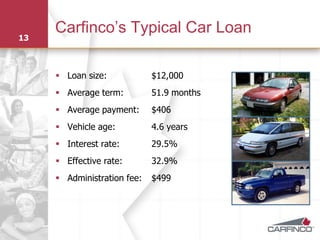

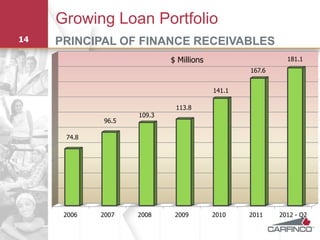

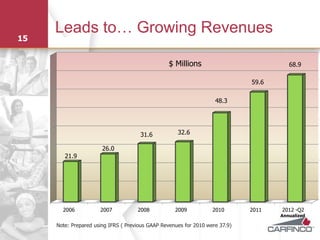

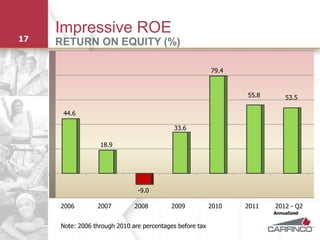

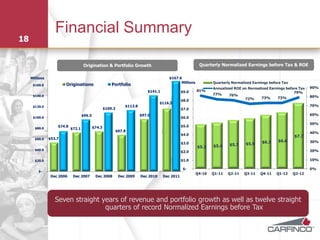

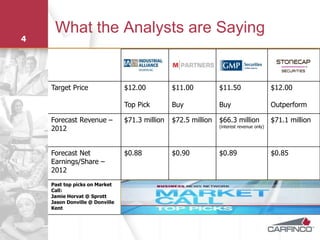

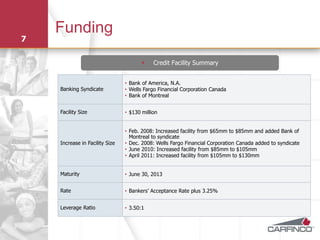

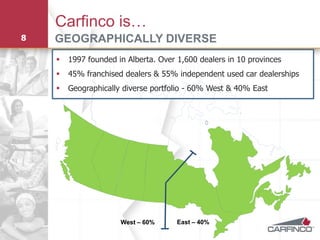

Carfinco Financial Group Inc. is a provider of auto financing to non-prime borrowers. The presentation highlights Carfinco's consistent growth, strong financial performance, and positive outlook. Analysts have set target prices between $11-12 per share and forecast continued revenue and earnings growth in 2012. Carfinco has a large and geographically diverse loan portfolio, stringent credit controls, and obtains funding through a $130 million credit facility.

![Canadian Non-prime Market

11 BEACON SCORE AS A % OF THE CANADIAN CREDIT MARKET

70%

58%

60% 55%

50%

40% 36%

30%

20% 14%

10% 10%

6%

10% 5% 4% 2%

0%

No Score 000 - 619 [D] 620 - 649 [C] 650 - 679 [B] 680 - 719 [A] 720 - 999

[A+]

Canadian Market Carfinco Portfolio](https://image.slidesharecdn.com/cfnpresentation-120821160242-phpapp01/85/CFN-August-Investor-Presentation-11-320.jpg)