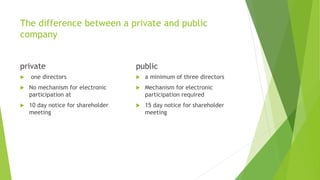

This document discusses different forms of business ownership and their key characteristics. It describes sole proprietorships, partnerships, private companies, public companies, and corporate corporations. For each form of ownership, it outlines advantages and disadvantages. Factors to consider when choosing a form of ownership include control, costs, liability, taxes, and legal requirements. Alternative approaches to starting a business mentioned are buying an existing business, entering a family business, or owning a franchise.

![References

Shah S. Forms of ownership. PowerPoint presentation

Republic of South Africa BUSINESS STUDIES - FORMS OF OWNERSHIP Available

from:

file:///C:/Users/General/Downloads/BUSINESS%20STUDIES%20SELF%20STUDY-

GUIDE%20-%20FORMS%20OF%20OWNERSHIP.pdf. [Accessed: 3 march 2014]

Walton, S. Forms of ownerships. PowerPoint presentation

An overview of business. PowerPoint presentation [Accessed: 3march 2014]](https://image.slidesharecdn.com/formsofownership-140308043132-phpapp02-180823151036/85/economics-management-science-24-320.jpg)