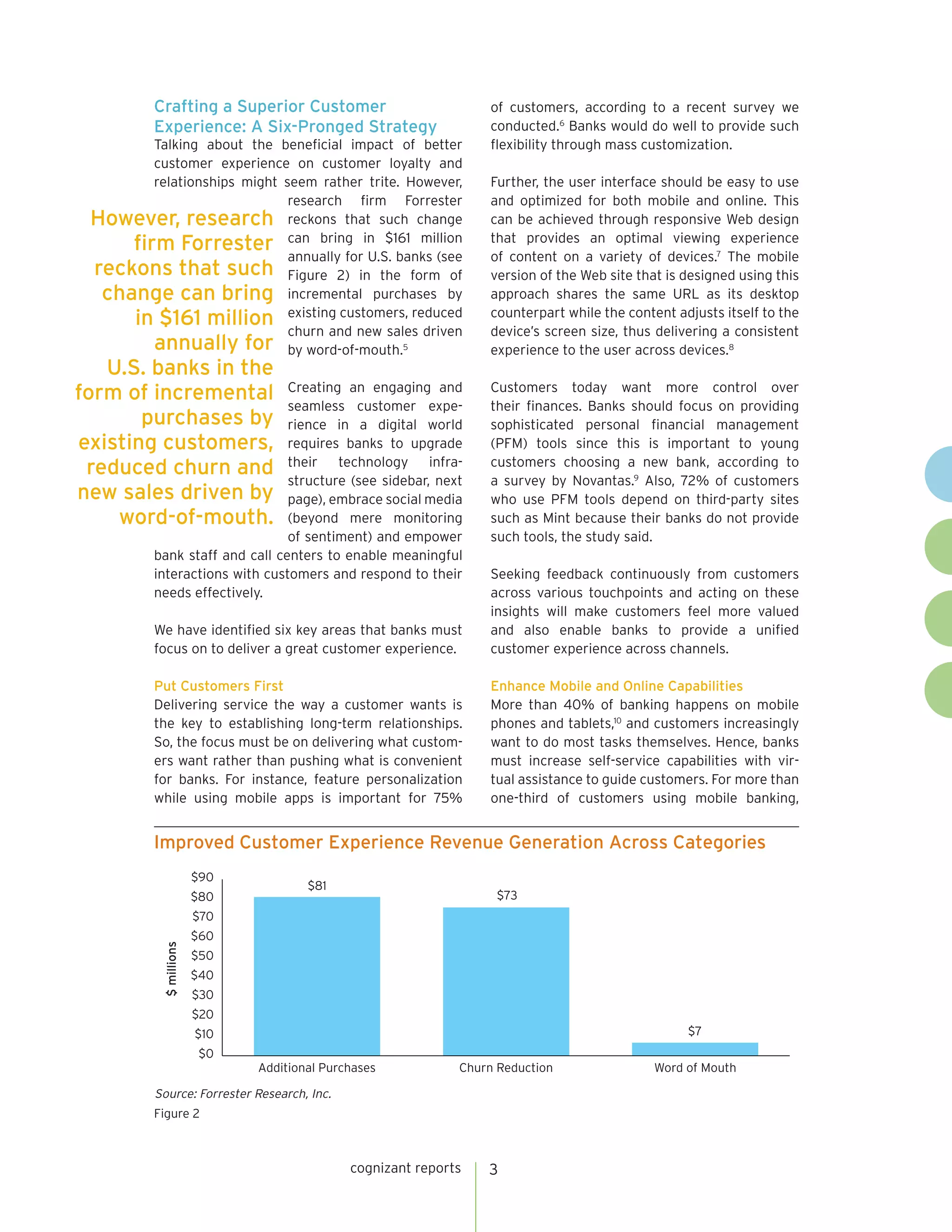

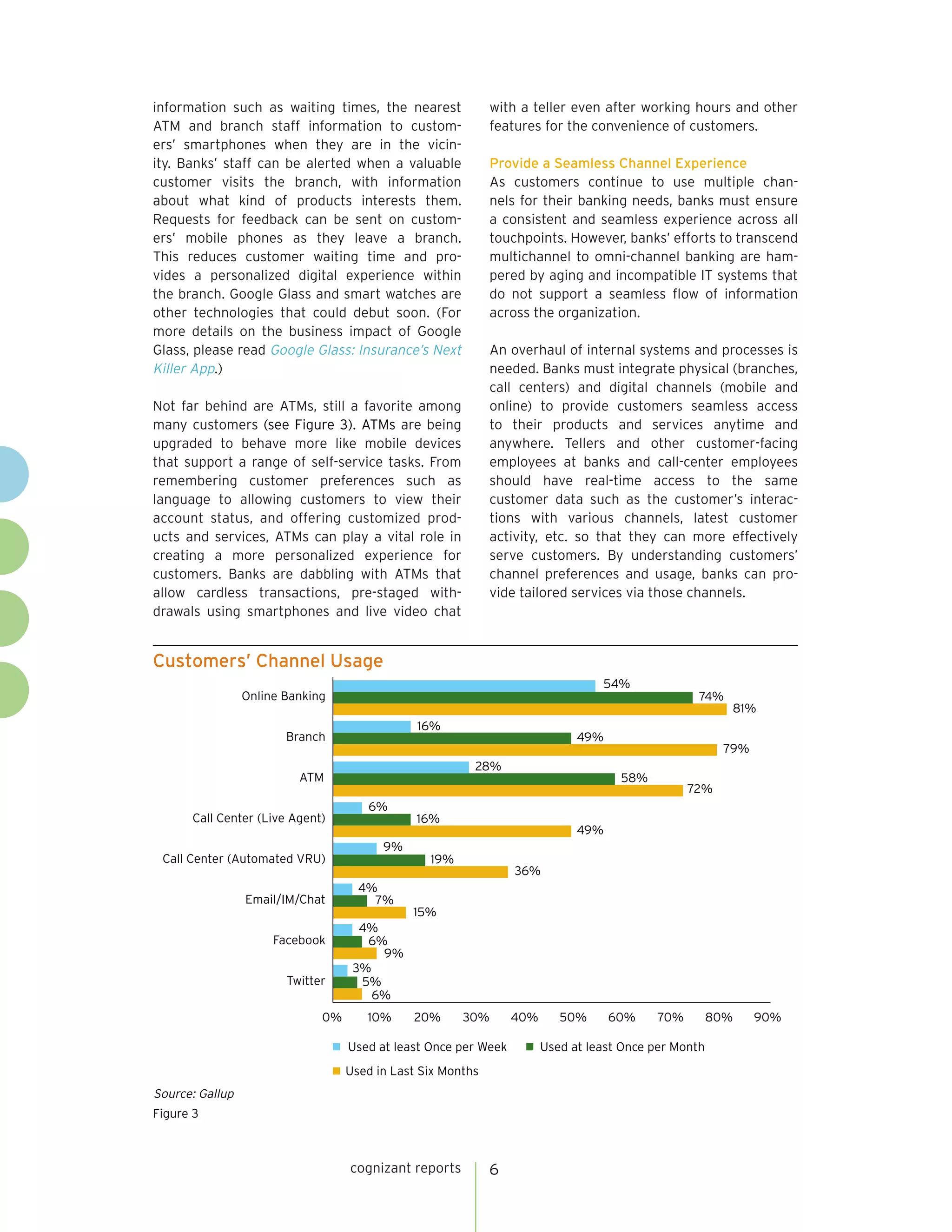

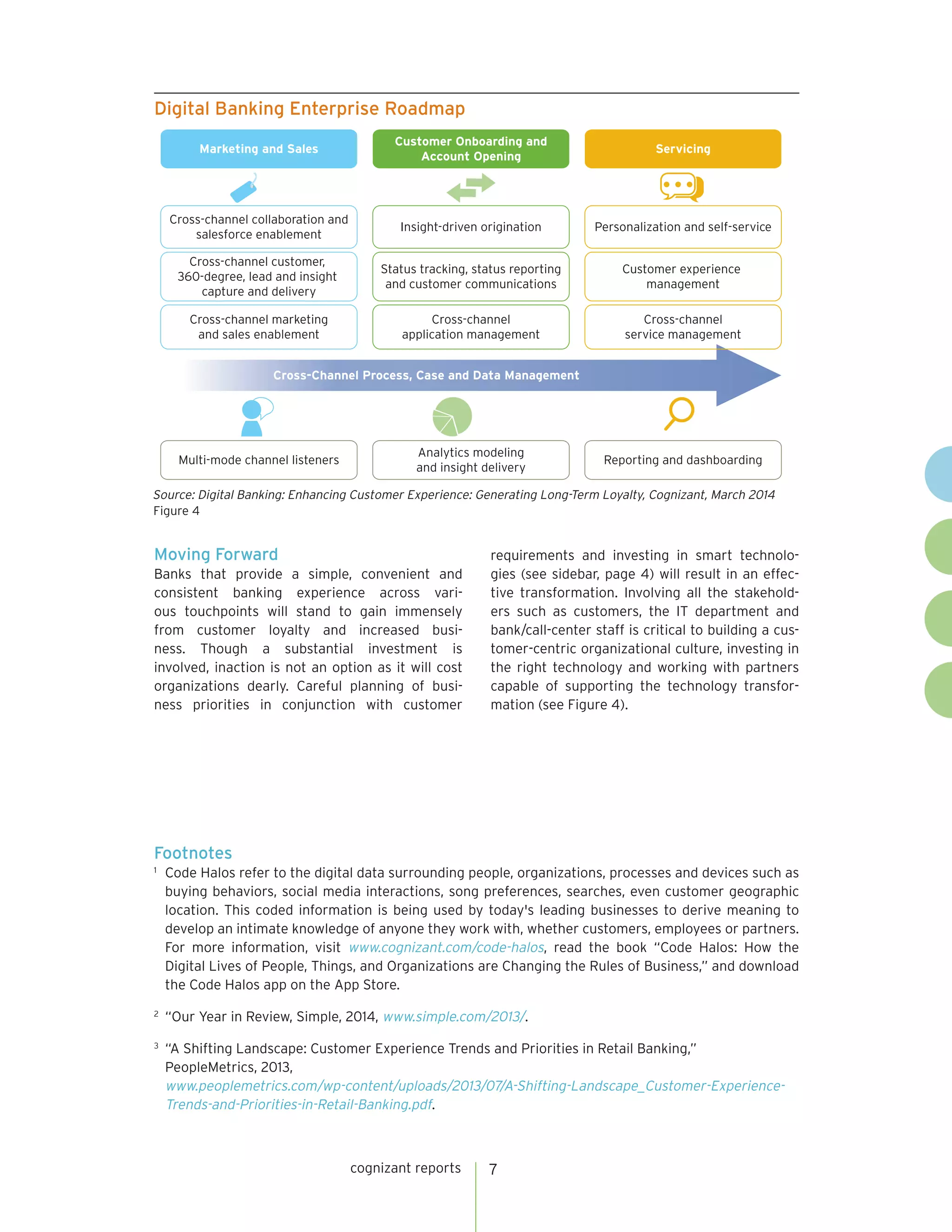

Traditional banks face challenges in enhancing digital customer experiences due to rising competition from digital-only banks and changing customer expectations for personalized and seamless services. To address these issues, banks are encouraged to adopt a customer-centric strategy focused on improving mobile capabilities, leveraging customer data, and integrating various banking touchpoints. By doing so, banks can enhance customer loyalty and satisfaction, ultimately benefiting their overall business performance.