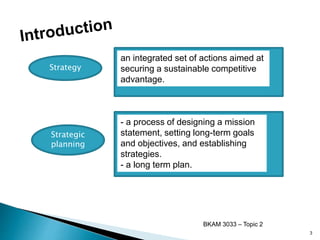

This document discusses strategic management accounting. It begins by defining strategic management accounting as the role of management accounting in strategic analysis, planning, and control of organizations. It then discusses various strategic management accounting techniques like life cycle costing, kaizen costing, target costing, and benchmarking. The document explains these techniques and provides examples. It also discusses Porter's competitive strategies of cost leadership, differentiation, and focus. Finally, the document defines strategic management accounting according to various authors and discusses exploiting internal and external linkages through value chain analysis to gain competitive advantage.