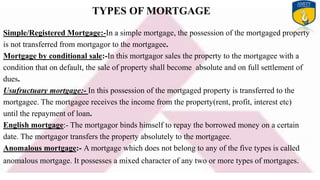

This document discusses securities taken by banks to secure loans. It defines different types of securities including movable and immovable securities. Movable securities can be charged via hypothecation or pledge while immovable securities are typically charged via registered or equitable mortgages. The document outlines the process banks follow to create mortgages on immovable property as security, including pre-qualification, application, credit checks, appraisal, underwriting, closing disclosure and closing. It emphasizes the legal precautions banks must take to properly create and register mortgages according to applicable laws and regulations to ensure they can recover loans if needed.