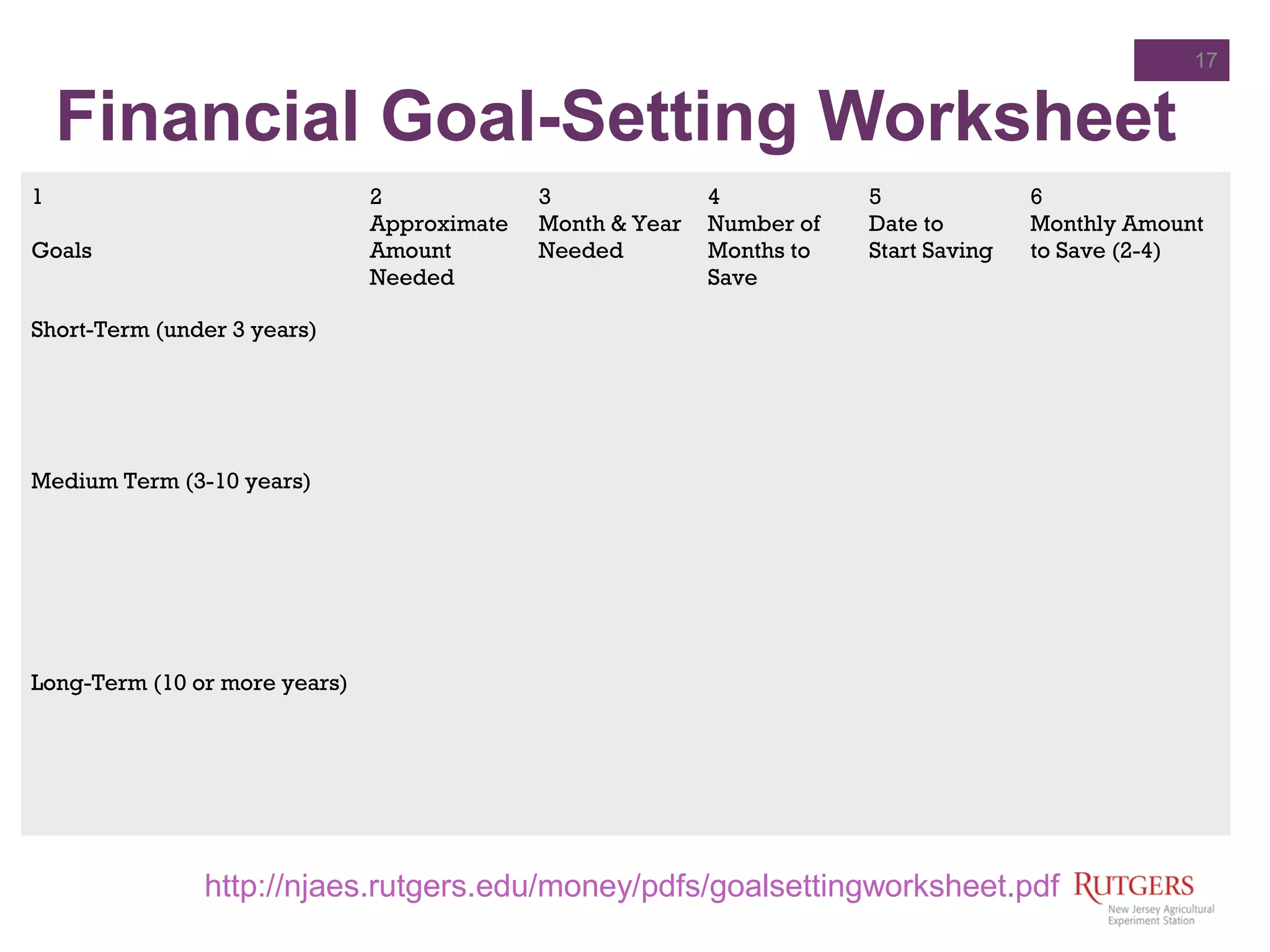

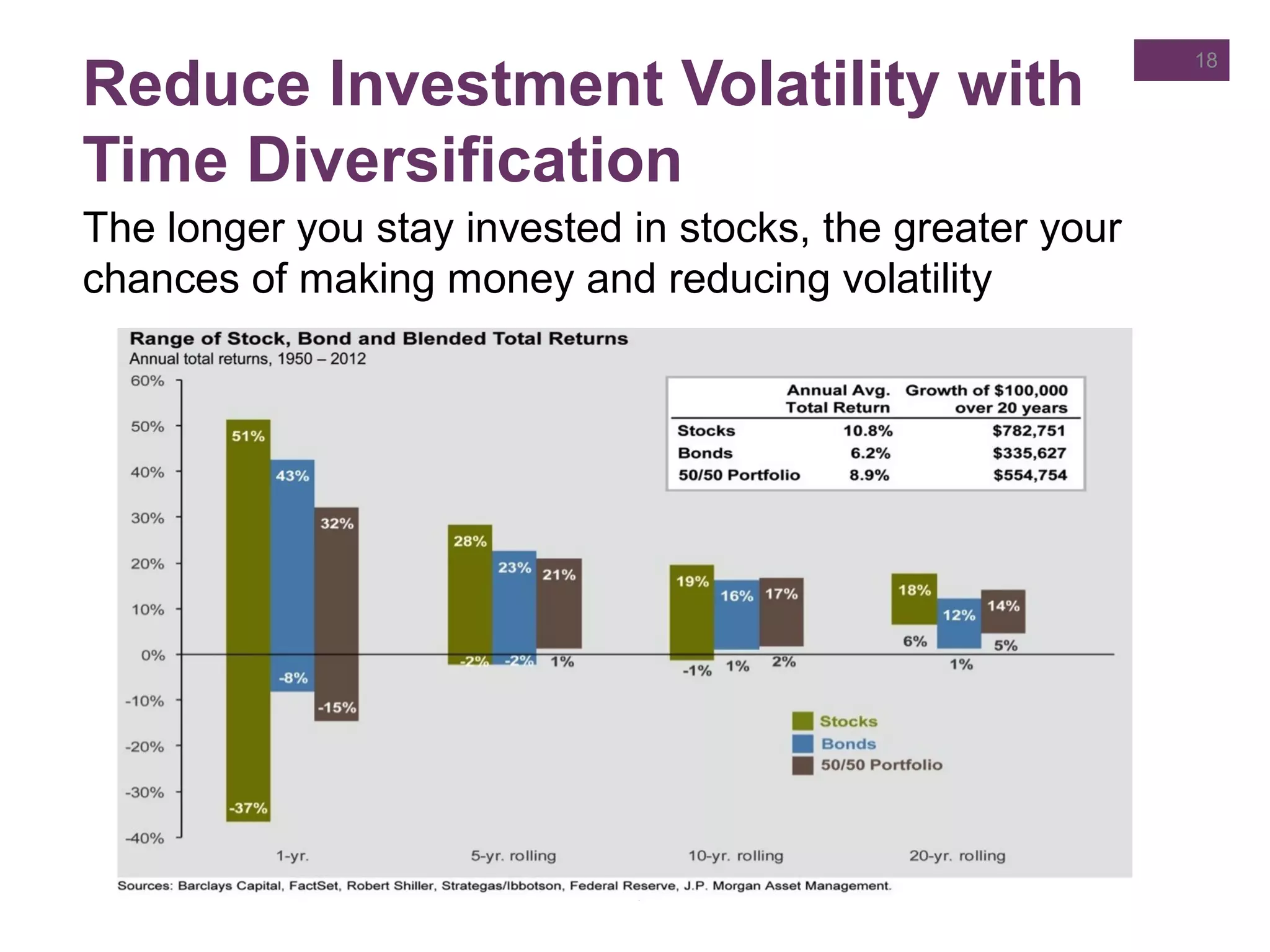

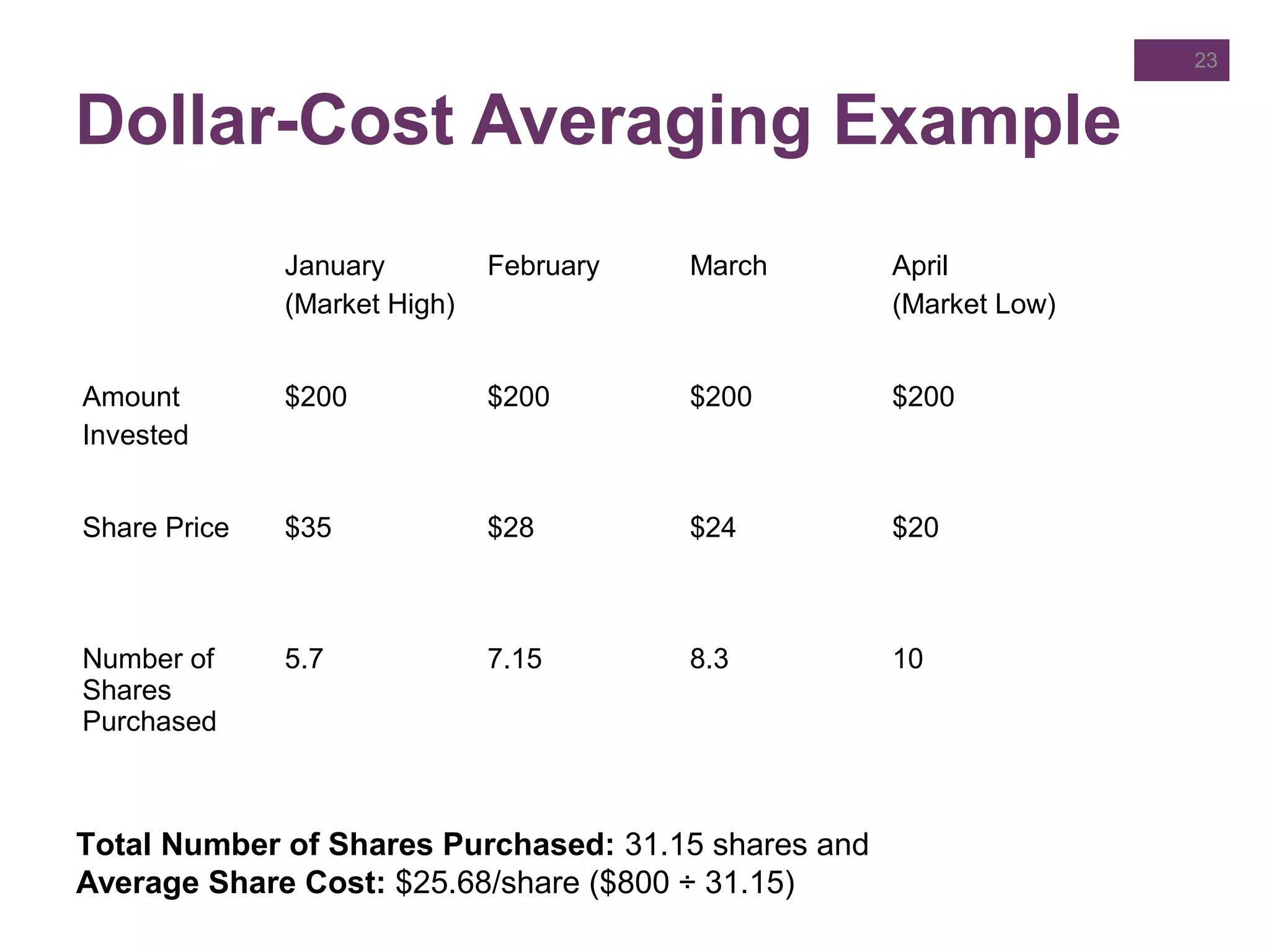

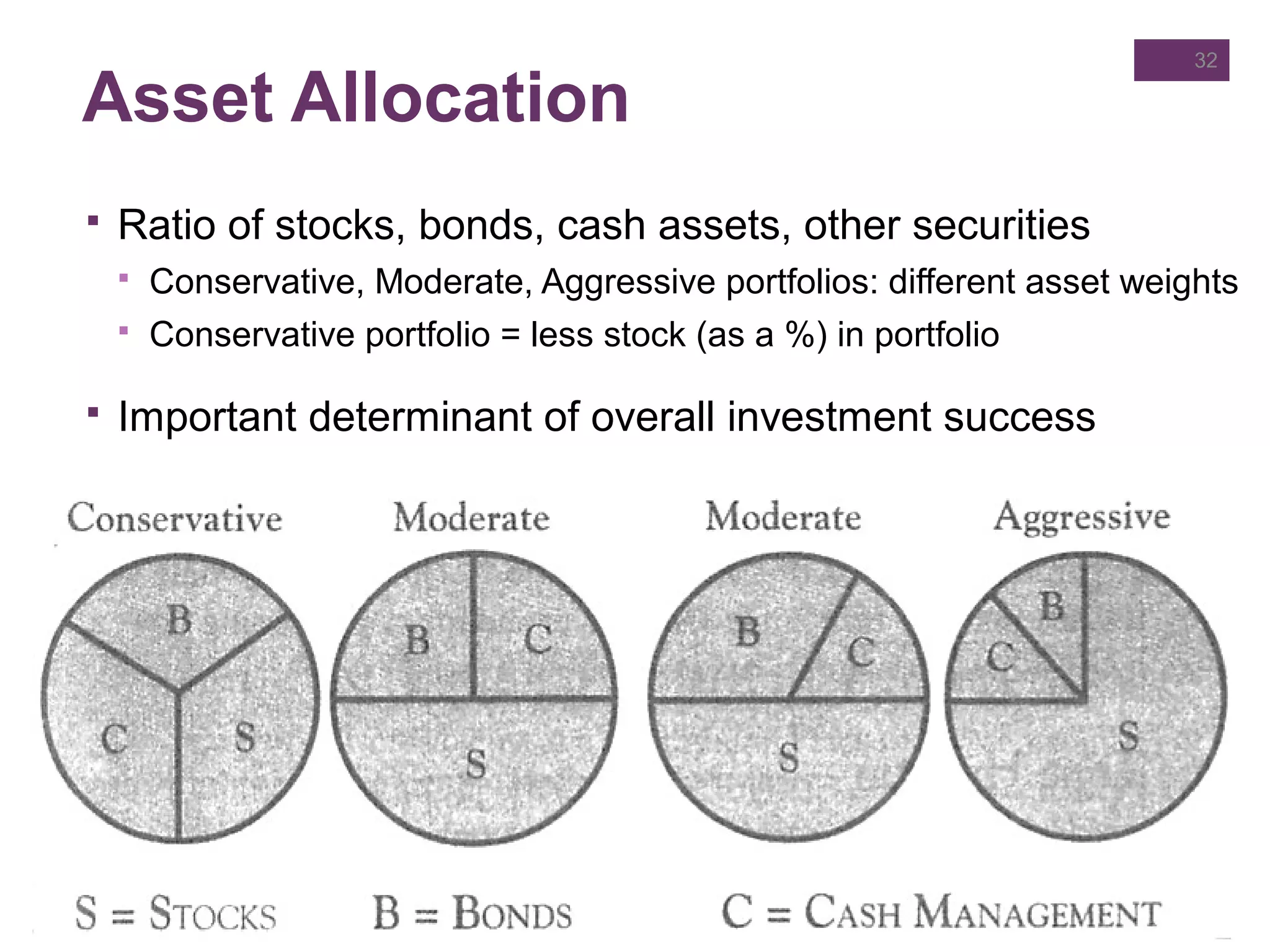

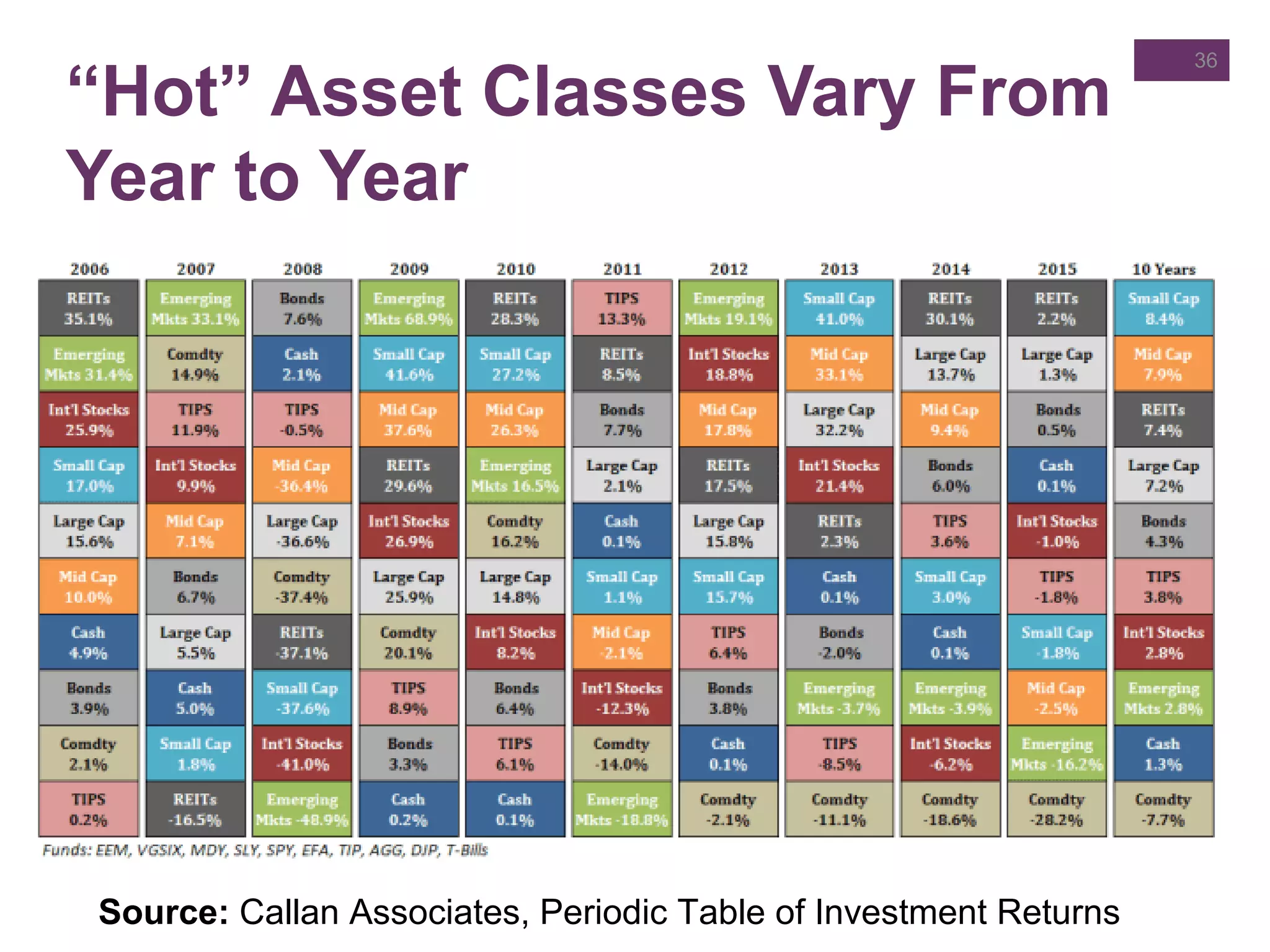

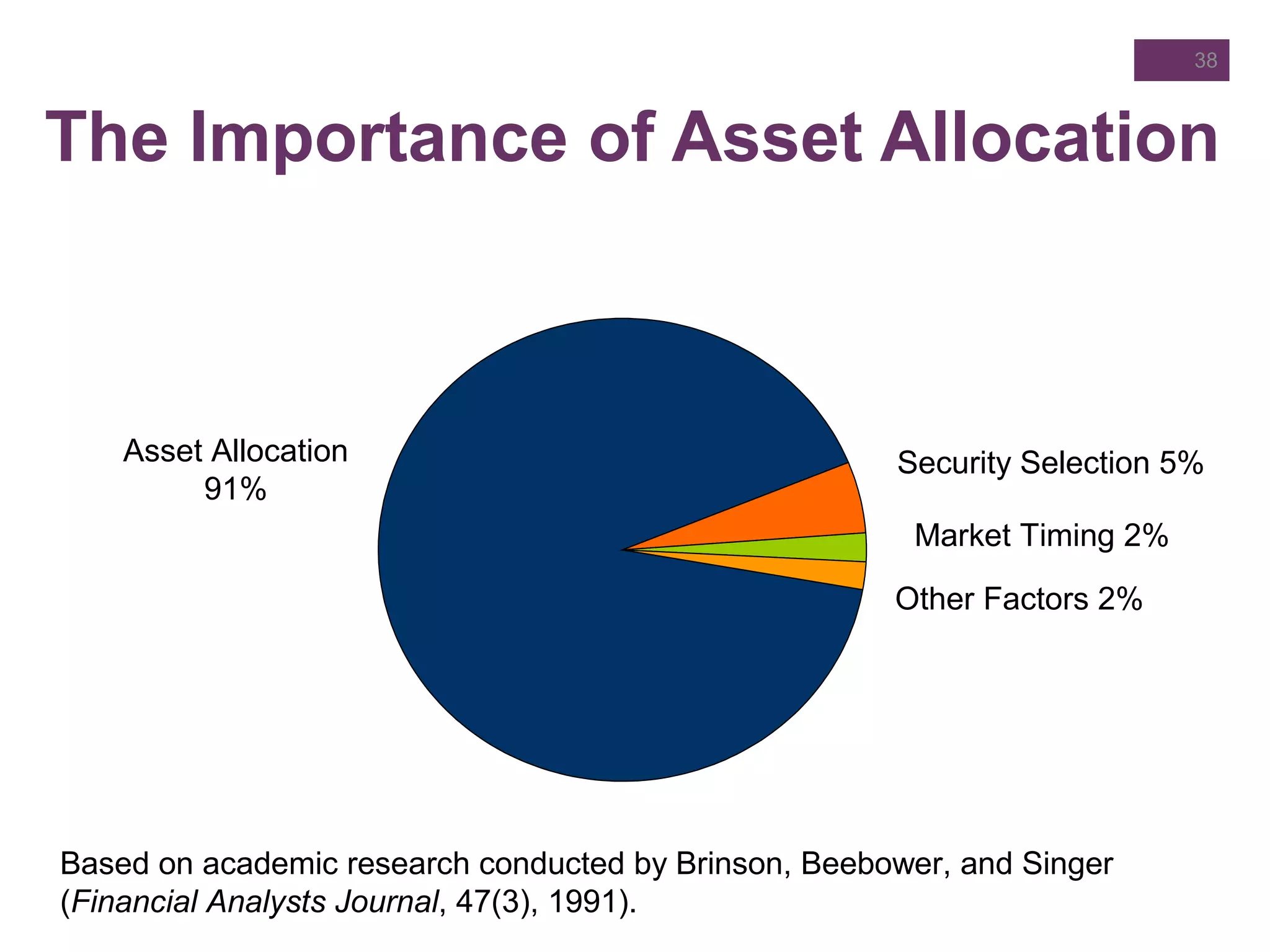

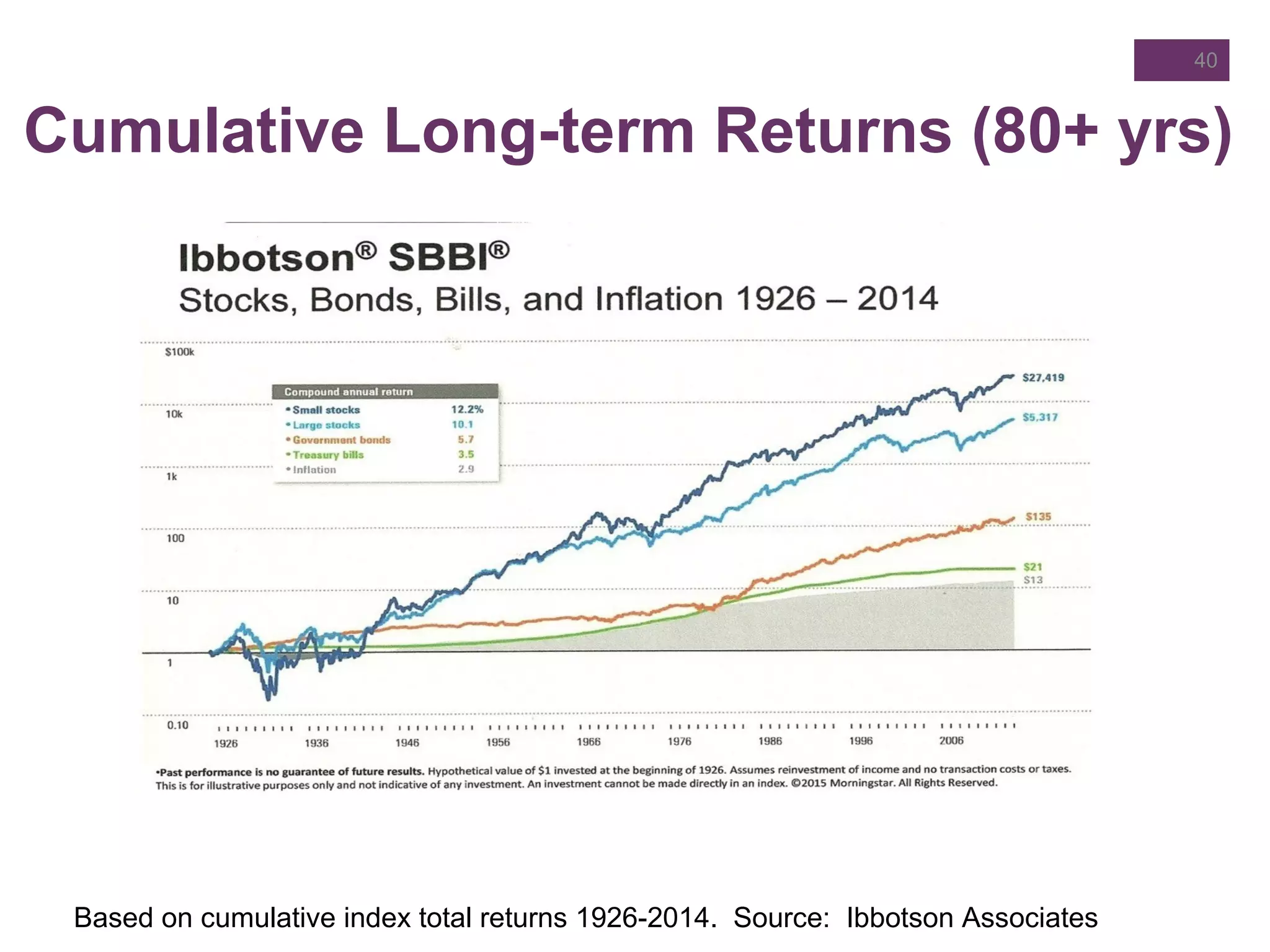

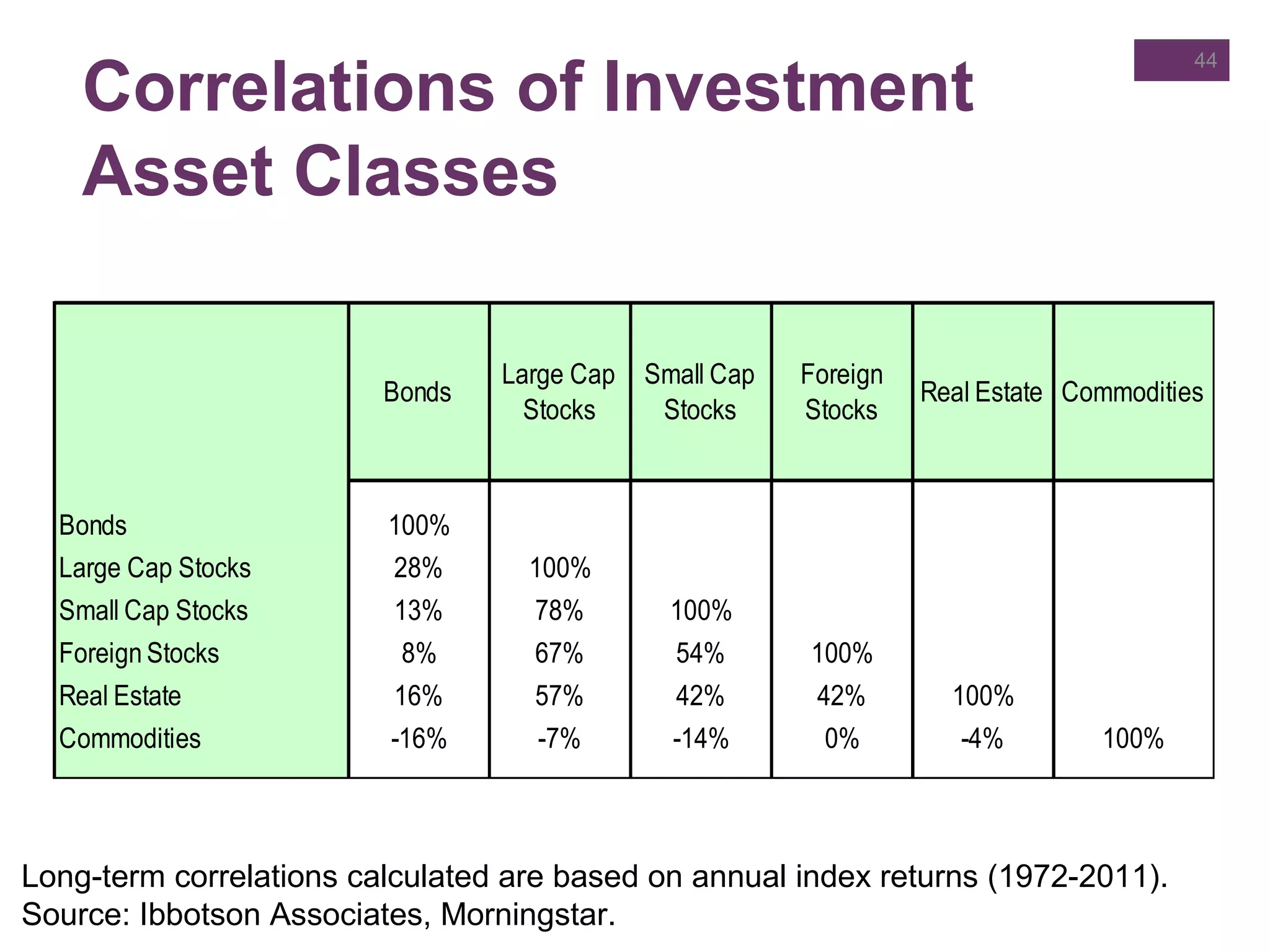

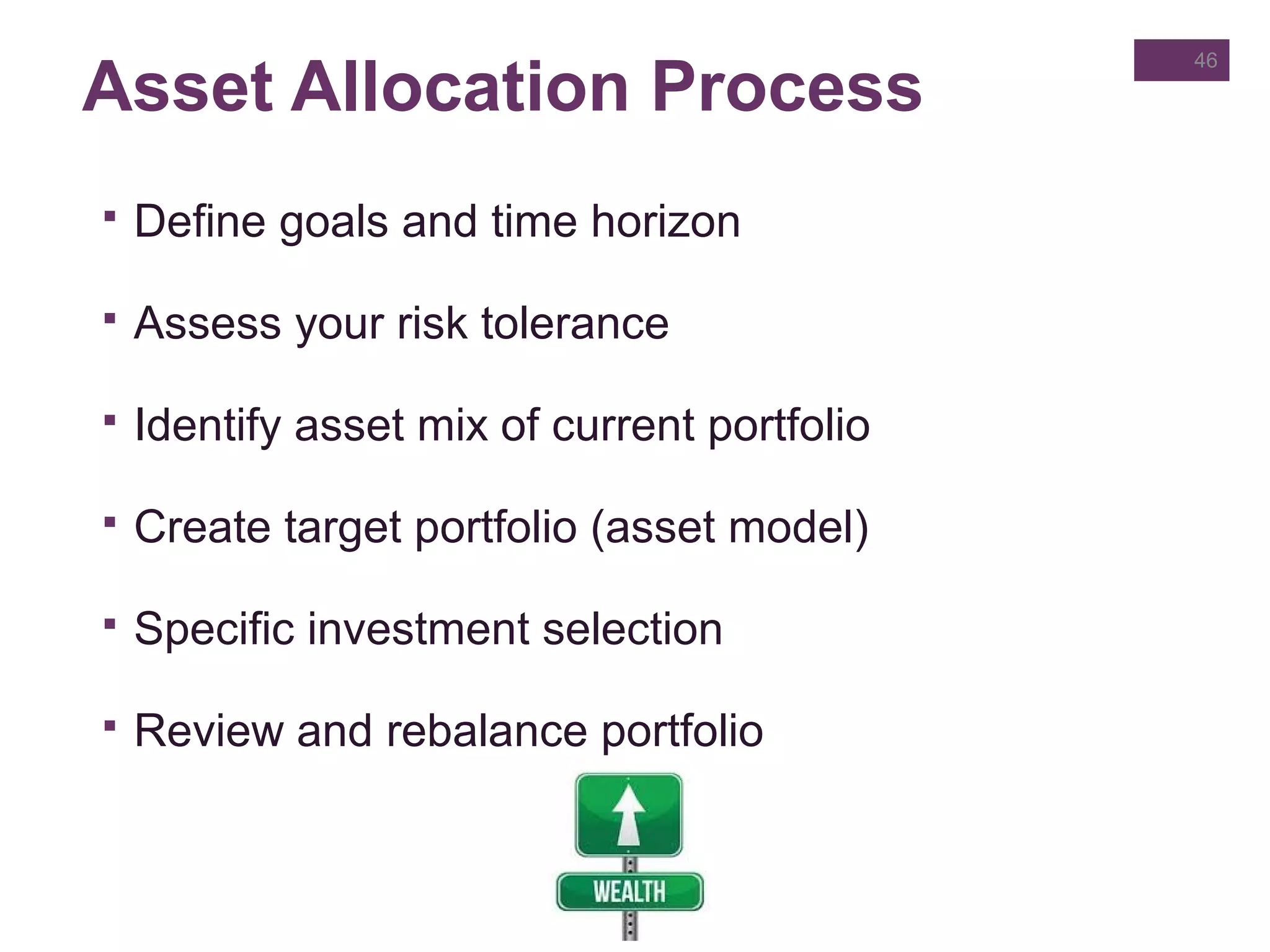

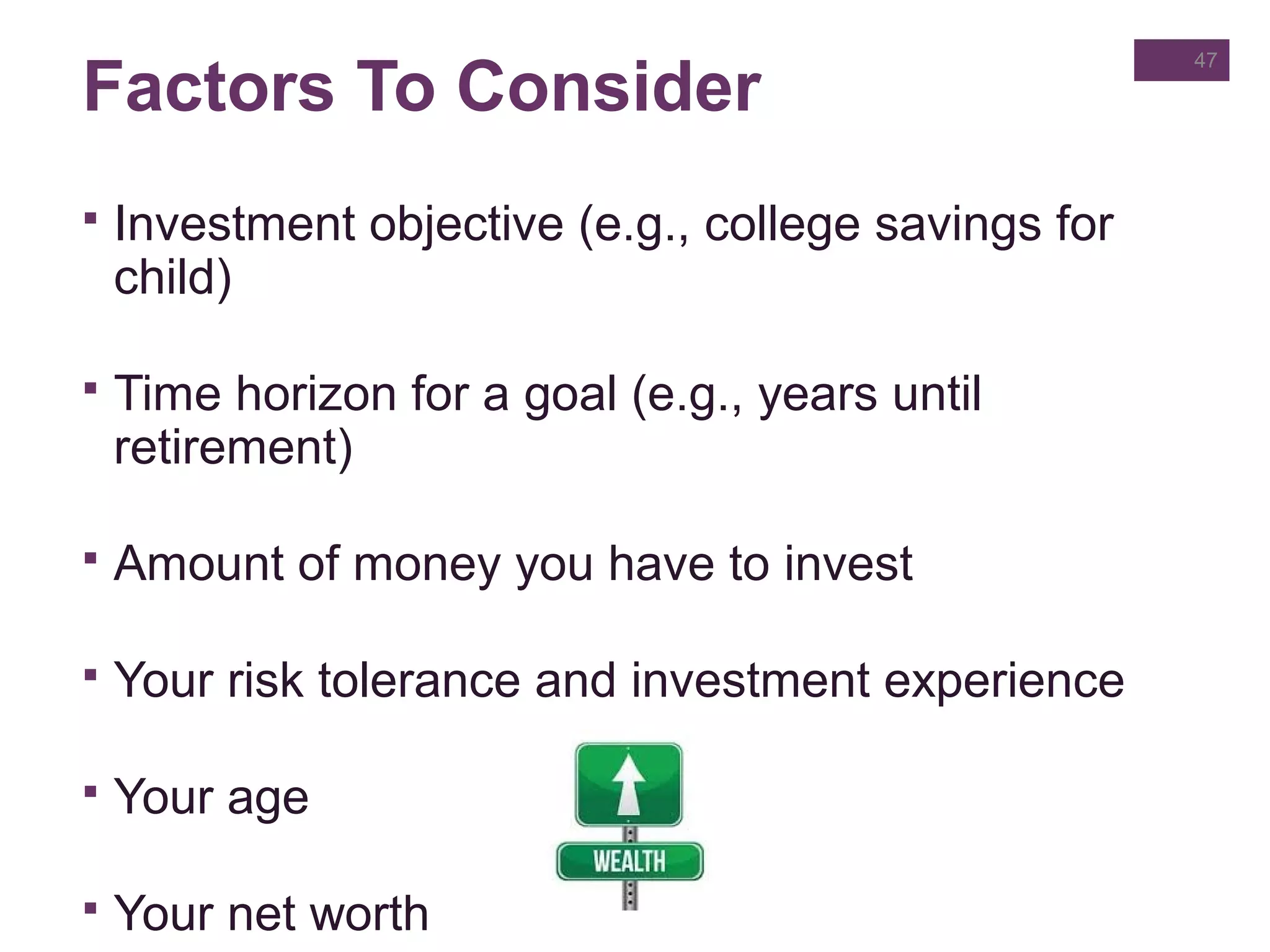

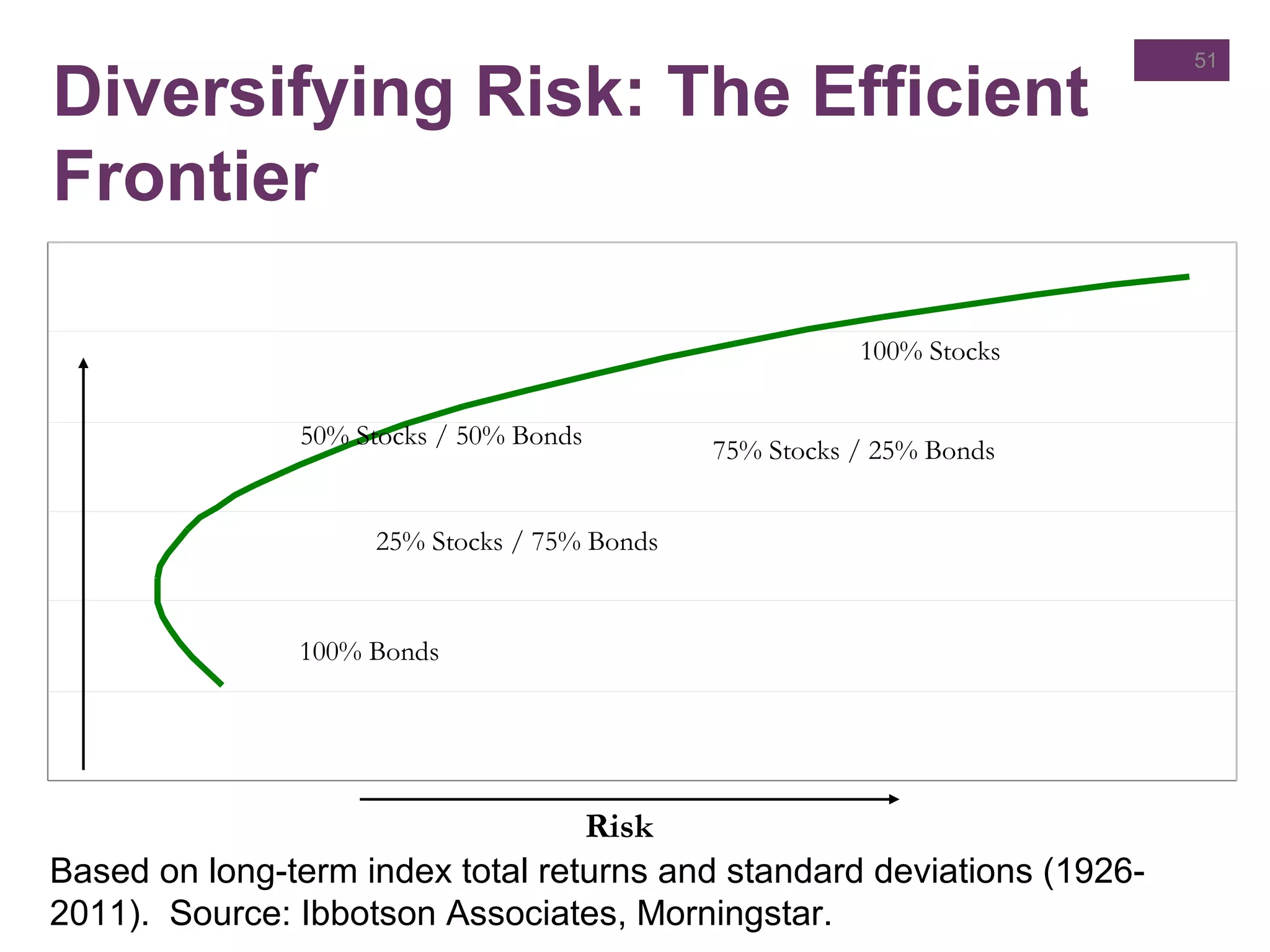

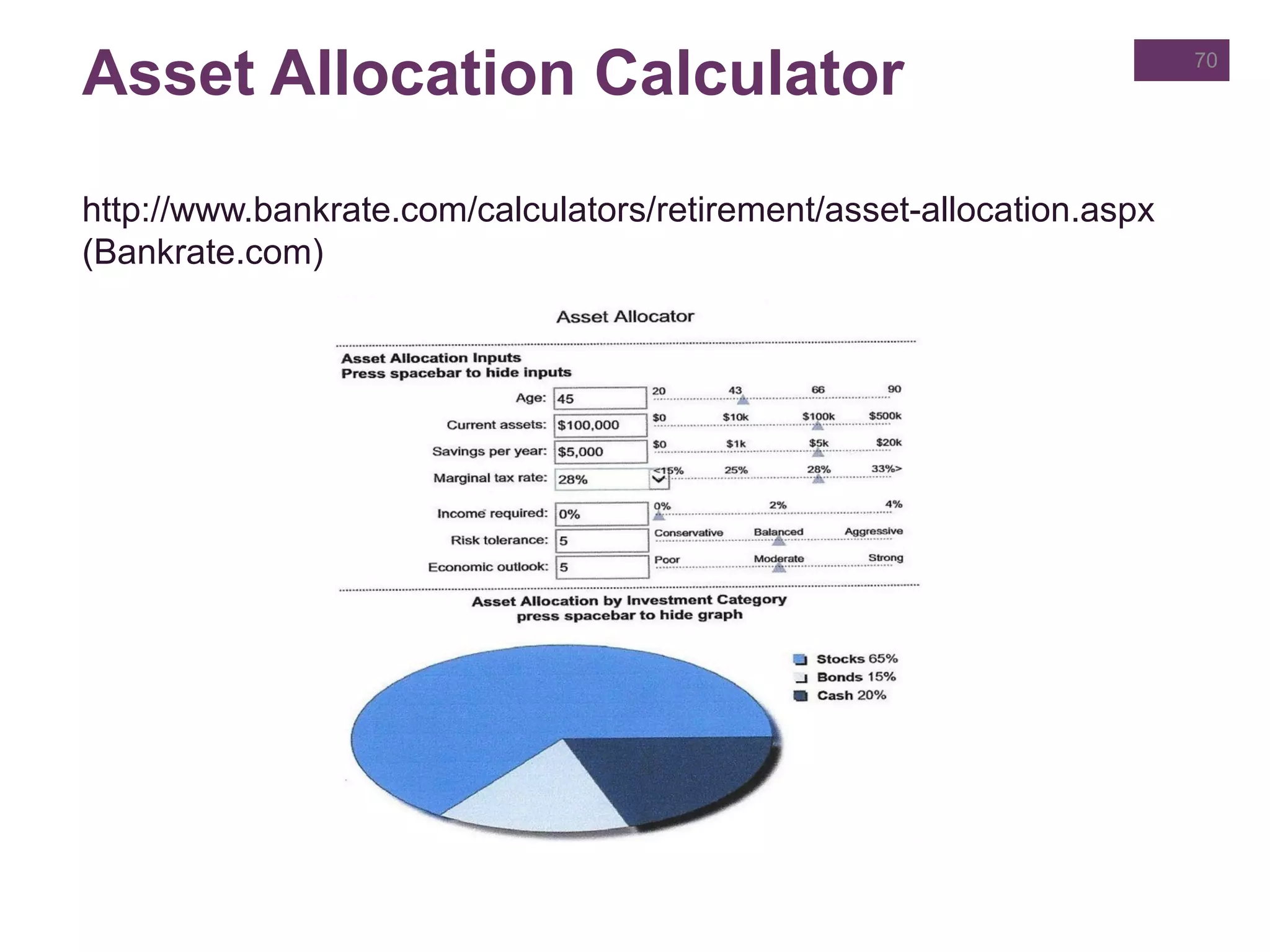

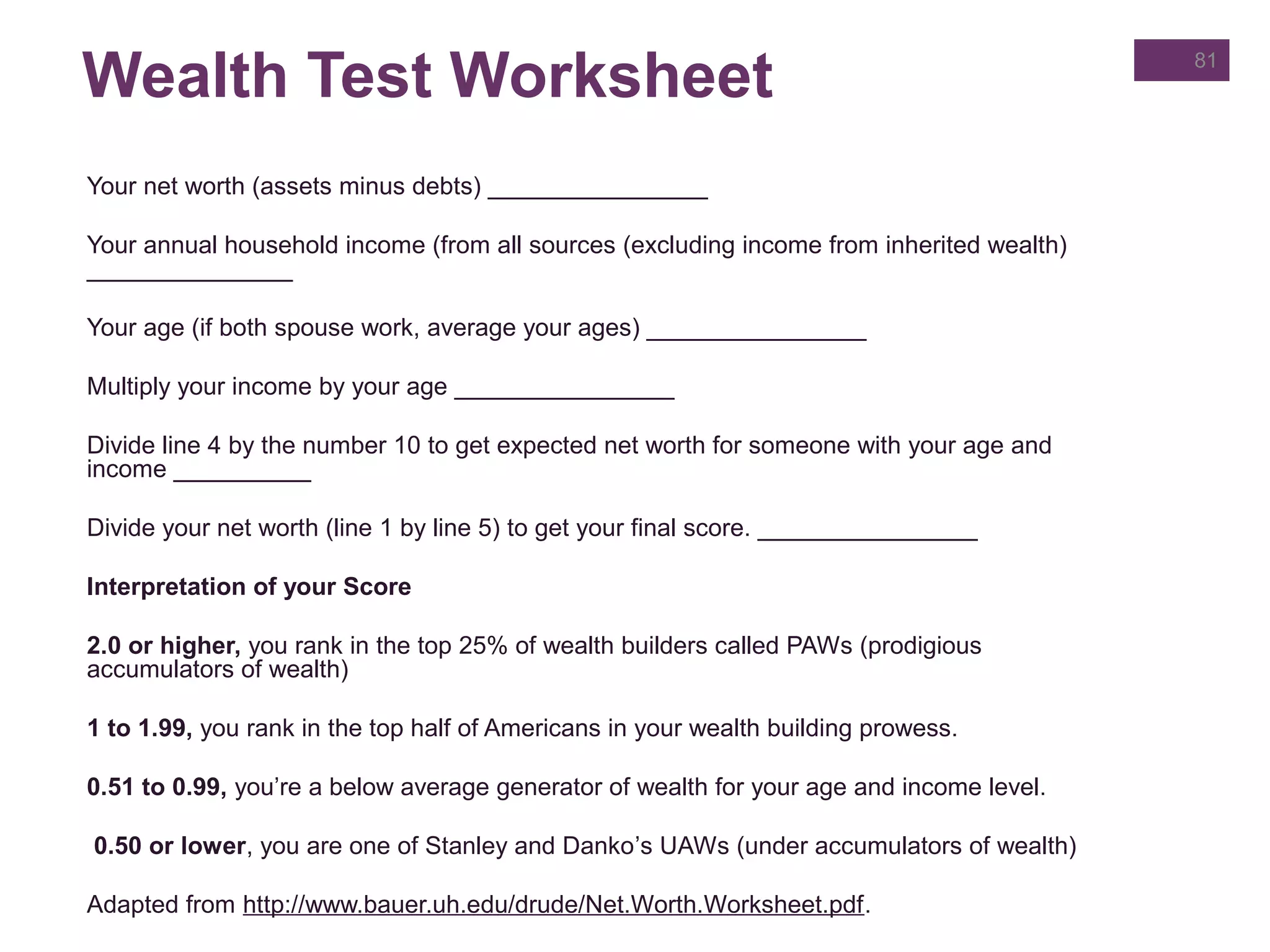

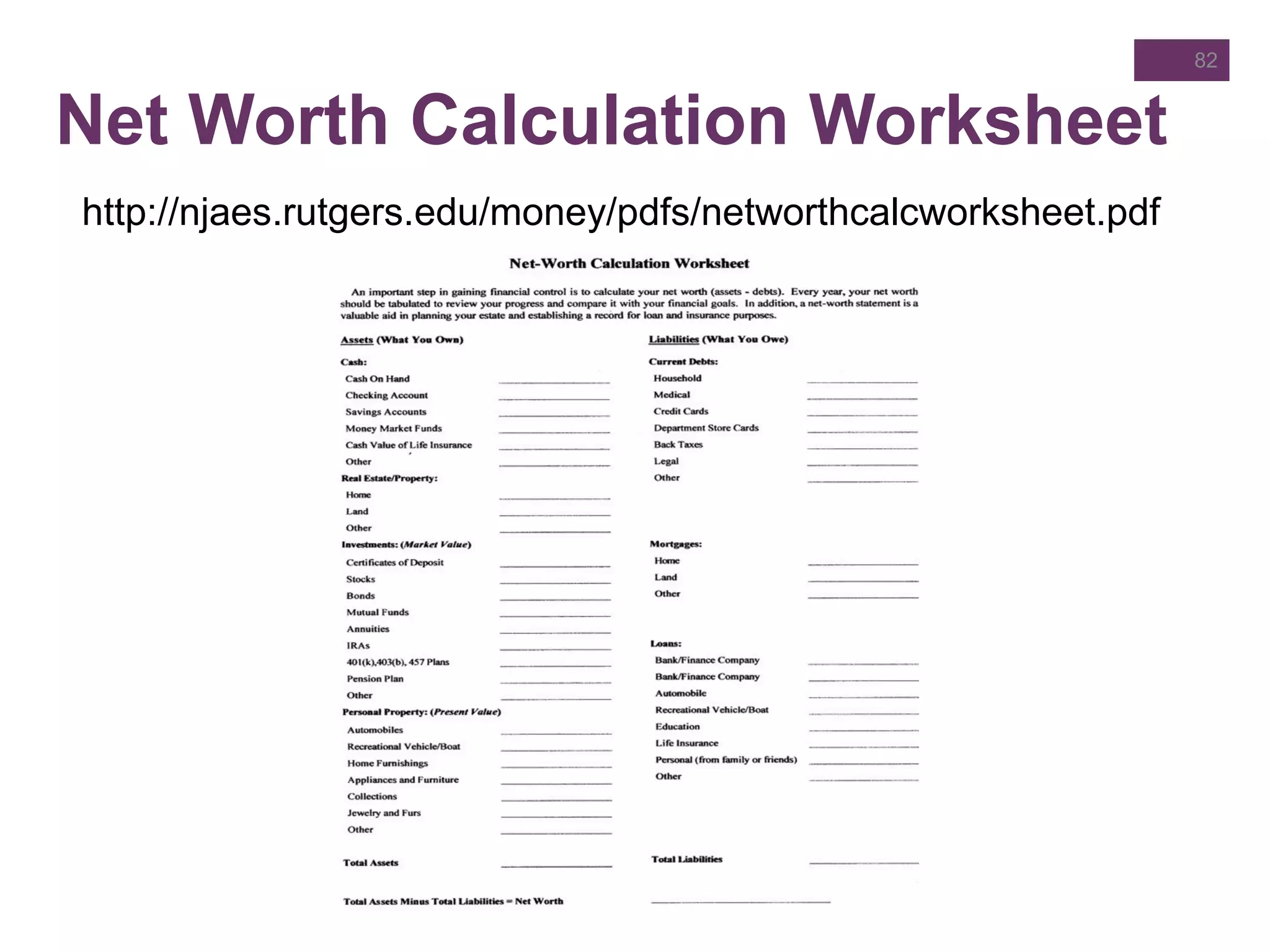

This document provides information about building wealth through savings, investments, and handling windfalls. It begins with defining what wealth means, then discusses strategies that wealthy people commonly use like living below their means and paying themselves first. Tips for building wealth include having clear investment objectives, diversifying investments through asset allocation, and taking advantage of tax-advantaged investment practices. Strategies for investing include dollar cost averaging, rebalancing portfolios, and investing for the long term. The document also defines what a windfall is and provides guidance on handling unexpected large sums of money.