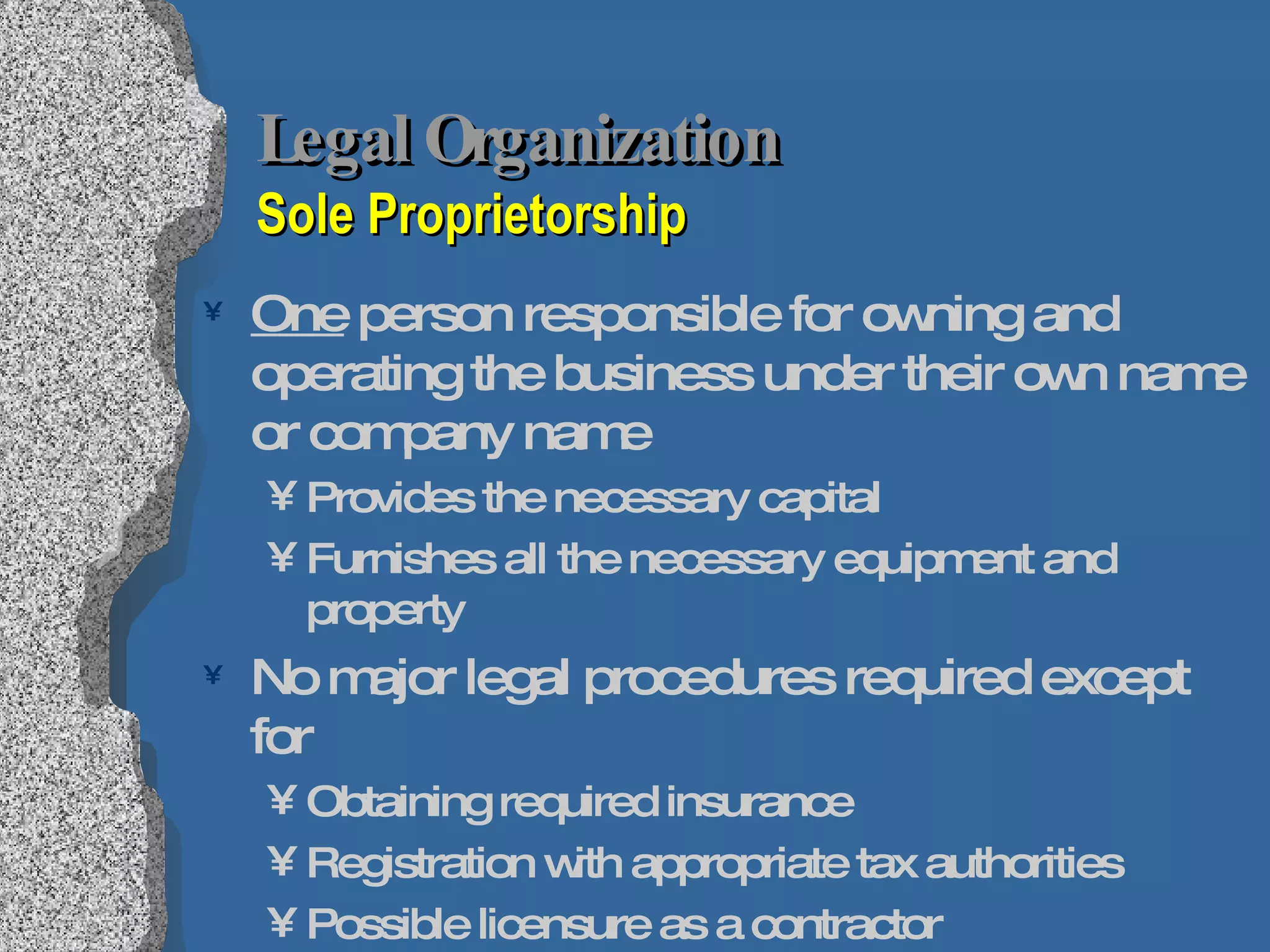

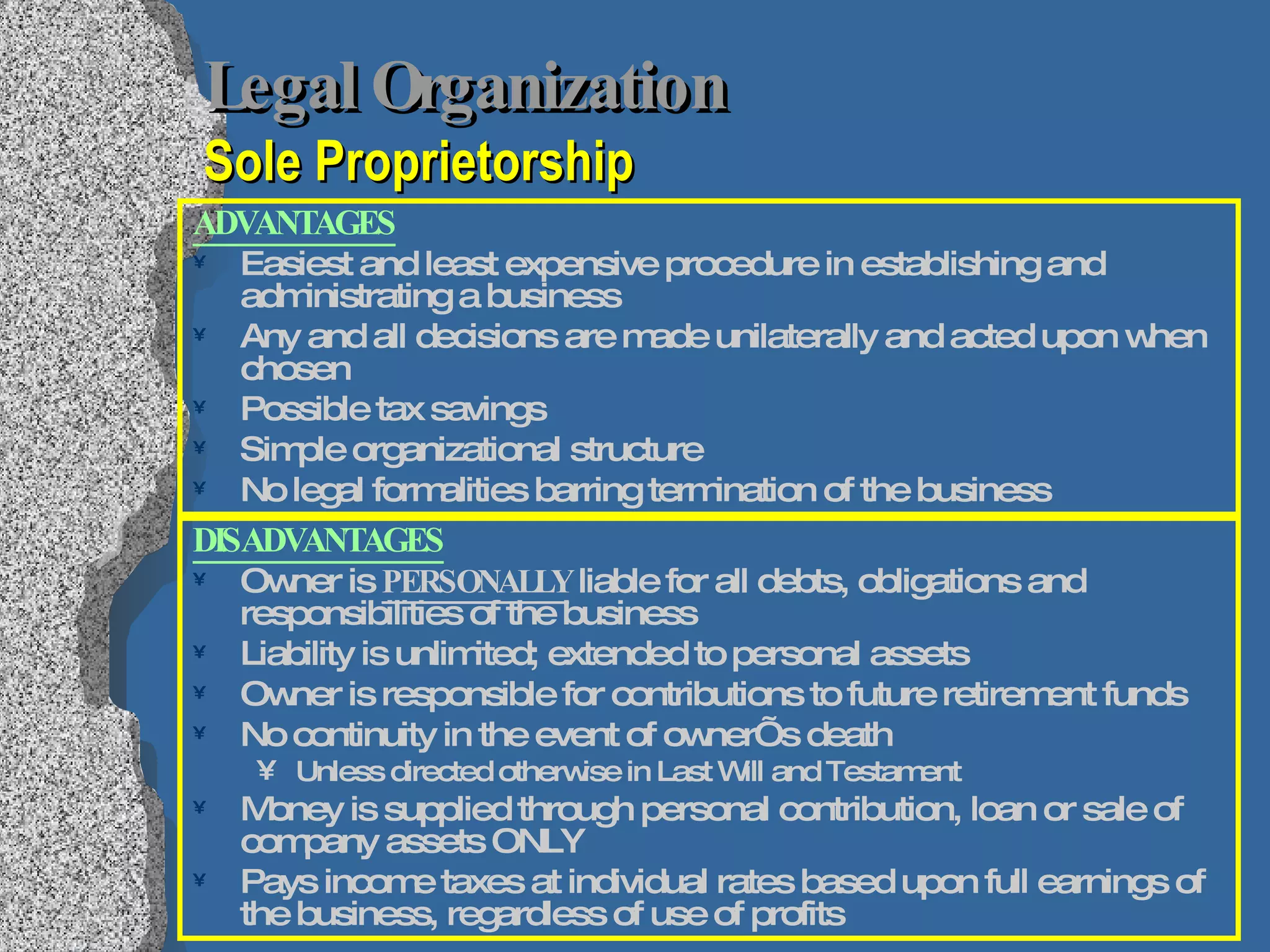

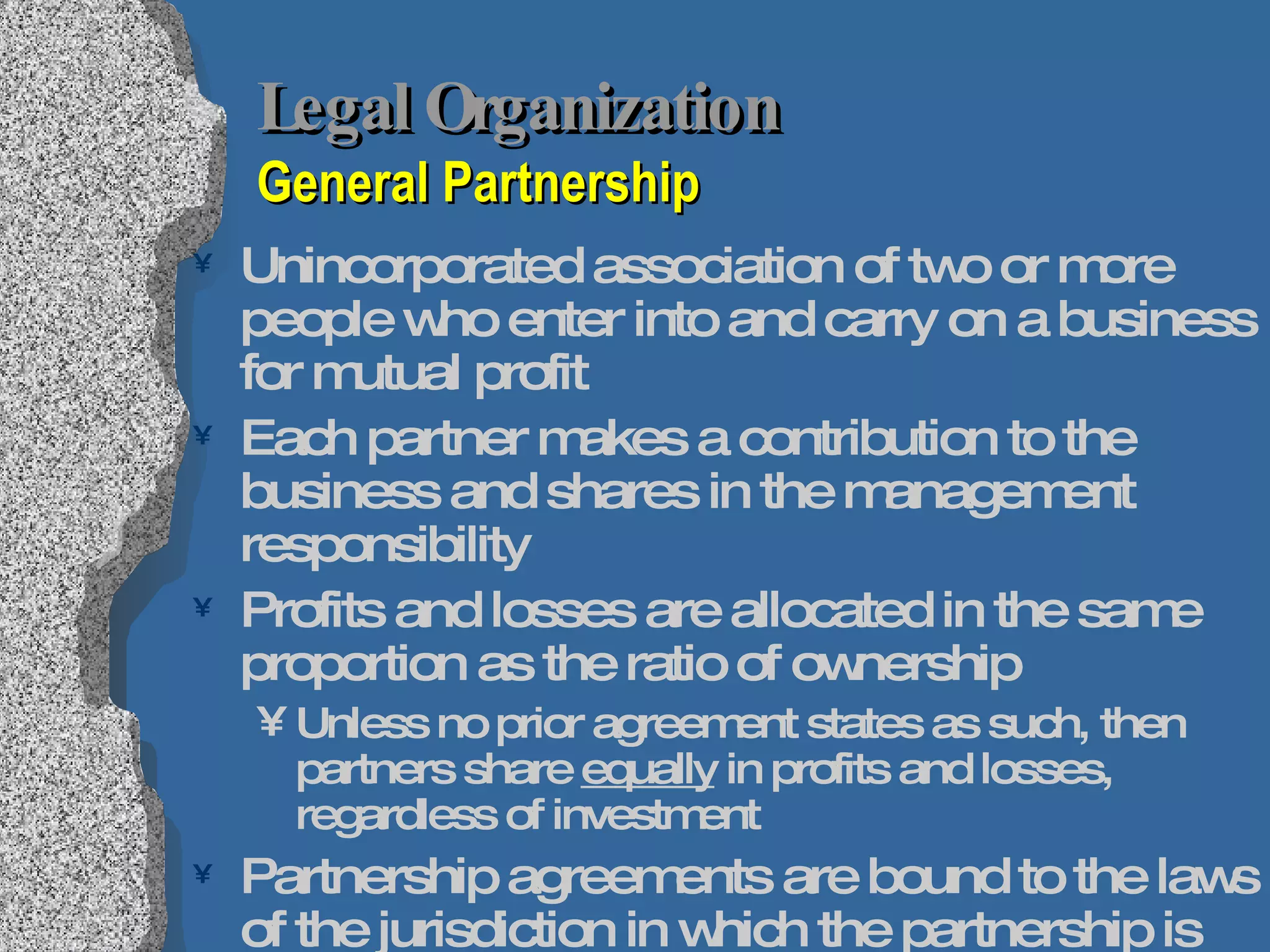

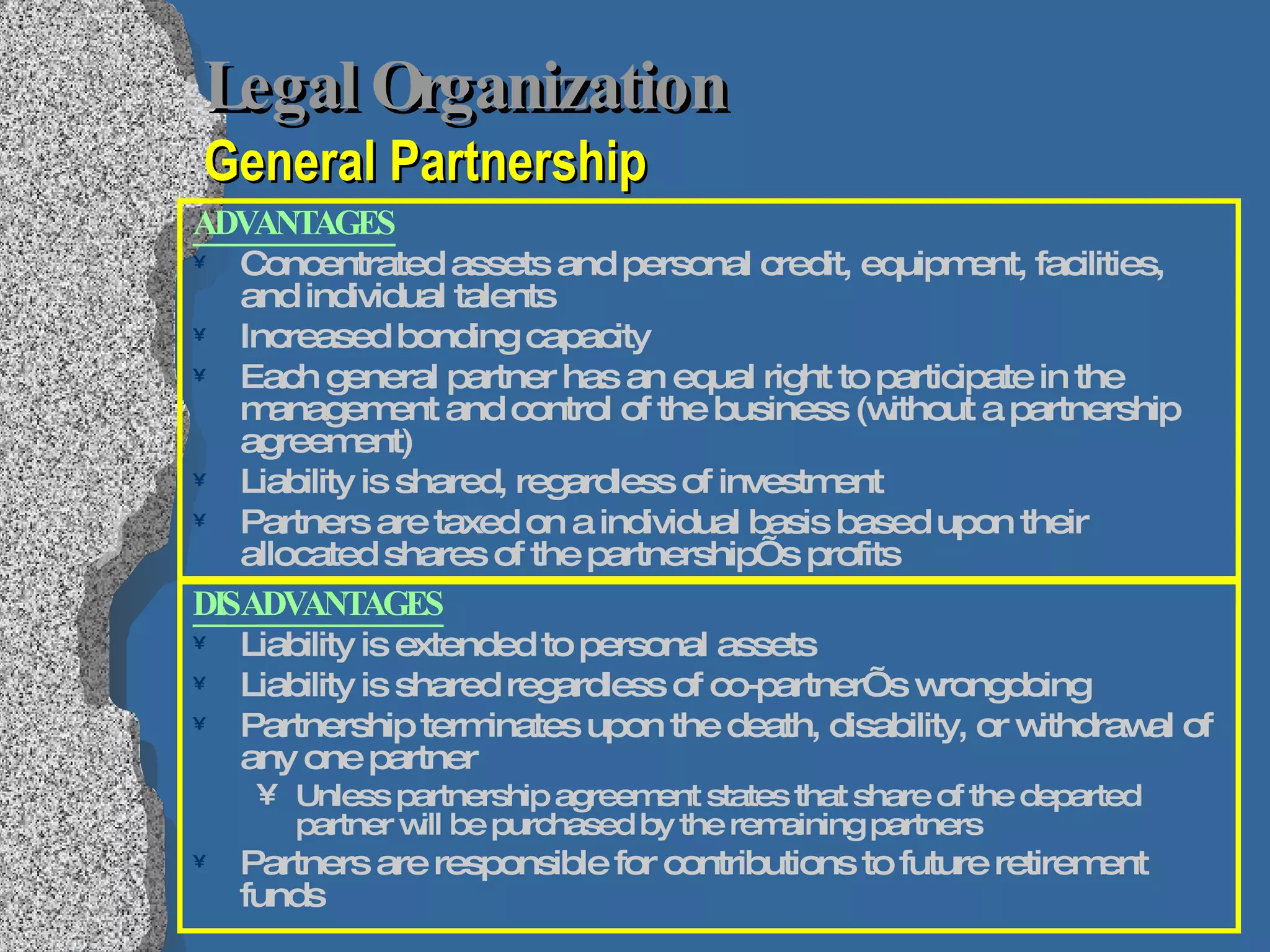

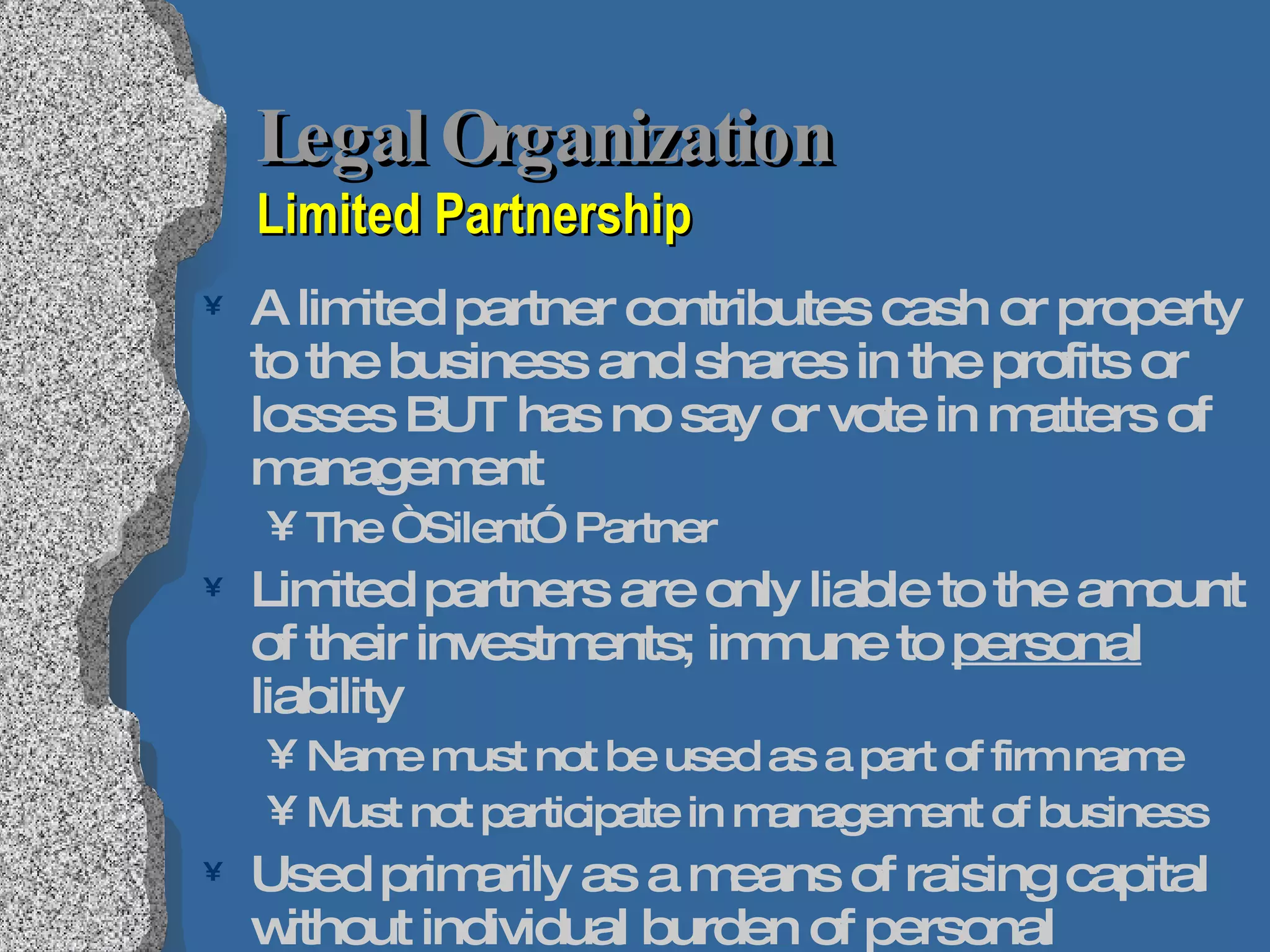

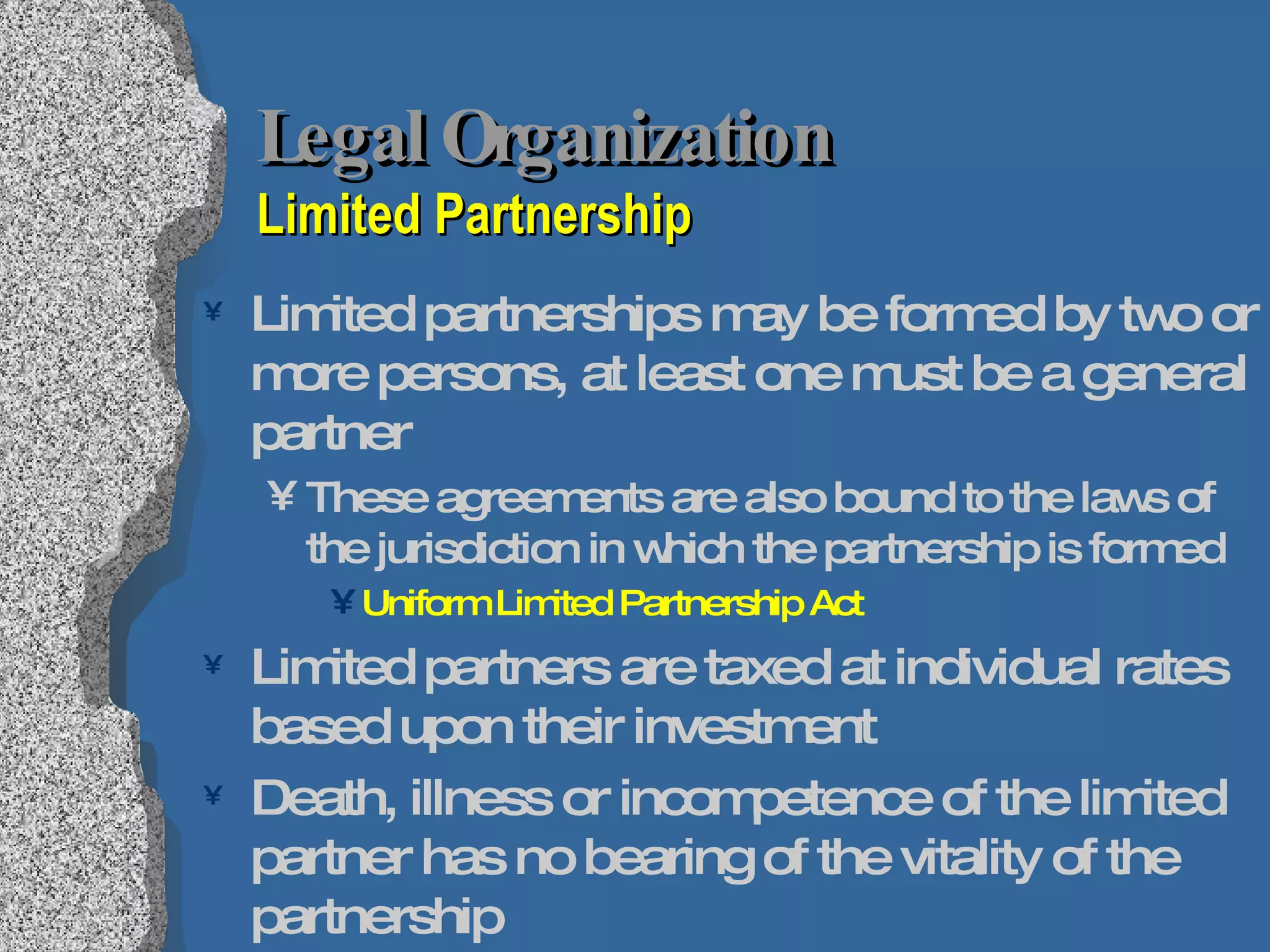

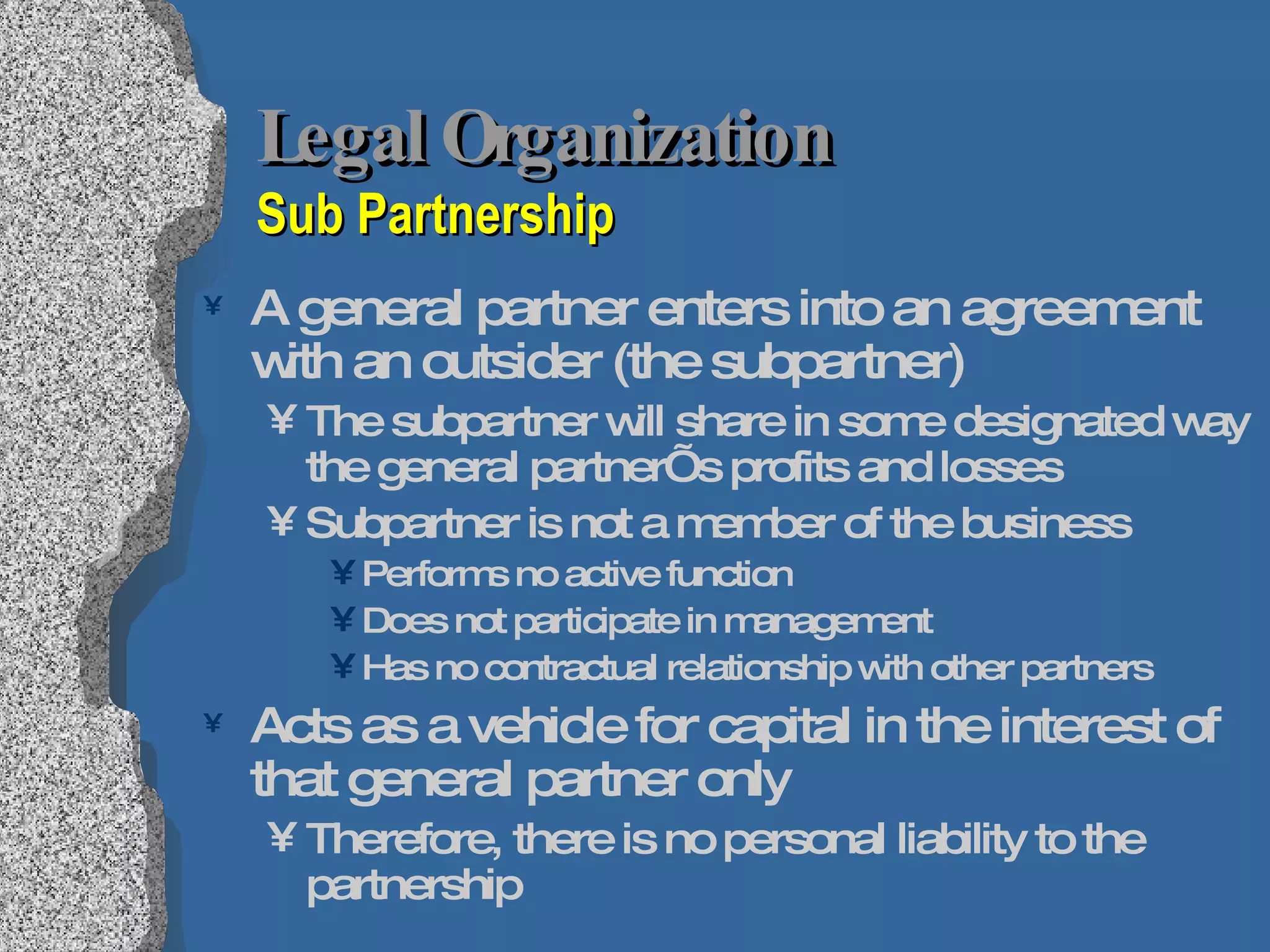

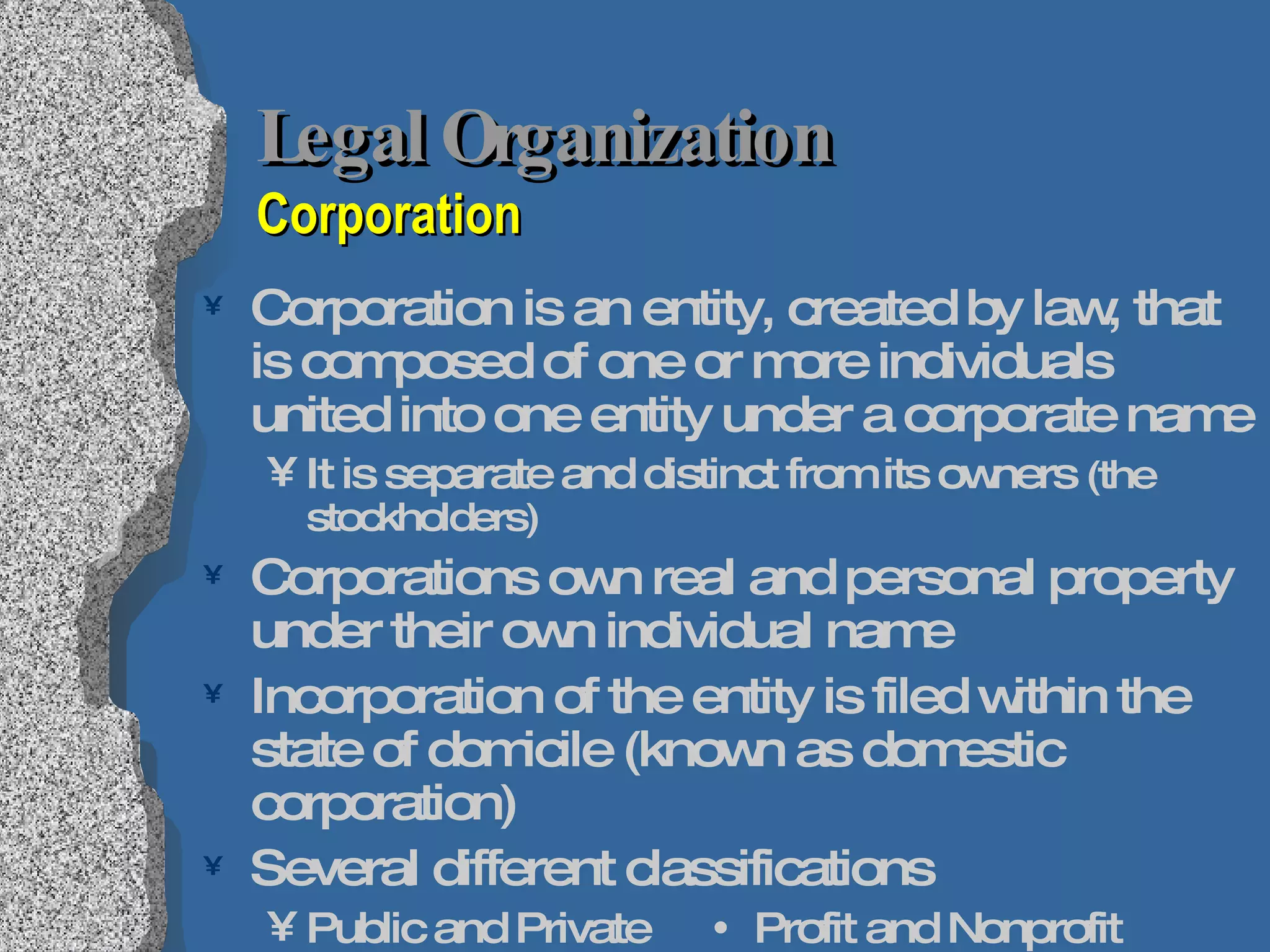

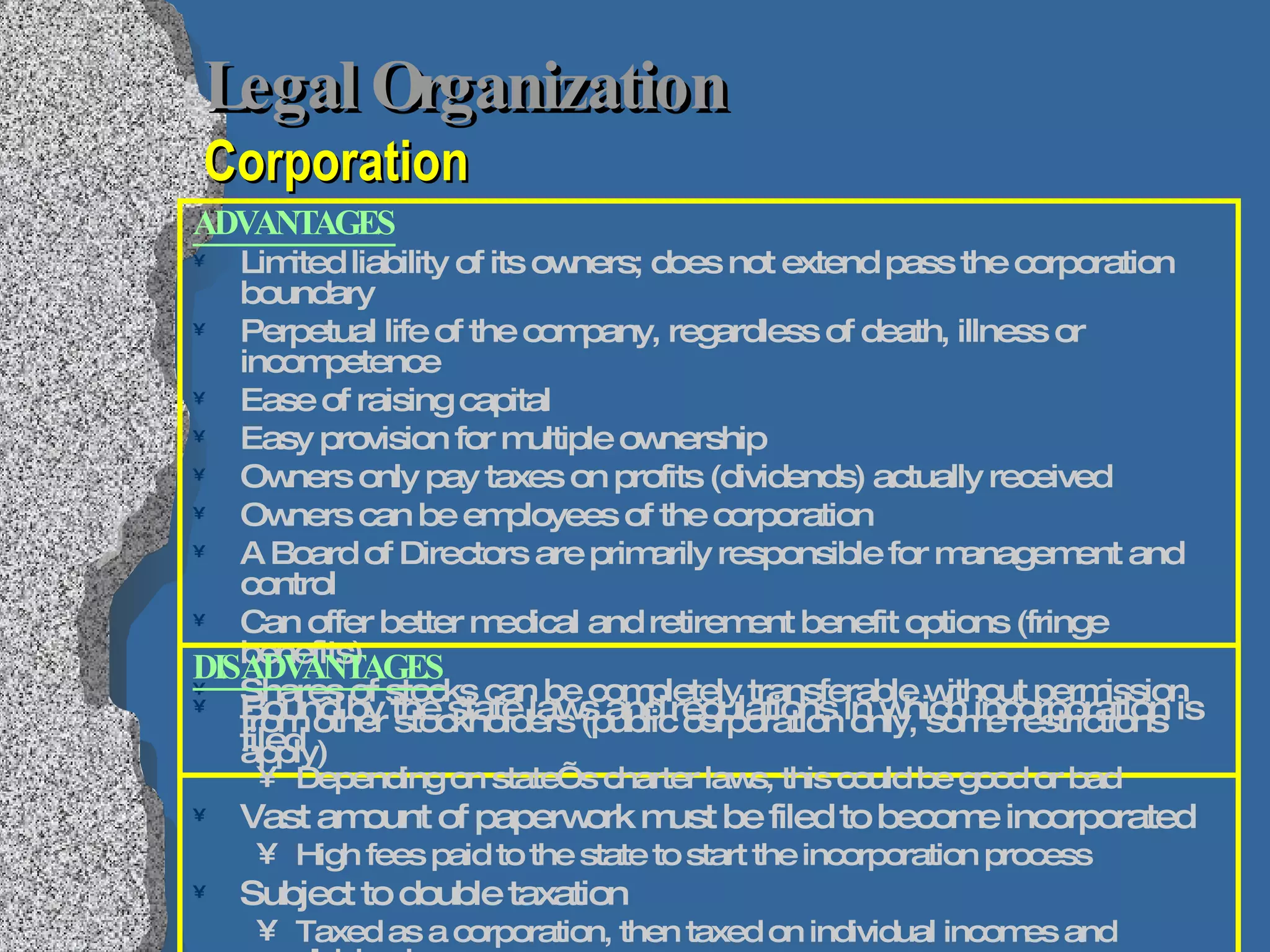

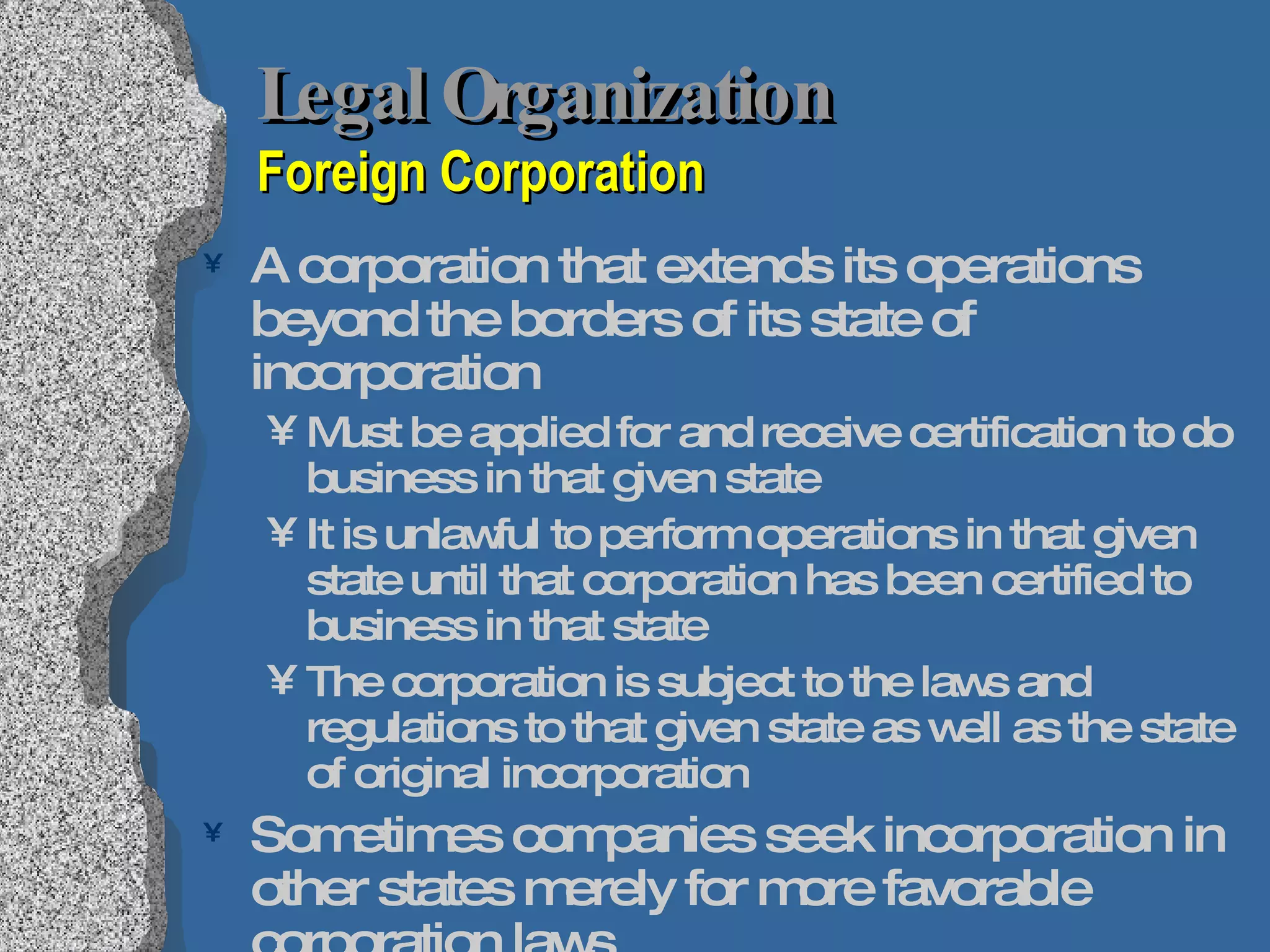

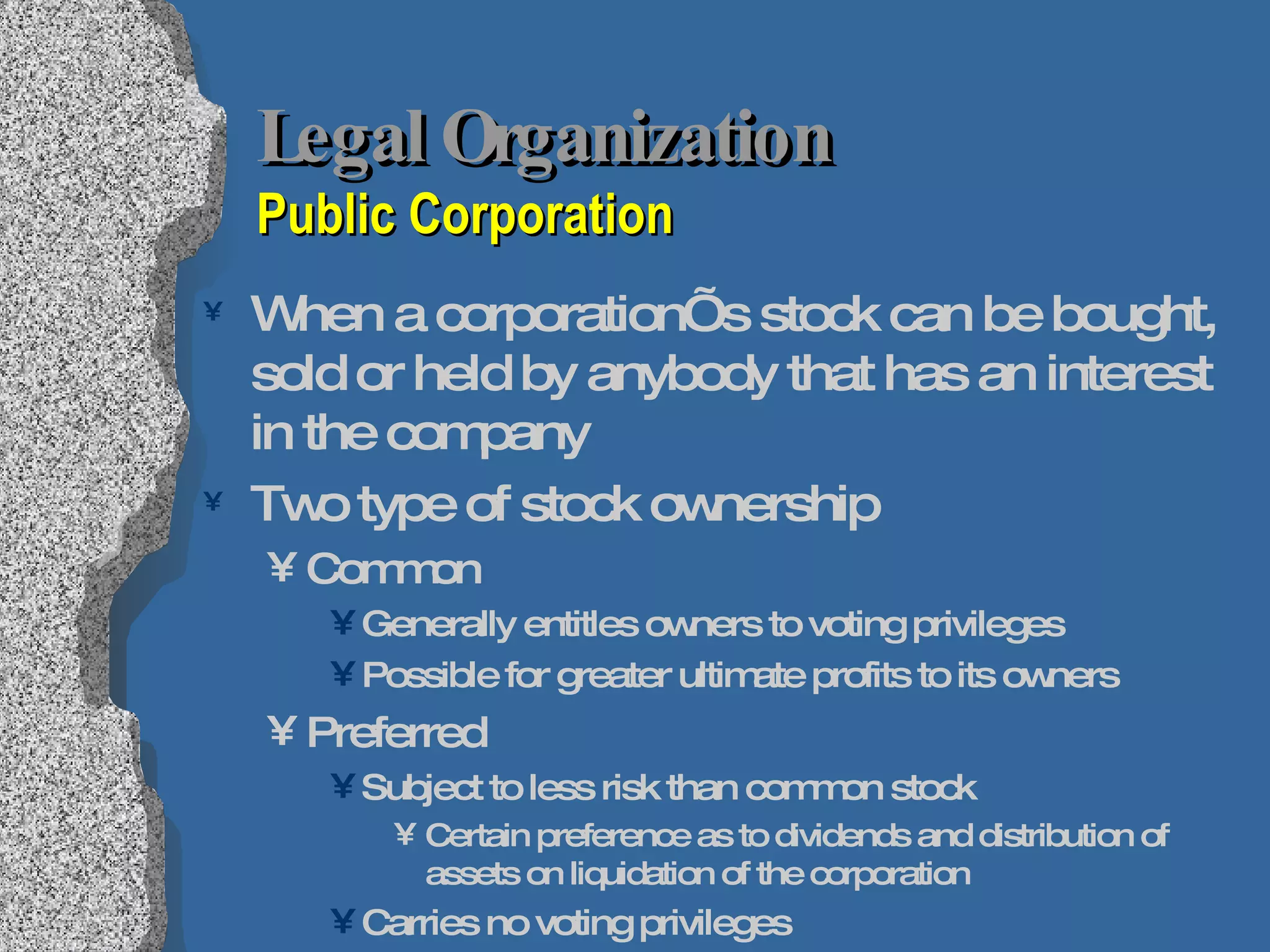

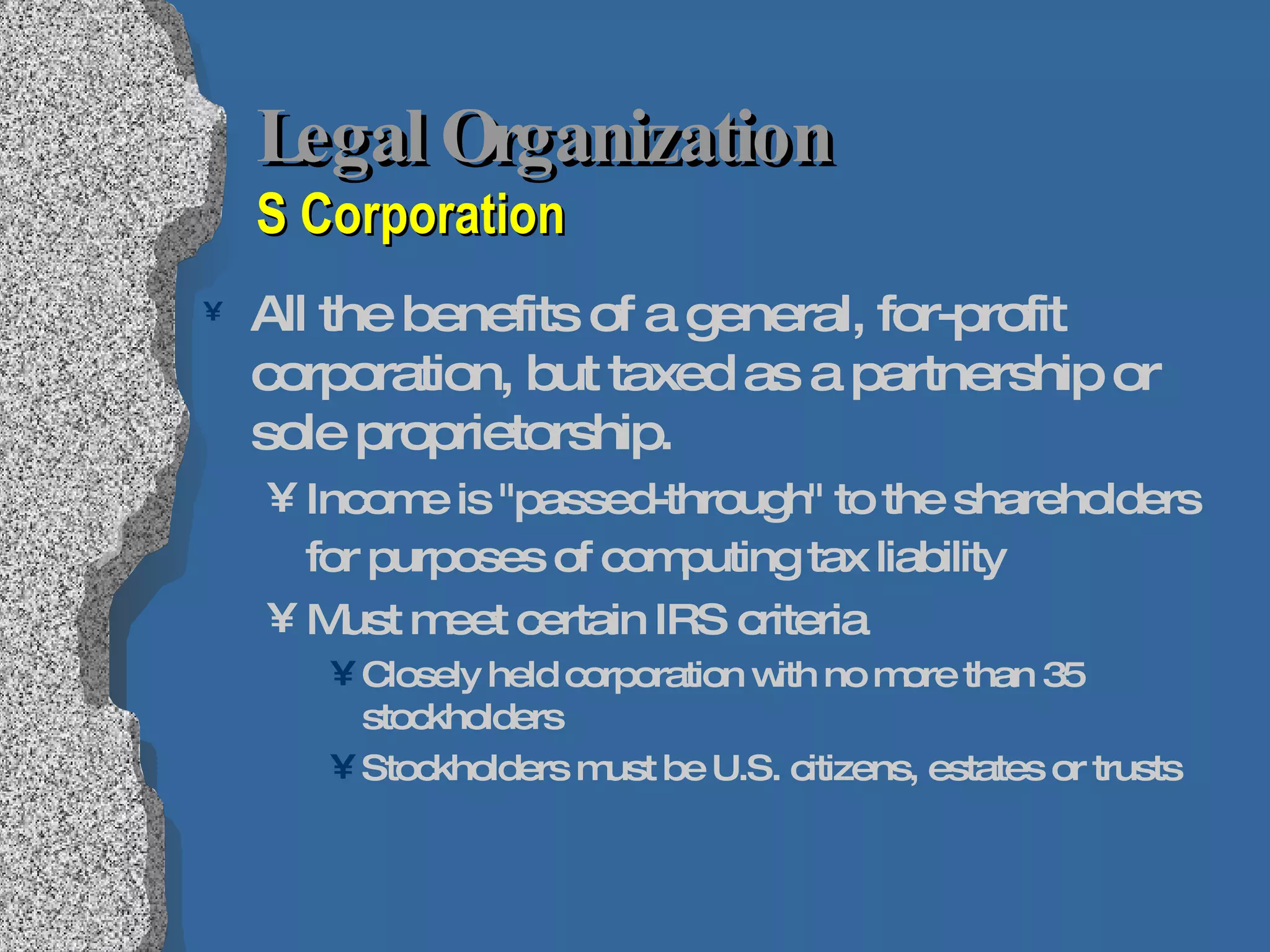

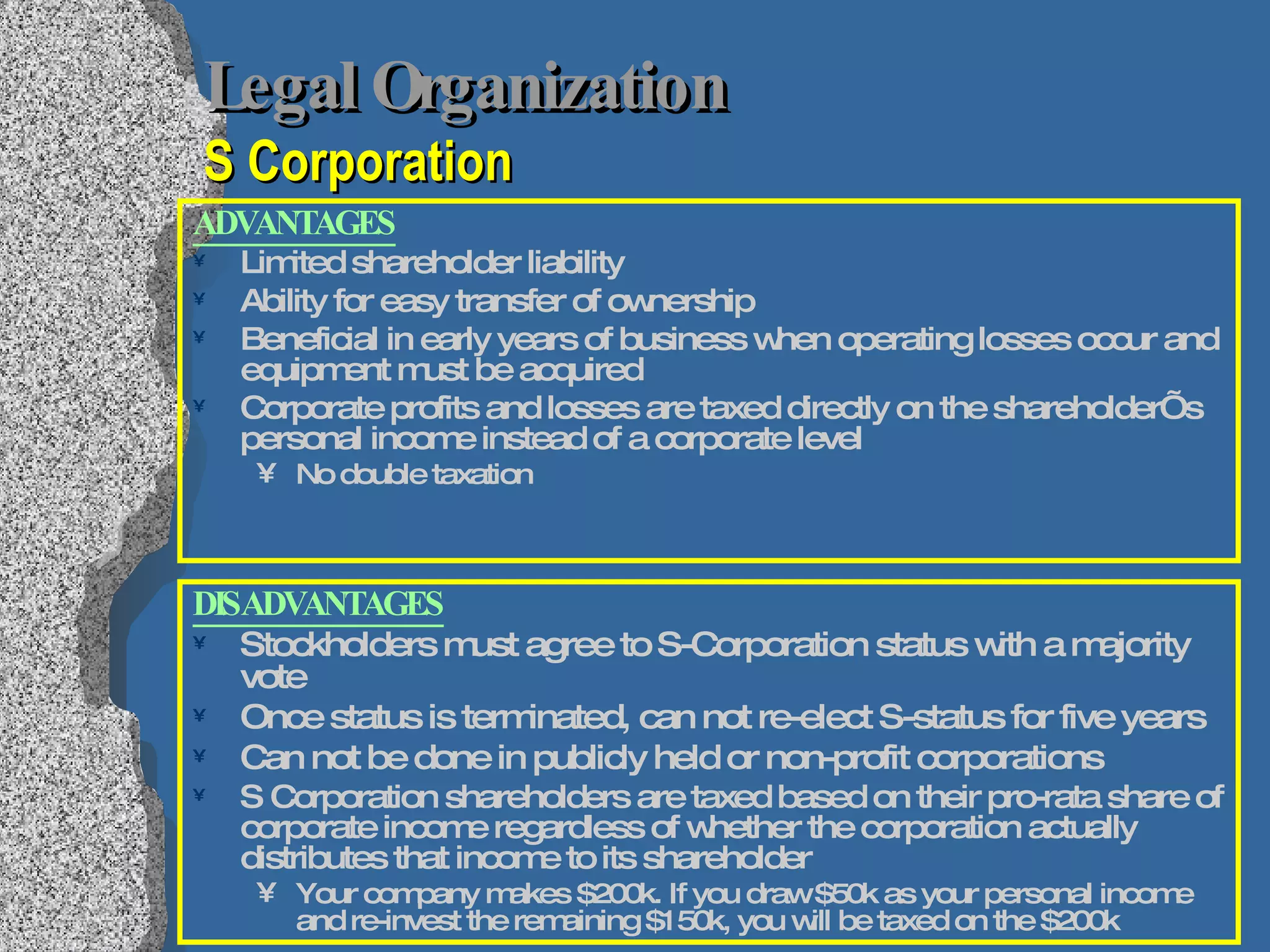

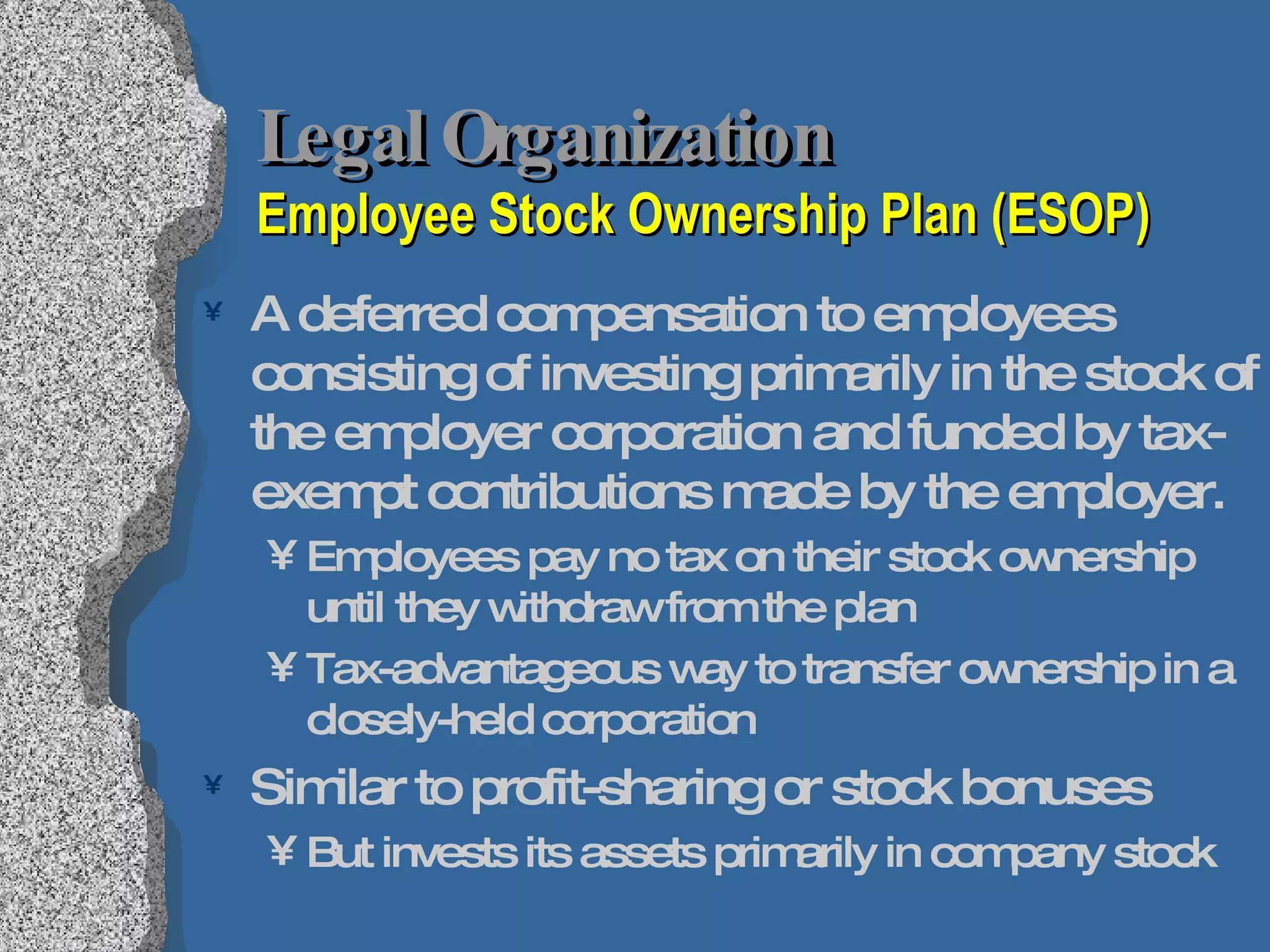

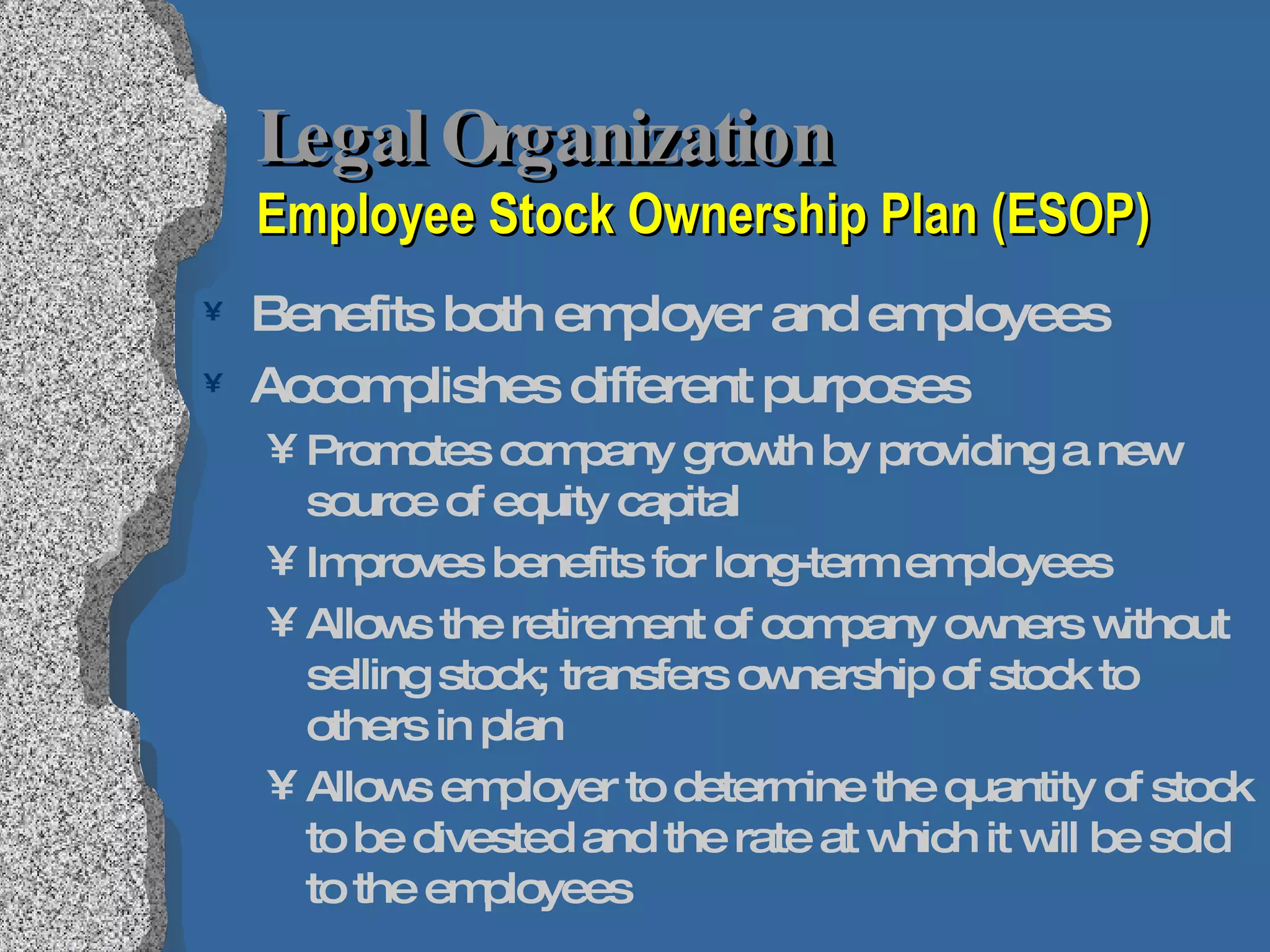

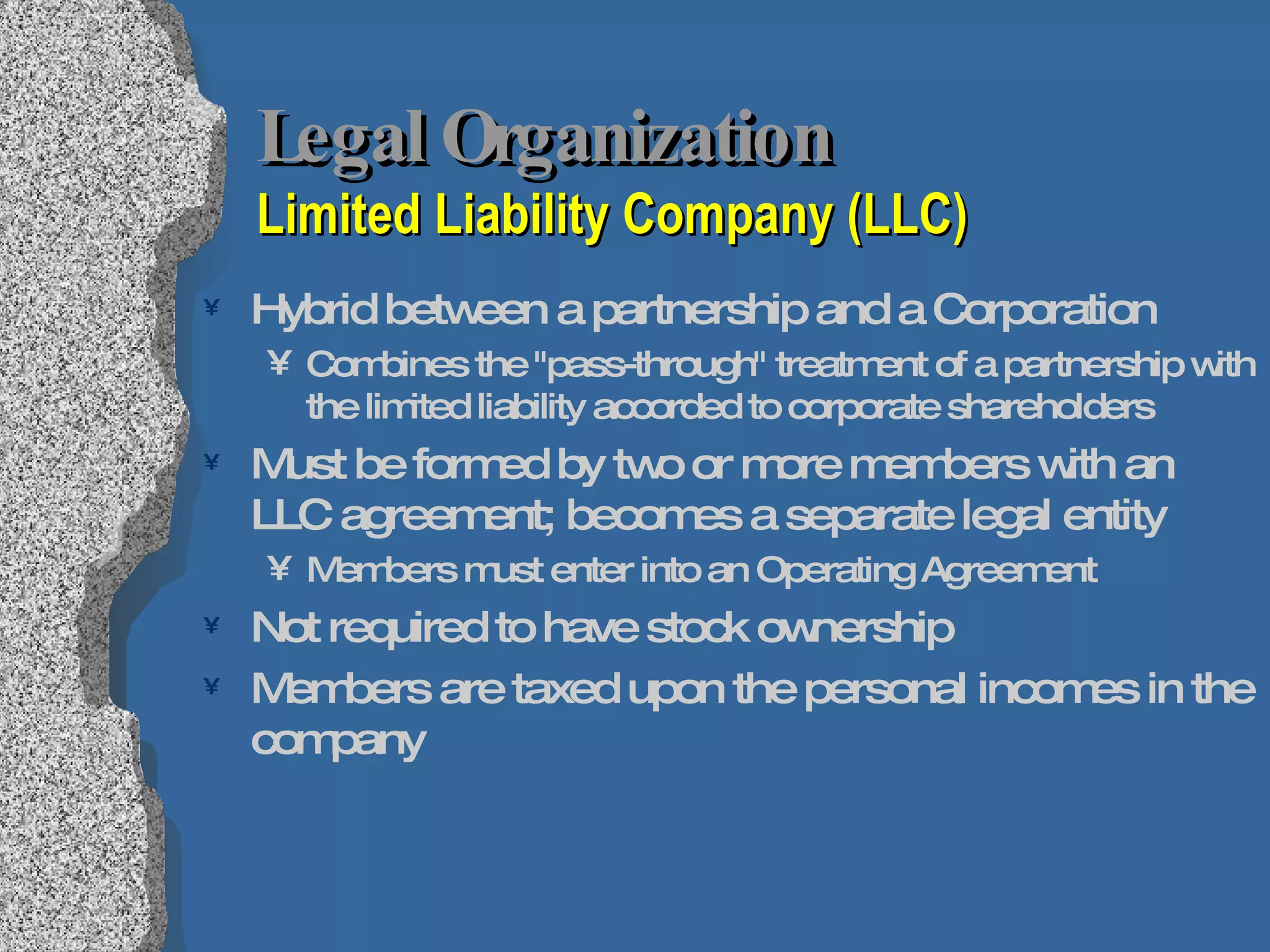

The document discusses different types of legal organizational structures for construction companies, including sole proprietorships, partnerships, corporations, S-corporations, employee stock ownership plans (ESOPs), and limited liability companies (LLCs). Each structure has different legal, tax, and financial implications to consider regarding ownership, liability, taxation, and other factors. The document provides details on the key advantages and disadvantages of each type of structure.