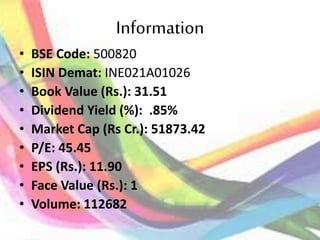

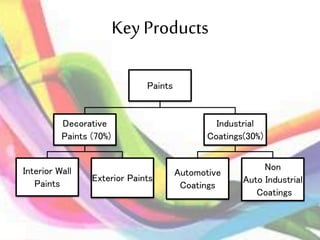

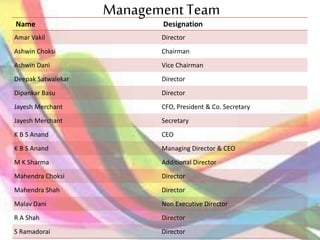

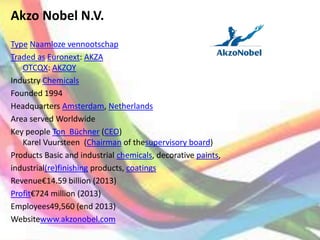

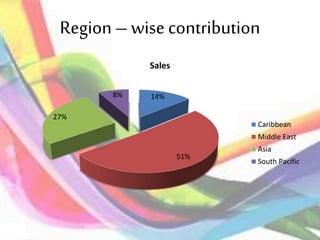

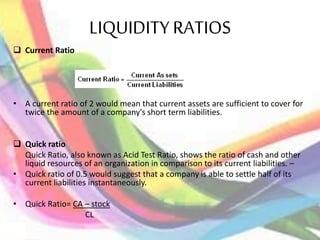

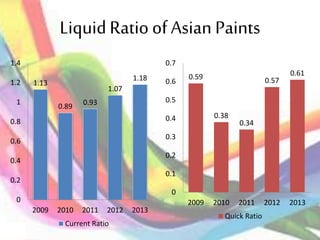

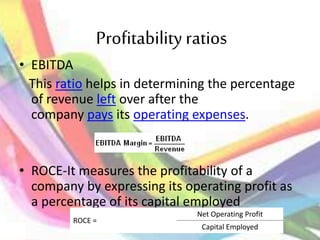

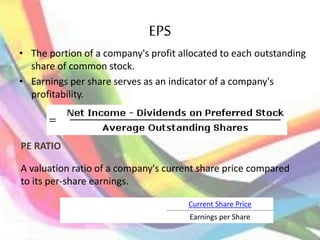

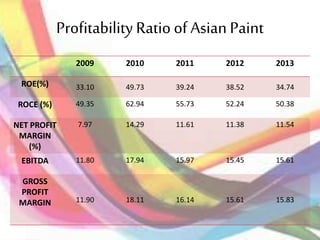

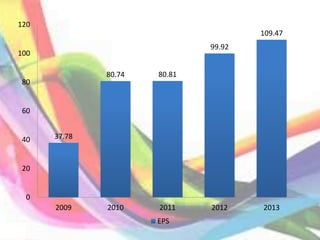

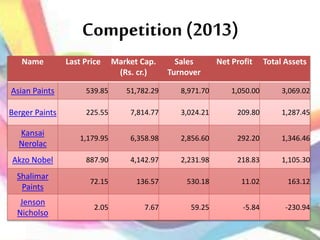

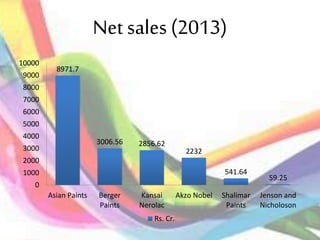

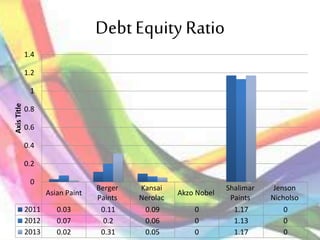

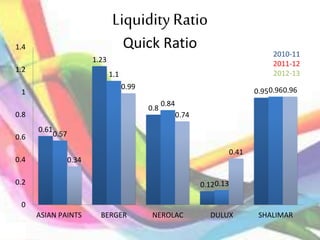

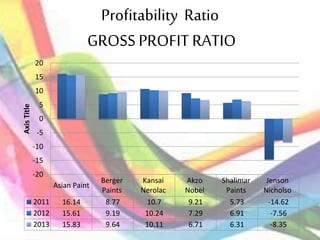

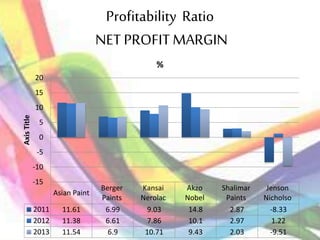

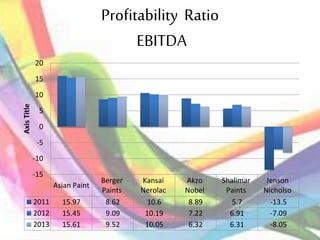

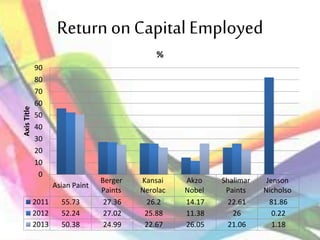

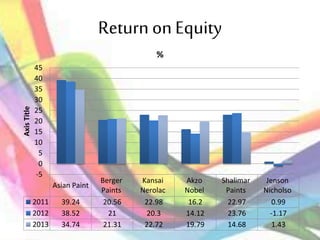

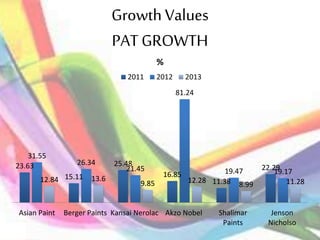

- The document provides financial information and analysis of Asian Paints and compares it to 5 peers. It includes details on the company profile, products, market share, global presence, financial ratios, and performance over time. Asian Paints has the largest market share in India's paint industry at around 50% and has a global presence in 17 countries. Financial analysis shows Asian Paints has strong liquidity, debt, and profitability ratios compared to peers.