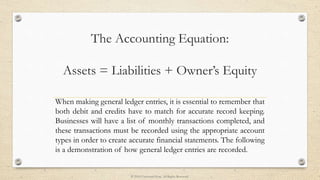

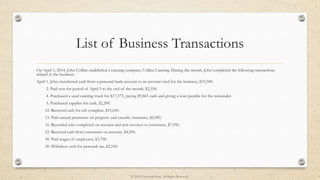

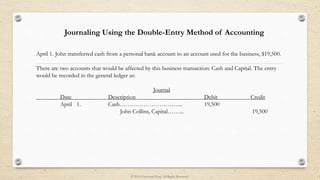

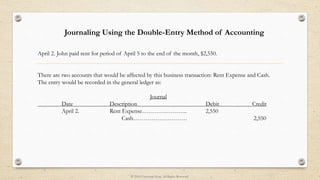

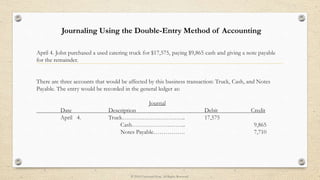

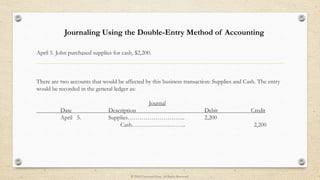

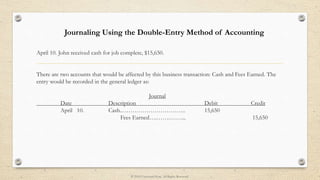

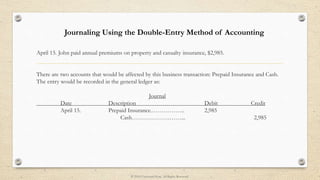

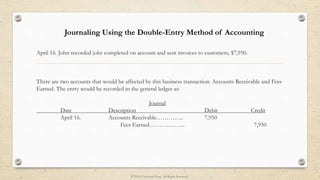

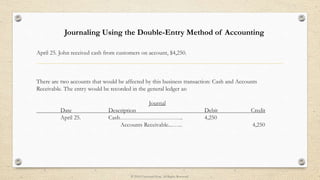

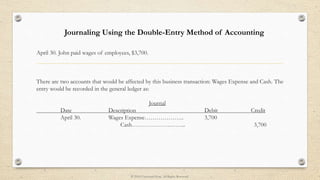

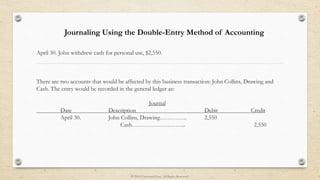

This document explains how to make journal entries using the double-entry accounting system, emphasizing the importance of matching debits and credits for accurate financial record keeping. It details various transactions of John Collins' catering business in April 2014, illustrating how each transaction affects different accounts in the general ledger. The entries correspond to events such as cash transfers, expenses, and income, demonstrating the application of the accounting equation.