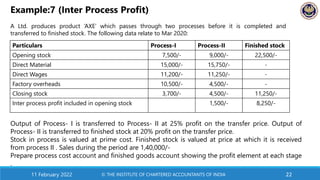

The document outlines virtual coaching classes on process costing, a method used in manufacturing industries where products pass through multiple processes. Key topics covered include normal and abnormal losses, valuation of work in progress, equivalent production, and inter-process profits. Practical examples and methods for calculating costs related to these concepts are also detailed.