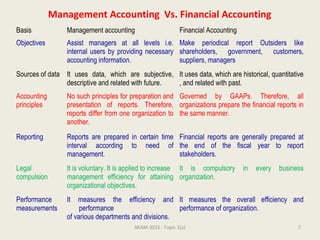

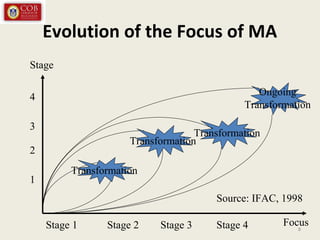

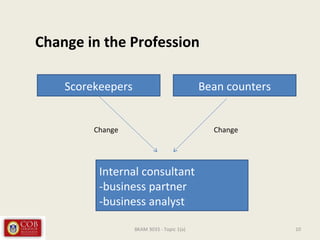

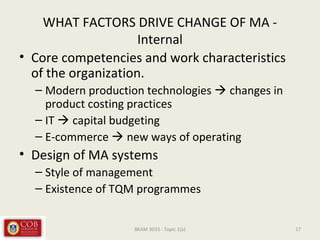

This document discusses recent developments in management accounting. It covers the evolution of management accounting from a focus on cost determination and financial control to value creation. It also discusses how management accountants have transitioned from being "bean counters" to business partners and consultants. Additionally, the document outlines factors driving changes in management accounting, including technology, globalization, and a focus on customers. It notes a gap between management accounting theory and practice and the role of professional bodies in addressing this.