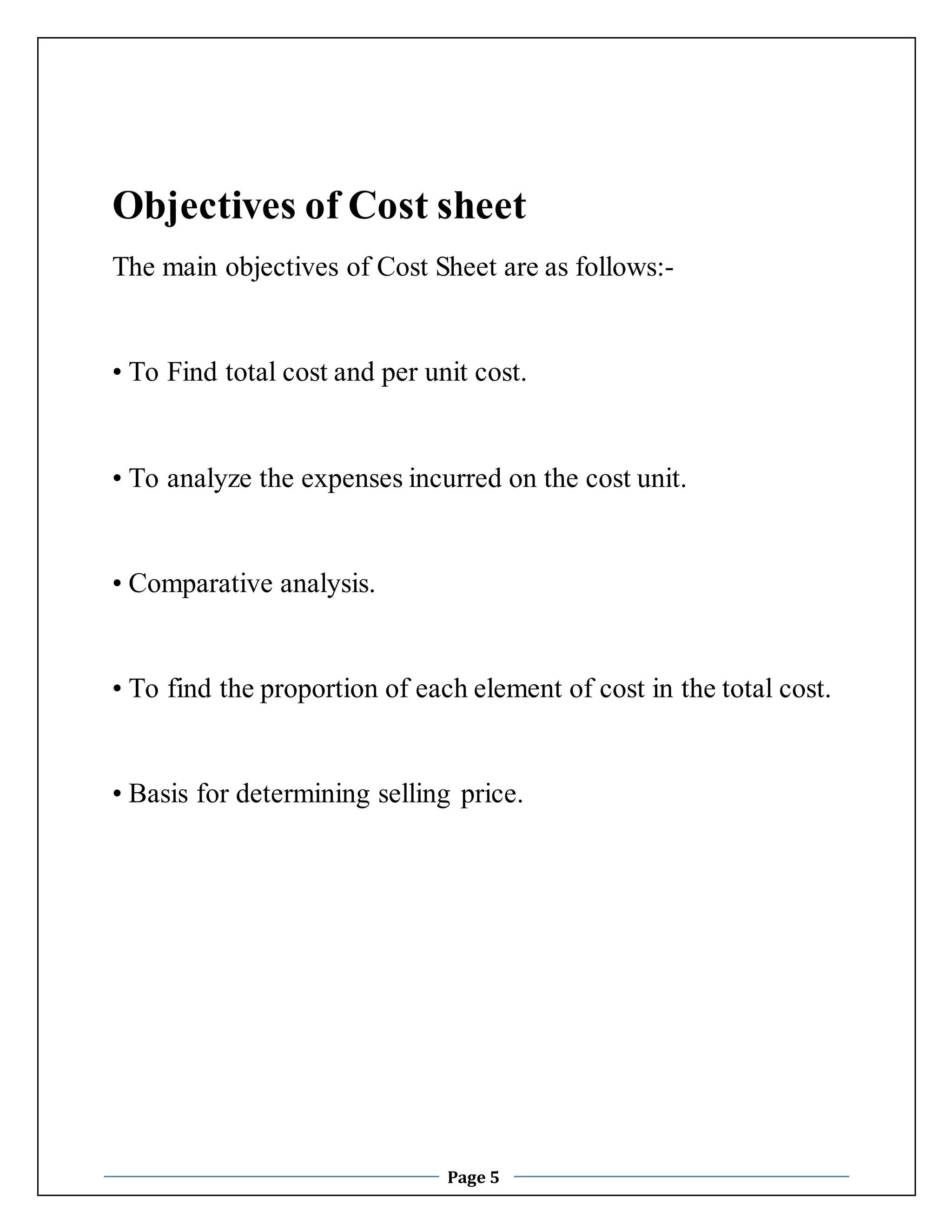

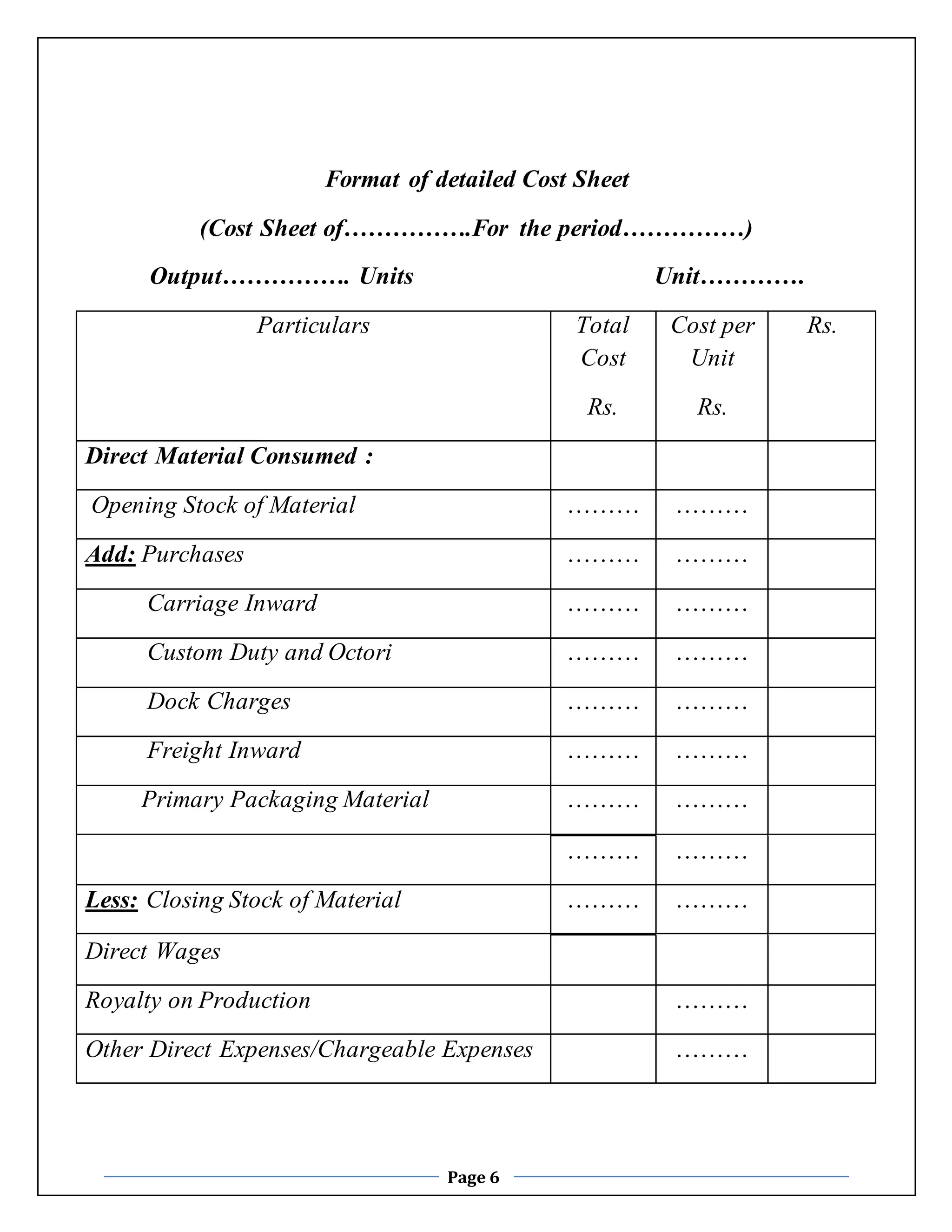

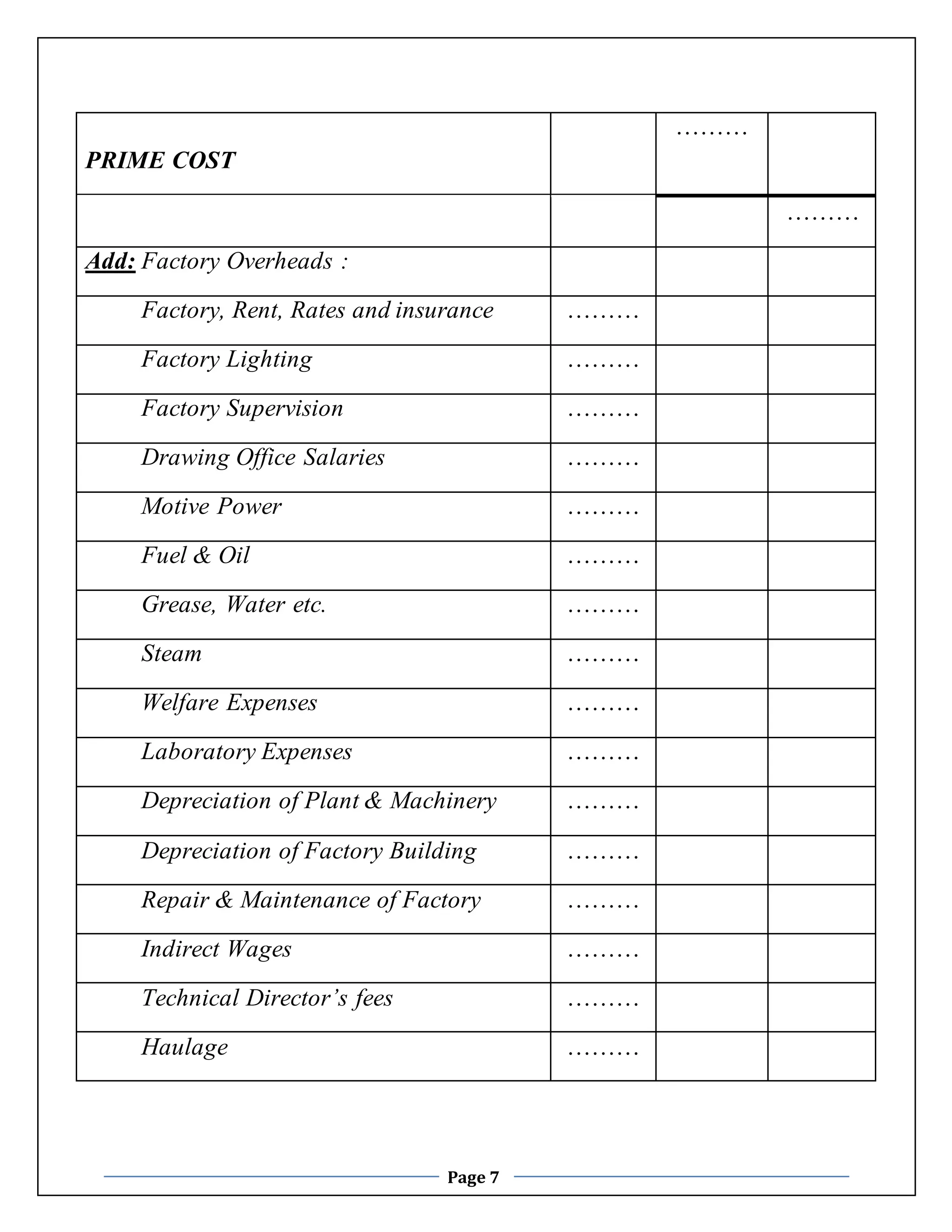

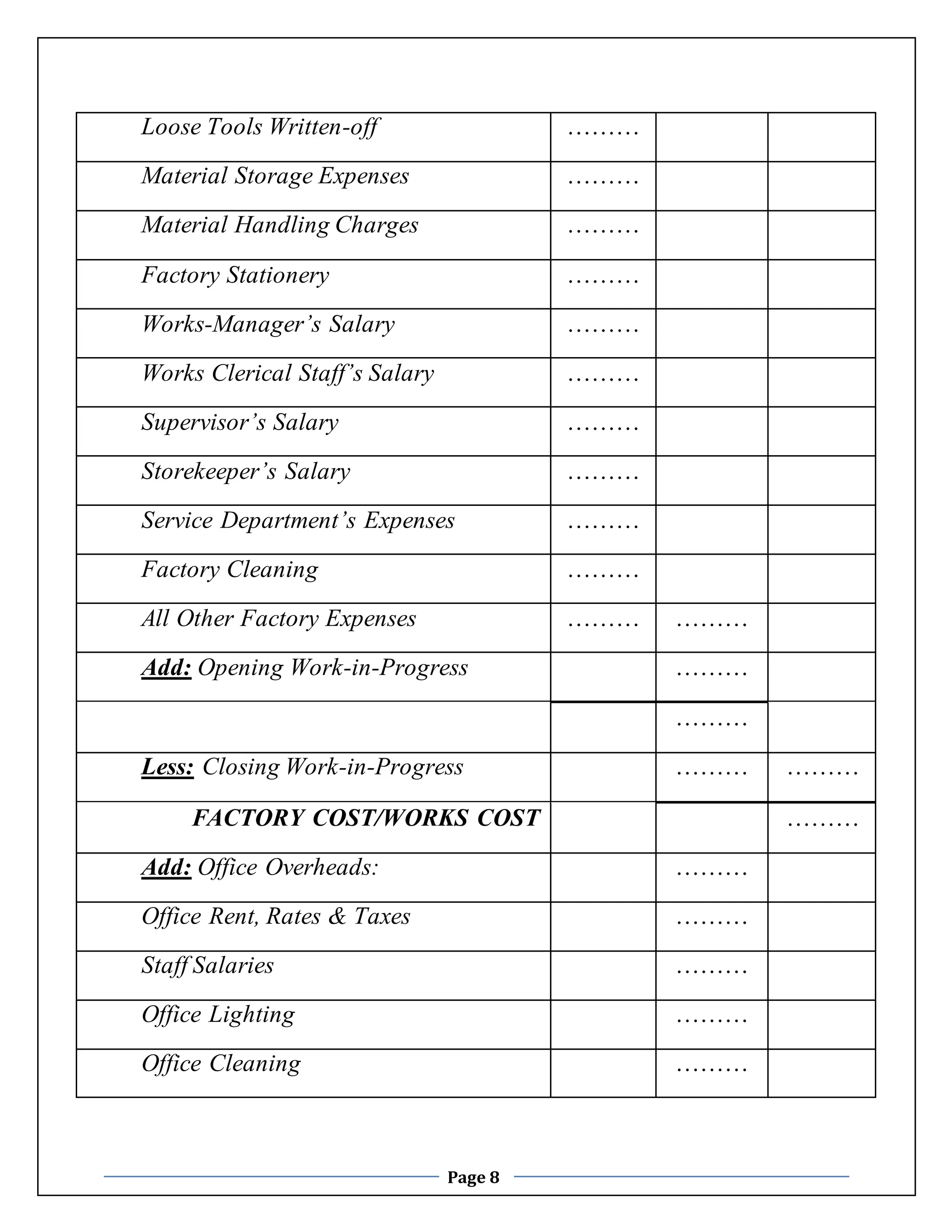

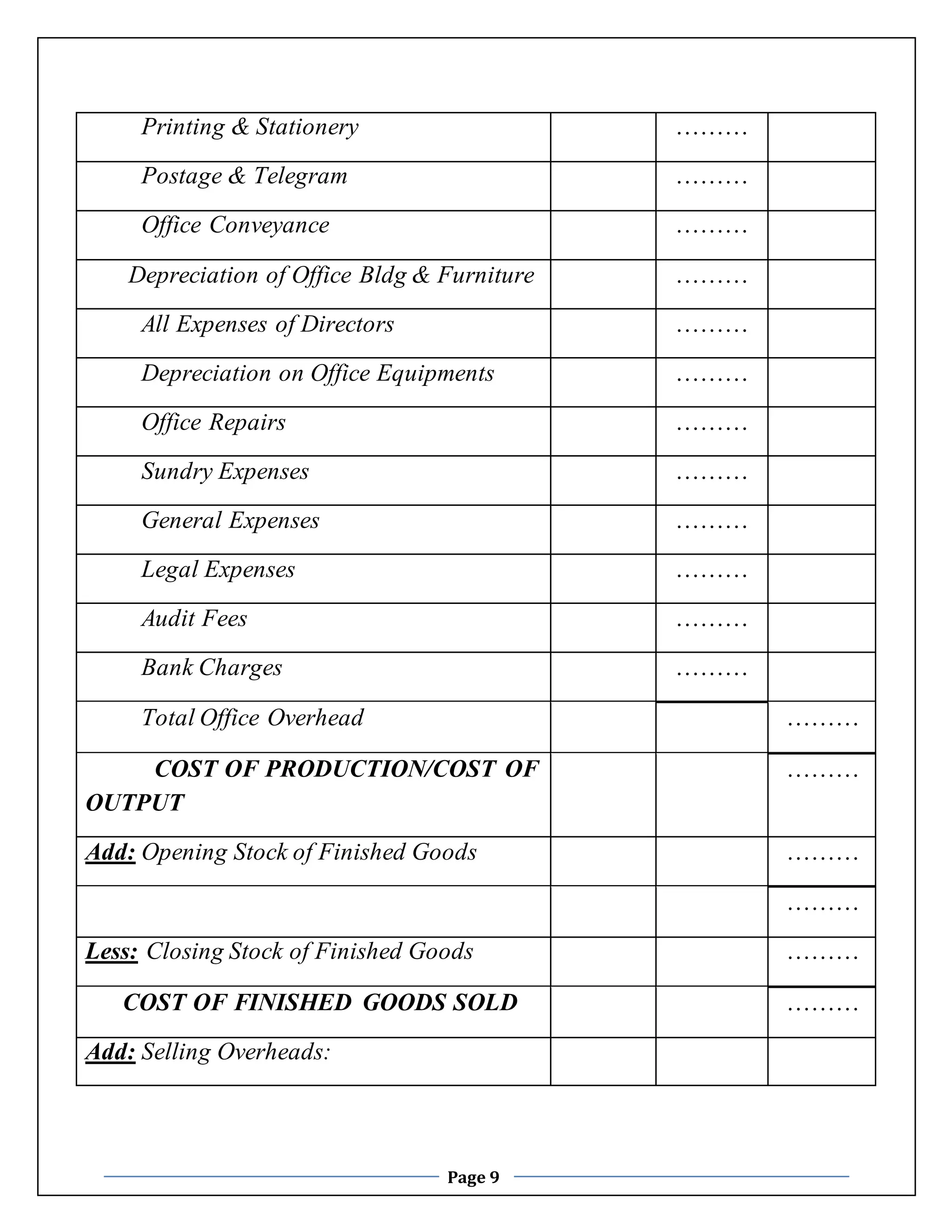

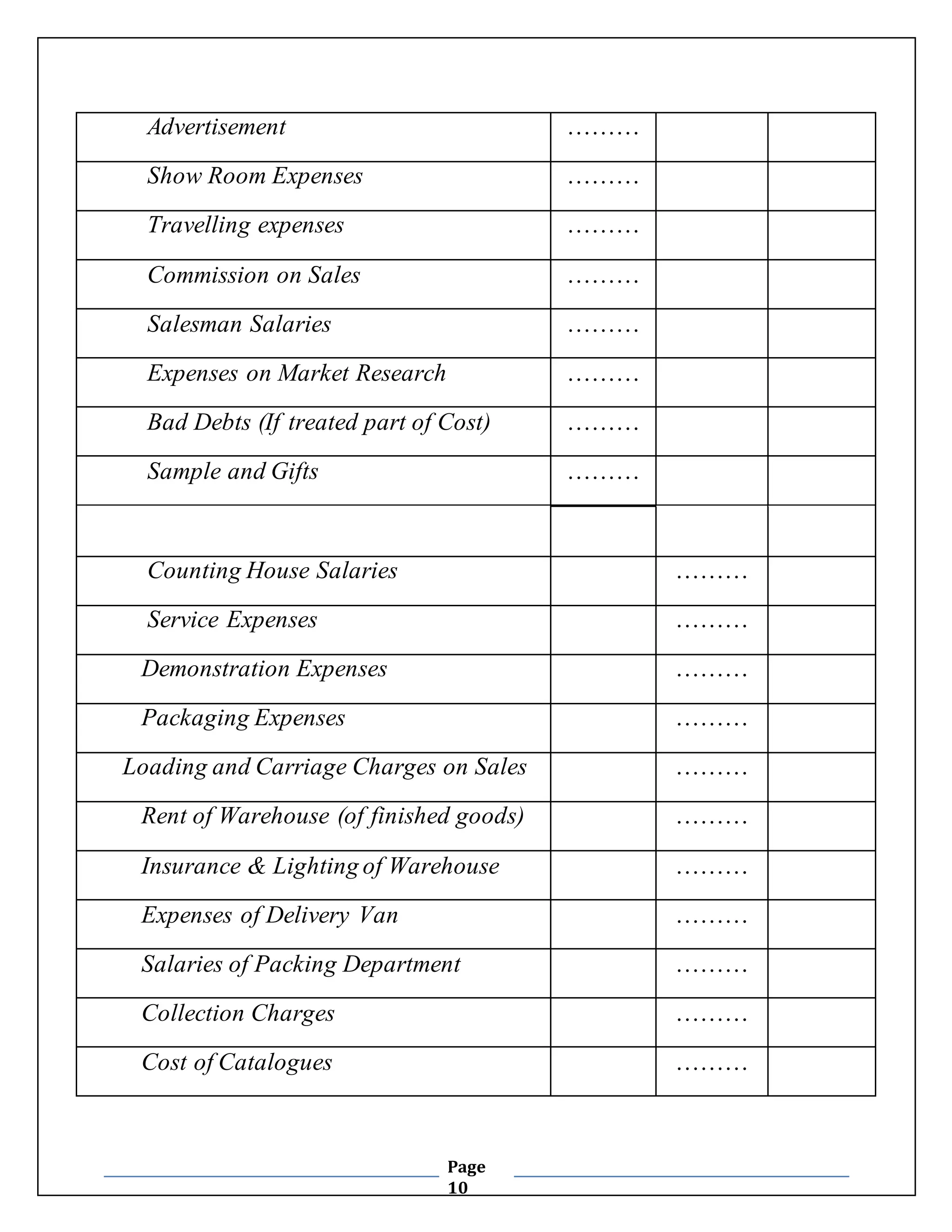

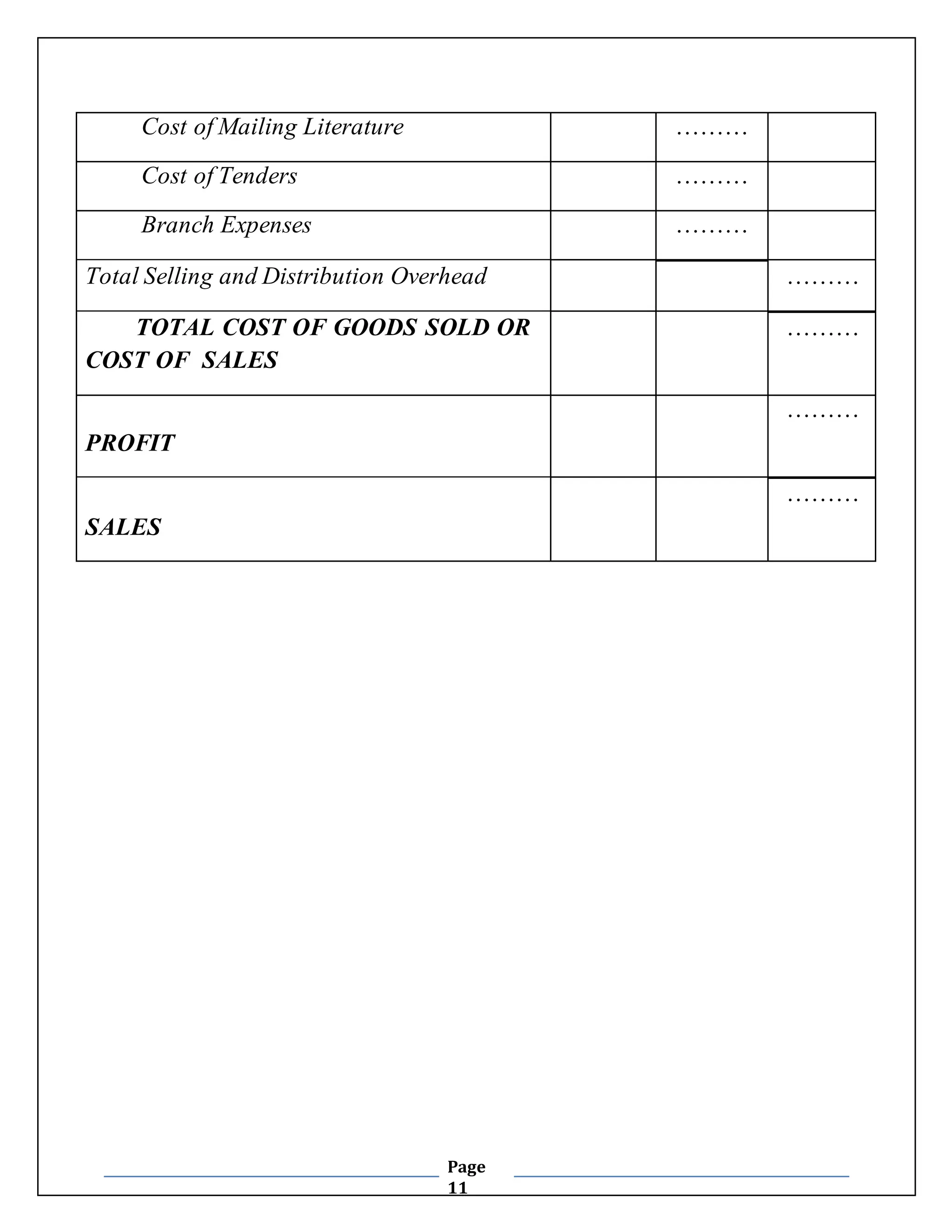

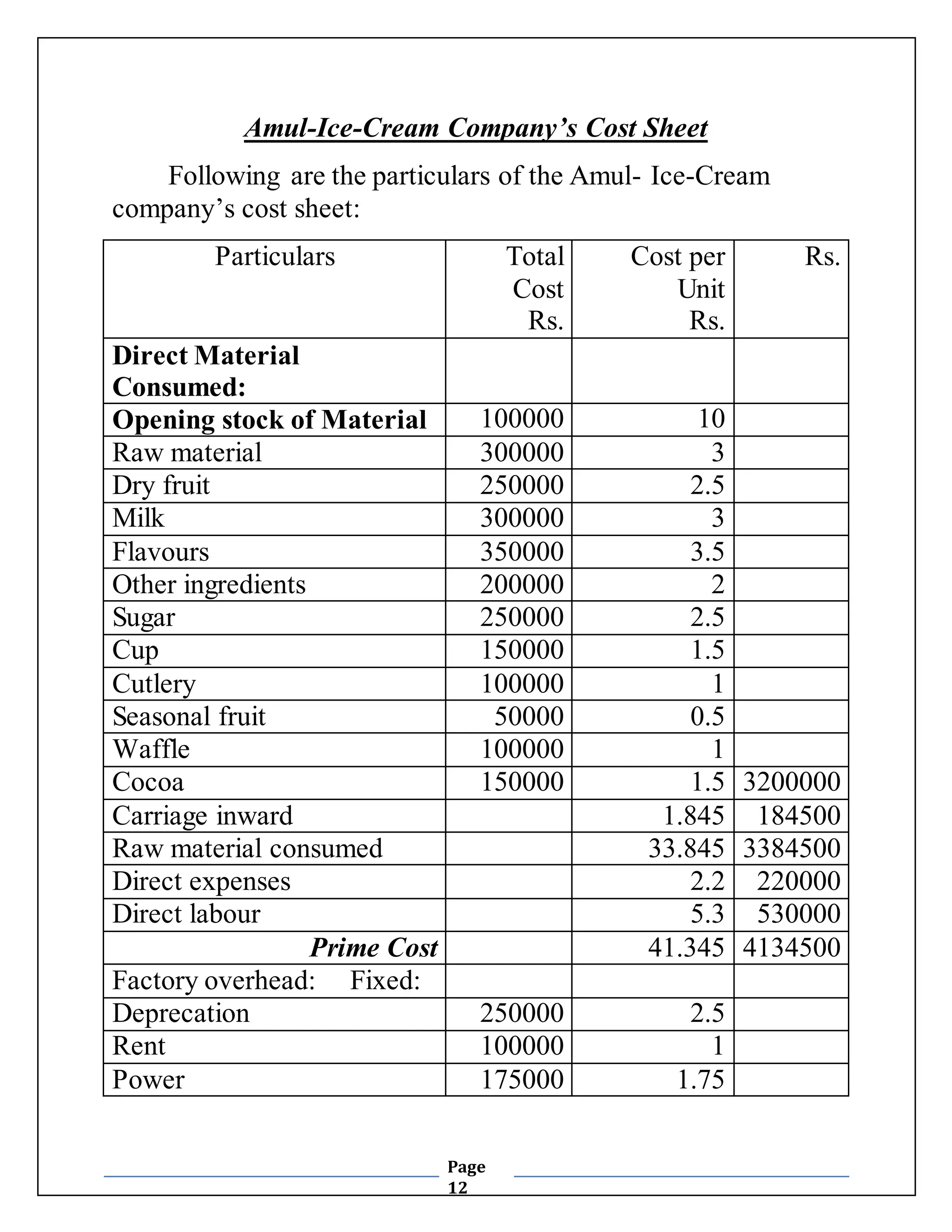

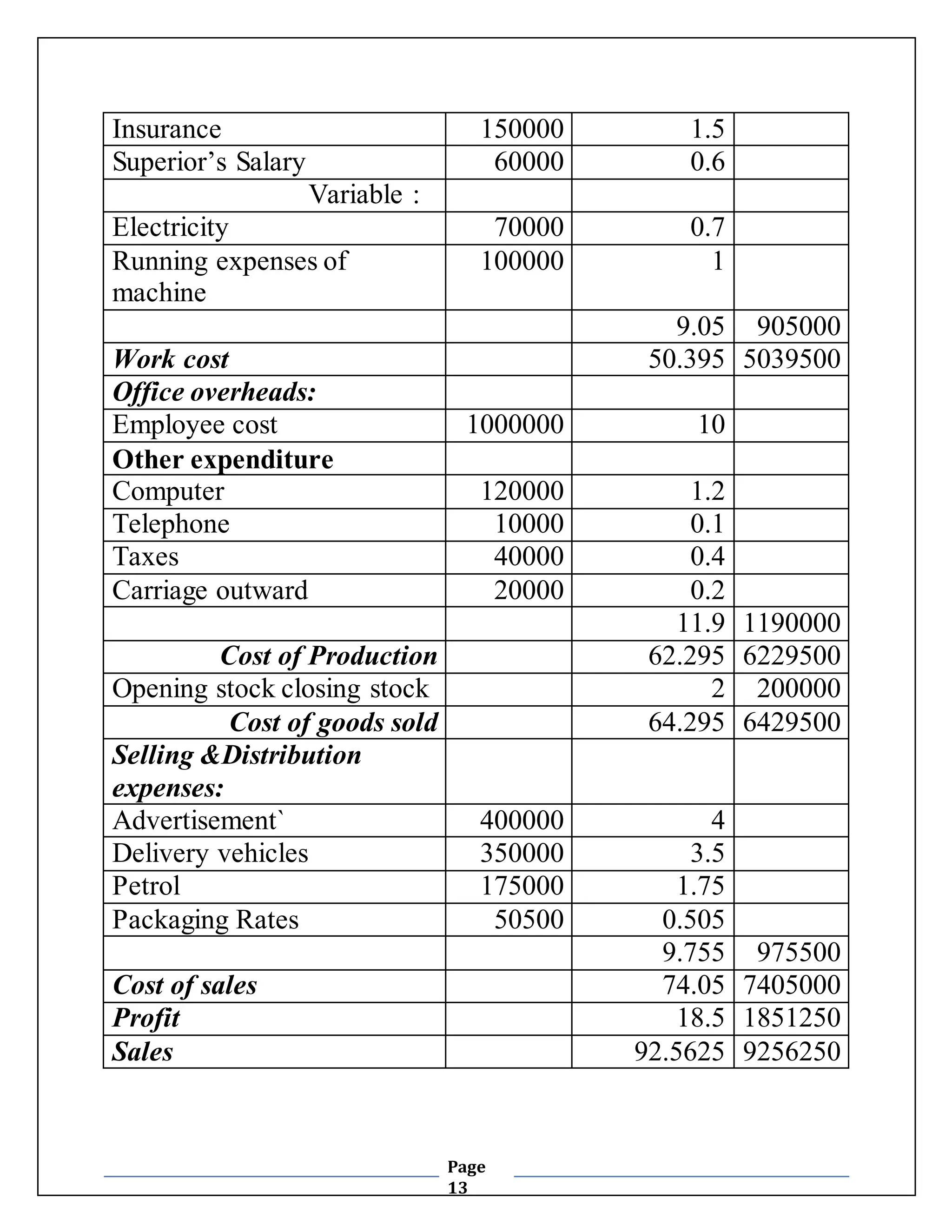

The document is a numerical case study on cost accounting for Amul Ice Cream Company, detailing its successful market entry and growth since 1996, achieving a significant market share. It explains the purpose and objectives of a cost sheet, as well as provides a detailed cost breakdown for Amul's ice cream production, revealing total costs, unit costs, and profit analysis. The conclusion emphasizes the utility of the cost sheet in competitive analysis and affirms the company's profitable position.