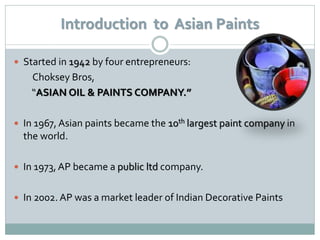

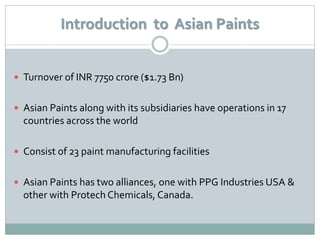

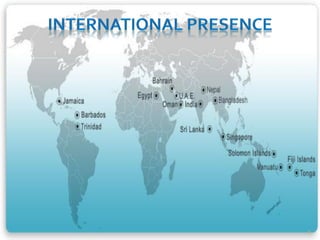

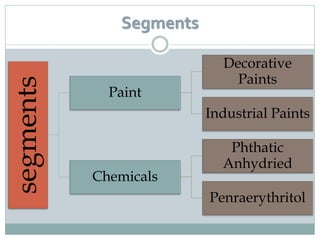

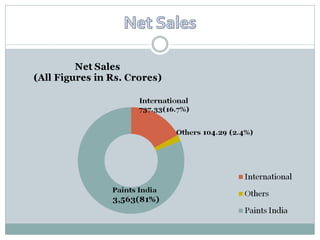

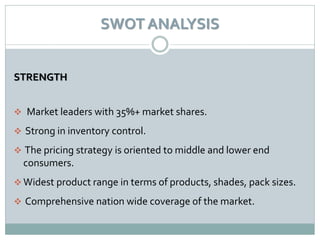

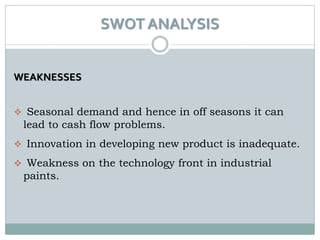

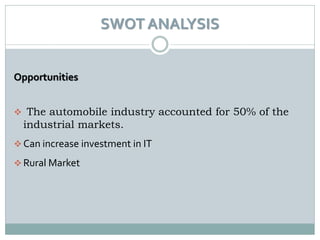

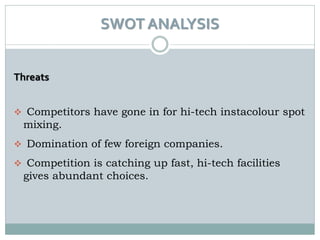

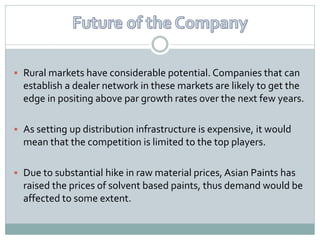

The document provides information about the paint industry in India and Asian Paints. It states that the paint industry in India is estimated at INR 135 billion with 35% of the market being unorganized. Asian Paints started in 1942 and has since become a market leader in India with over 35% market share. It has operations in 17 countries and 23 manufacturing facilities. While it faces threats from competition and raw material price fluctuations, it can leverage opportunities in the rural market and automotive industry.