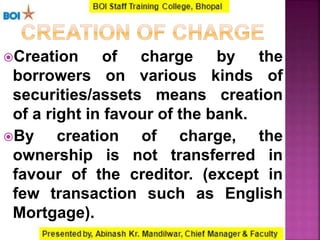

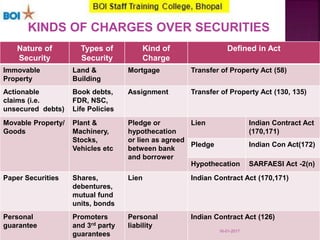

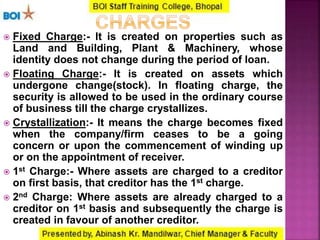

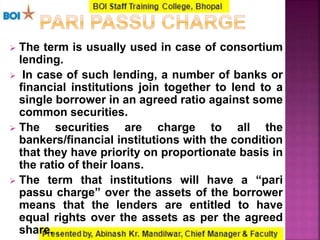

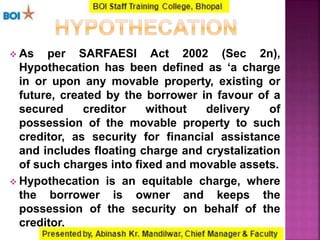

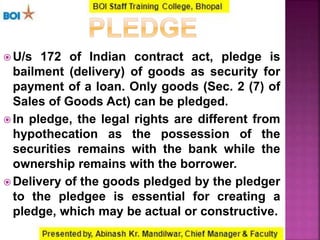

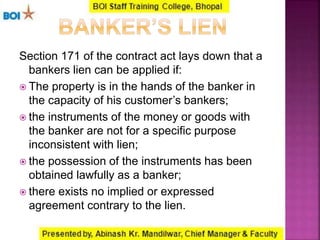

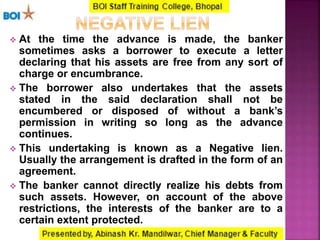

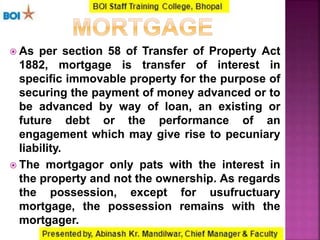

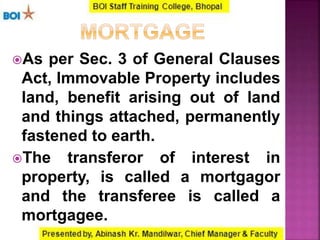

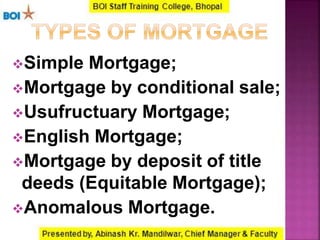

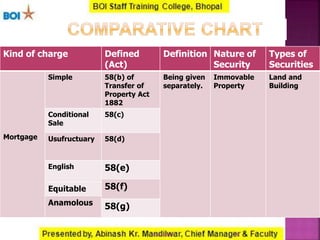

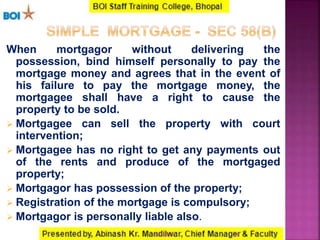

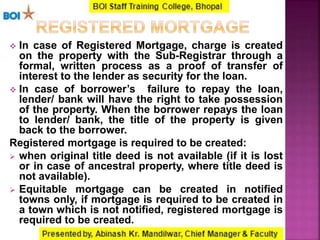

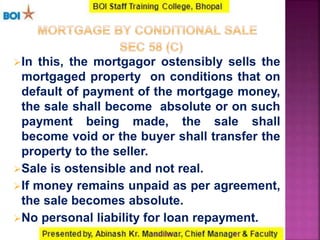

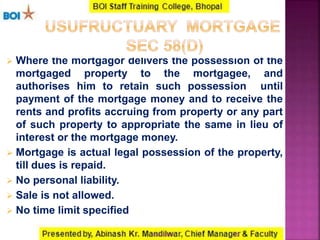

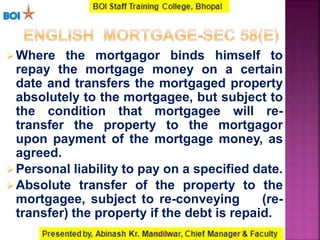

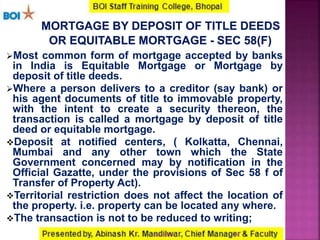

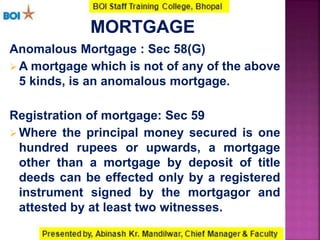

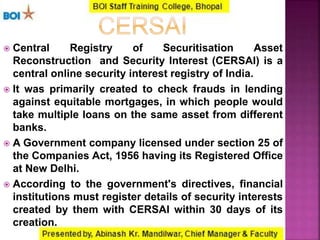

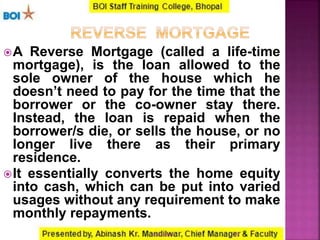

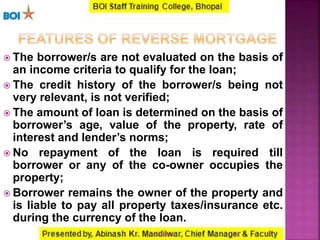

This document discusses various types of charges that can be created over different types of securities to secure loans. It defines mortgage, hypothecation, pledge, lien, assignment and personal guarantee. It explains key characteristics of different kinds of charges like fixed charge, floating charge and crystallization. It also summarizes different types of mortgages like simple mortgage, conditional sale, usufructuary mortgage and equitable mortgage.