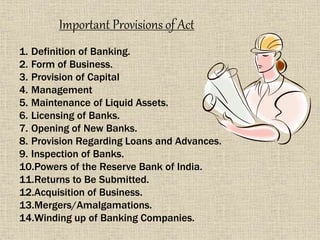

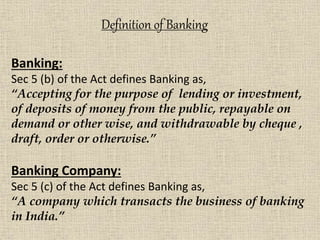

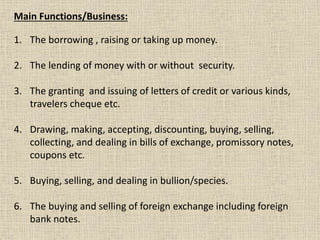

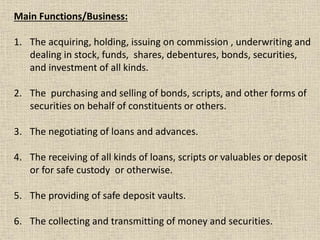

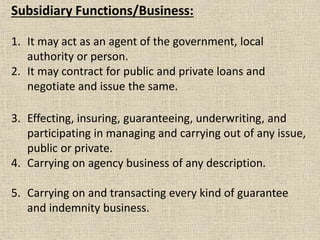

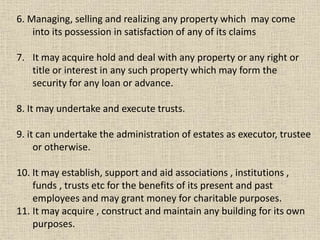

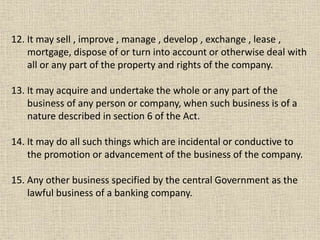

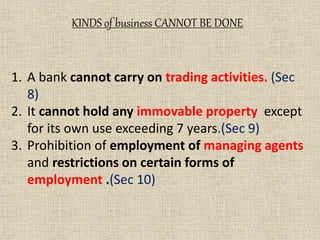

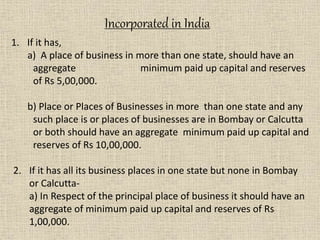

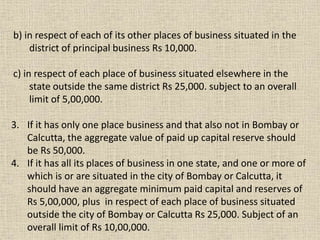

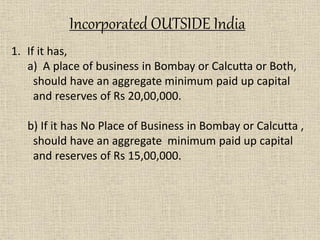

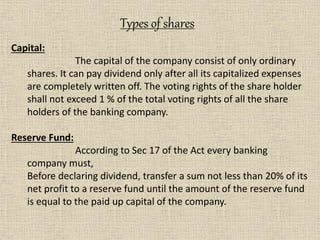

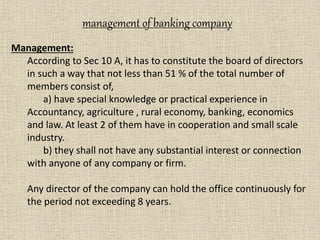

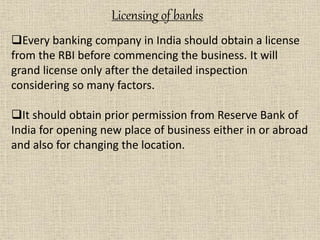

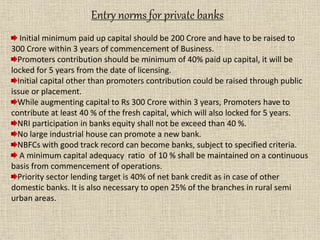

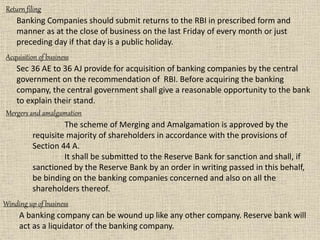

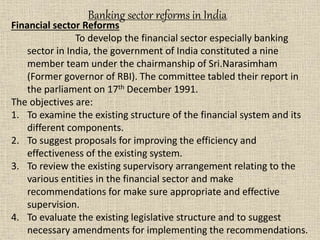

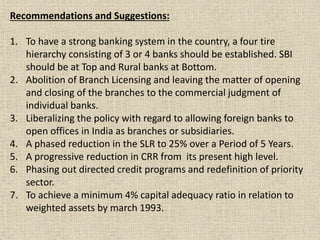

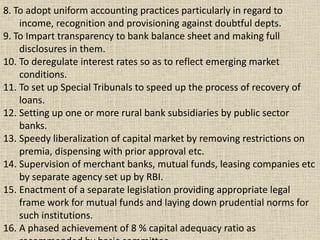

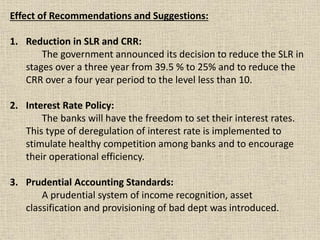

The document summarizes the key aspects of the Banking Regulation Act of 1949 in India. It defines banking and banking companies. It outlines the main and subsidiary business activities banks can engage in, as well as prohibited activities. It discusses capital requirements for domestic and foreign banks. It also covers management structure requirements, liquidity reserves like SLR and CRR, licensing provisions, RBI powers of supervision and control, return filing obligations, winding up procedures, and reforms from the Narasimham committee.