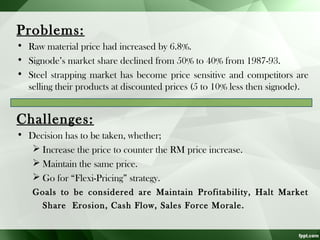

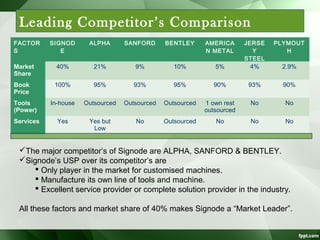

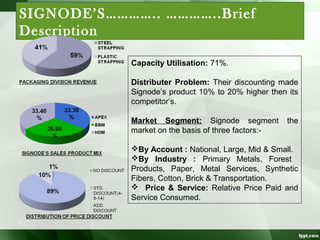

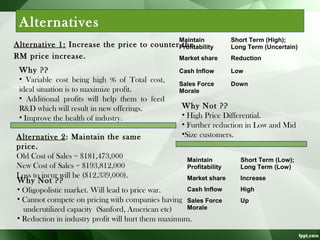

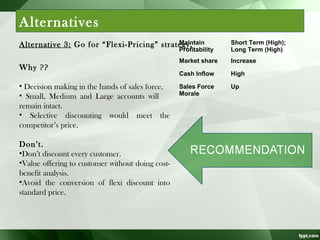

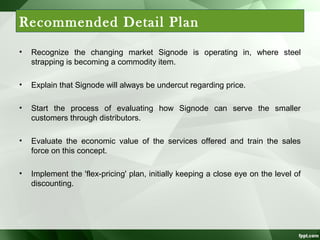

Signode Industries faces several problems including increased raw material prices and declining market share. It must decide whether to increase prices to offset costs, maintain prices, or implement a flex-pricing strategy. Maintaining prices would lead to losses while increasing prices could further reduce its market share against competitors offering discounts. A flex-pricing strategy allows selective discounting to meet competitors' prices while retaining large accounts. The recommended plan is to implement flex-pricing initially while monitoring discount levels and shifting focus to the value of Signode's services as steel strapping becomes a commodity.