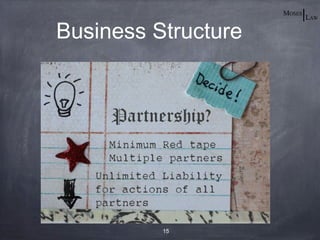

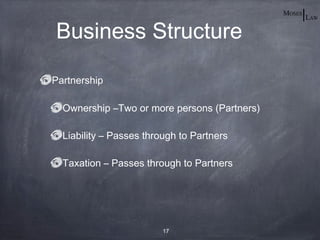

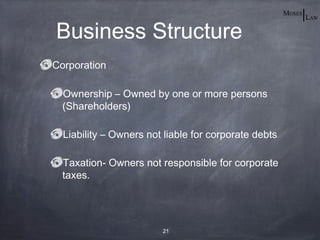

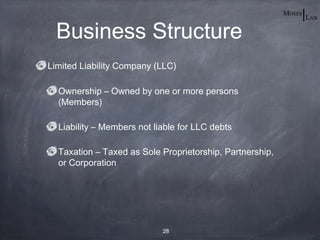

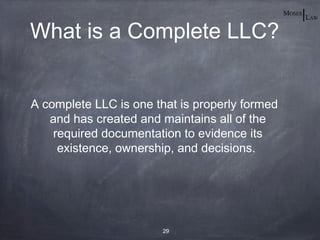

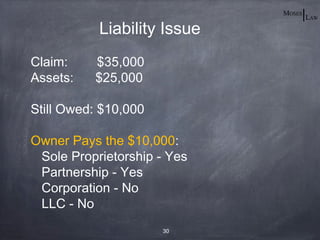

The document presents a webinar by Ambrose Moses, III, focusing on various business structures such as sole proprietorships, partnerships, corporations, and limited liability companies (LLCs). It outlines key considerations for each structure, including ownership, liability, and taxation. The document emphasizes the importance of understanding these elements when establishing a business.