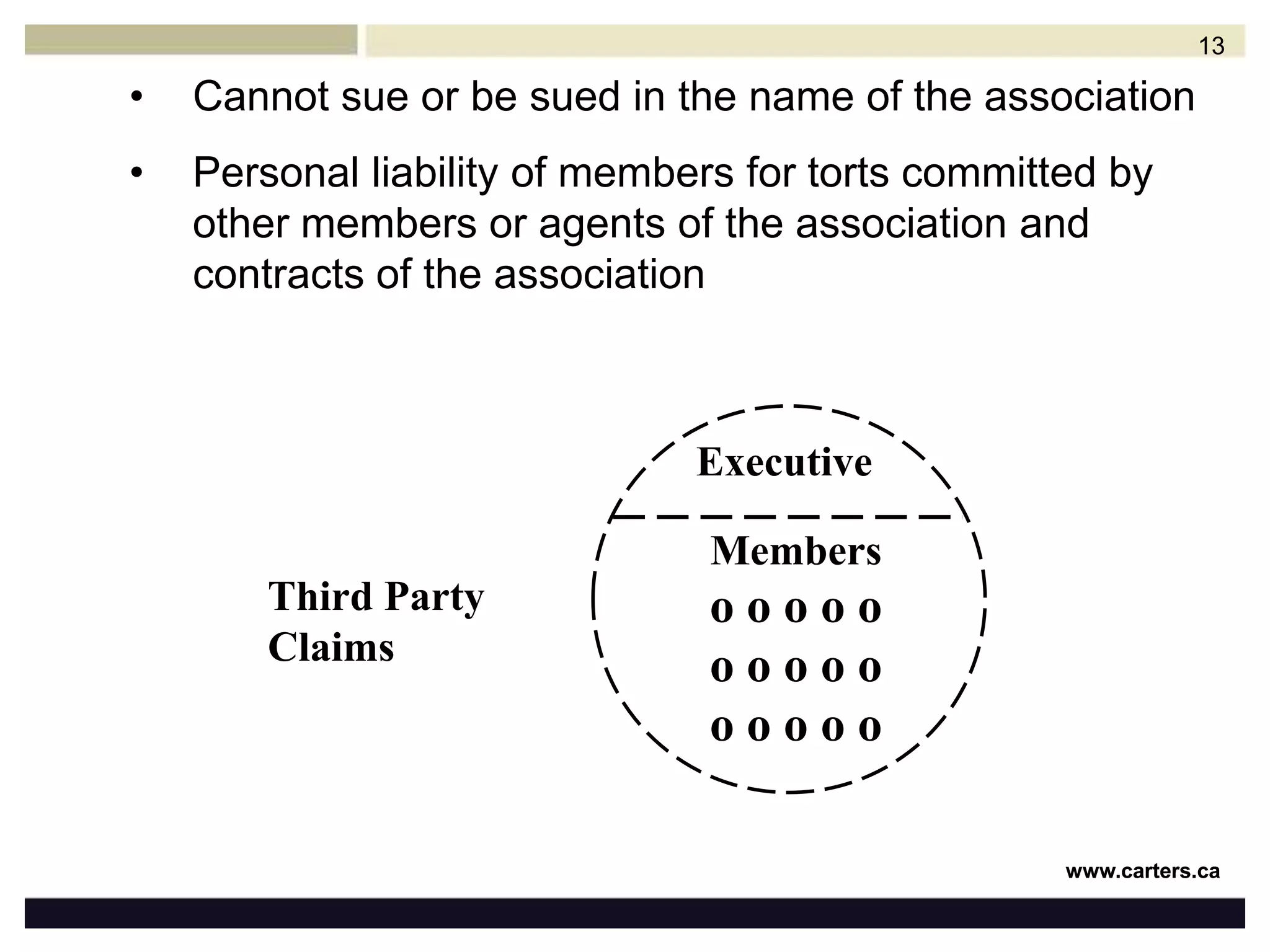

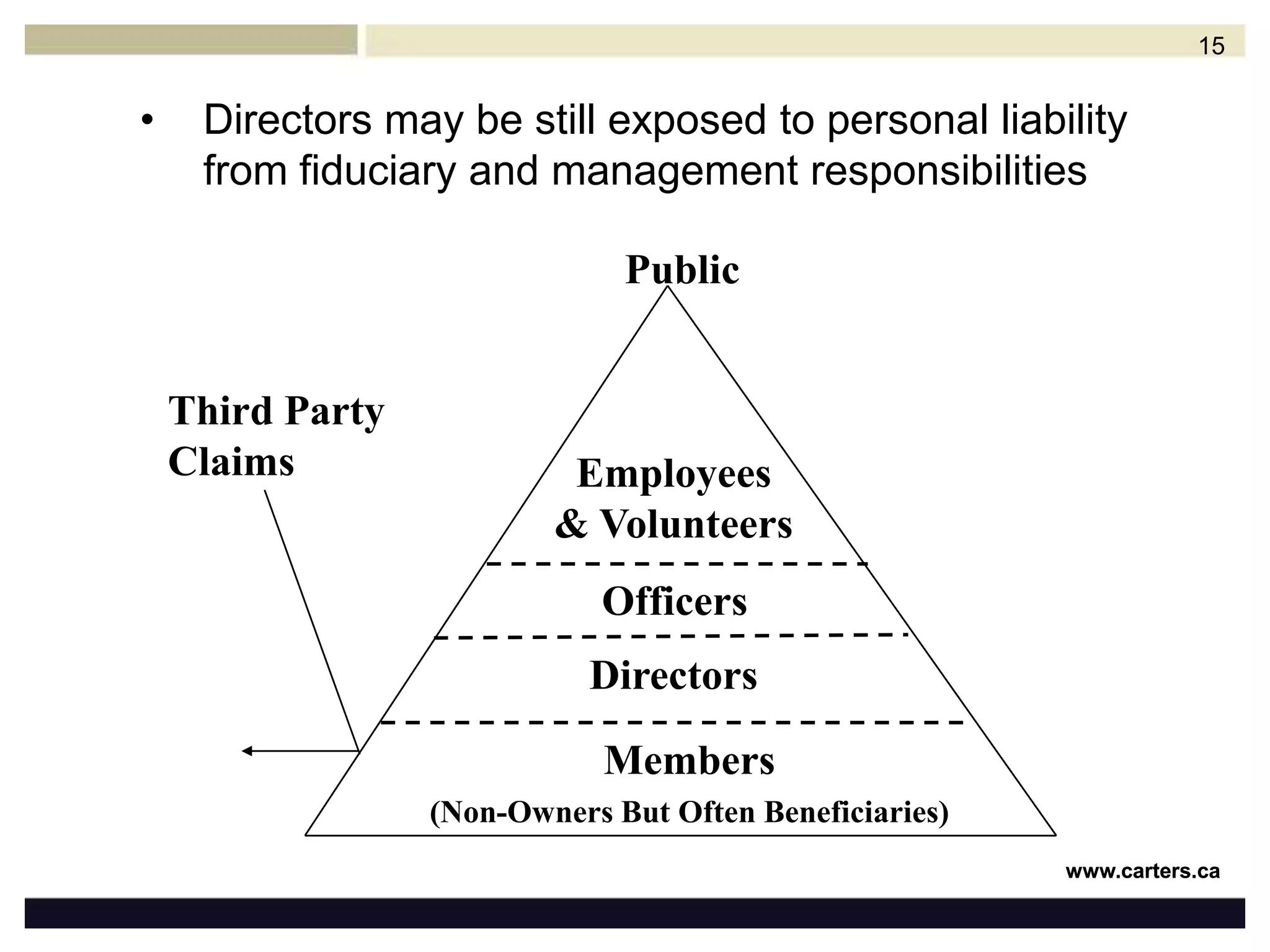

This document discusses the advantages and disadvantages of incorporating as a not-for-profit organization. It provides an overview of key topics related to not-for-profit status under tax law, maintaining tax-exempt status, and the differences between charities and not-for-profit organizations. The document also examines the benefits of incorporation such as limited liability, as well as potential disadvantages like increased compliance requirements and liability risks for directors and officers. It outlines the process for incorporating as a not-for-profit in Canada.