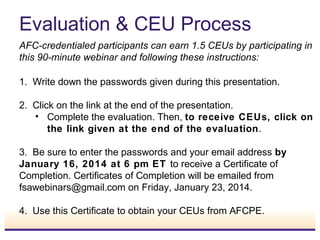

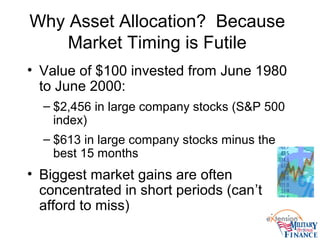

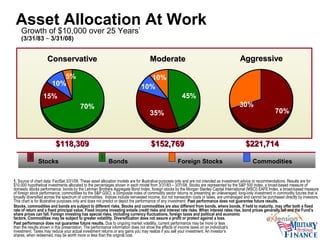

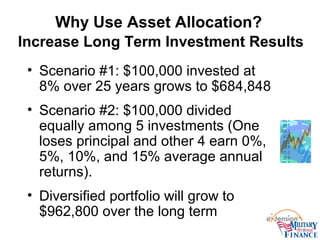

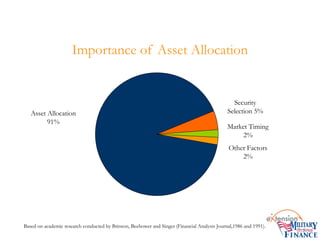

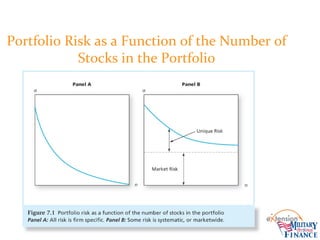

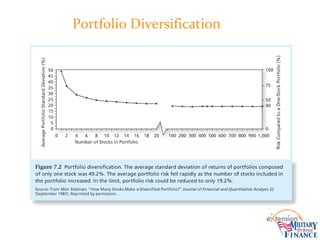

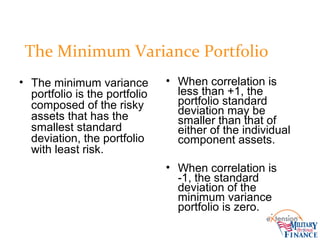

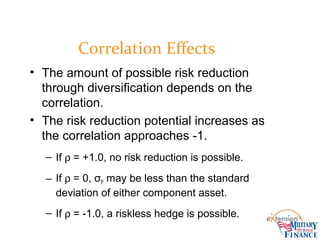

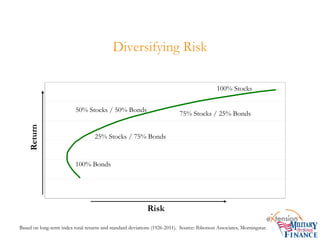

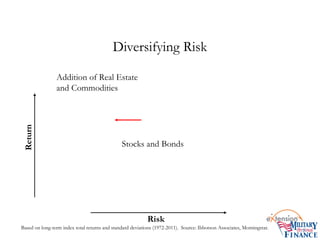

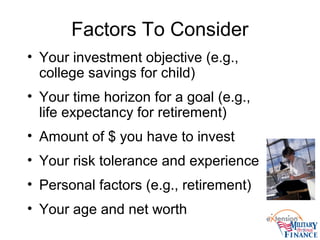

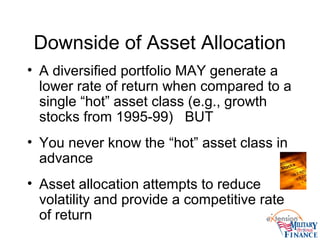

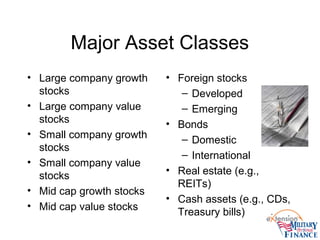

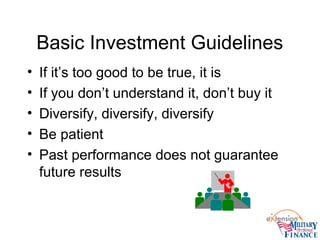

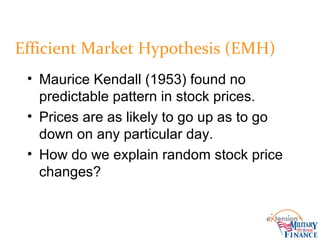

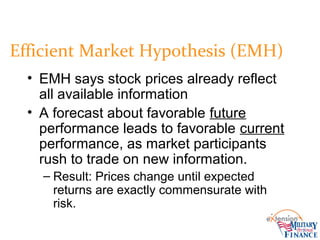

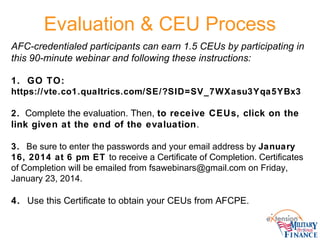

The document describes a webinar focused on asset allocation and investing for military families, emphasizing the importance of diversification to reduce investment risk. It includes expert insights from Dr. Michael Gutter, who outlines the objectives of the webinar, the process of asset allocation, and common misconceptions about market timing. Participants can earn continuing education units (CEUs) by following specific instructions during and after the webinar.