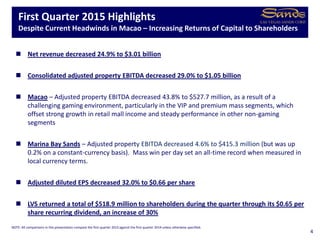

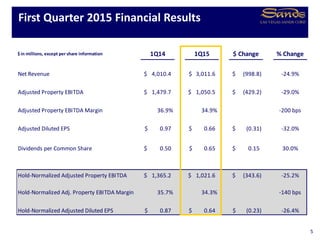

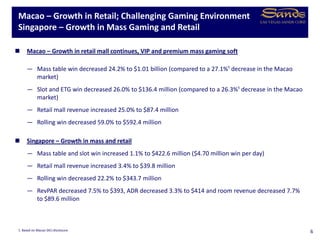

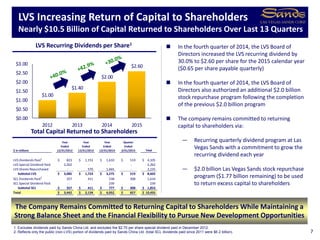

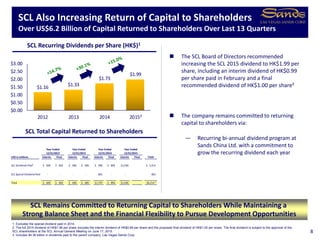

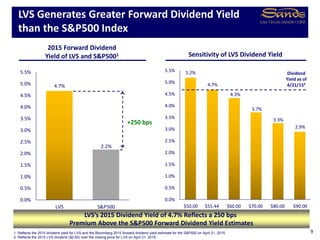

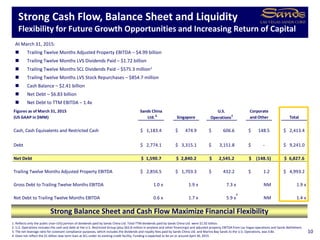

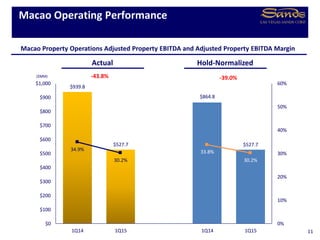

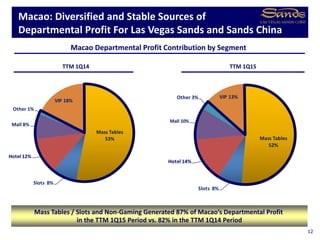

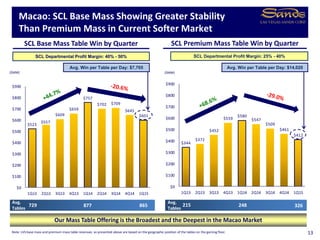

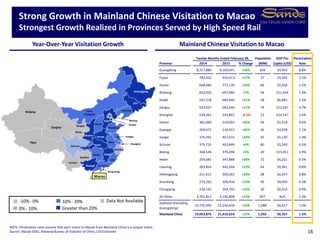

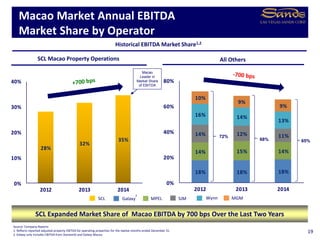

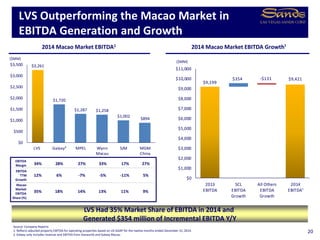

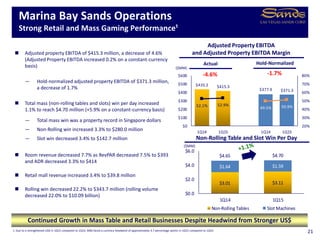

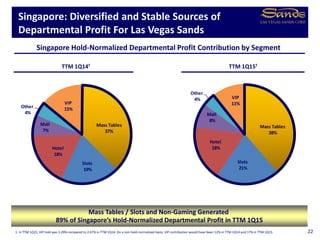

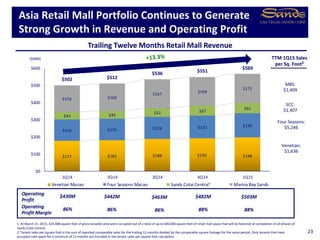

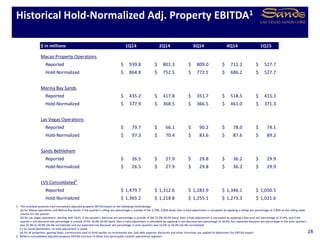

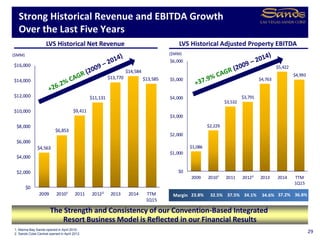

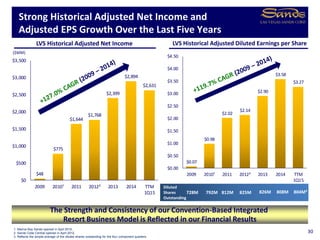

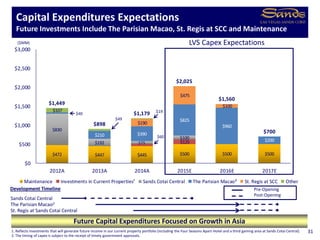

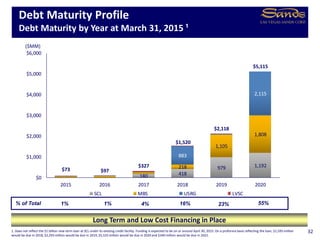

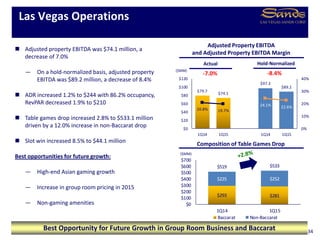

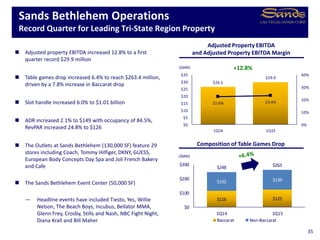

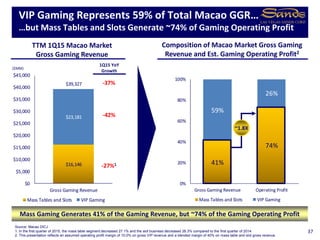

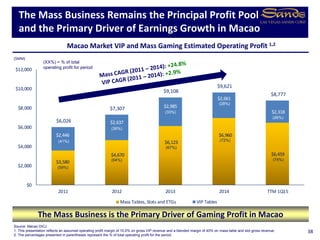

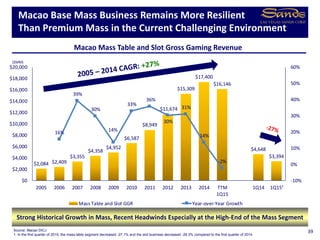

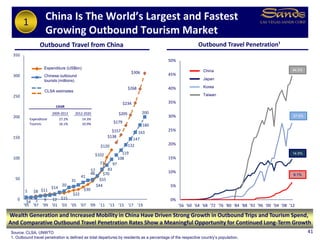

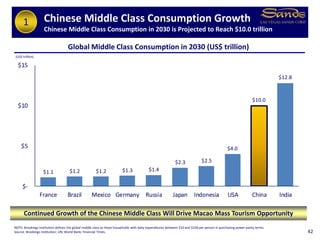

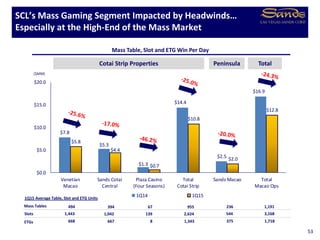

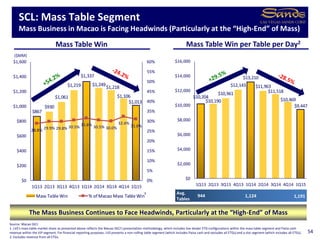

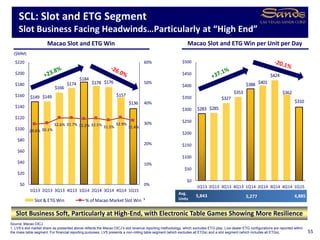

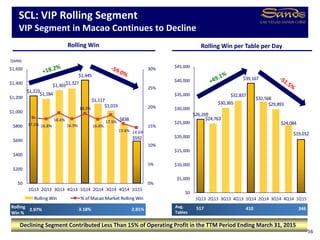

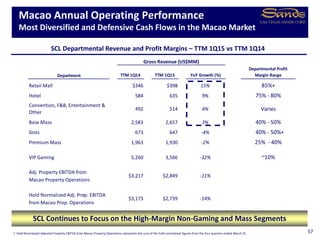

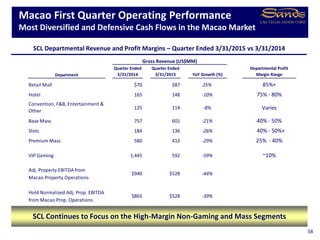

The document is Las Vegas Sands' 1Q15 earnings call presentation. It discusses financial results for the quarter, including a decrease in net revenue and adjusted property EBITDA. It highlights declines in Macao gaming revenue, especially in VIP and premium mass segments, while Singapore saw growth in mass gaming and retail. The presentation emphasizes the company's commitment to maximizing shareholder returns through continued growth, increasing recurring dividends, and stock repurchases totaling nearly $10.5 billion returned to shareholders over the last 13 quarters.