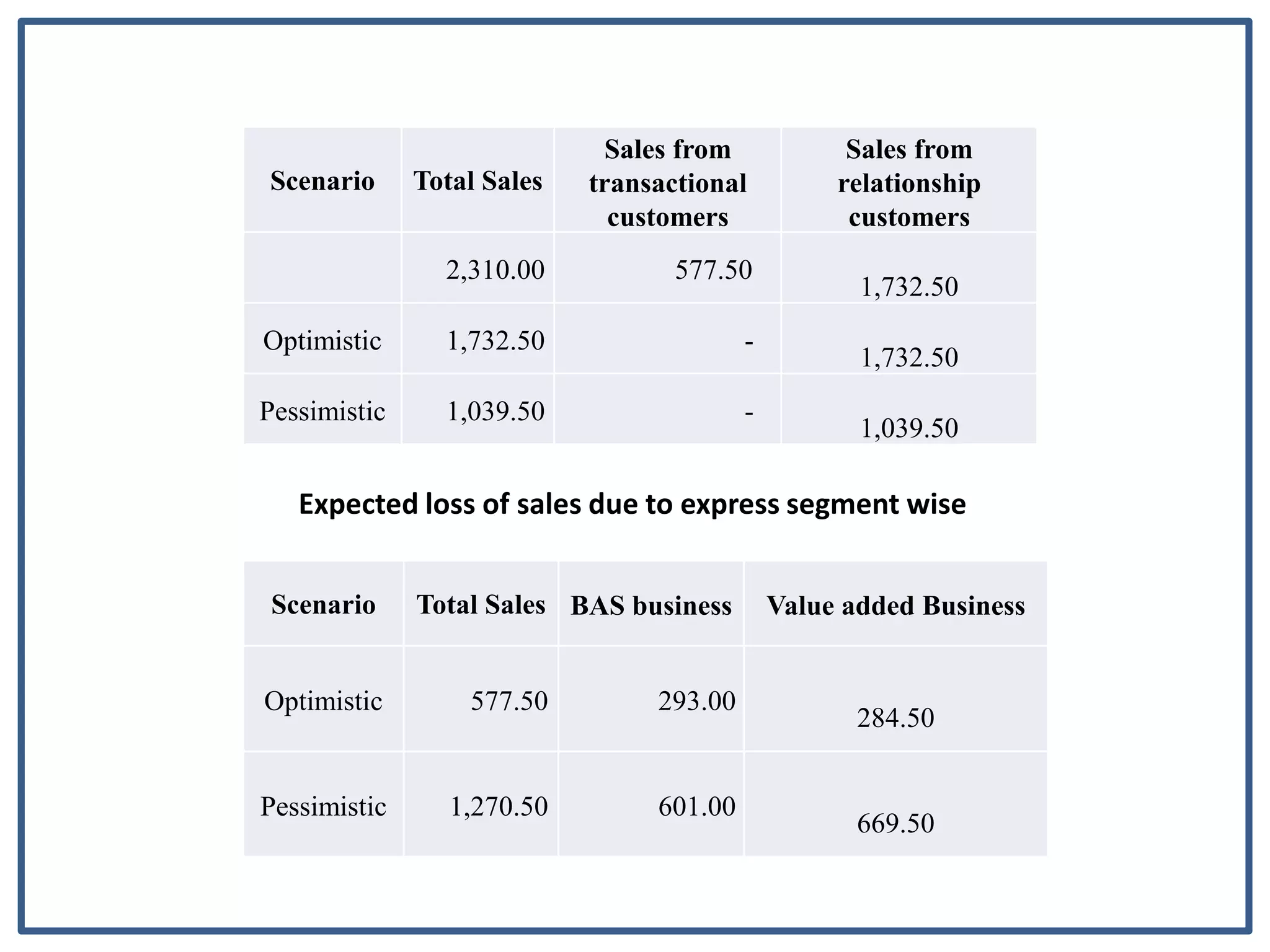

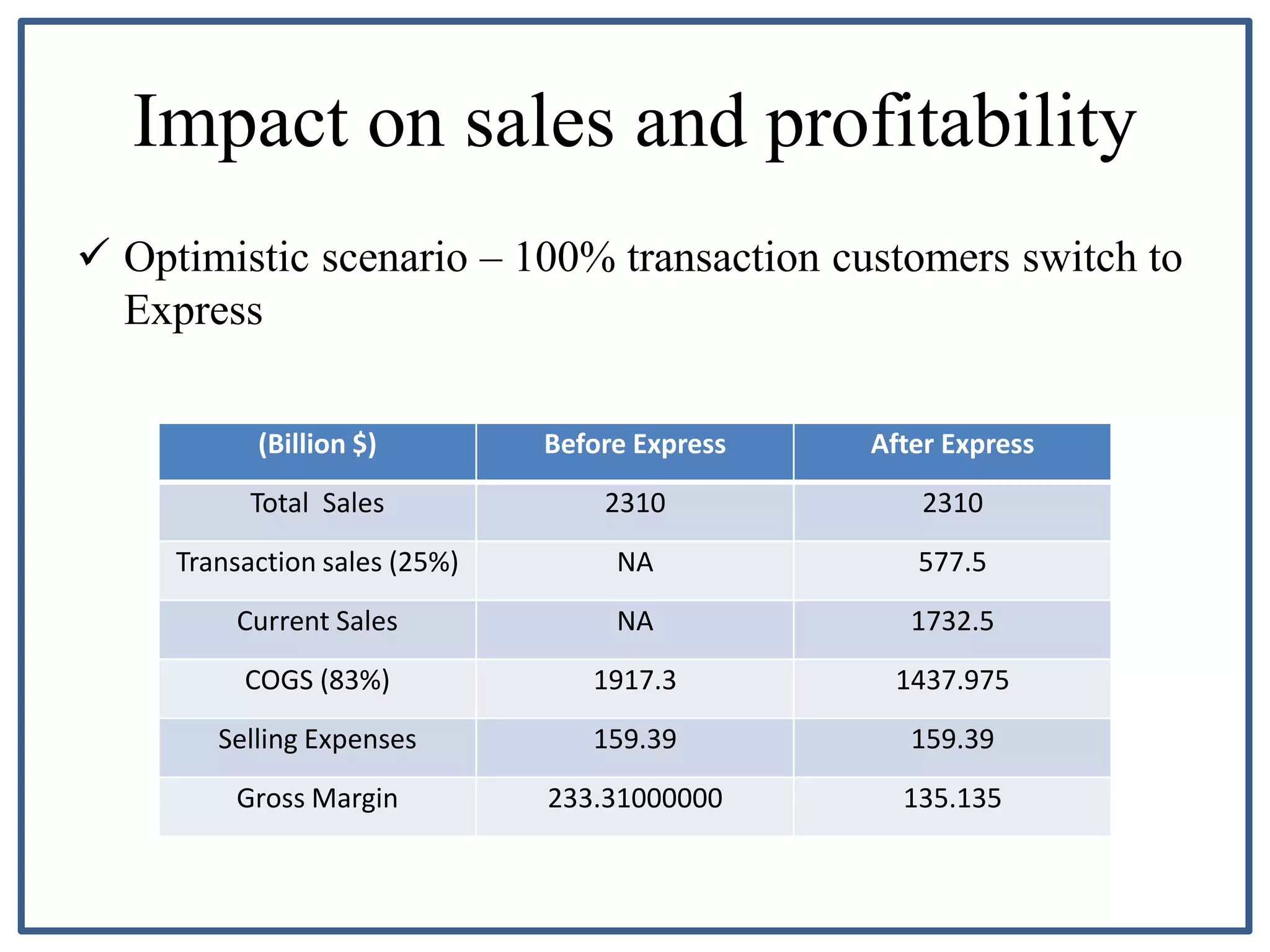

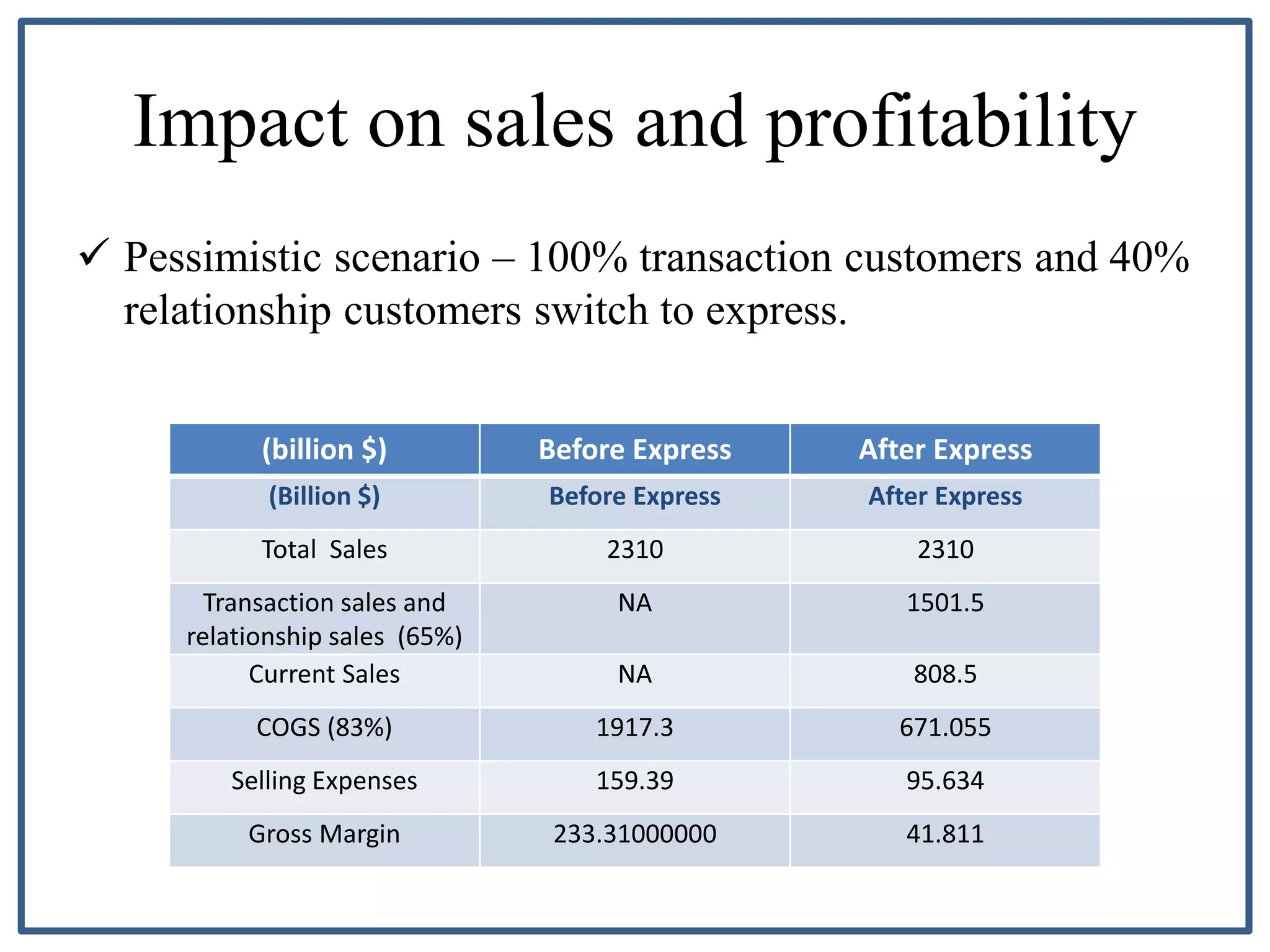

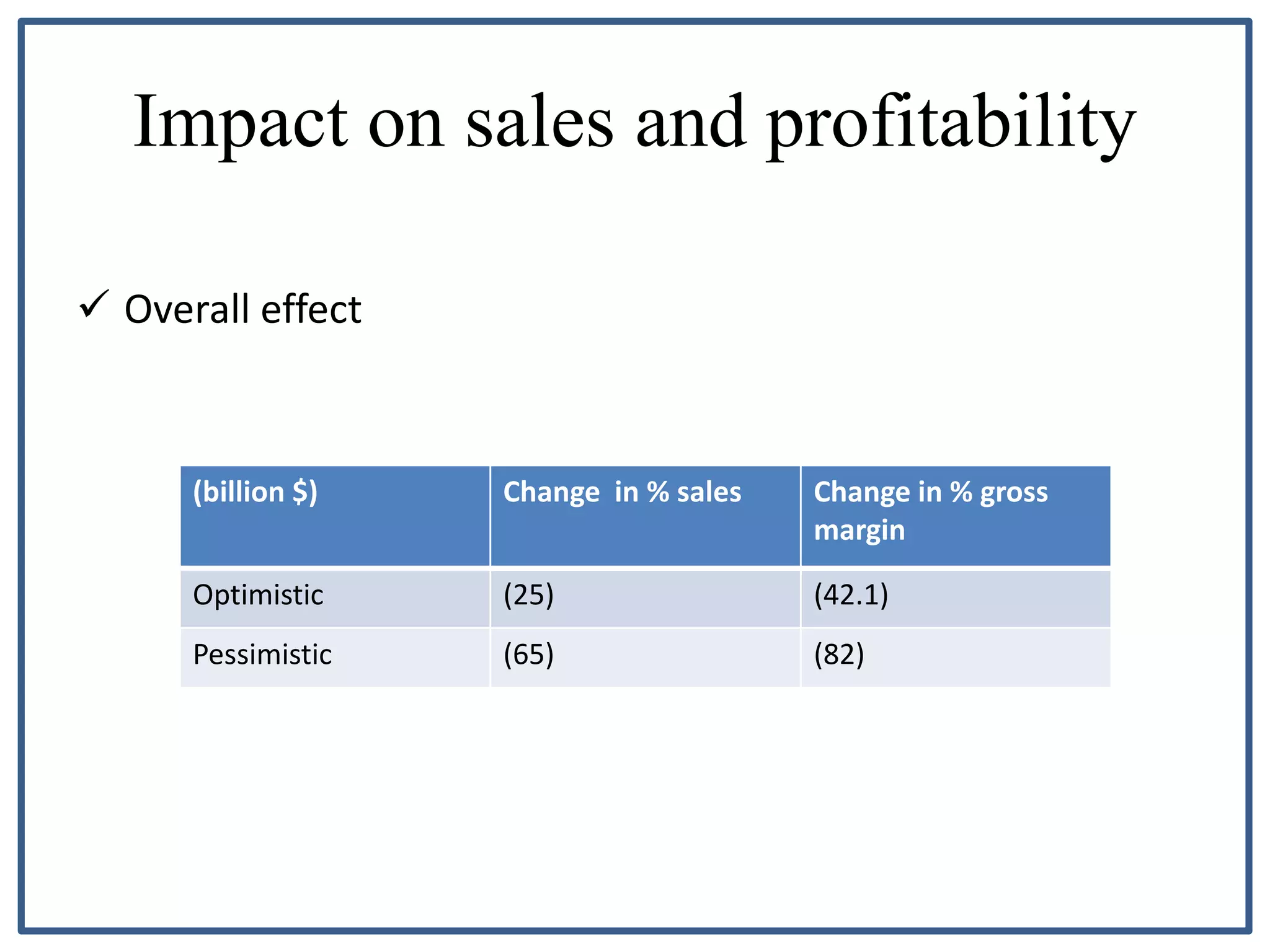

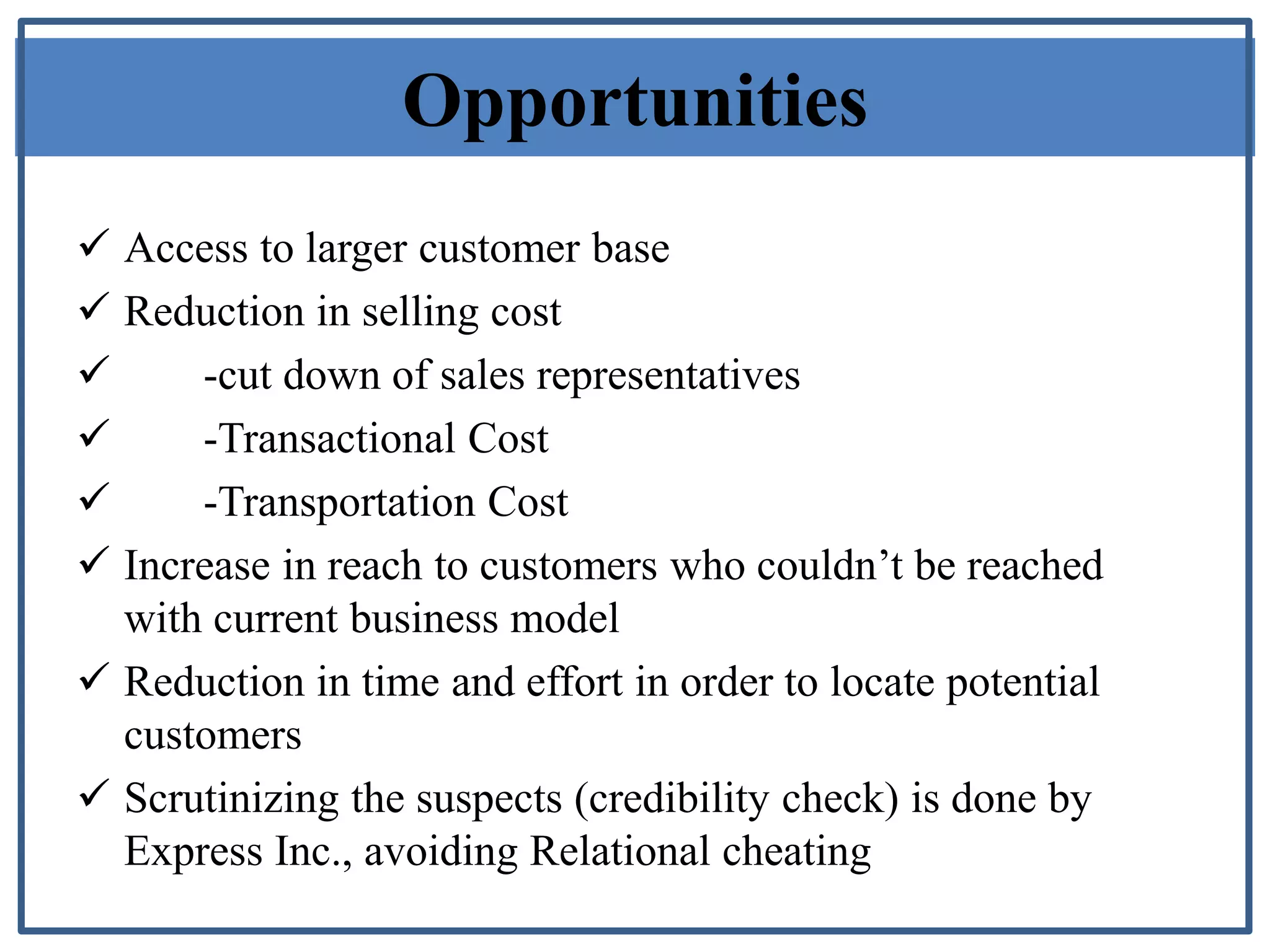

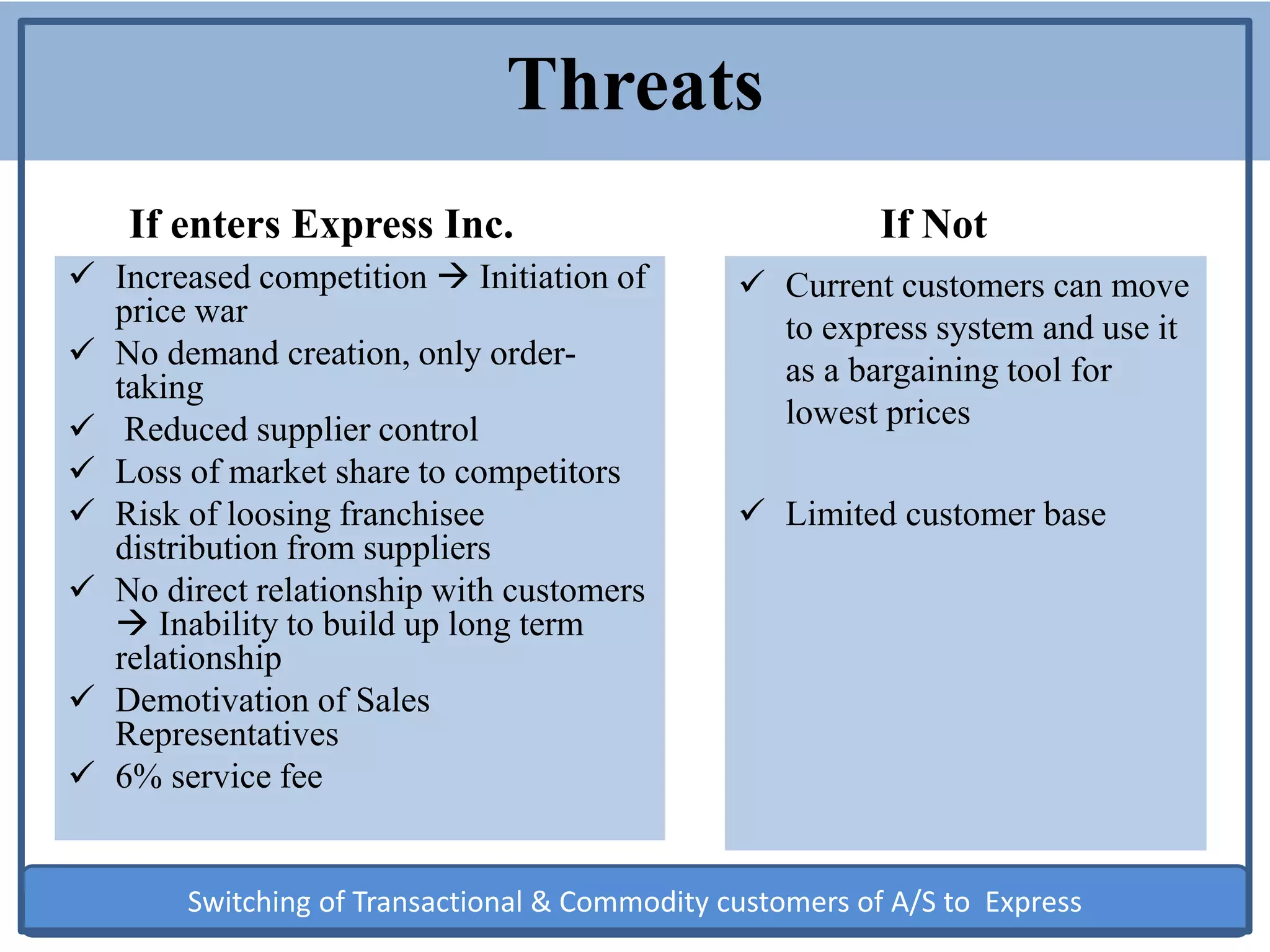

Transactional customers currently make up 25% of A/S's sales. Express could impact A/S in two scenarios: optimistic where all 25% of transactional customers switch to Express, and pessimistic where all transactional (25%) and some relationship (40%) customers switch. This would lead to declines in total sales of 42.1% in the optimistic scenario and 82% in the pessimistic scenario. A/S's suppliers may try to undercut A/S's margins by lowering prices for products on Express. However, suppliers would lose control over demand generation without A/S's sales team. Overall, Express poses more threats as a competitor than opportunities for A/S due to potential loss of customers