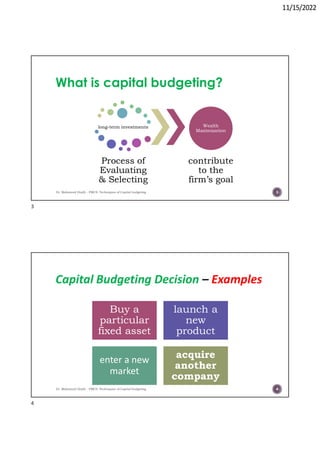

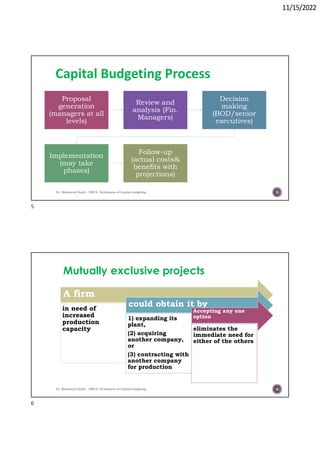

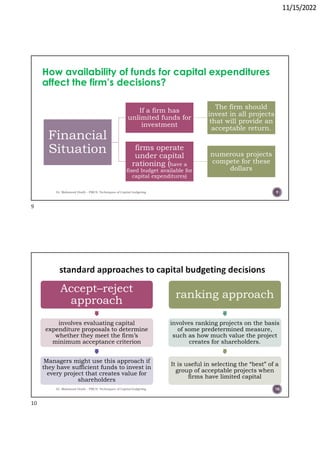

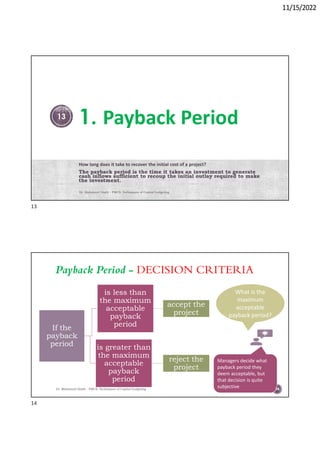

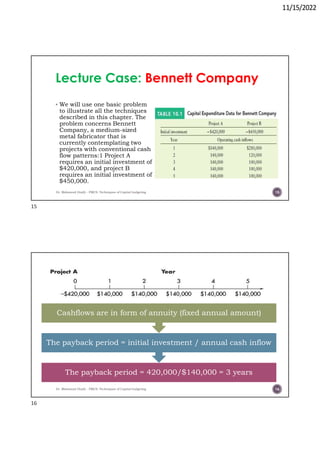

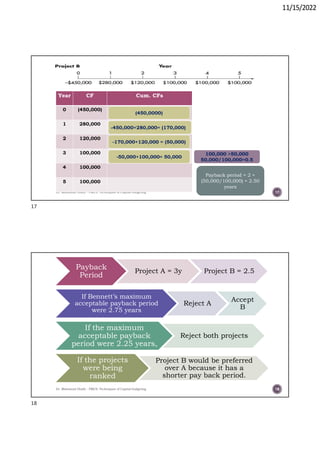

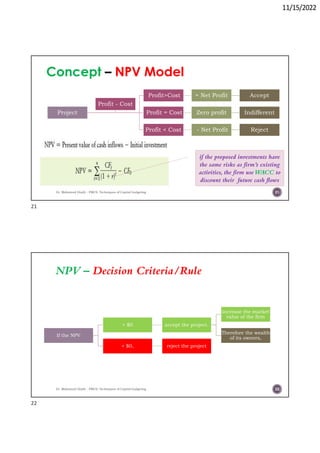

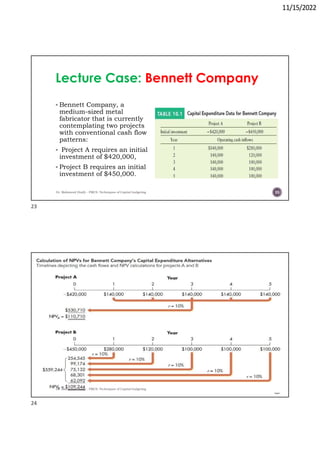

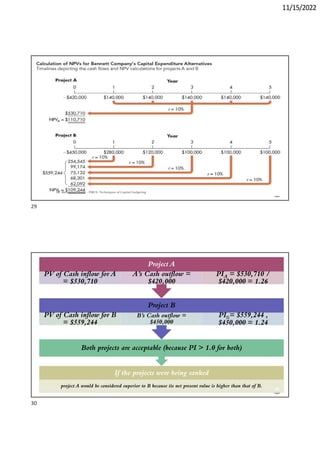

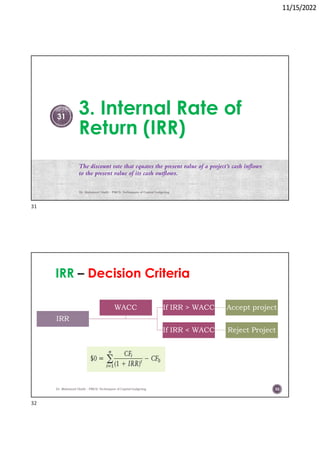

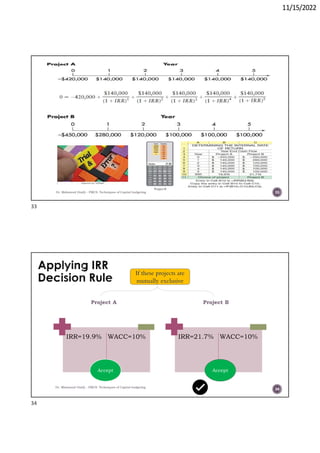

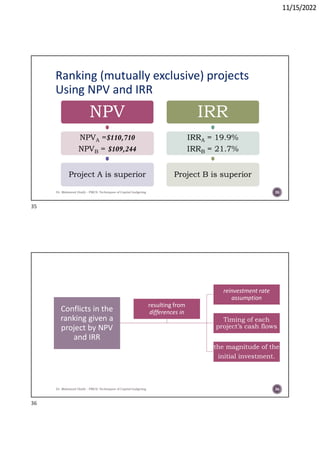

The document discusses various capital budgeting techniques used to evaluate long-term investment projects. It begins with definitions of capital expenditures and operating expenditures. It then discusses what capital budgeting is and gives examples of capital budgeting decisions. The capital budgeting process and categories of investment projects are outlined. How the availability of funds affects a firm's decisions is explored. Techniques used to analyze potential ventures including payback period, net present value (NPV), internal rate of return (IRR), and profitability index are defined. The document uses a case study of Bennett Company to illustrate the application of these techniques.