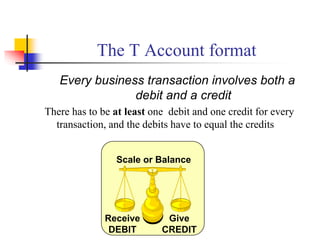

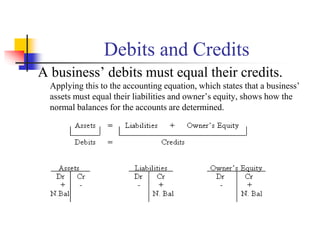

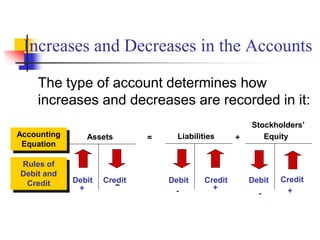

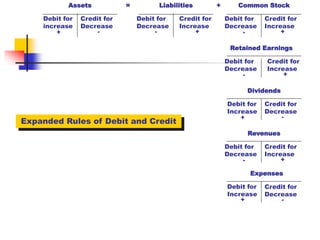

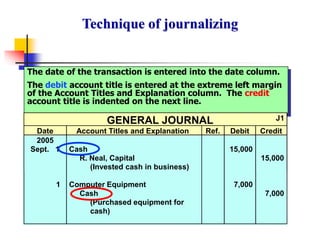

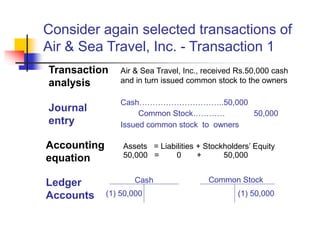

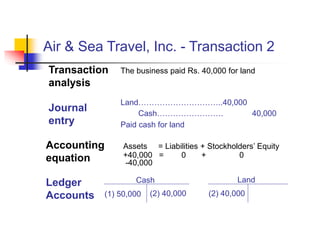

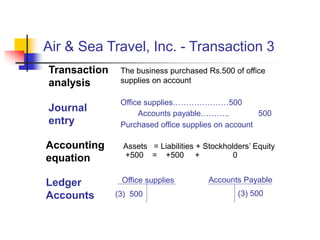

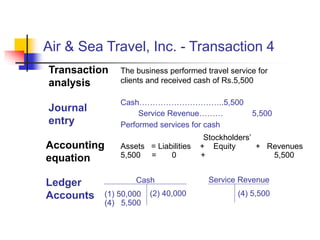

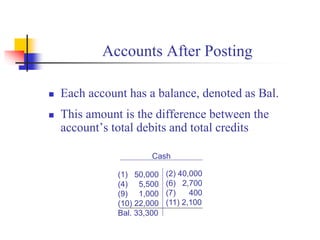

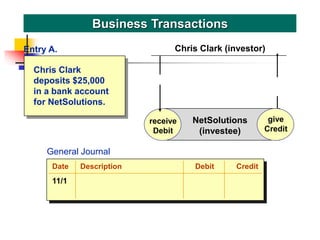

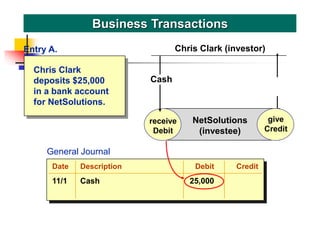

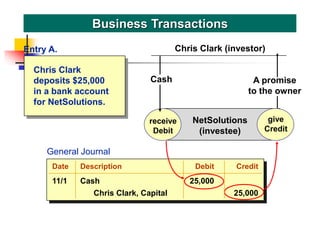

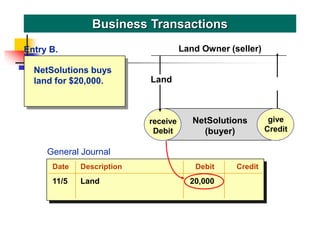

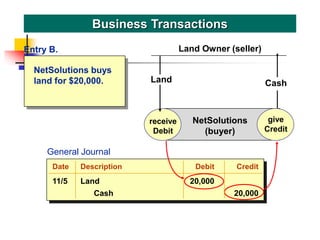

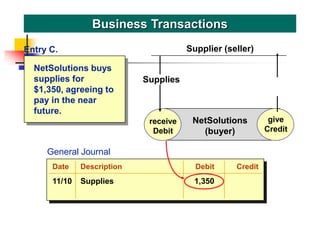

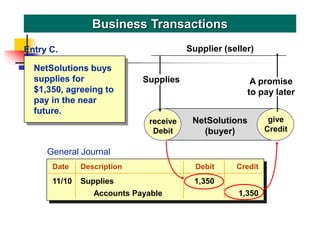

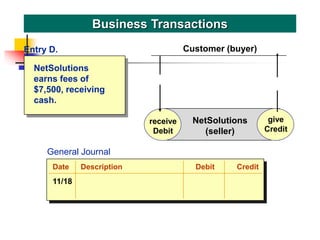

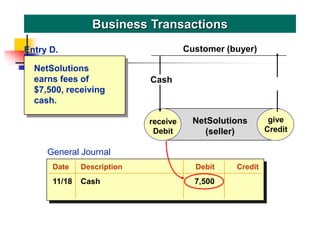

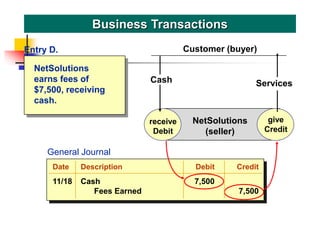

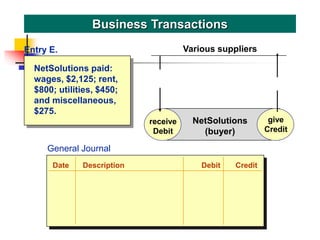

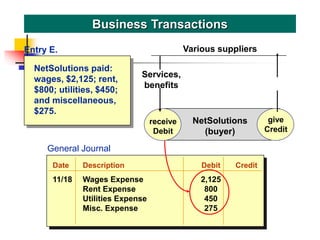

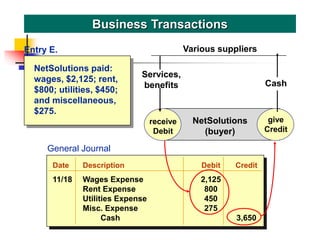

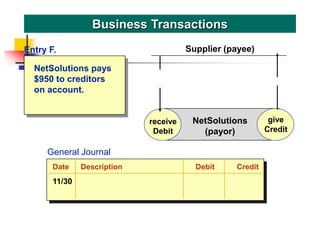

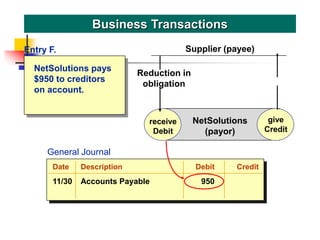

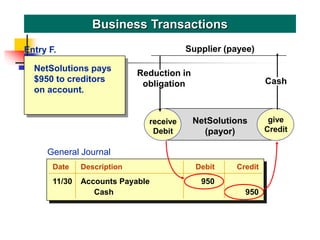

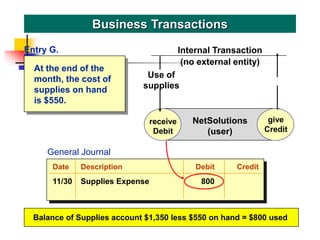

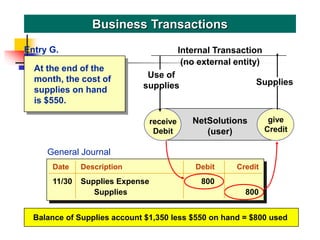

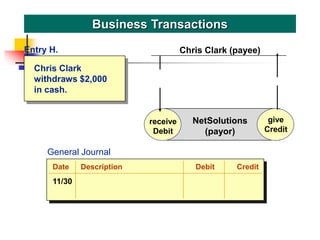

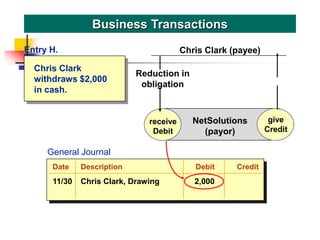

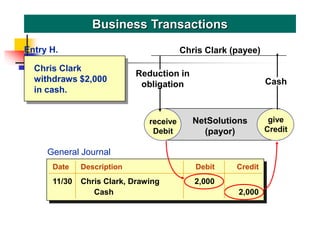

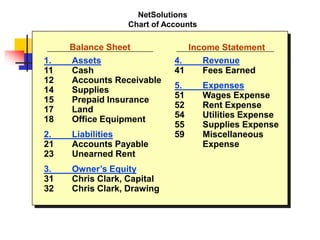

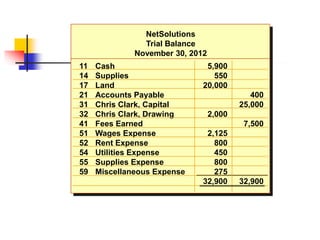

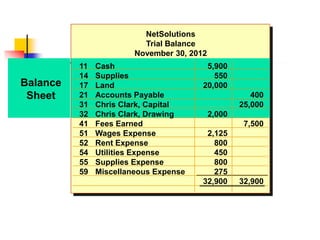

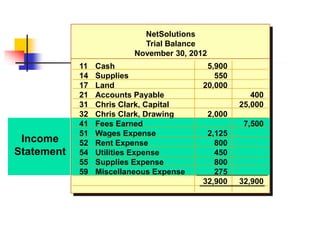

NetSolutions records business transactions using double-entry accounting. Transactions include Chris Clark investing $25,000 cash in the business, purchasing $20,000 of land, buying $1,350 of supplies on account, earning $7,500 in fees, paying $3,650 in expenses, paying $950 to creditors, using $800 of supplies, and Chris Clark withdrawing $2,000 cash. Debits and credits are equal for each transaction to maintain the accounting equation of assets = liabilities + owner's equity.