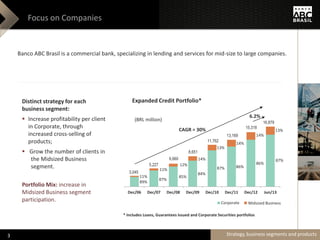

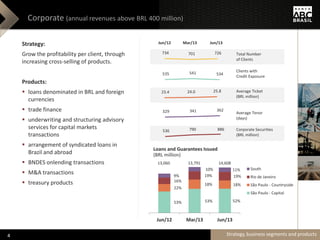

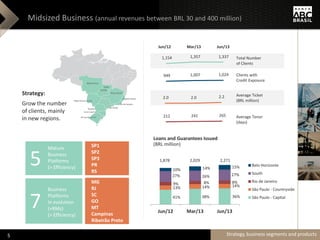

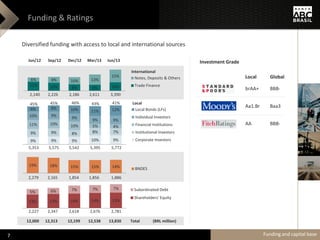

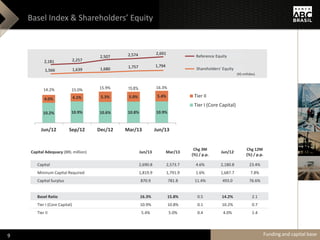

This document provides an overview of an investment bank including its strategy, business segments, products, funding and capital base, financial highlights, and ownership structure. The bank focuses on lending and services for mid-size to large companies in Brazil. It has two main business segments: Corporate (large companies with annual revenues over BRL 400 million) and Midsized Business (companies with revenues between BRL 30-400 million). The presentation discusses the strategies, products, and financial details of each segment. The bank has a diversified funding base and adequate capital and liquidity levels. Credit quality remains strong with low past due levels and loan loss reserves covering over 1% of loans.