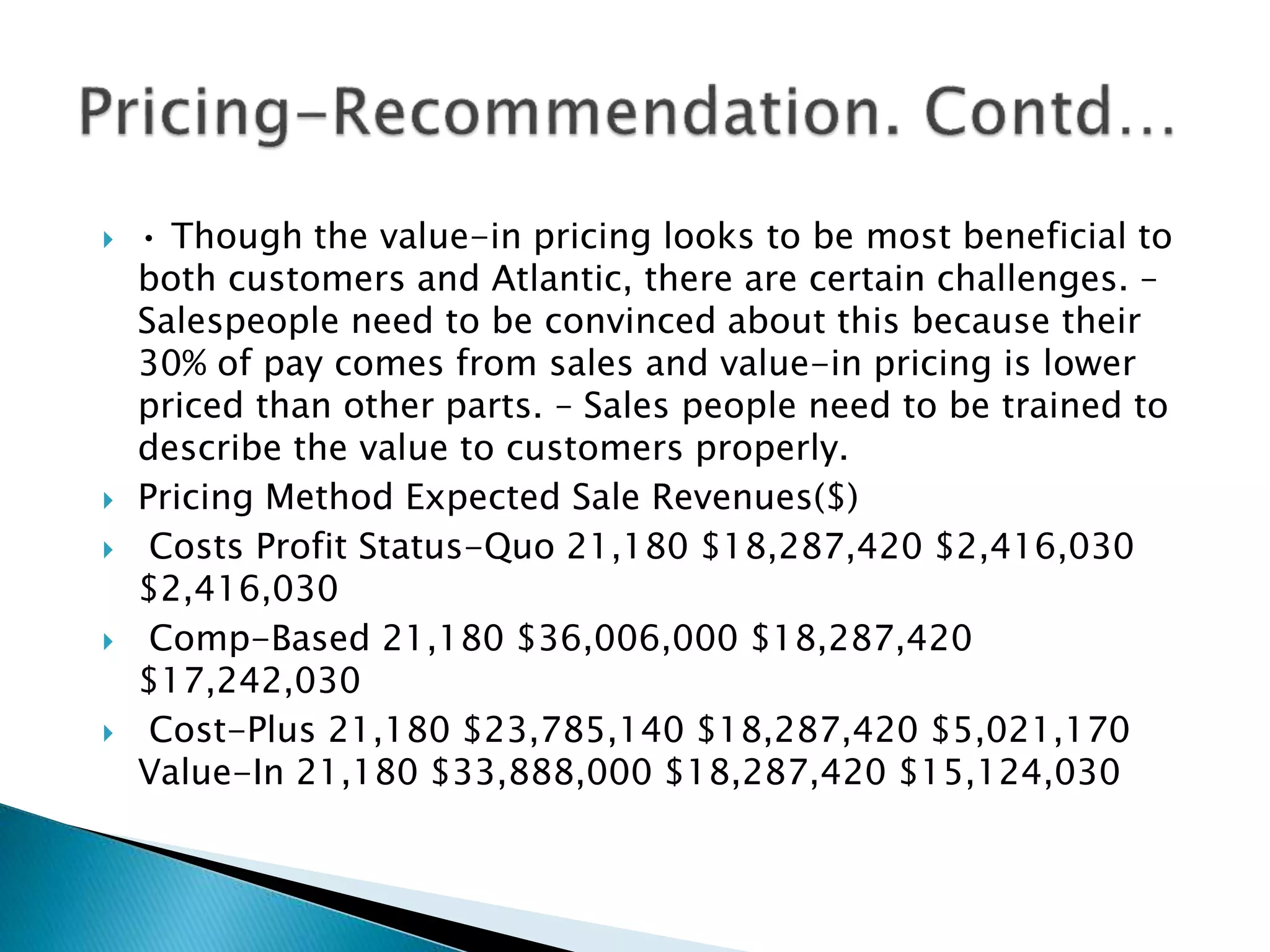

Atlantic Computers is a server manufacturer with a 20% share in the high-performance market, but it is entering the growing basic server market with its new Tronn server and PESA software. The company is evaluating pricing strategies, including maintaining the status quo, competition-based pricing, cost-plus pricing, and value-in-use pricing, with a recommendation to adopt value-in pricing due to its potential to demonstrate greater customer value. There are challenges such as ensuring salespeople can effectively communicate this strategy, given that their commissions are tied to sales volume.