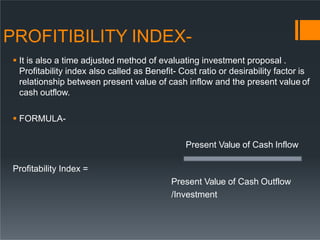

This document provides an overview of capital budgeting. It defines capital budgeting as the planning process used to determine if long-term investments are worth funding through a firm's capital structure. It discusses key concepts like replacement, expansion, and research and development cases of capital budgeting. It also outlines techniques for evaluating capital budgeting proposals, including payback period, accounting rate of return, net present value, and profitability index. The document emphasizes that capital budgeting decisions require large capital outlays and have long-term implications for a firm's growth.