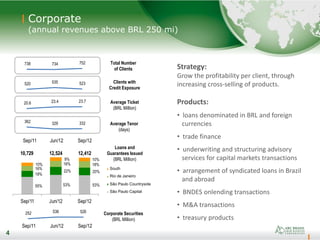

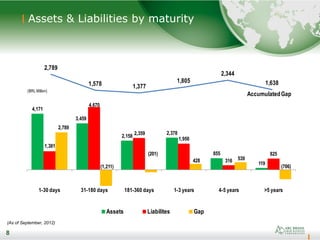

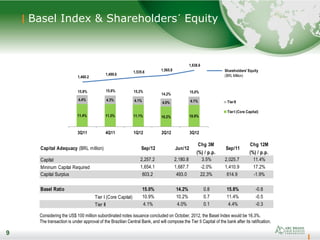

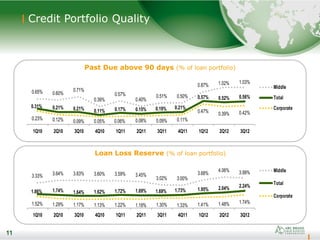

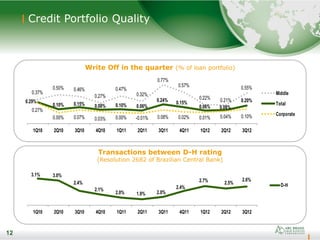

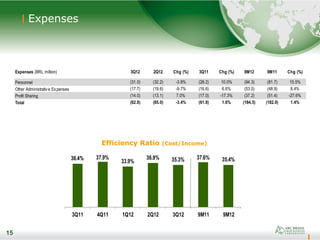

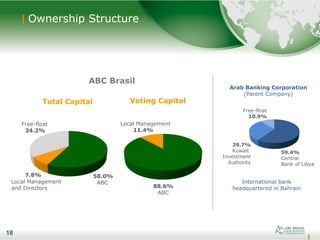

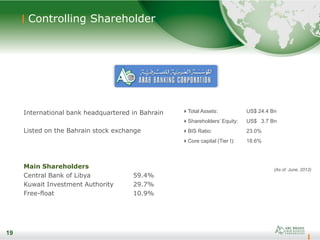

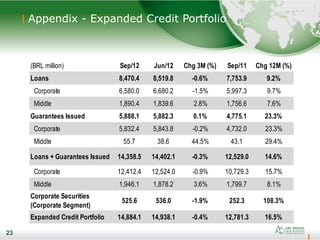

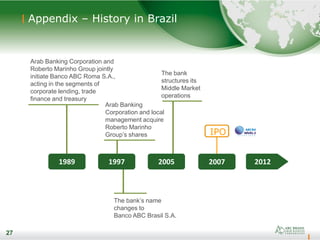

This document summarizes the strategy, business segments, financial performance, and capital position of Banco ABC Brasil. It discusses the bank's focus on corporate and middle market clients, expansion into new regions, and growth of non-interest income. Key highlights include an increase in the middle market loan portfolio, diversified funding sources, and stable credit quality. The bank maintains strong capital ratios and profitability, with a return on equity above 20% and efficiency ratio around 35%.