This document discusses cash management strategies for firms. It covers:

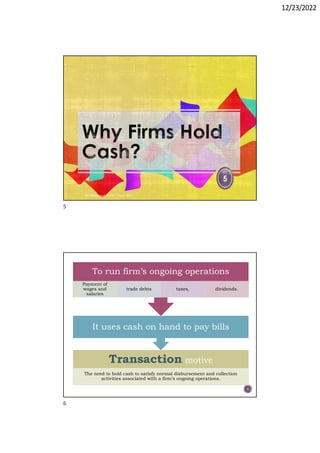

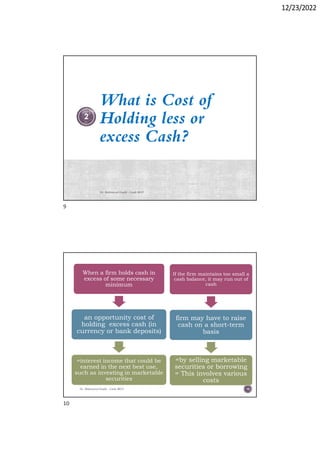

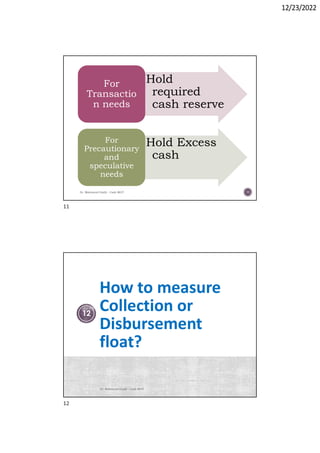

1. Reasons why firms hold cash including transactional, precautionary, and speculative motives.

2. Costs of holding too little or too much cash, including opportunity costs and financing costs.

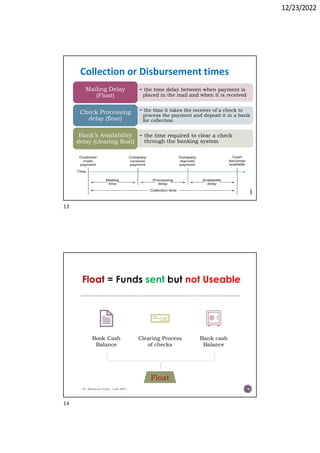

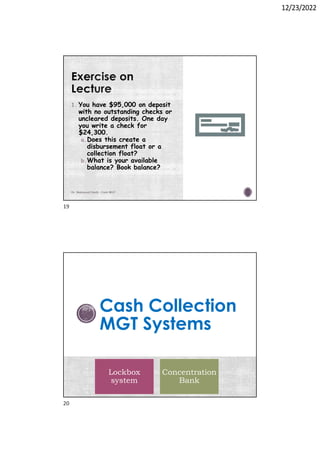

3. Measuring collection and disbursement float.

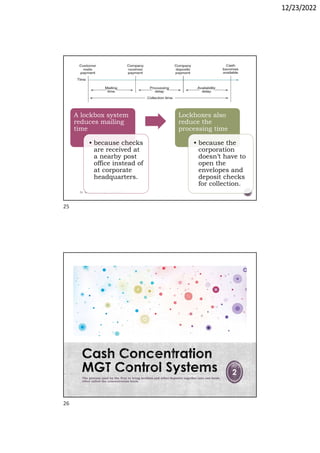

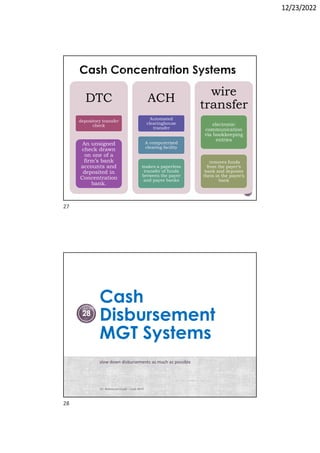

4. Techniques for managing cash collections like lockbox systems and concentration banking.

5. Techniques for managing cash disbursements like controlled disbursement accounts.