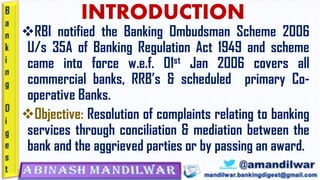

The Banking Ombudsman Scheme provides a mechanism for resolution of complaints related to deficiencies in banking services. Key points:

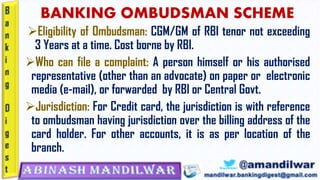

- The scheme is administered by the Reserve Bank of India and covers all scheduled commercial banks, regional rural banks, and scheduled primary cooperative banks.

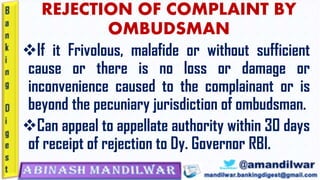

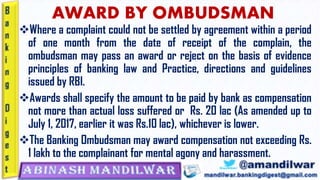

- Complaints can be filed by individuals or authorized representatives regarding issues that were not resolved by the bank within a month. The ombudsman may pass an award with compensation up to Rs. 20 lakh or reject the complaint.

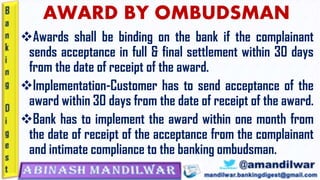

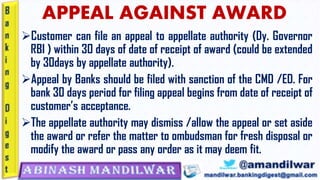

- Awards made by the ombudsman are binding if accepted by the complainant within 30 days. Banks must implement accepted awards within a month and confirm compliance. Appeals can be made to the Deputy Governor