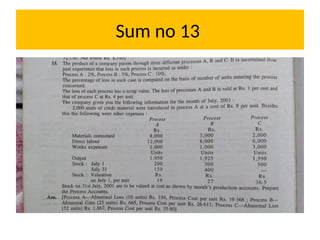

Process Costing is defined as a branch of operation costing, that determines the cost of a product at each stage, i.e. process of production.

It is an accounting method which is adopted by the factories or industries where the standardized identical product is produced, as well as it passes through multiple processes for being transformed into the final product.

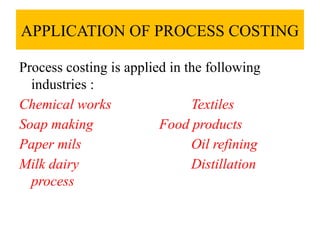

Process costing is used in mass production producing standard products such as cement , sugar, steel , oil refining etc

In such industries goods produced are identical and processes are standardized.

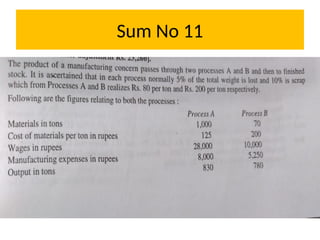

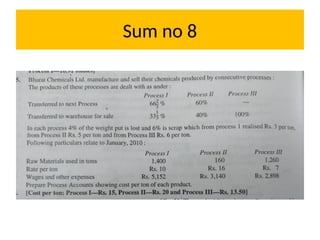

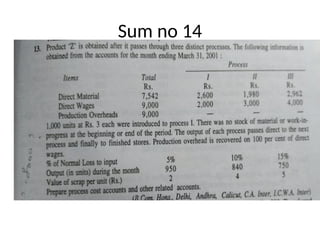

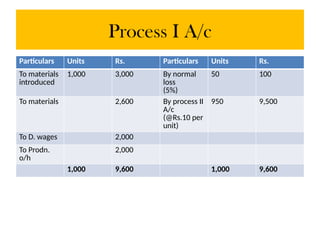

For manufacturing a product, the raw material has to pass several stages of manufacture in a pre determined sequence .

Such stage of manufacture is called process .

Methods of cost ascertainment in such industries is called process costing

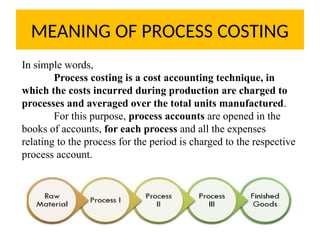

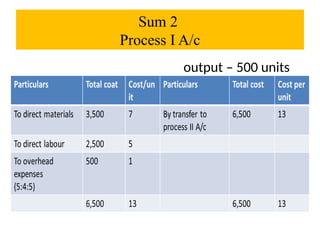

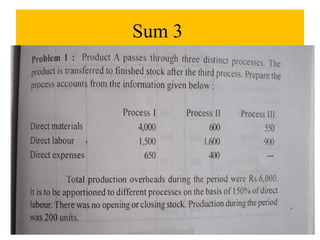

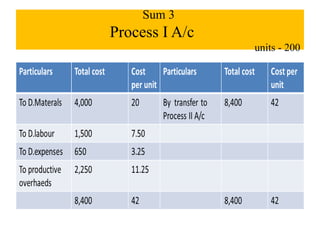

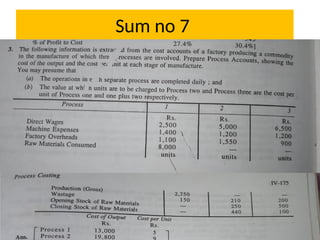

Process costing is a cost accounting technique, in which the costs incurred during production are charged to processes and averaged over the total units manufactured.

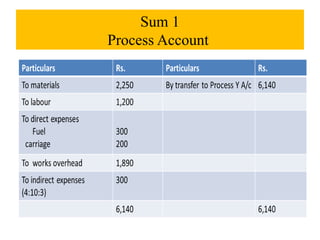

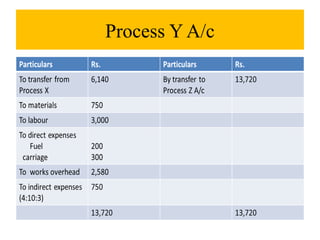

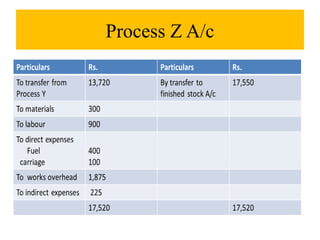

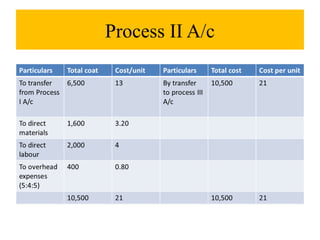

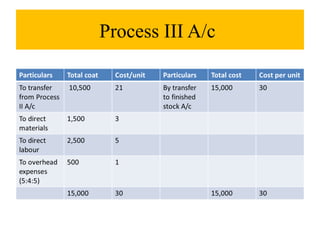

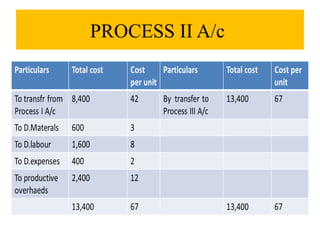

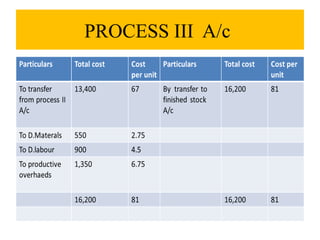

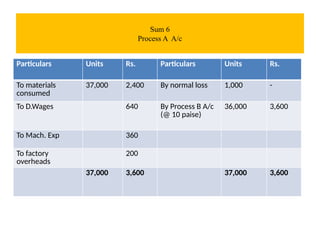

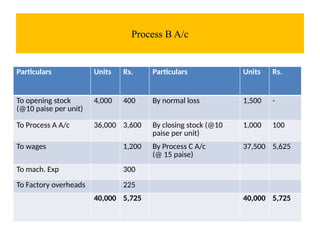

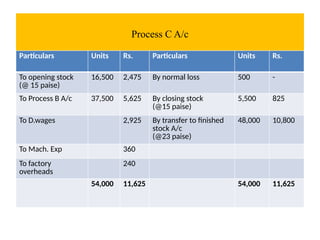

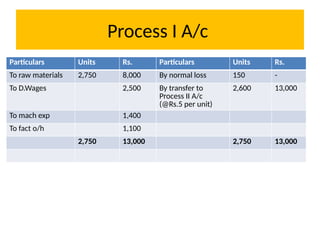

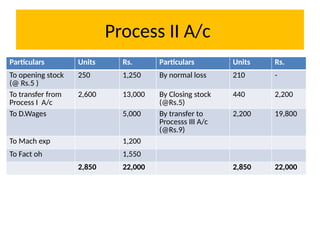

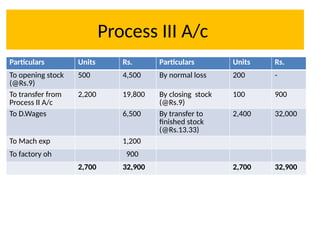

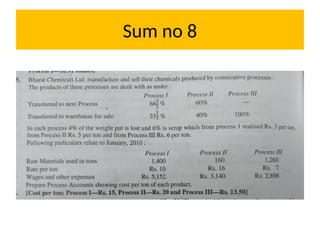

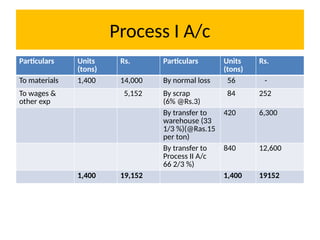

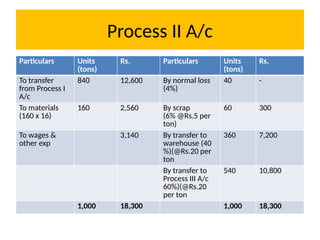

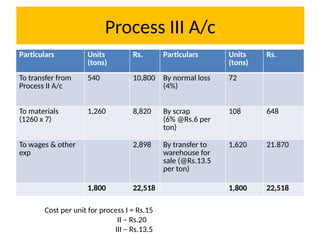

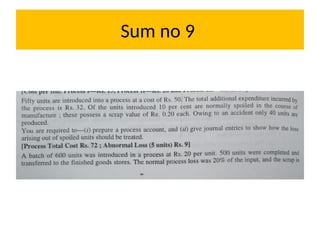

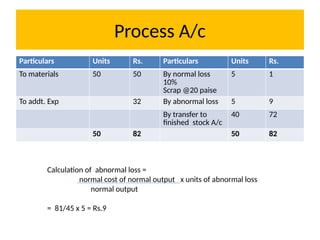

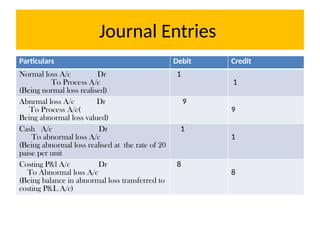

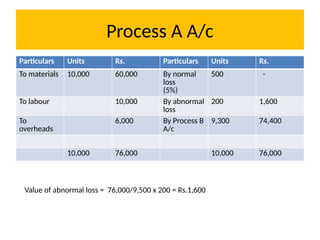

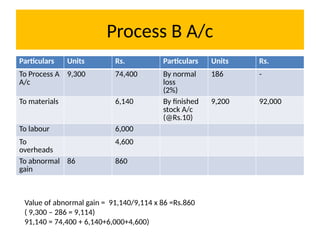

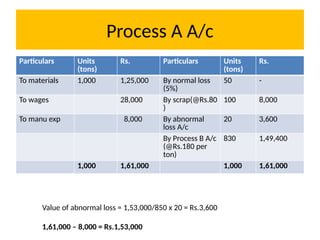

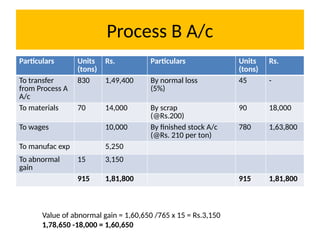

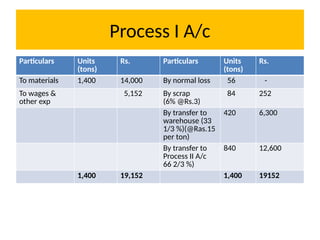

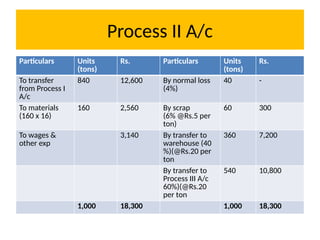

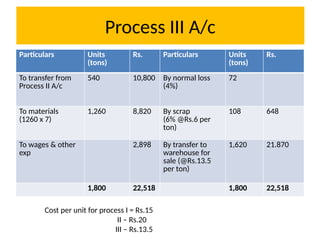

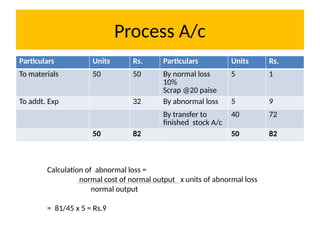

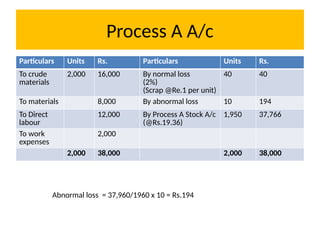

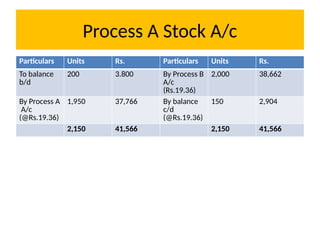

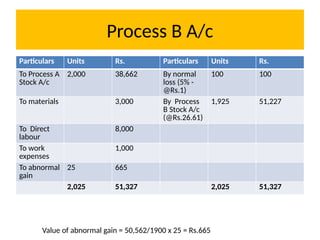

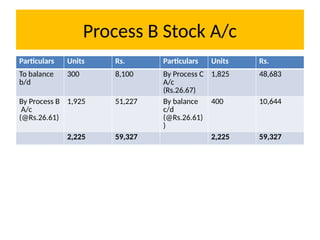

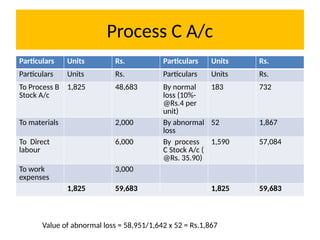

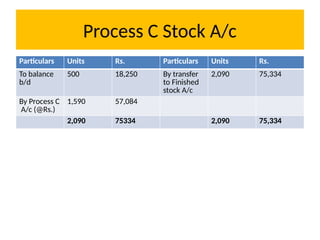

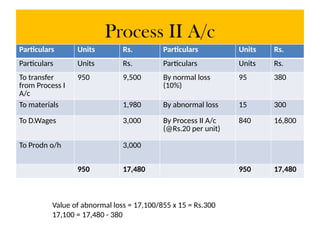

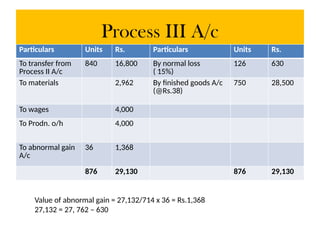

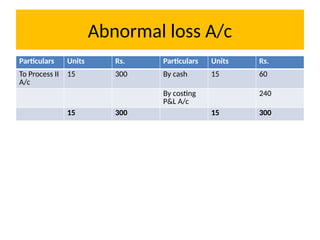

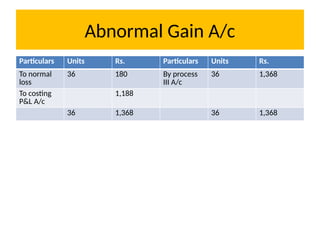

For this purpose, process accounts are opened in the books of accounts, for each process and all the expenses relating to the process for the period is charged to the respective process account.

Continuous production

Costs are accumulated by processes

Standardized products

The finished product of each process becomes the input for the next process

Predetermined sequence of process

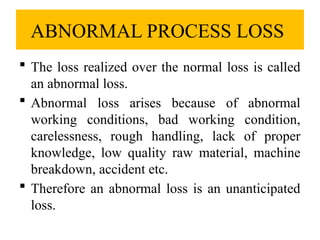

Unavoidable loss

Production of by-products

Simple and less expensive

Better managerial control

Easy to allocate the expenses to processes

Easy to quote prices with standardization of process

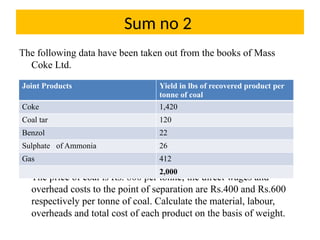

In some industries ,two or more products of equal importance and value are produced,simultaneously in a process. Such products are called joint products.

Motor spirit,kerosene oil,fuel oil,lubricating oil,wax,tar are examples of joint products produced from crude petroleum.In some industries ,two or more products of equal importance and value are produced,simultaneously in a process. Such products are called joint products.

Motor spirit,kerosene oil,fuel oil,lubricating oil,wax,tar are examples of joint products produced from crude petroleum.

Correct collection, compilation and classification of process costs.

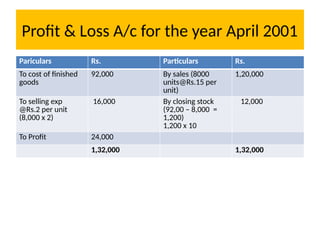

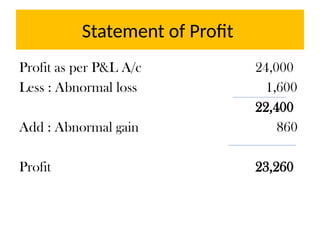

The profit or loss of joint products manufacture is determined.

The method or pattern of production may be determined.

Fixing most profitable product mix may increase the profit.

The relationship between the cost and profit can be studied to fix the price of joint products.

The effect of increase or decrease in cost is to be find out due to increase or decrease in the output of joint products.

The profitability in selling of joint products and by-products can be determined.

The volume of profit may also be maximized with the help of marginal contribution analysis.

All the costs incurred prior to the split off point are called Joint Product cost.

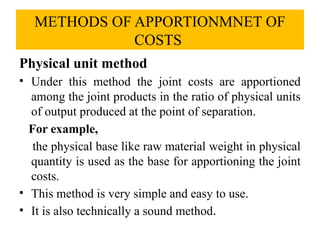

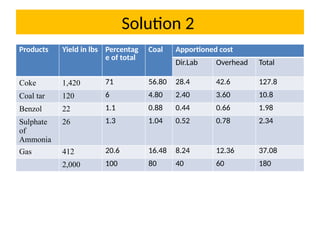

Accounting for joint products implies the assignment of a portion of the joint cost to each of the joint products

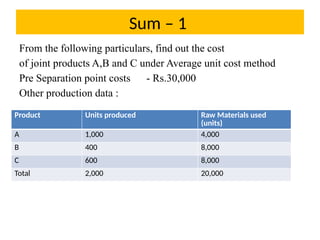

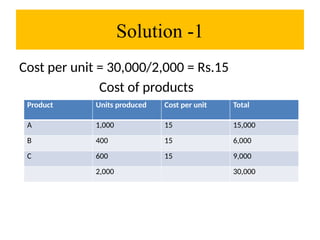

Under this method, the total units produced at costing