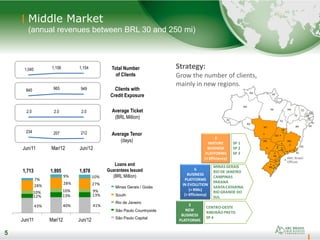

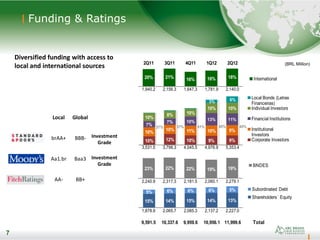

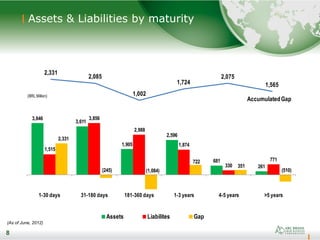

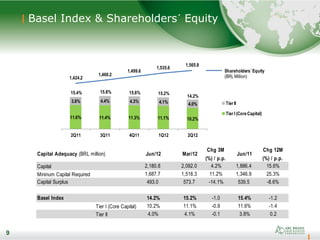

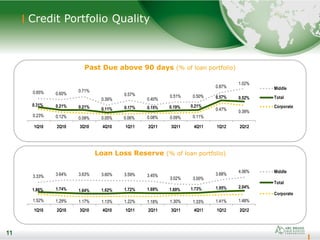

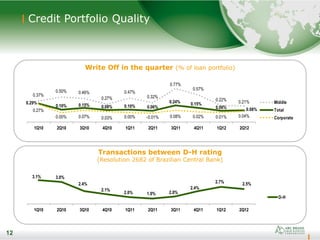

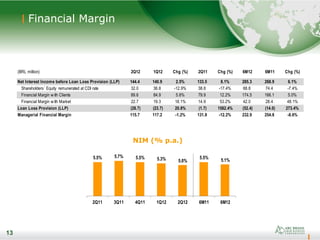

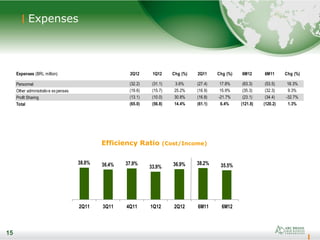

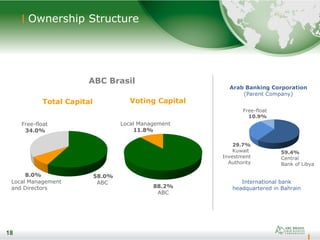

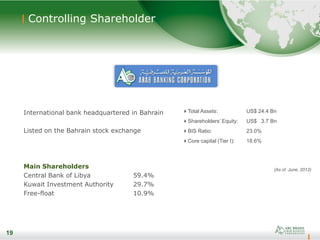

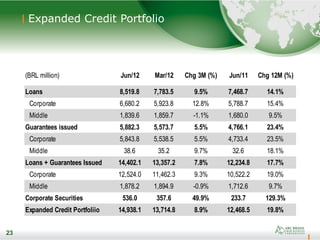

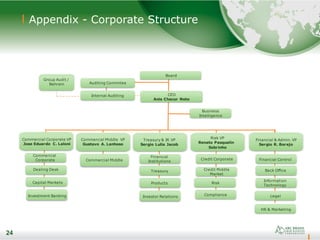

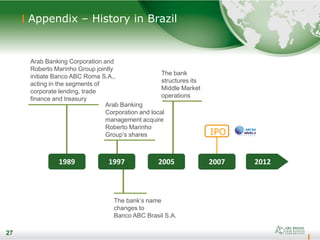

This document summarizes the strategy, business segments, financial performance, and capital position of Banco ABC Brasil. It discusses the bank's focus on corporate and middle market clients, expansion of credit portfolio to middle market, and strategies to increase profitability per corporate client and grow middle market clients. Key financial highlights presented include steady growth in total assets and net income, strong capital and liquidity positions, and stable credit quality.