This document discusses nomination facilities available in bank accounts and lockers in India according to the Banking Regulation Act of 1949. Key points include:

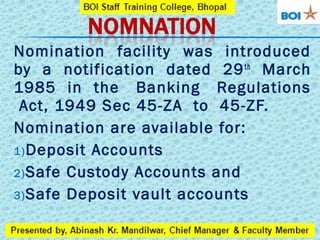

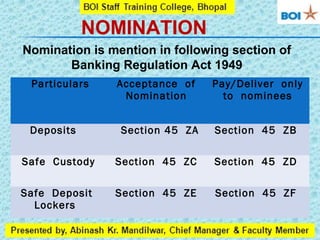

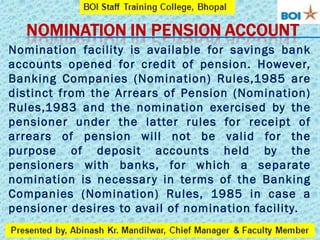

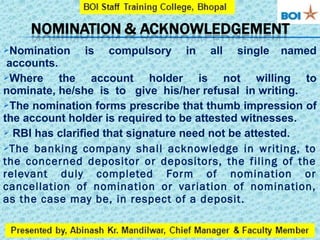

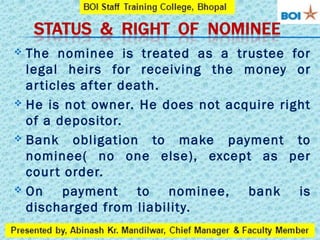

- Nomination allows for faster release of funds to a nominee without requiring a legal certificate. It is available for deposit accounts, lockers, and safe custody.

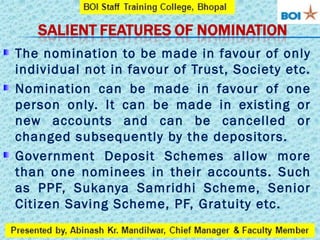

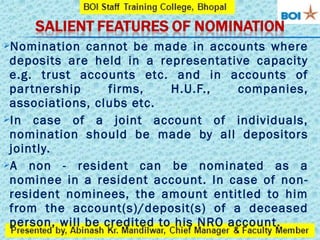

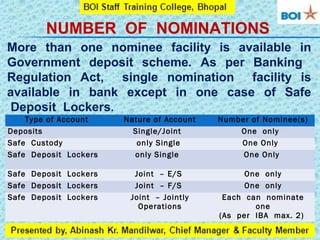

- A nomination names one individual (not organizations) who can claim the funds/articles. It can be made for new or existing accounts.

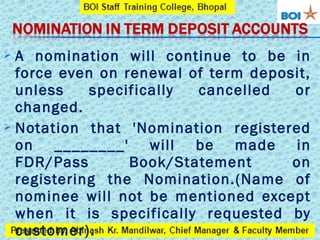

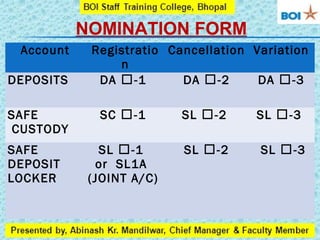

- Nomination registration is noted on account documents but the nominee's name is not included without customer request.

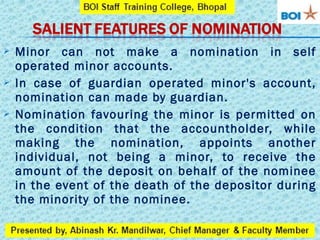

- Nomination continues unless cancelled and minors require a guardian's nomination until adulthood. Payments to nominees discharge the bank from further liability