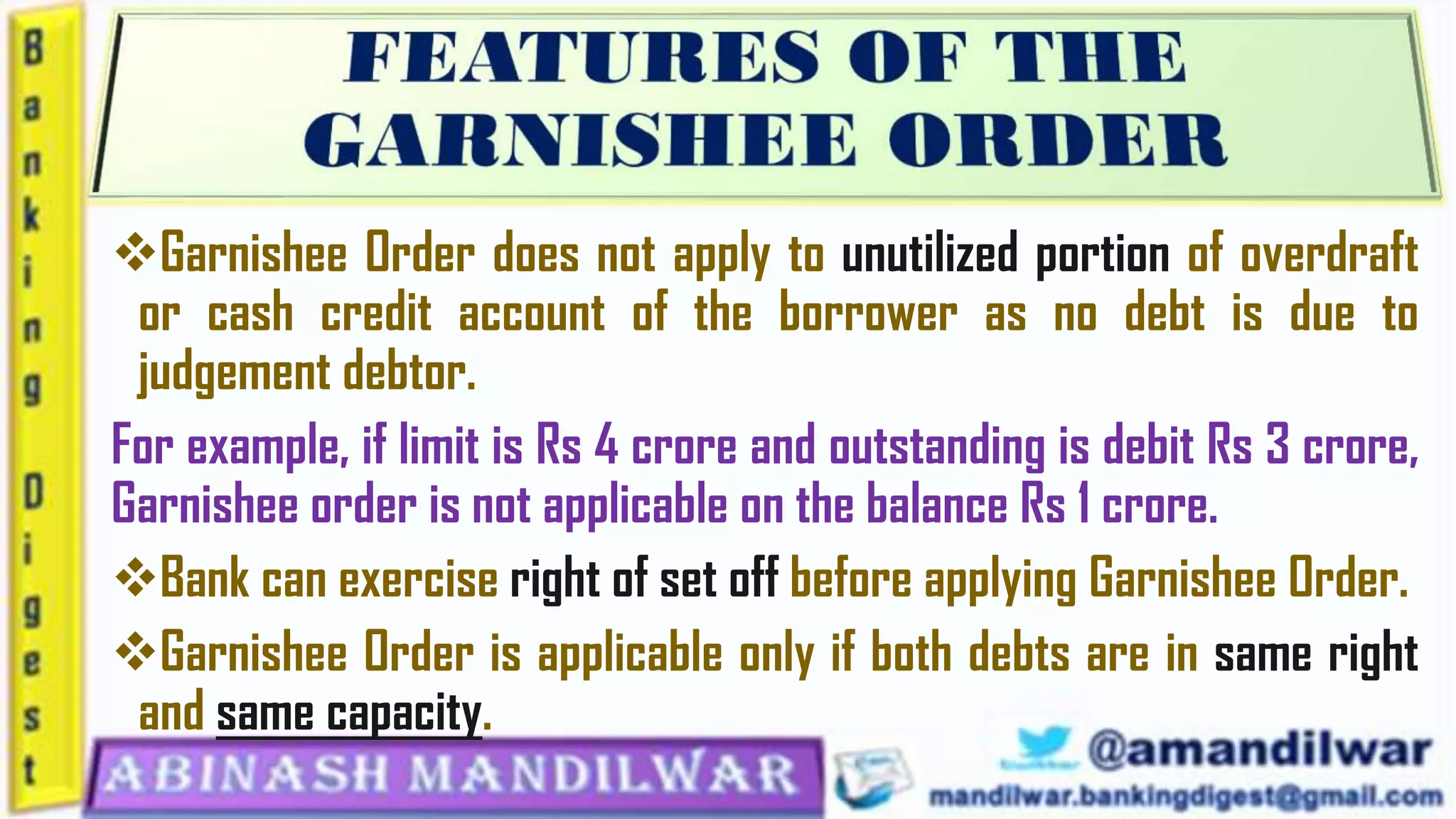

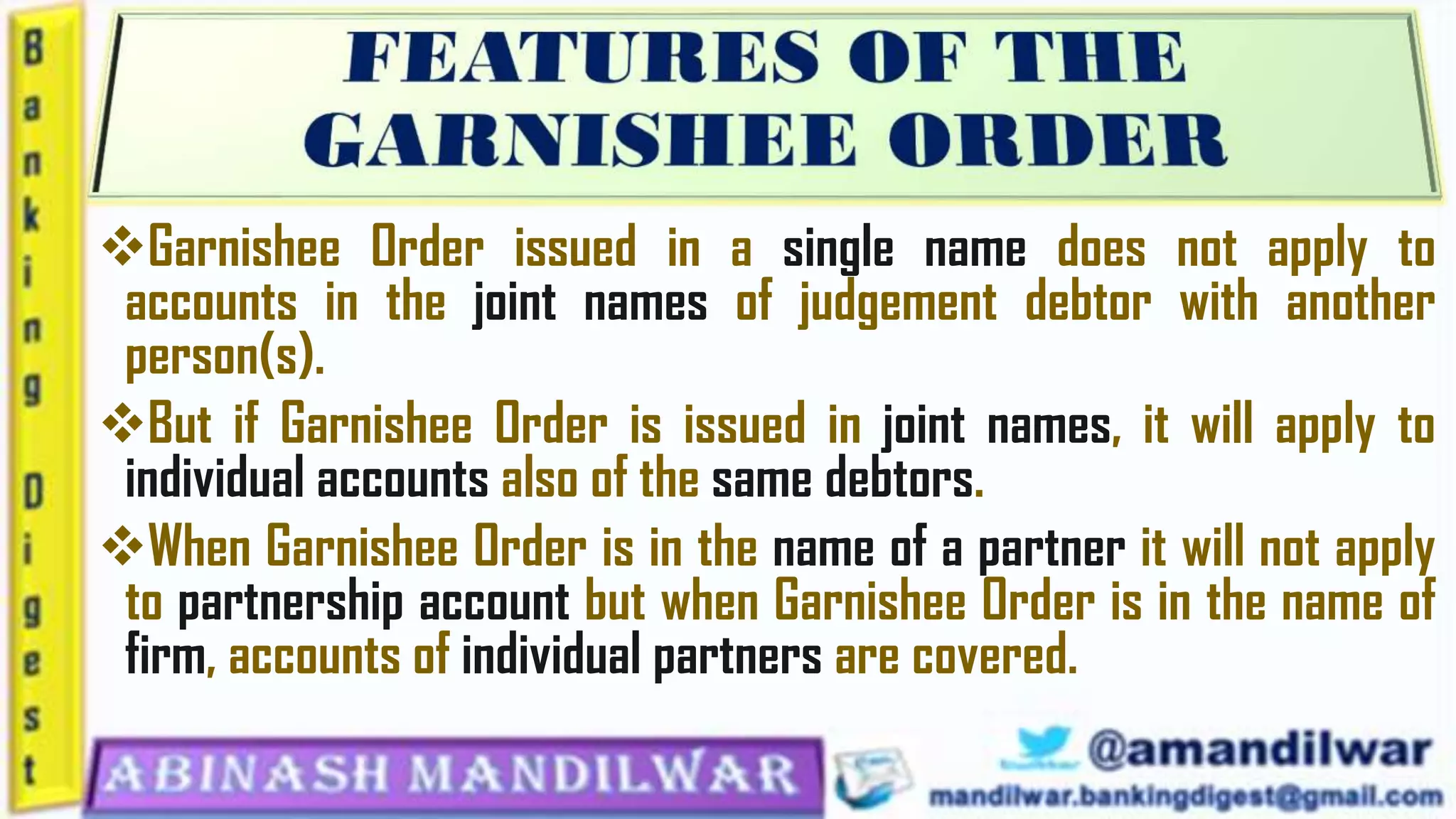

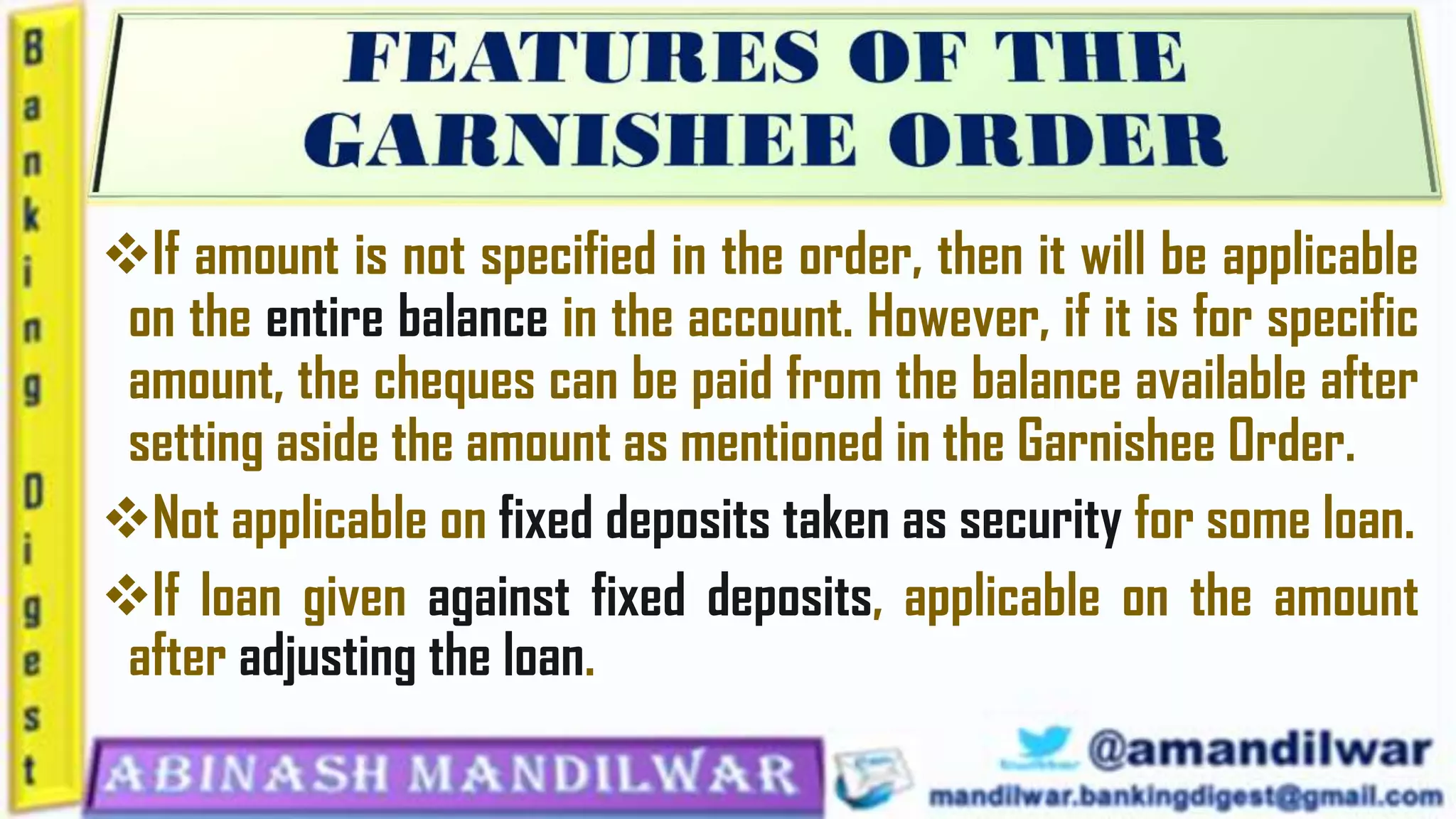

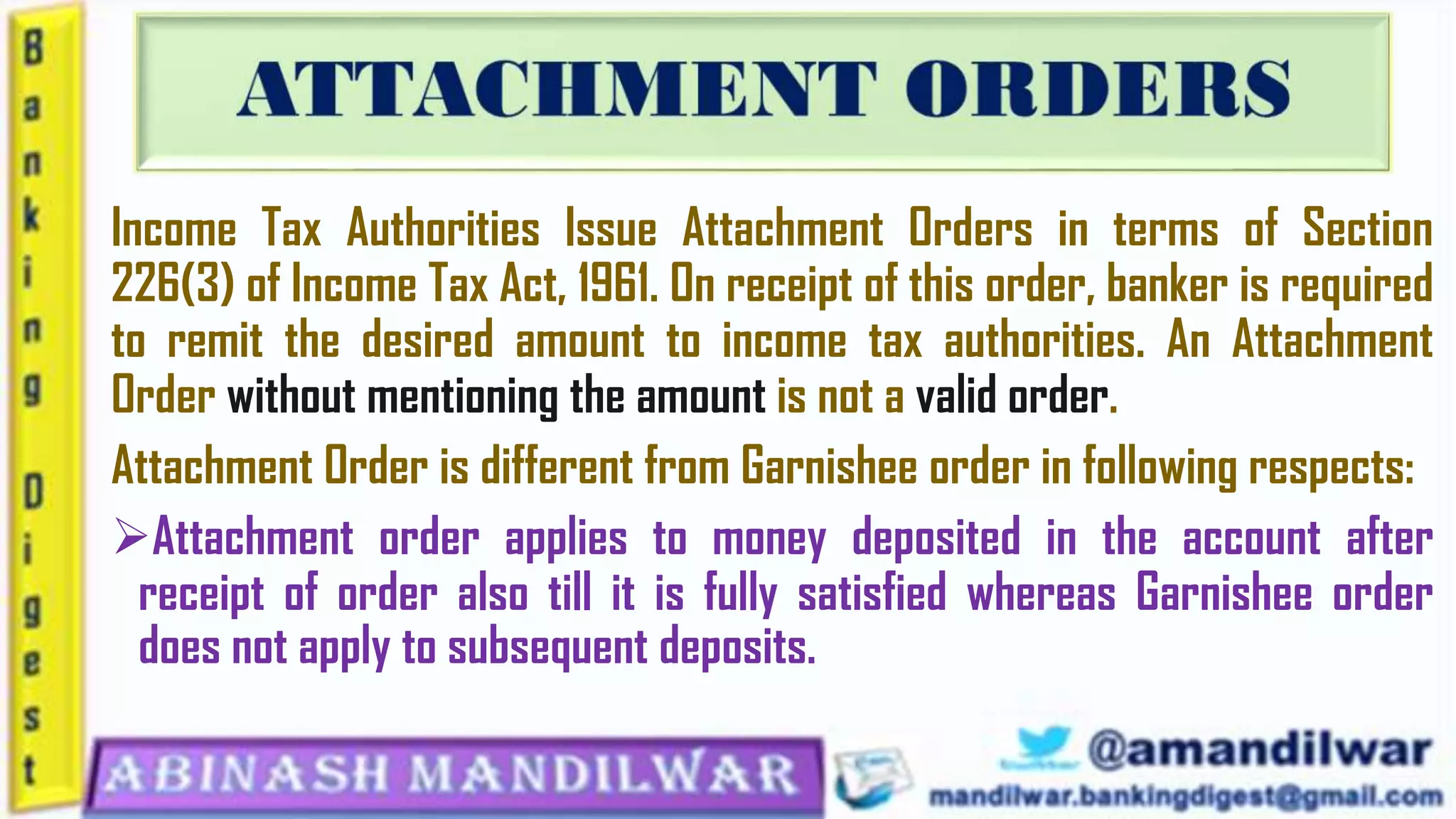

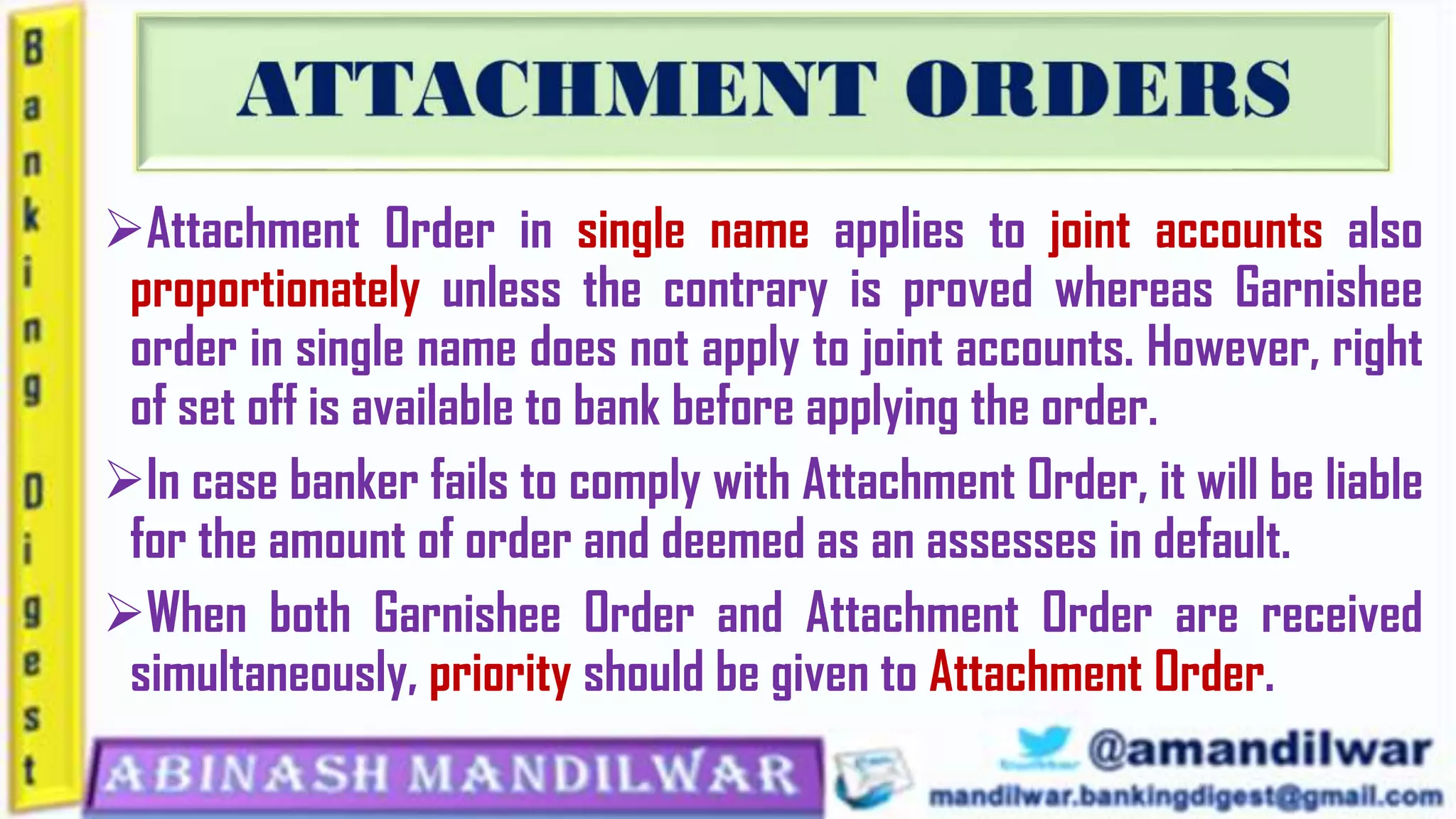

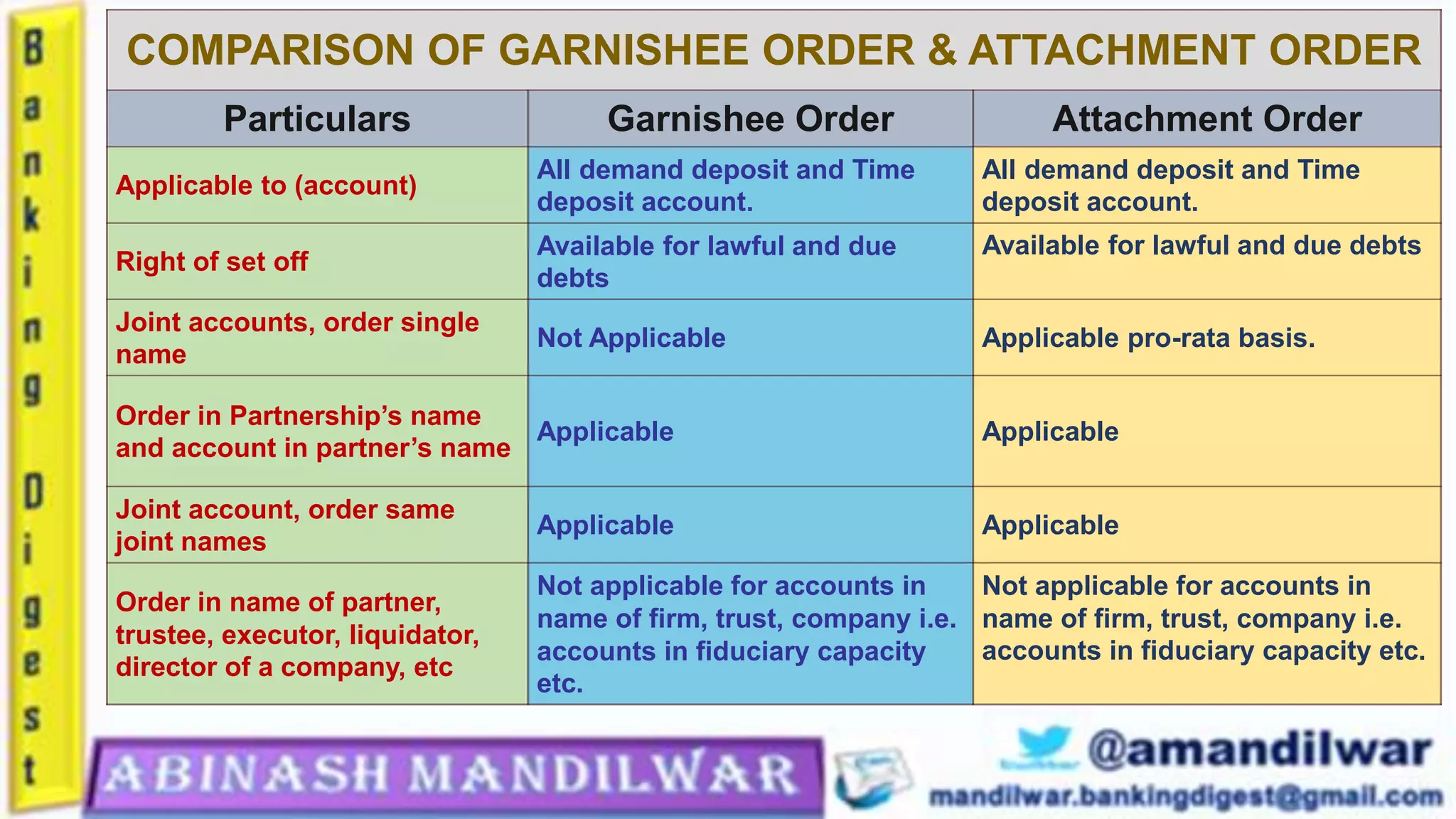

The document outlines the definitions, processes, and comparisons between garnishee orders and attachment orders as per the Civil Procedure Code and Income Tax Act. A garnishee order involves a third party (garnishee) holding the debtor’s money or property at the request of a creditor, while an attachment order is issued by tax authorities and can affect future deposits in addition to current balances. Key differences include applicability to joint accounts, the scope of debts, and compliance consequences for financial institutions.