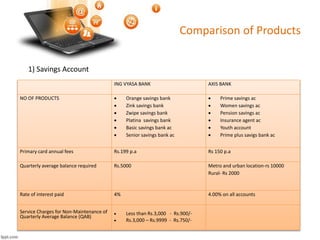

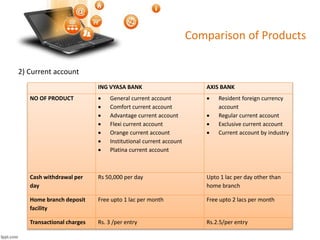

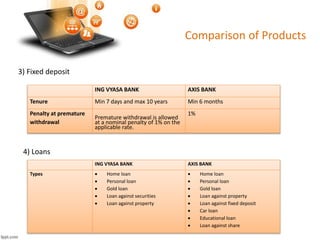

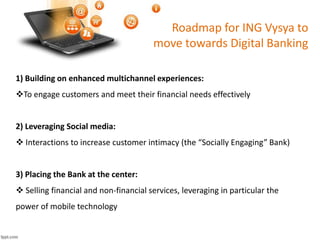

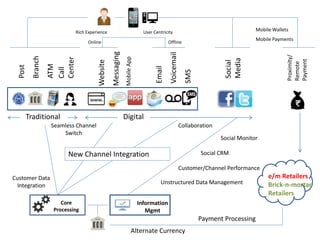

This document discusses digital banking versus branch banking and provides a roadmap for ING Vysya Bank to move towards more digital banking. It highlights the advantages of digital banking through a SWOT analysis and compares the products offered by ING Vysya Bank and Axis Bank. Additional features for ING's digital platform like wallets, chat, a virtual branch, and customized products are proposed. Research findings show a need for banks to improve digital services to increase profits and customer base.