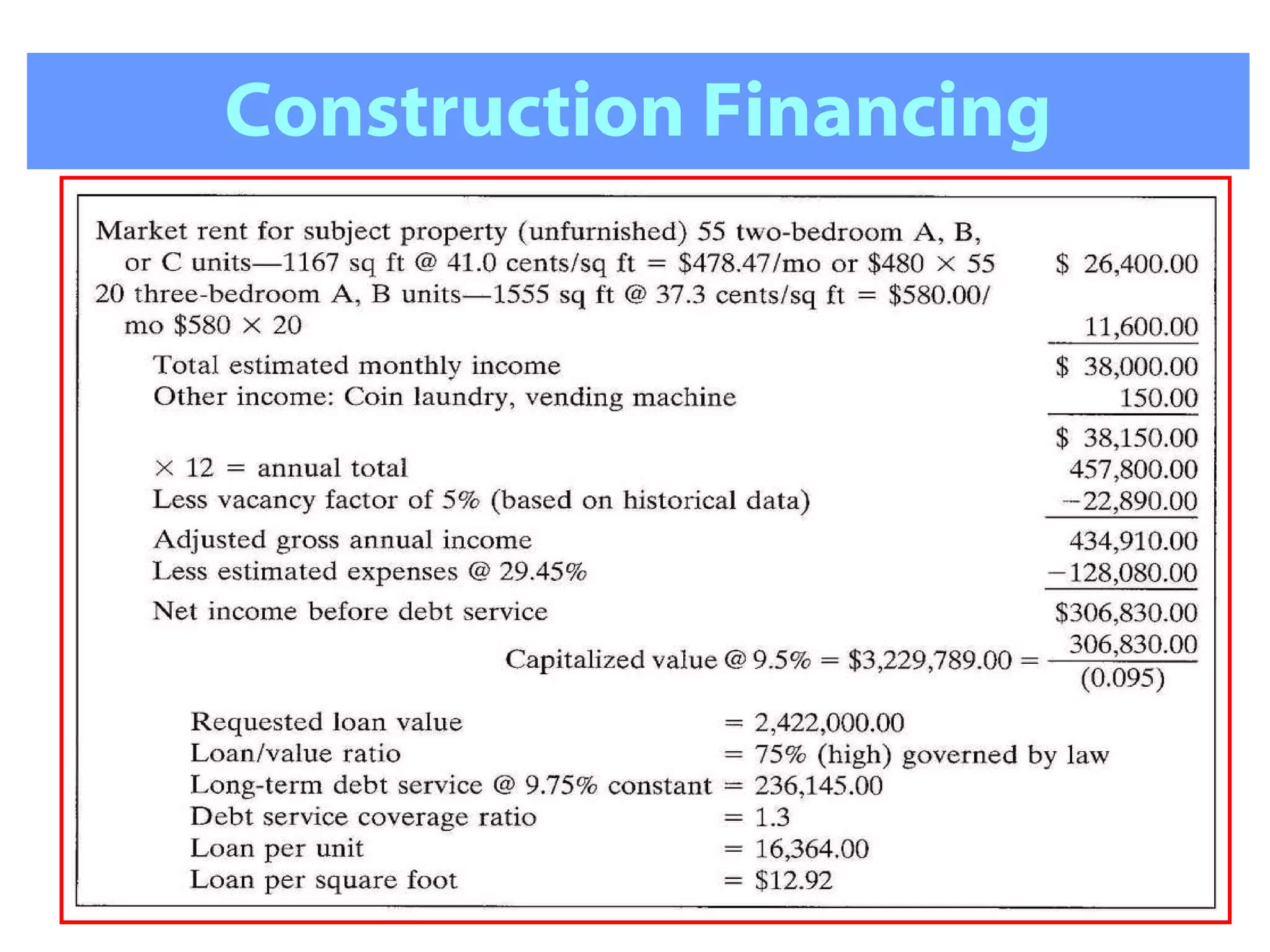

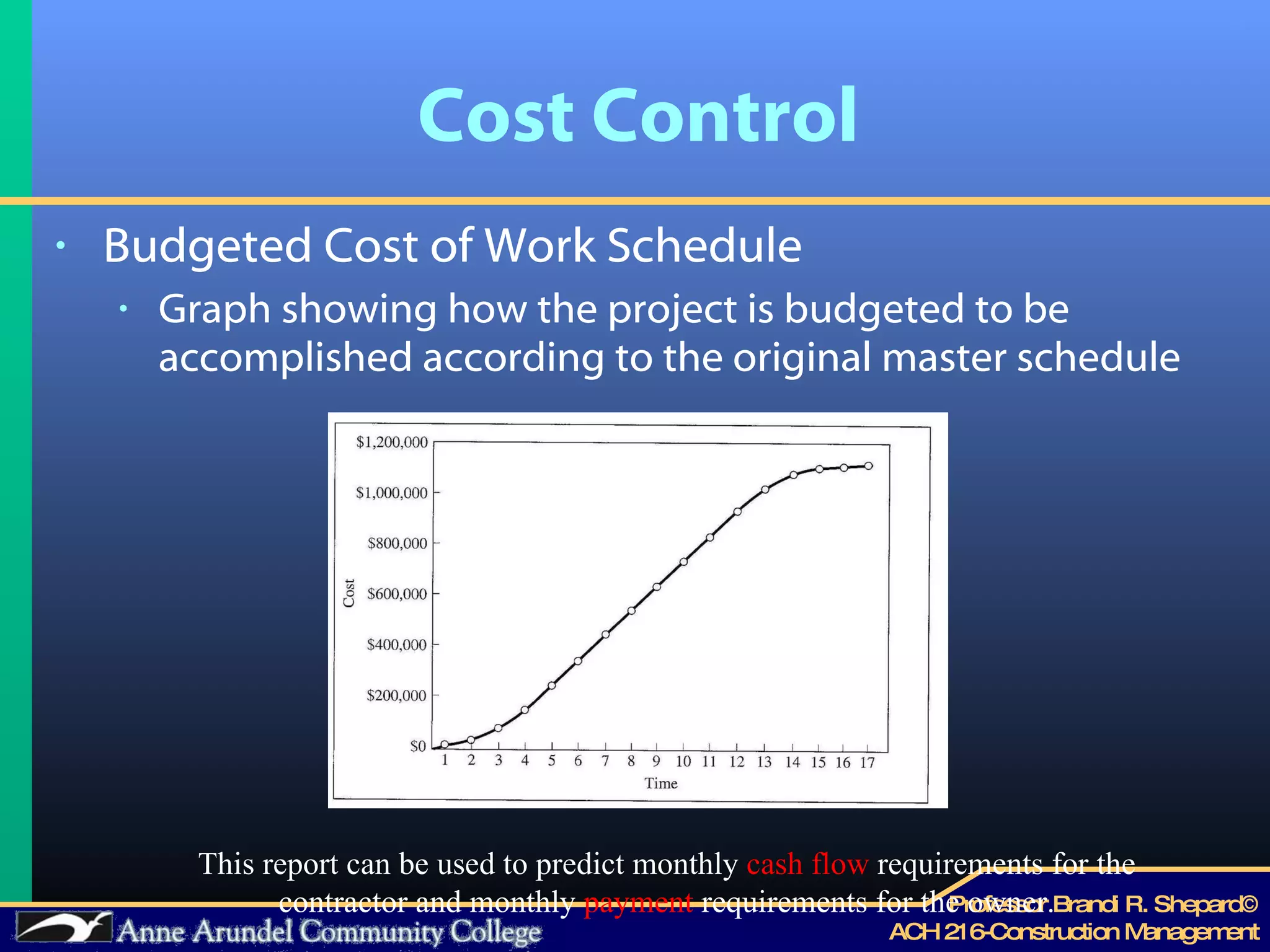

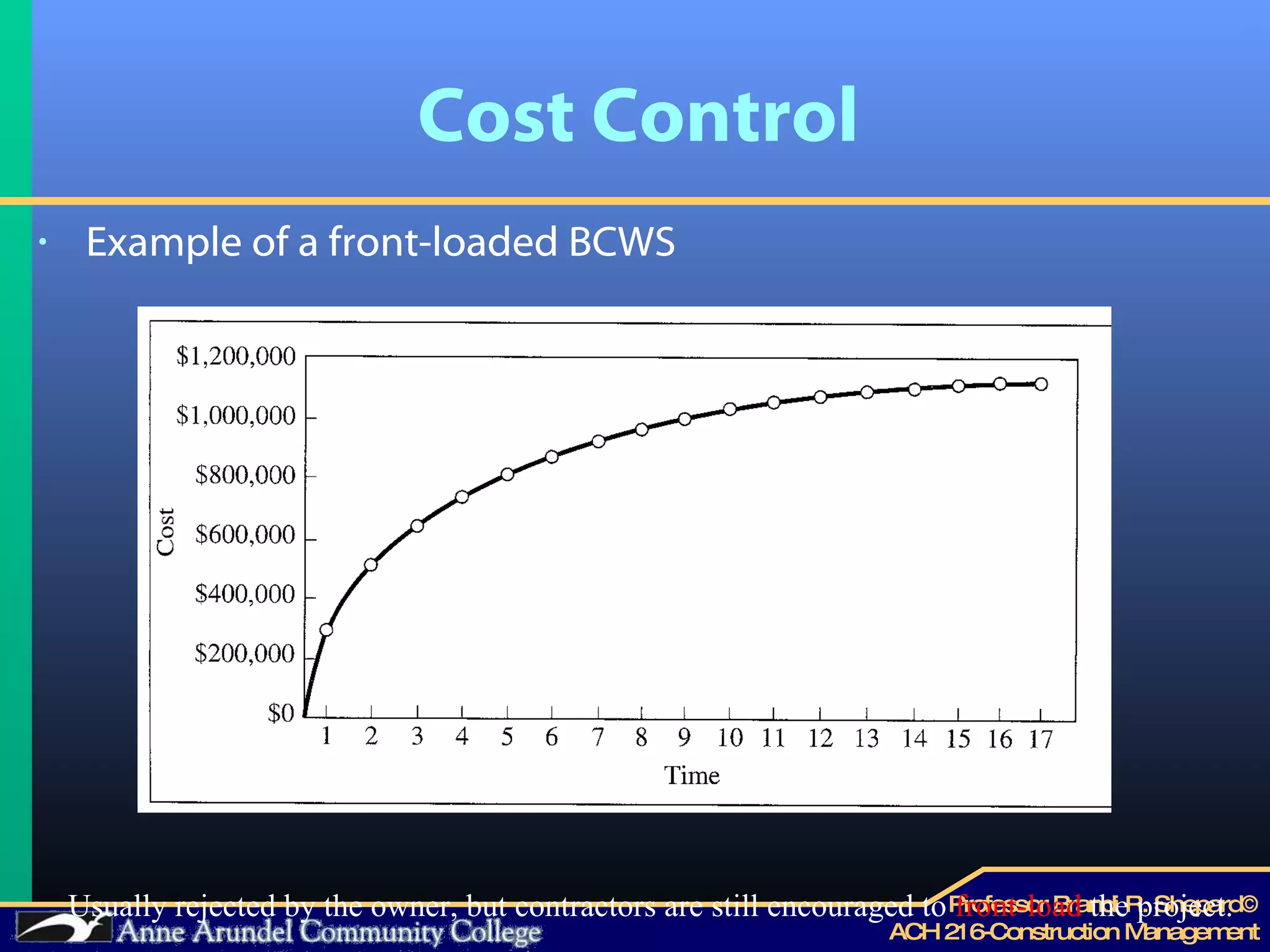

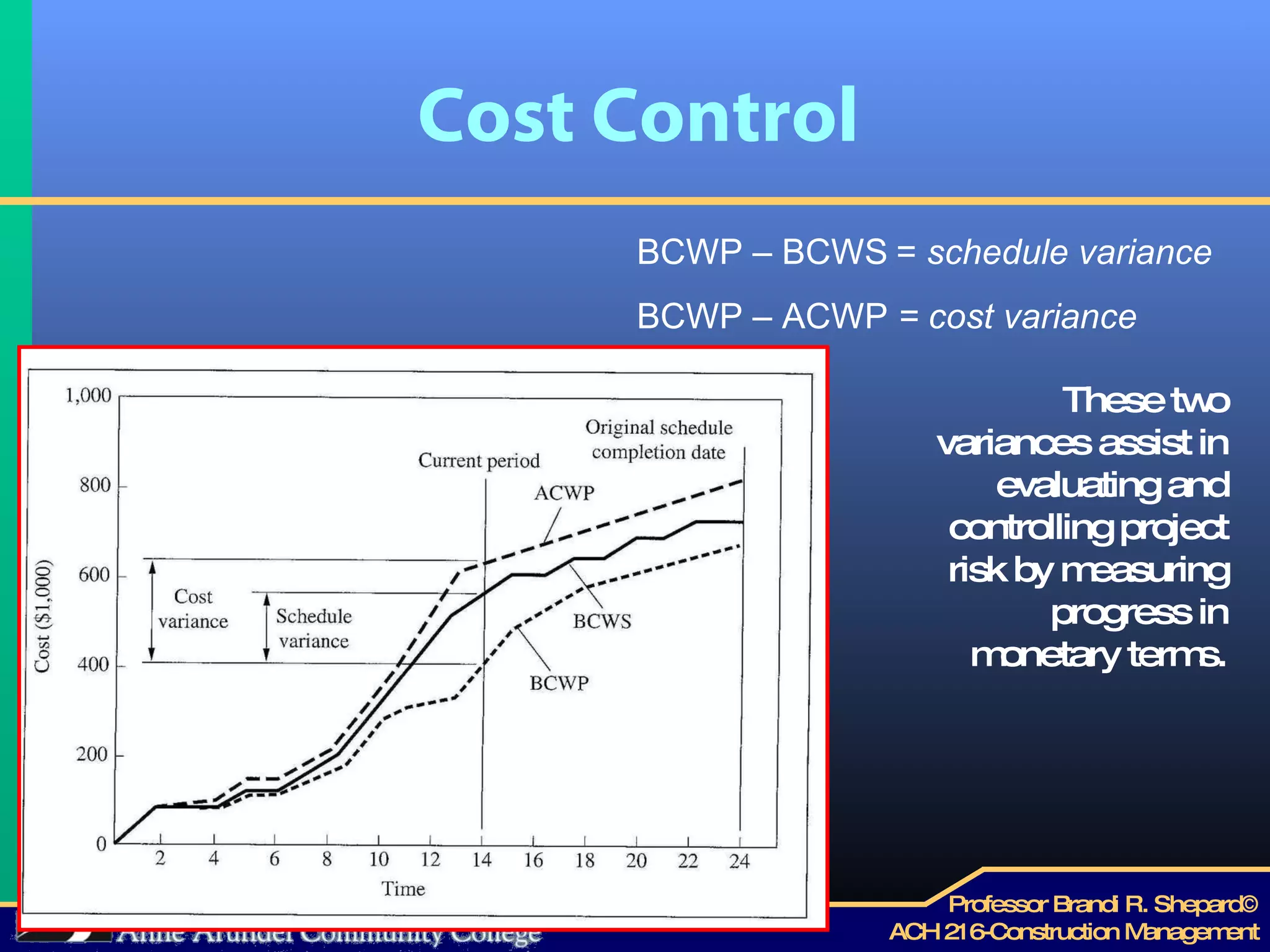

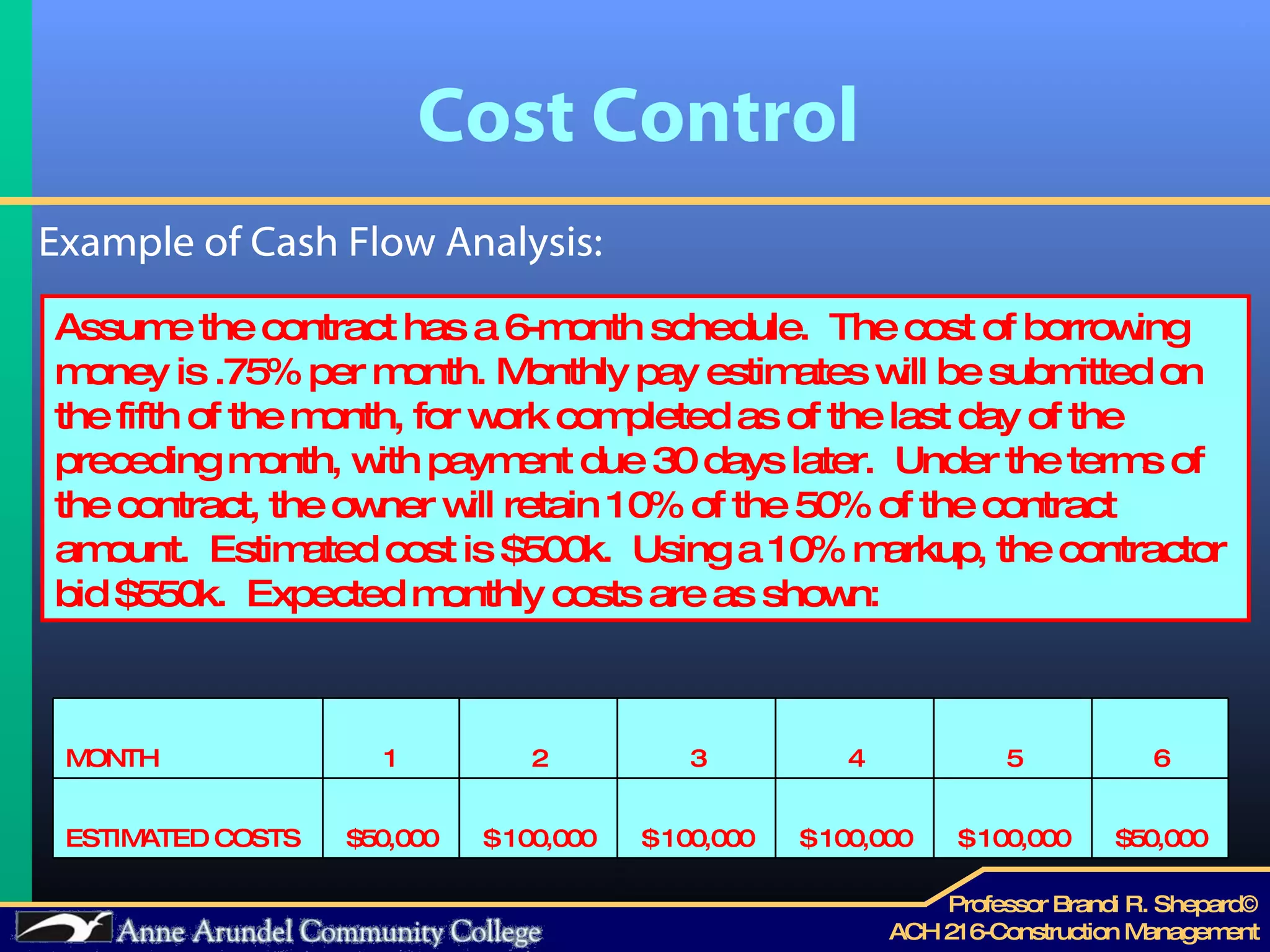

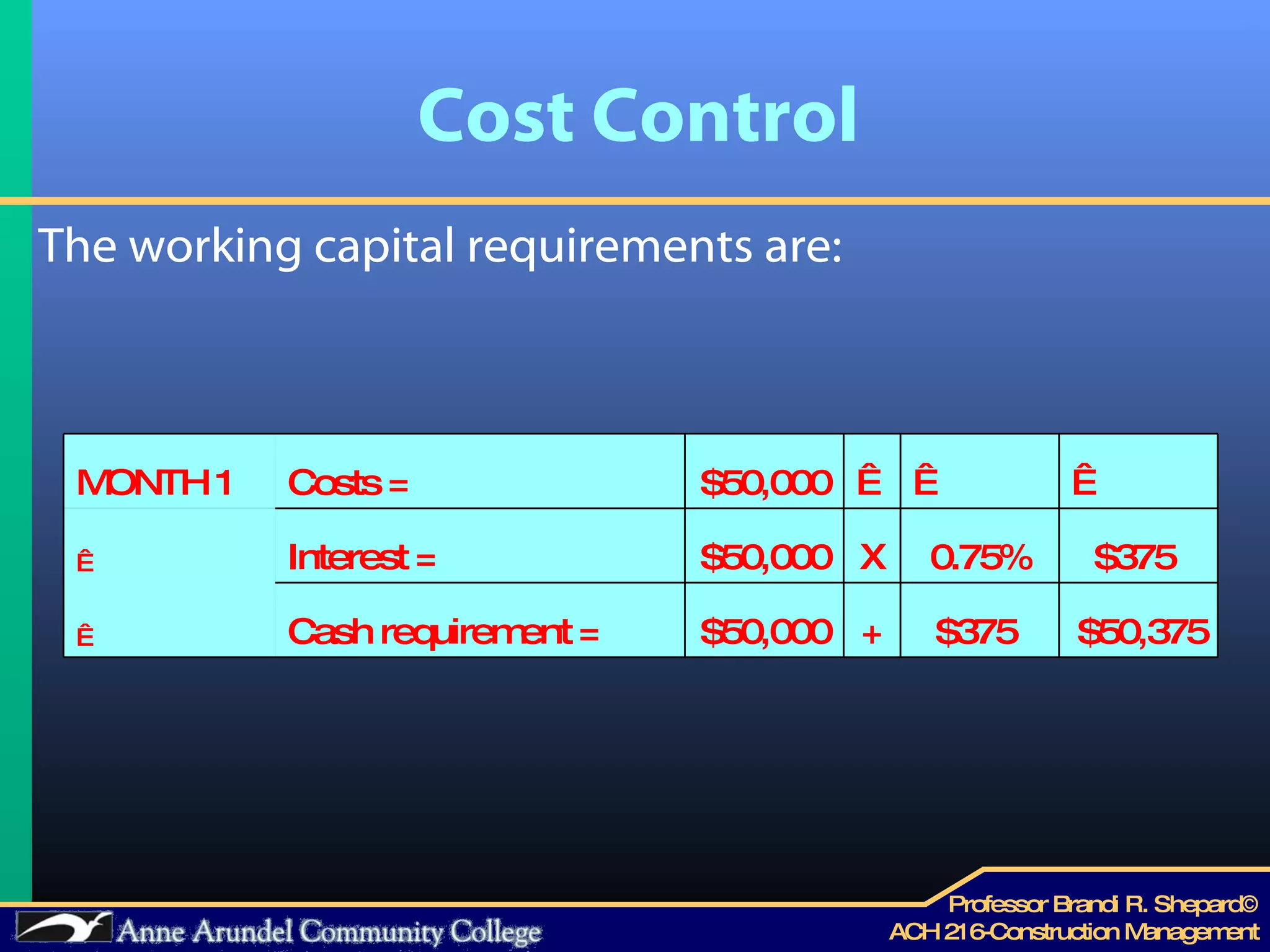

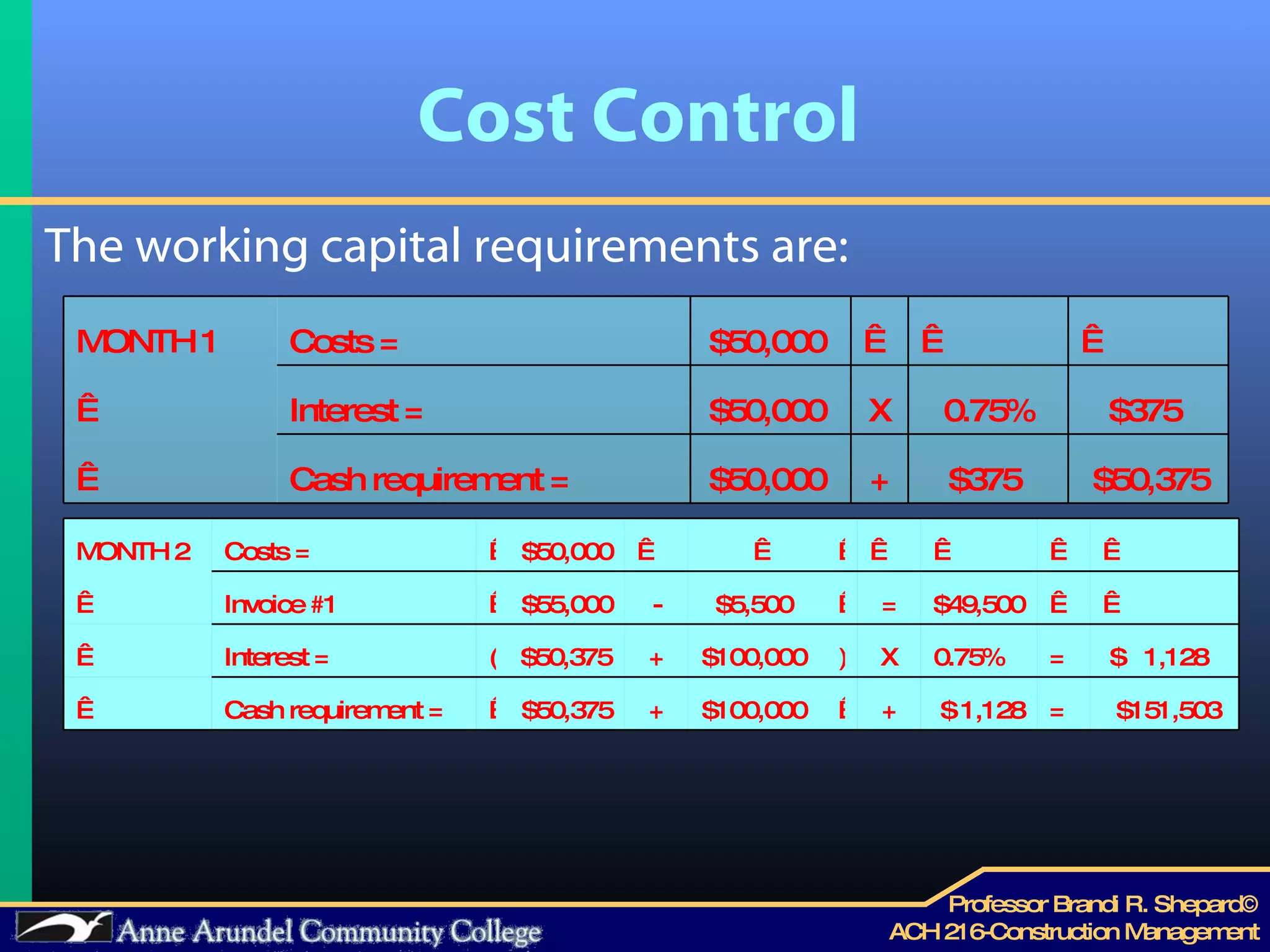

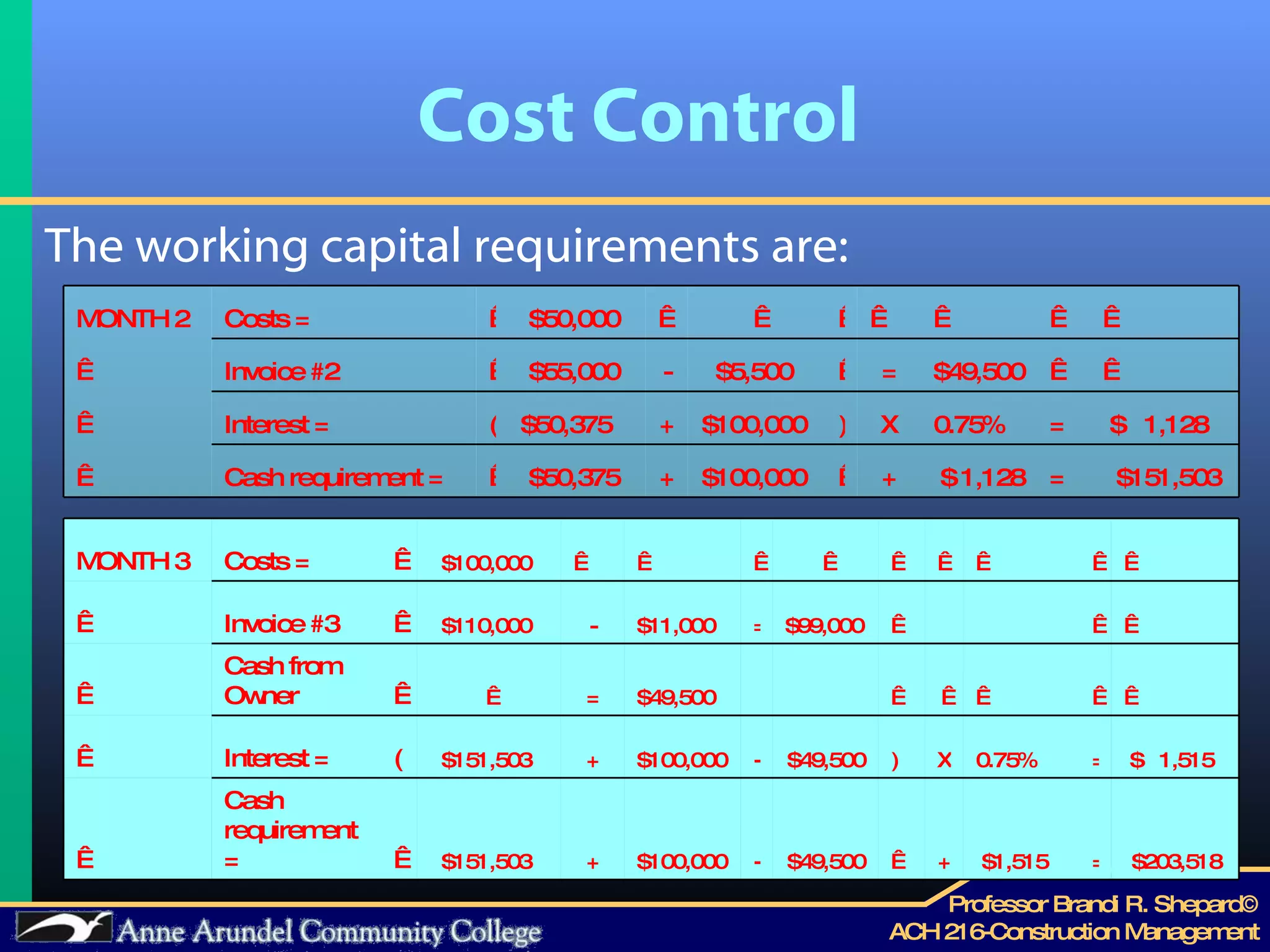

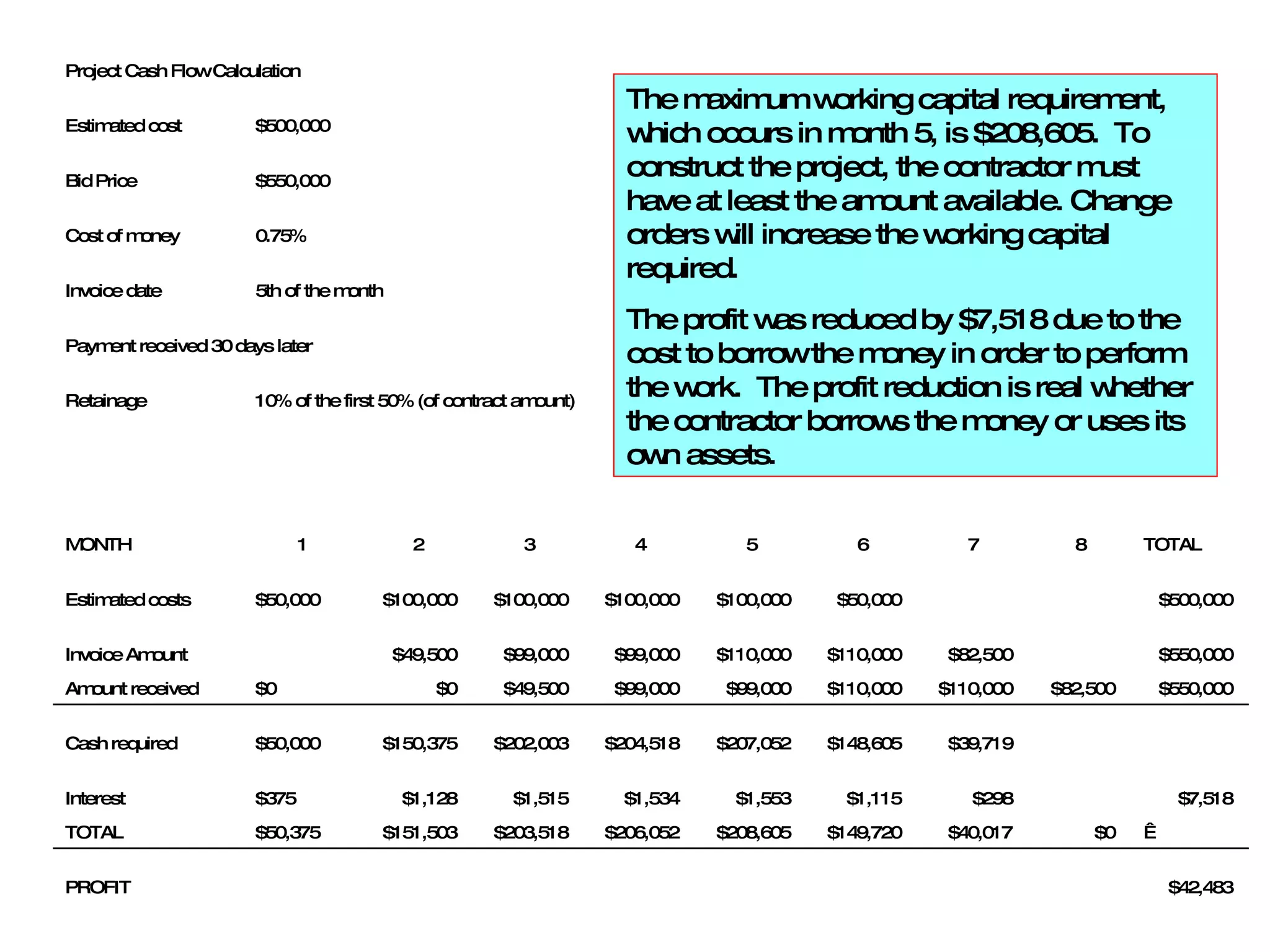

This document discusses several key aspects of construction project management including project funding, scheduling, procurement, cost control, and cash flow analysis. It describes the basic resources needed for construction including money, materials, manpower, and machines. It then focuses on construction financing, explaining the types of loans, lenders, and requirements. Procurement and cost control methods like productivity tracking and cash flow analysis are also outlined.