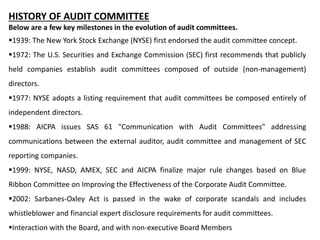

This document provides an overview of audit committees, including their definition, composition, responsibilities, roles, and history. An audit committee is a key part of corporate governance that typically oversees financial reporting, risk management, compliance, and the internal and external audit functions. It must be composed of independent directors, with at least one financial expert. The main responsibilities of an audit committee are to oversee the financial reporting process, internal controls, and the selection and independence of external auditors. Audit committees have evolved over time with various regulations and acts, such as the Sarbanes-Oxley Act of 2002, requiring their establishment and independence.