Embed presentation

Downloaded 41 times

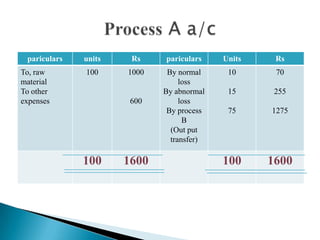

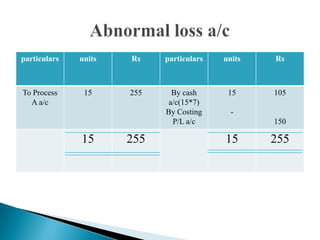

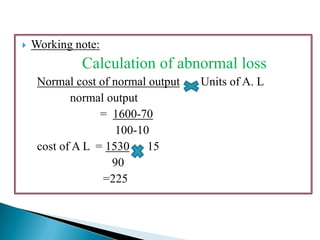

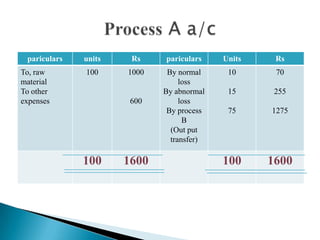

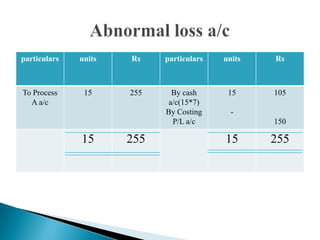

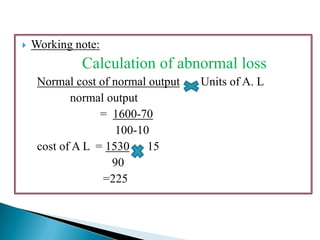

This document contains an example of calculating abnormal loss from a manufacturing process. 100 units of raw materials costing Rs. 1000 with other expenses of Rs. 600 were introduced to Process A. Normally 10% of units would be lost, but the actual output was only 75 units. The summary provides: 1) Process A account showing raw materials and other expenses as debits and normal loss, abnormal loss, and output transfer as credits. 2) Abnormal loss account showing the process A account as a debit and cash for scrap value and costing profit and loss account as credits. 3) A working note calculating abnormal loss as actual cost of normal output minus normal cost of normal output. Abnormal loss was