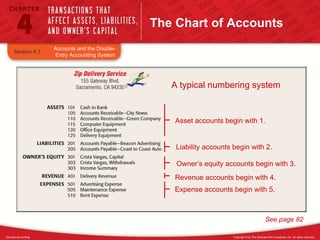

The document discusses key accounting terms and concepts including the chart of accounts, ledger, double-entry accounting, debit and credit entries, T-accounts, and normal account balances. It also provides examples of business transactions and steps for analyzing transactions using debit and credit rules.