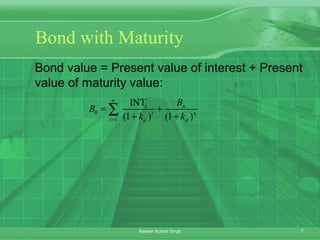

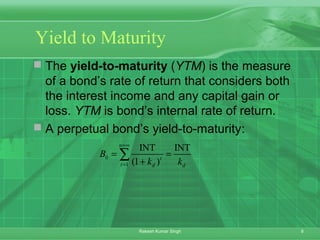

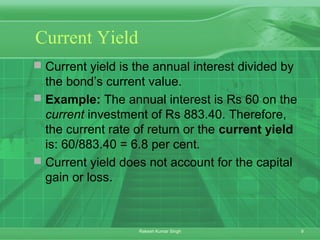

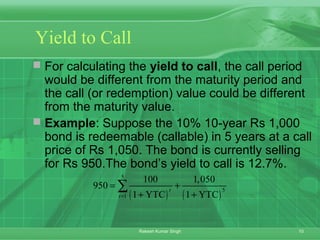

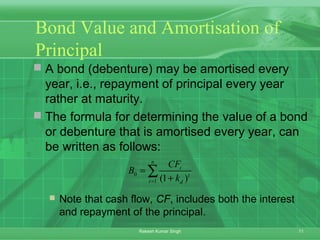

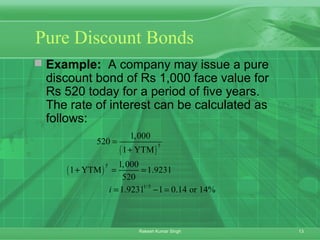

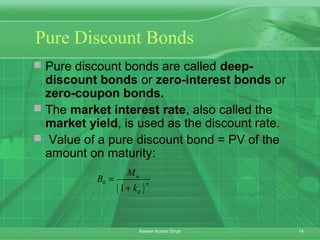

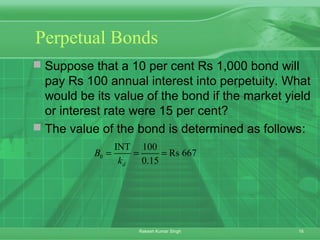

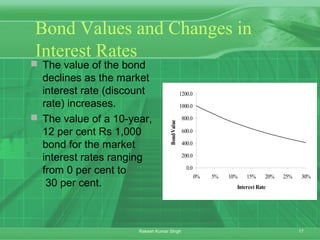

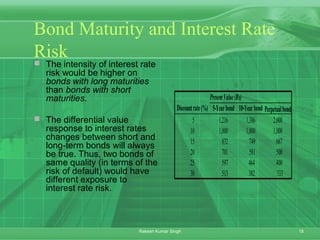

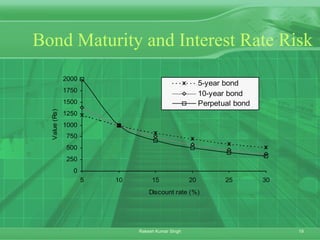

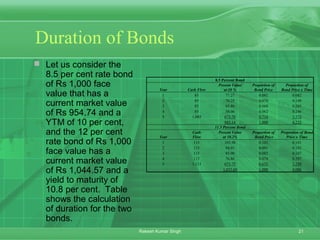

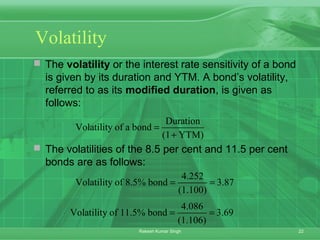

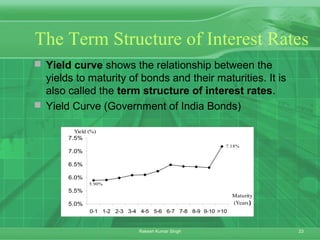

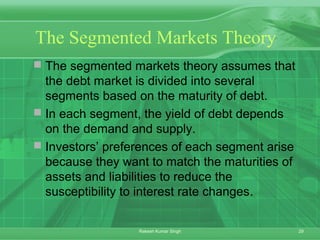

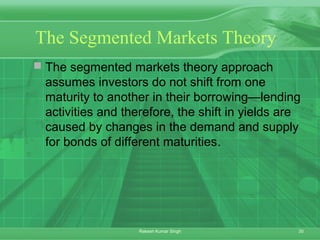

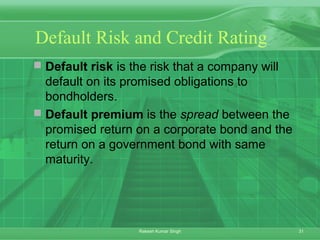

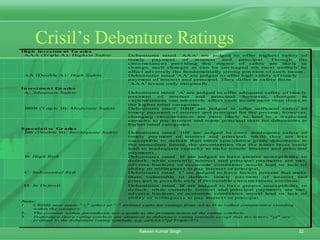

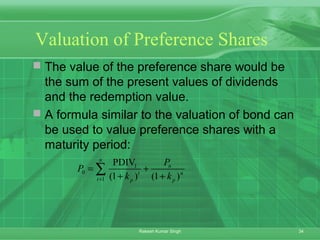

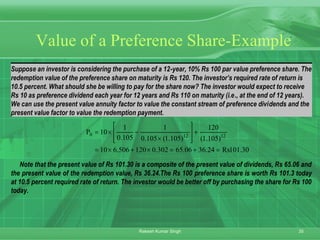

This document discusses the valuation of bonds and shares. It covers the fundamental characteristics of different types of shares and bonds, and how to value them using present value concepts. Key valuation methods discussed include yield to maturity, current yield, yield to call, and duration. The document also examines how bond values are affected by changes in interest rates and the term structure of interest rates. Different theories for the typical upward sloping yield curve are presented, including the expectation theory and liquidity premium theory.