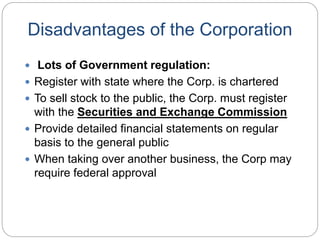

This document discusses different types of business organizations including sole proprietorships, partnerships, limited liability companies, cooperative societies, and public corporations. It provides details on forming and operating each type of business structure, highlighting their key advantages and disadvantages. Specifically, it notes that sole proprietorships are easy to start but owners have unlimited liability, while partnerships allow for ease of management but partners also have unlimited liability. Public corporations make it easy to raise capital through stock sales but involve more regulatory requirements and costs.