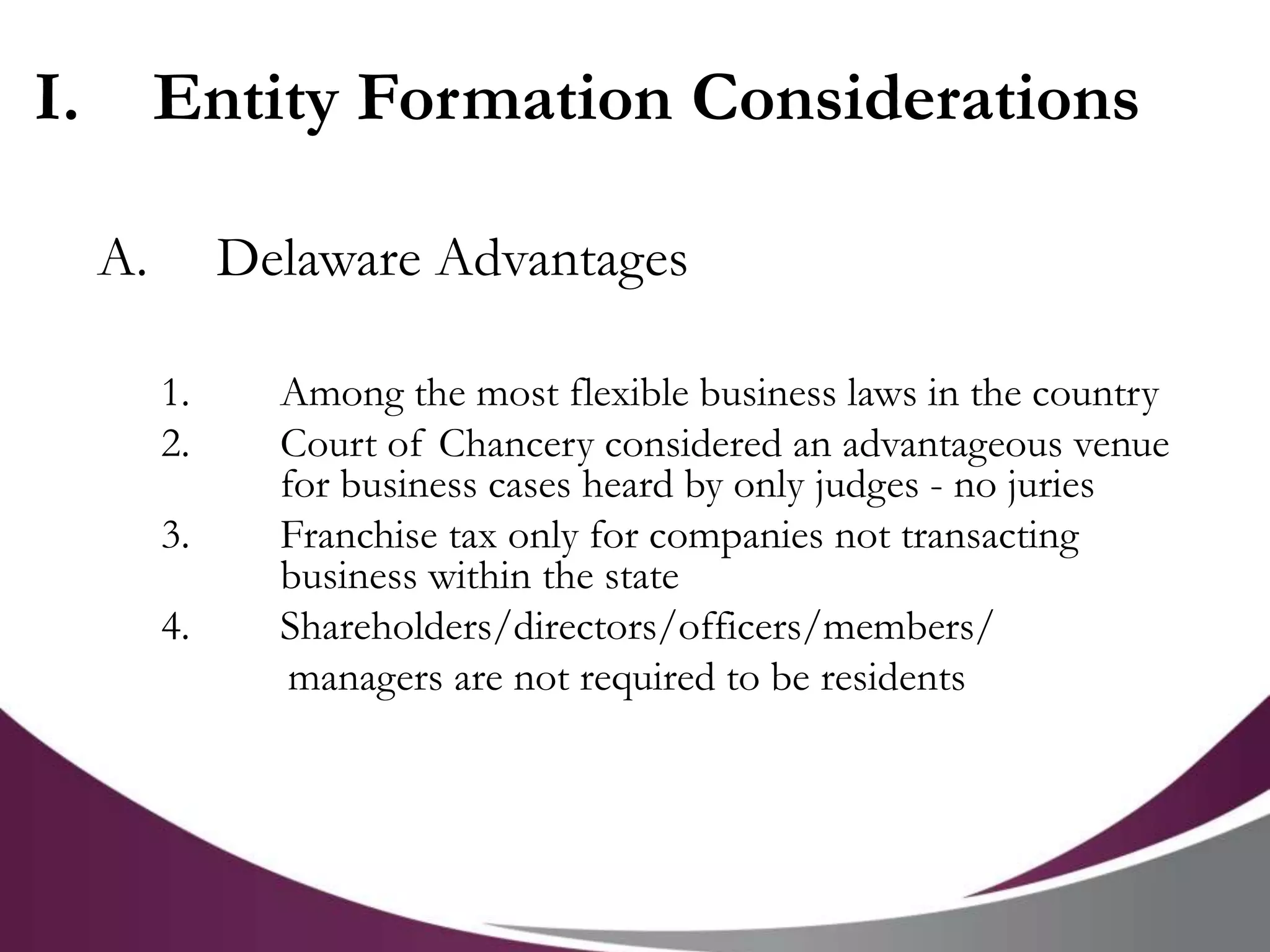

The document presents an overview of entity formation considerations in the context of avoiding personal liability, highlighting the advantages and disadvantages of various business structures such as sole proprietorships, corporations, partnerships, and limited liability companies. It discusses the implications of 'piercing the veil,' which can lead to personal liability for business debts, and explains specific issues related to Texas franchise tax account status, including consequences of failing to register and the effects of entity status forfeiture. Key factors influencing personal liability and business operations, such as capital adequacy and adherence to legal formalities, are also outlined.