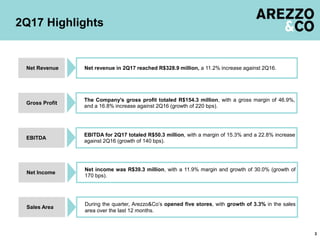

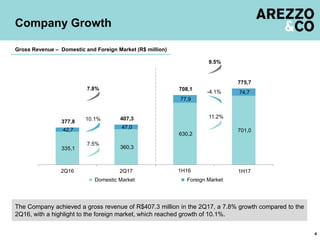

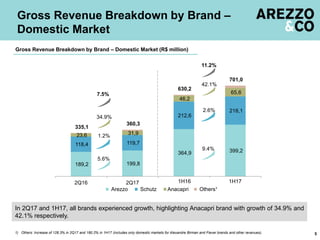

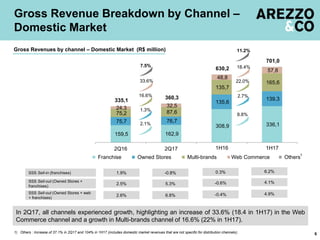

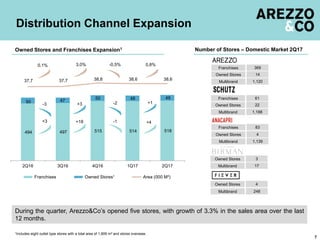

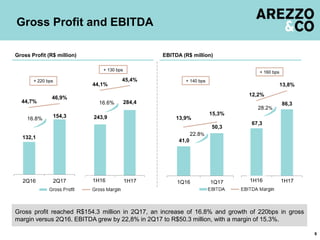

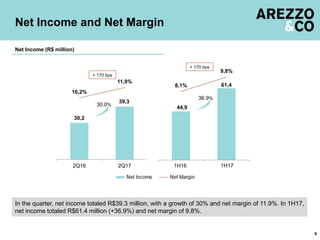

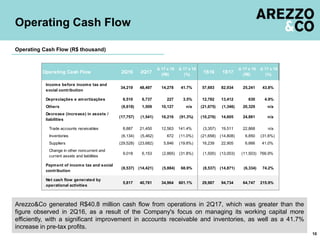

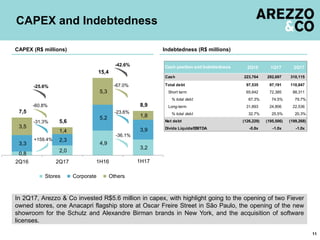

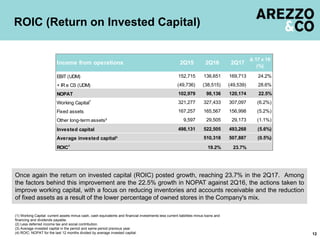

Arezzo & Co reported strong financial results for 2Q17. Net income grew 30% to R$39.3 million with margins expanding. Gross profit increased 16.8% to R$154.3 million and EBITDA grew 22.8% to R$50.3 million. All brands and channels experienced sales growth. The company continues expanding through new store openings and growing its online presence. ROIC improved to 23.7%, demonstrating efficient use of capital.