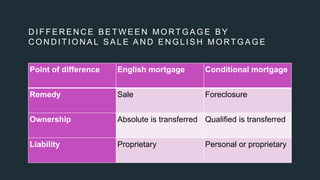

This document defines different types of mortgages and outlines their key elements and differences. It begins by defining a mortgage as the transfer of an interest in specific immovable property to secure a loan. It then describes the six main types of mortgages in India: simple mortgage, mortgage by conditional sale, usufructuary mortgage, English mortgage, mortgage by deposit of title deeds, and anomalous mortgage. For each, it provides details on elements such as possession, personal liability of the mortgagor, and appropriate legal remedies. The document also distinguishes between usufructuary mortgages and leases as well as English mortgages and mortgages by conditional sale.

![CONTD.

This mortgage is to be read with S.96 of TPA. All the provisions which may be applicable to simple mortgage will

also be applicable to mortgage by title deeds unless some clause is contrary.

Therefore, remedy is sale with court’s intervention and money decree

Recognised in India for the first time in case of Verdu Seth ram v. Kuckputty, 1892

Title deeds —

Shared Capital [Certificate that proves that this part of share is the persons - Proof ownership]

Probate or will [Document of will]

Gift deed

Remedy will be suit for money](https://image.slidesharecdn.com/mortgage-230521160410-dabf9494/85/Mortgage-pptx-20-320.jpg)