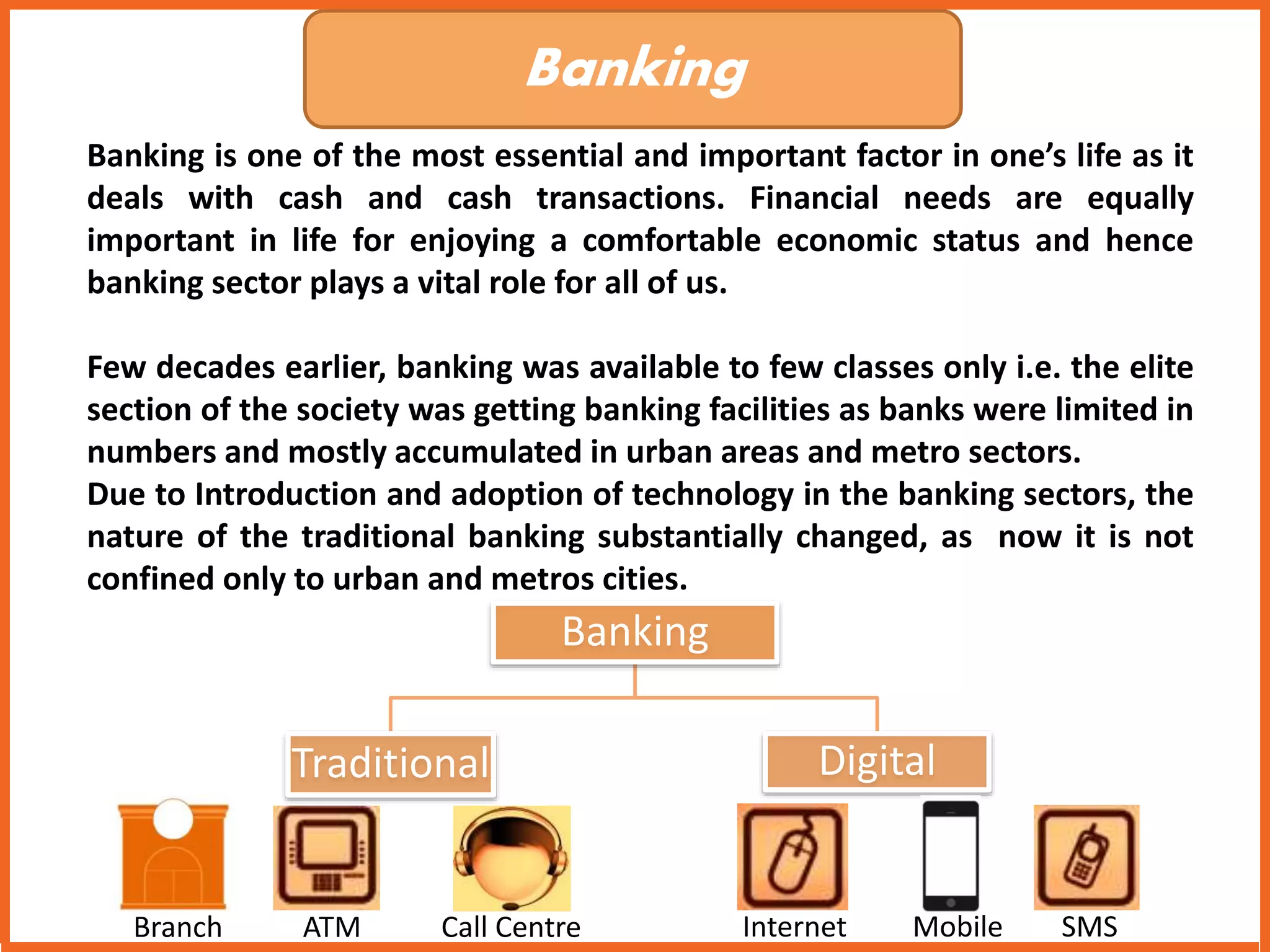

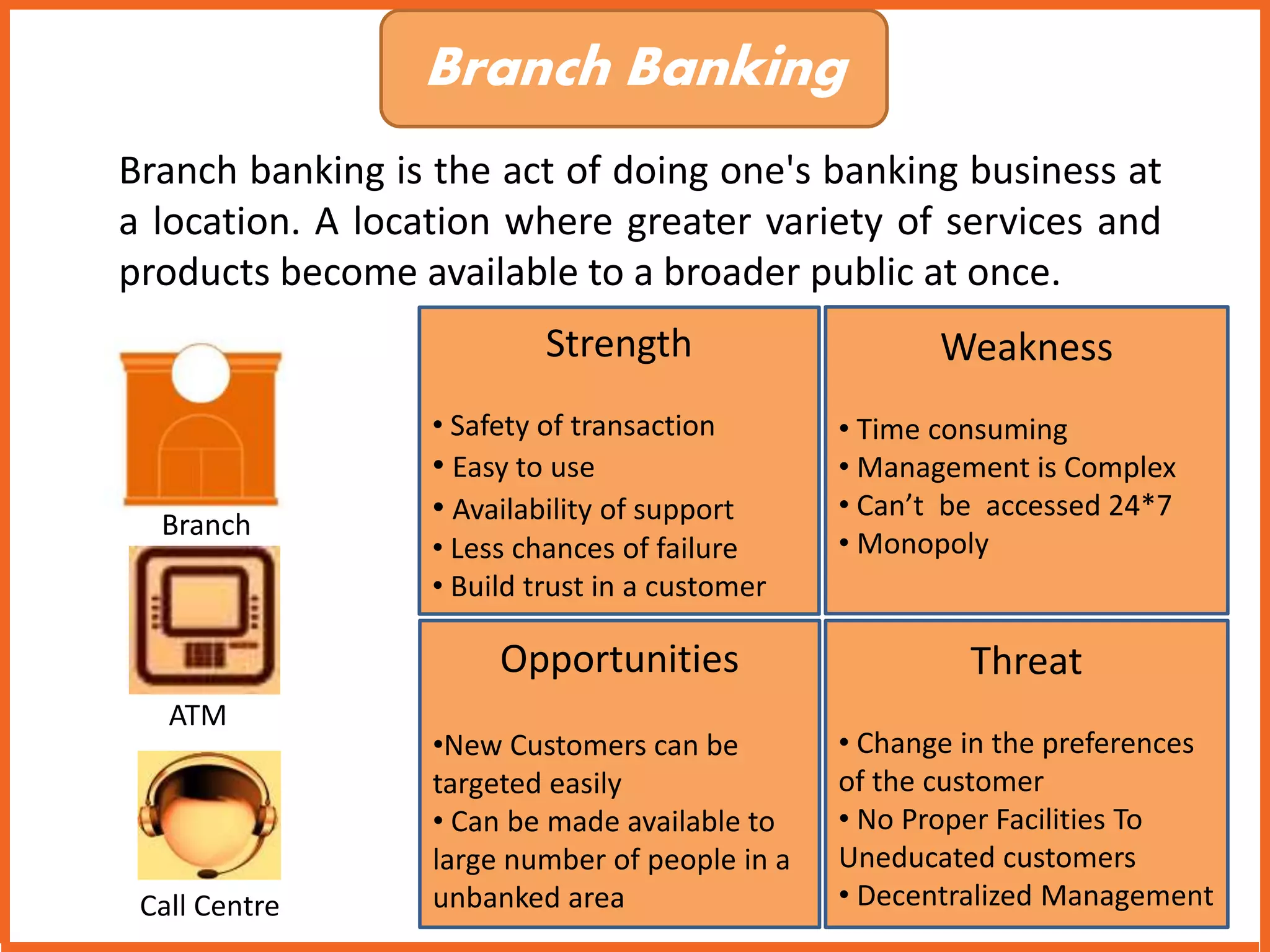

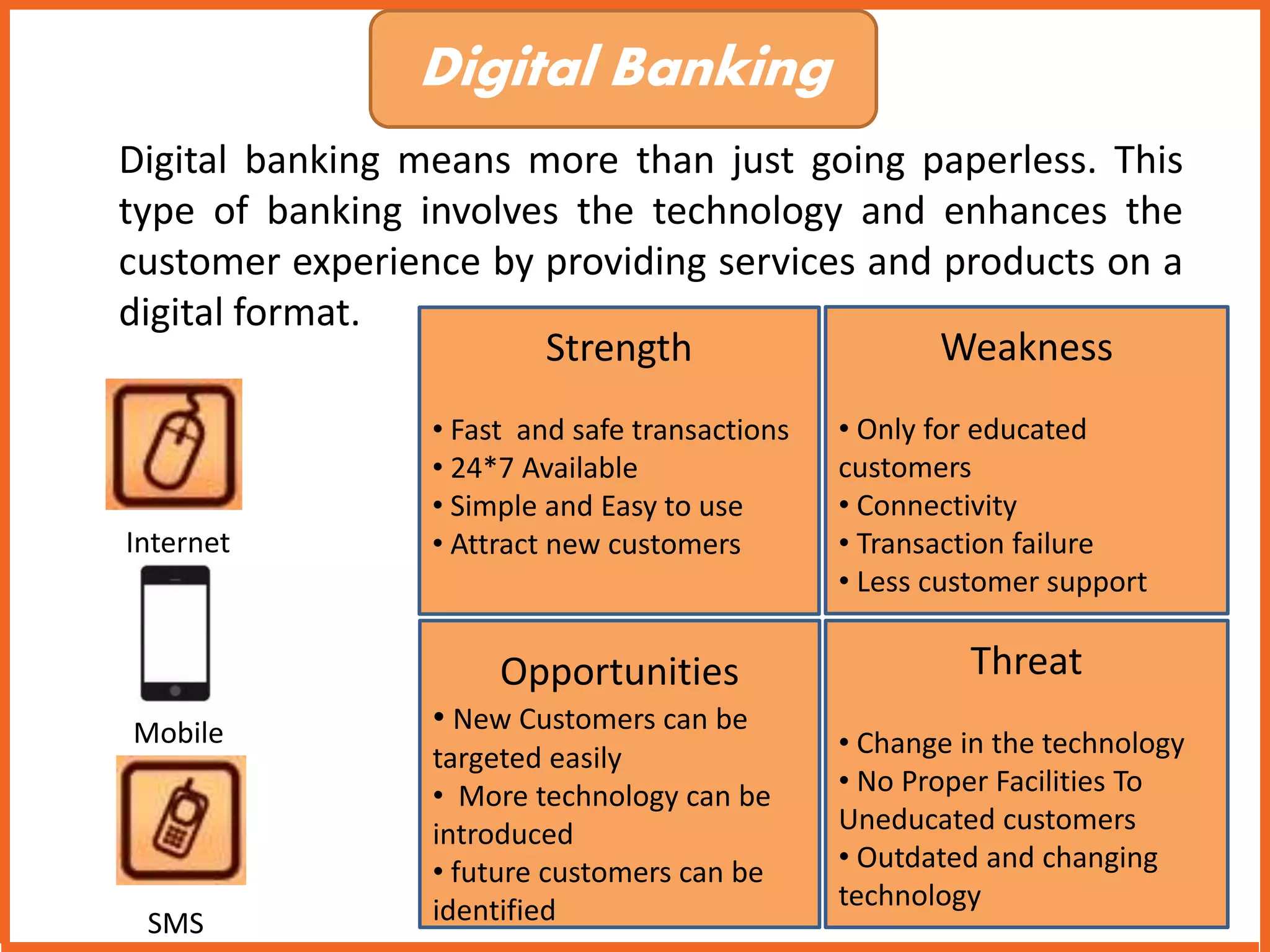

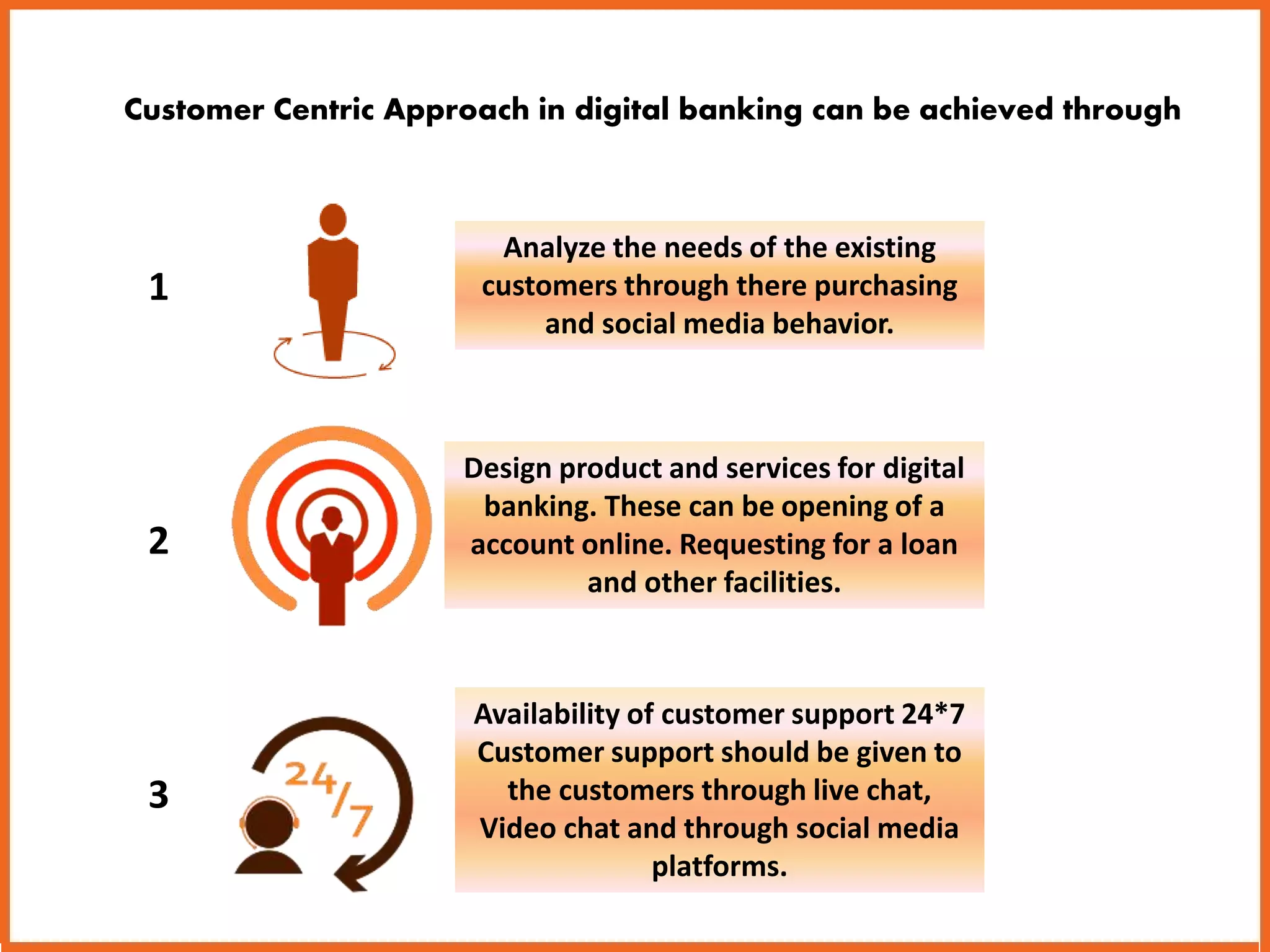

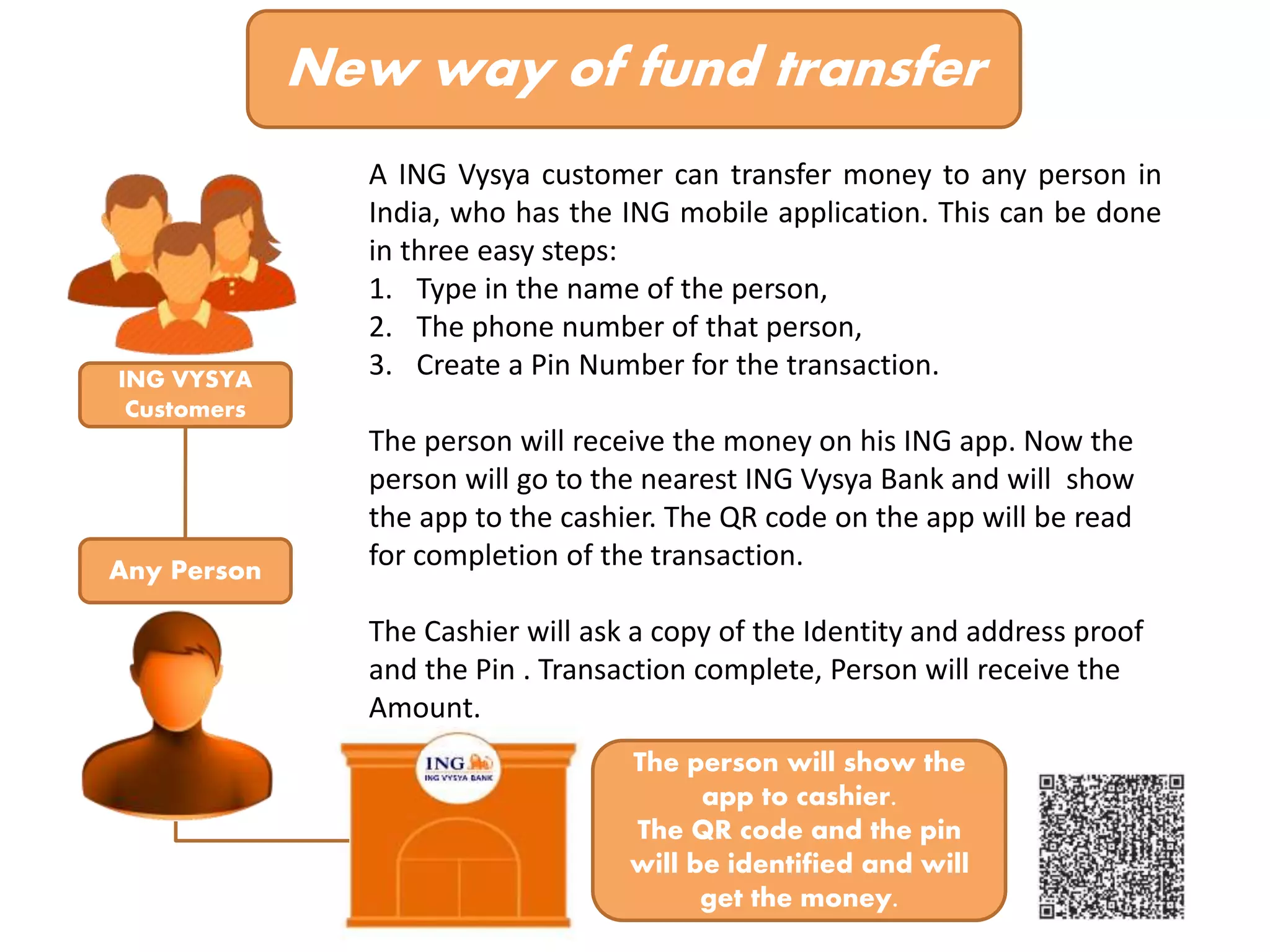

This document discusses the transition from traditional branch banking to digital banking. It analyzes the strengths and weaknesses of branch banking versus digital banking. The document then recommends a roadmap for ING Vysya Bank to move towards digital banking, including adopting a more customer-centric approach, targeting rural areas through technology, finding new ways to engage customers, and integrating products and services on a digital platform.