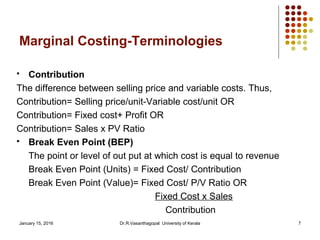

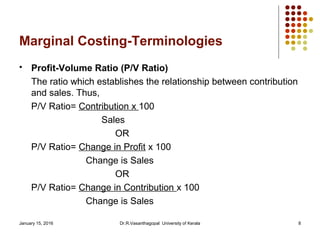

The document discusses marginal costing and cost-volume-profit (CVP) analysis techniques for decision making. It defines marginal costing as the separation of total costs into fixed and variable costs to understand the effect of changes in output on profit. The key assumptions and terminologies of marginal costing like contribution, break-even point, profit-volume ratio, and margin of safety are explained. CVP analysis expresses the relationship between sales volume, costs, and profits and can be used to answer questions about break-even revenues, effects of price and cost changes, and achieving budgeted profit levels.