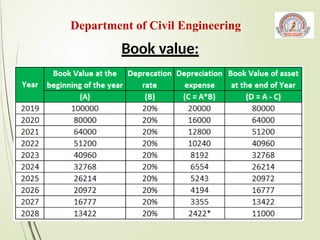

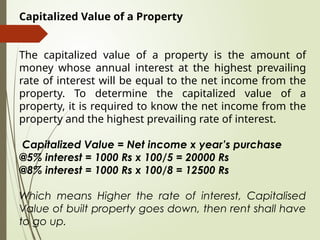

The document details various property valuation concepts, including market value, book value, rateable value, and capitalized value. Market value fluctuates based on demand and supply, while book value decreases over time due to depreciation. It also explains the calculation of capitalized value based on net income and prevailing interest rates.