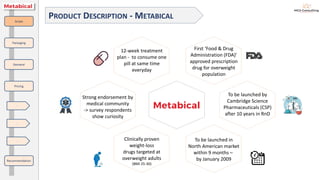

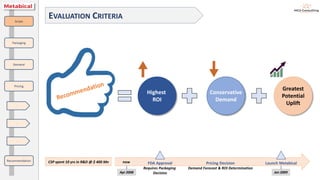

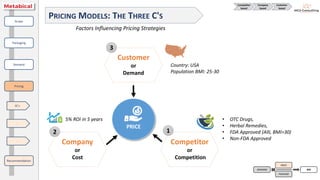

CSP is considering options for pricing, packaging, and demand forecasting for its new weight-loss drug Metabical. Three demand forecasting models were analyzed estimating the potential market between 4.3-9.8 million customers. Packaging and pricing strategies were evaluated using a matrix to determine ROI under different scenarios. Pricing at $150 targeting the ideal customer profile was estimated to achieve a 5.73% ROI, meeting CSP's objective.