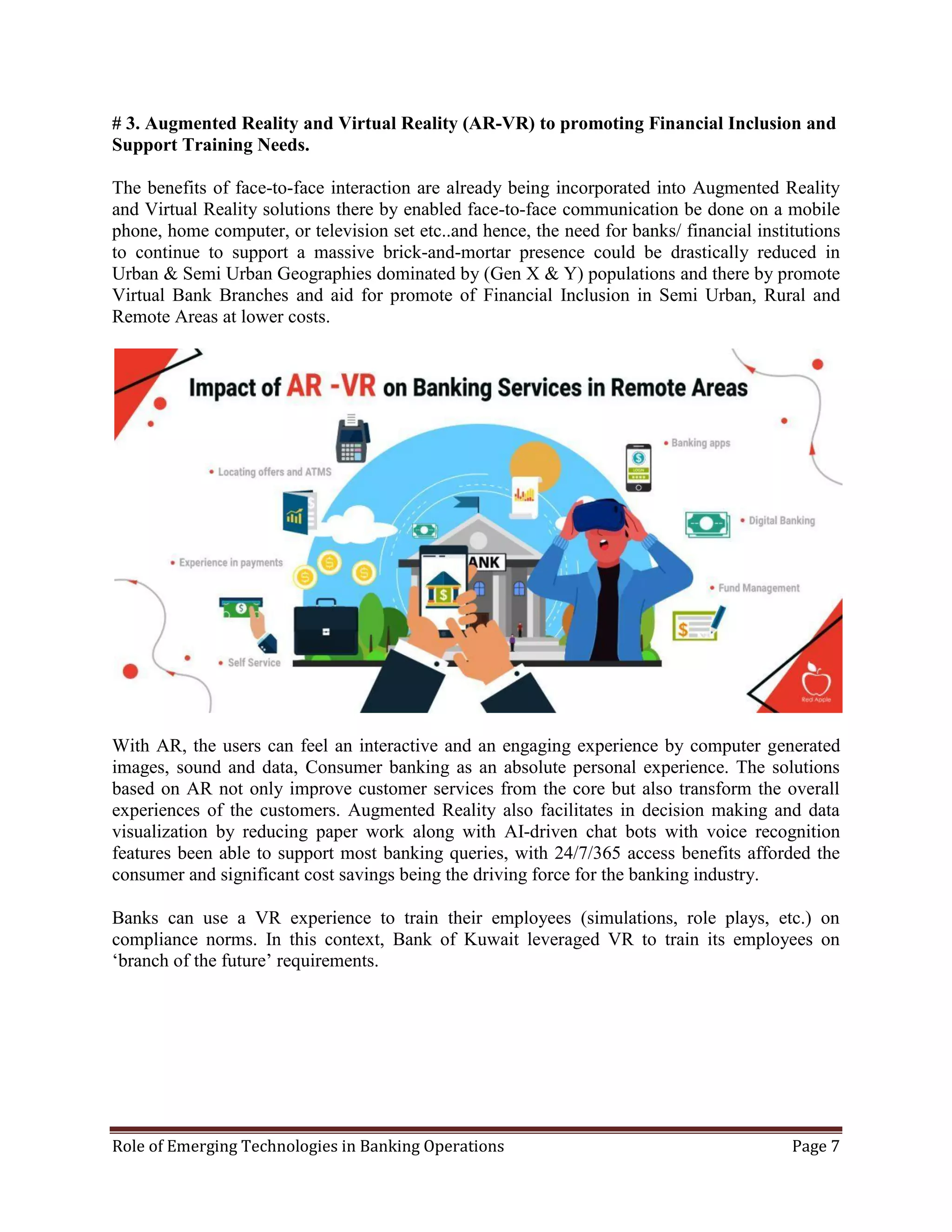

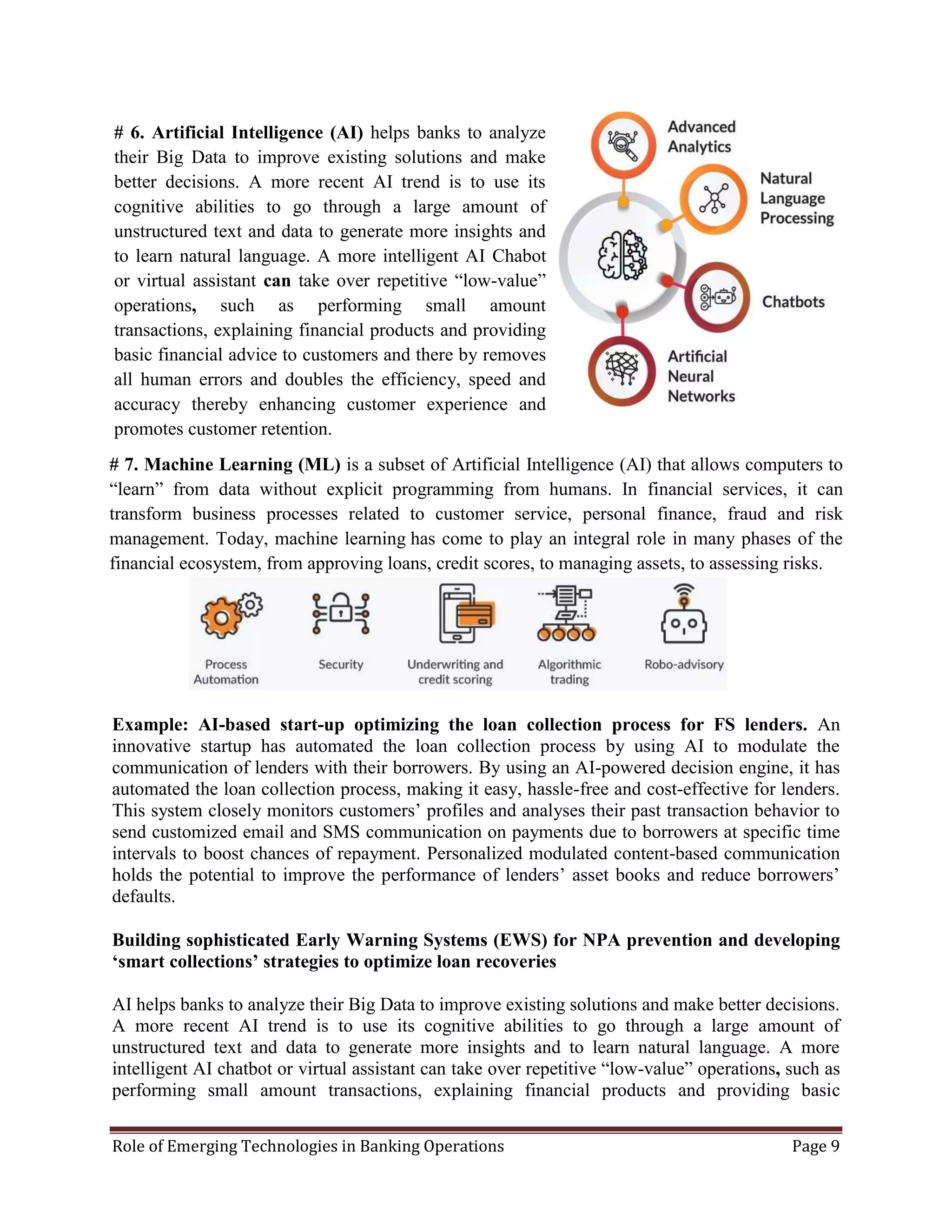

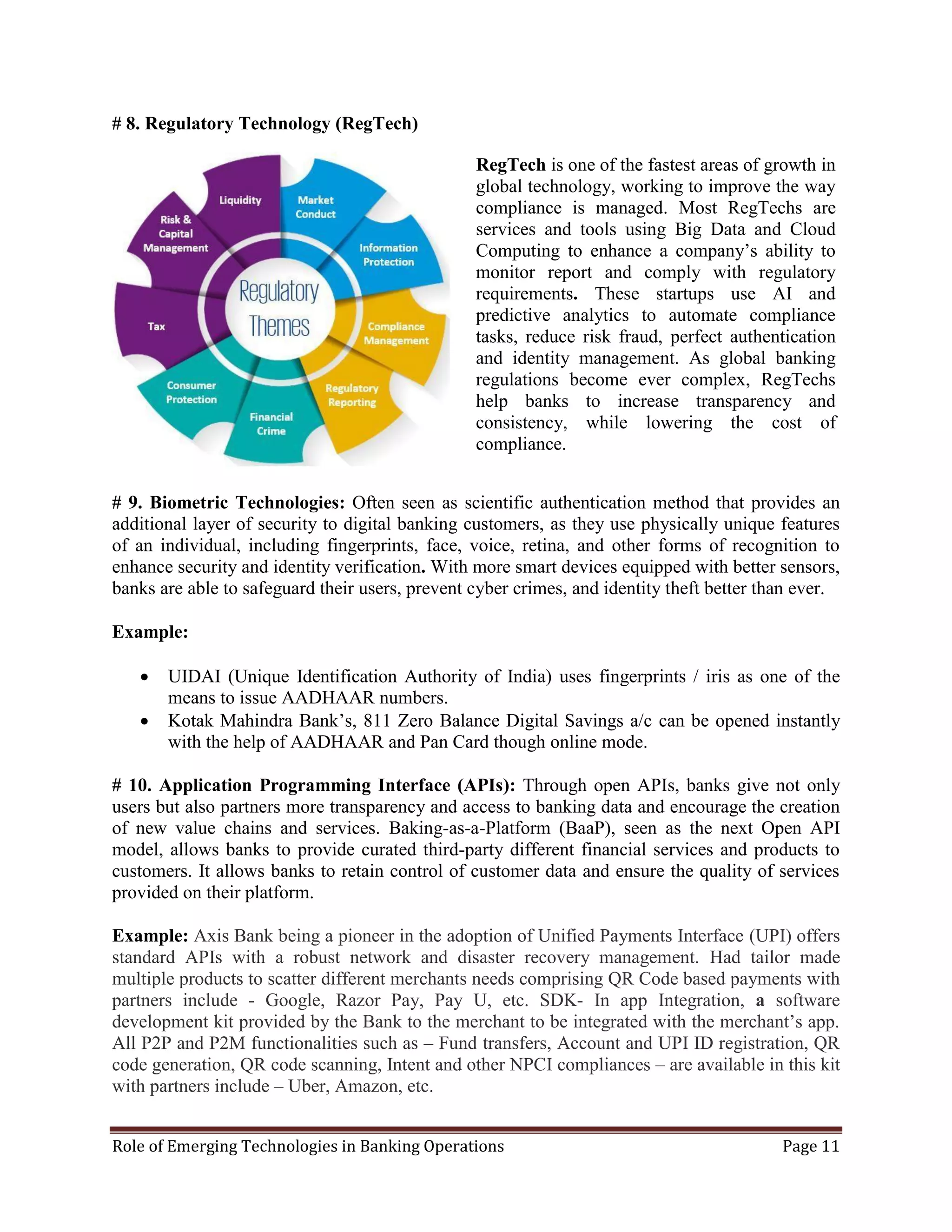

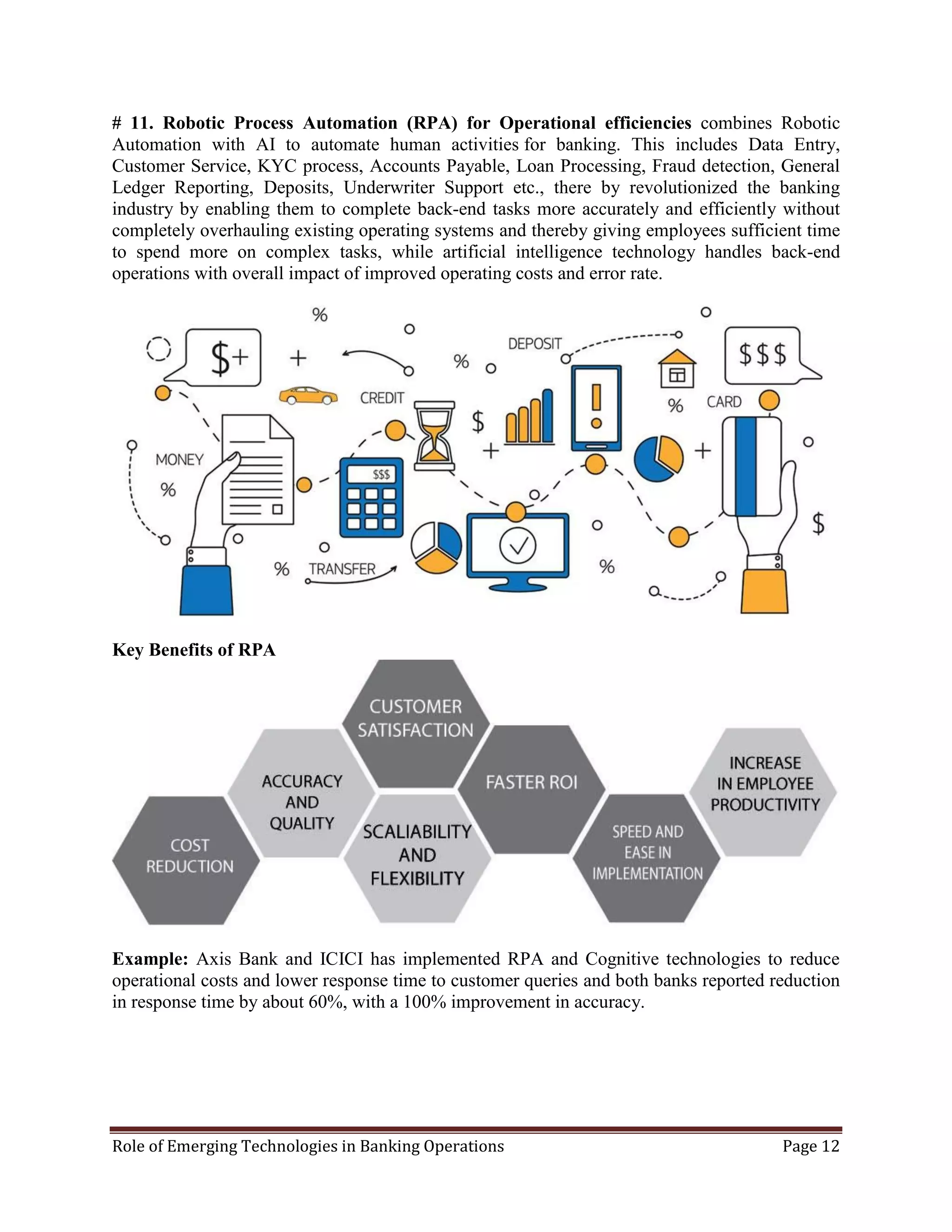

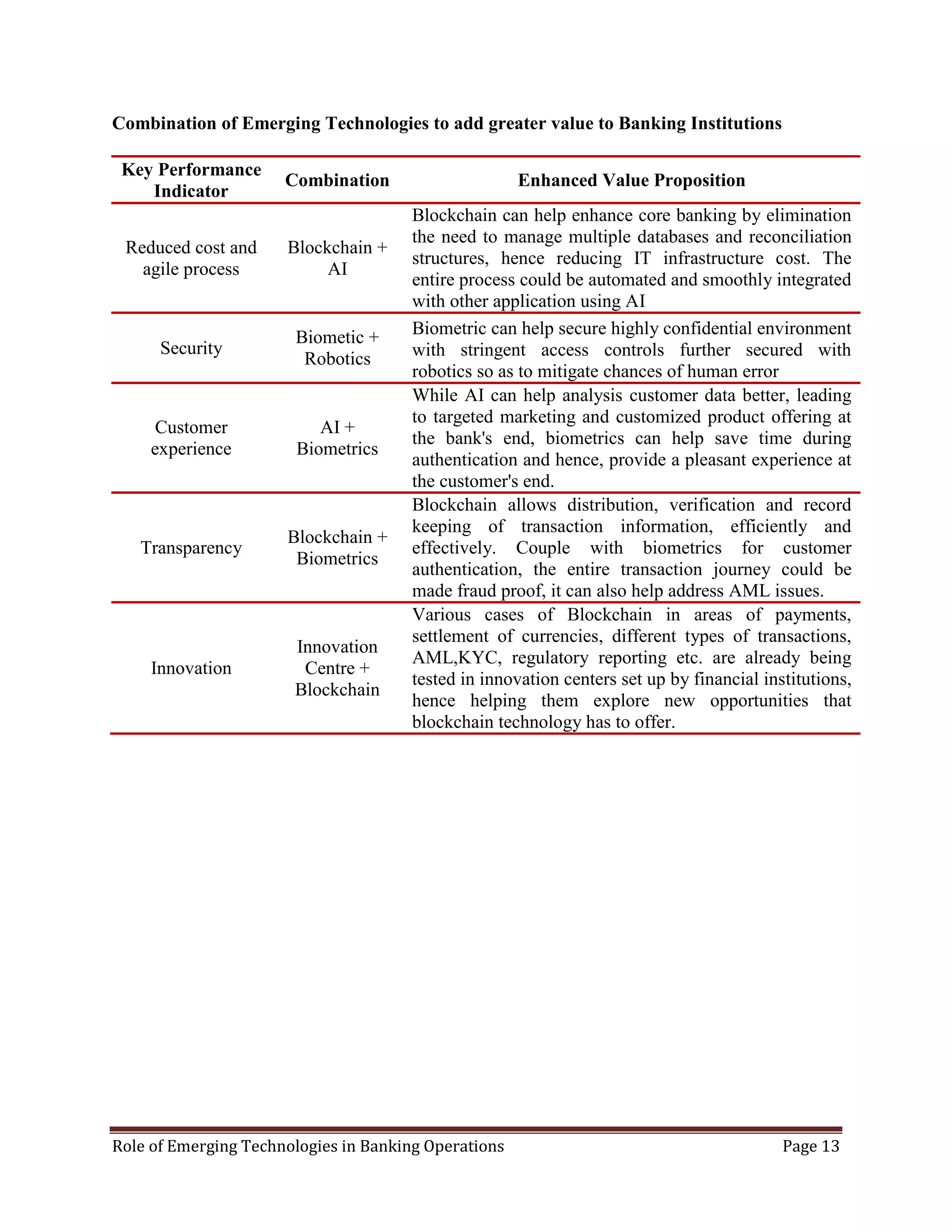

The document discusses the role of emerging technologies in banking operations. It describes how technologies like artificial intelligence, blockchain, cloud computing, big data analytics, and machine learning are transforming banking. These technologies are enabling personalized customer experiences, improving risk management and fraud detection, automating processes, and reducing costs. The document also provides examples of various banks implementing technologies like AI, blockchain, APIs, biometrics, and regulatory tech to enhance operations, compliance, security, and the customer experience.