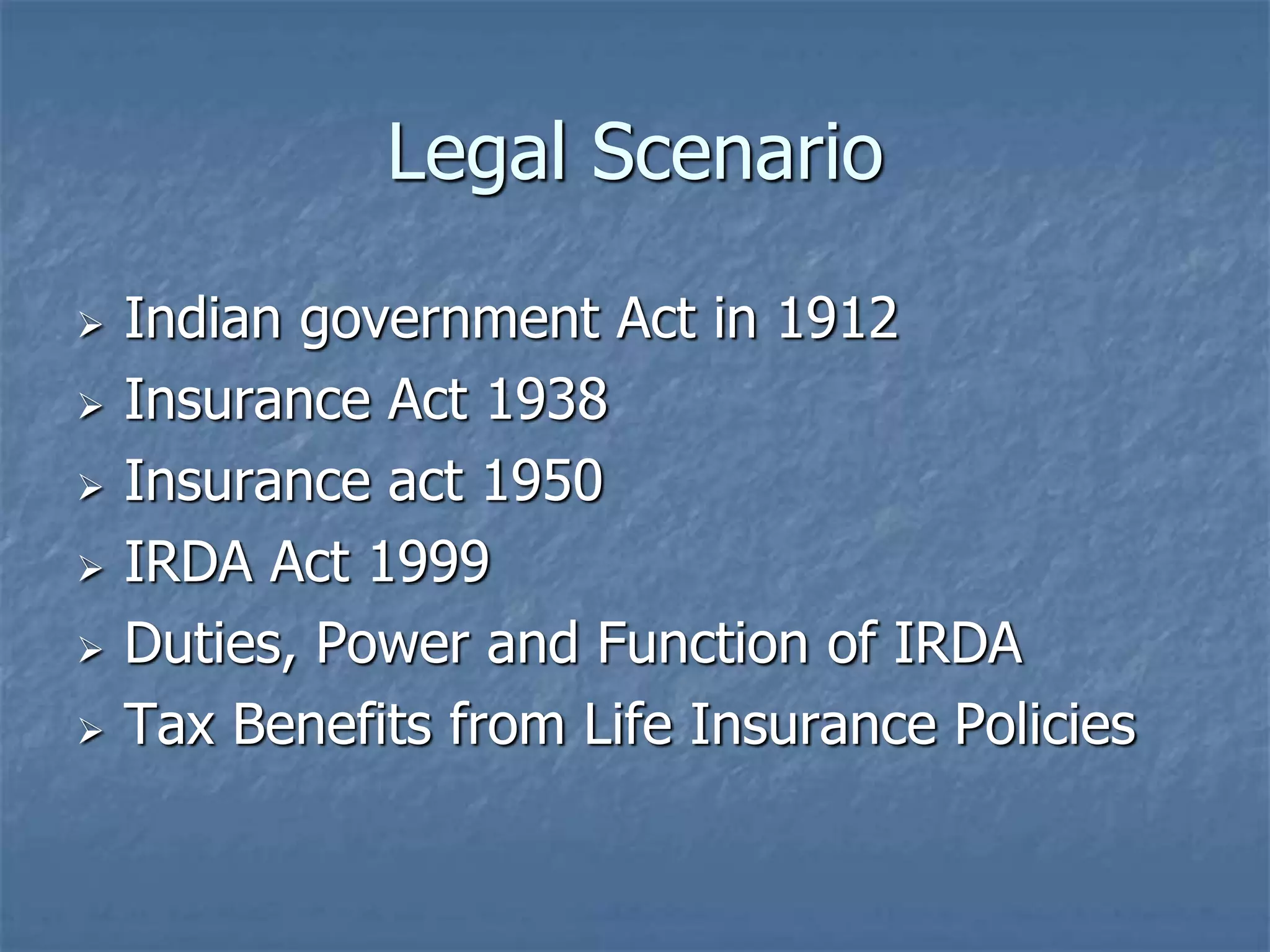

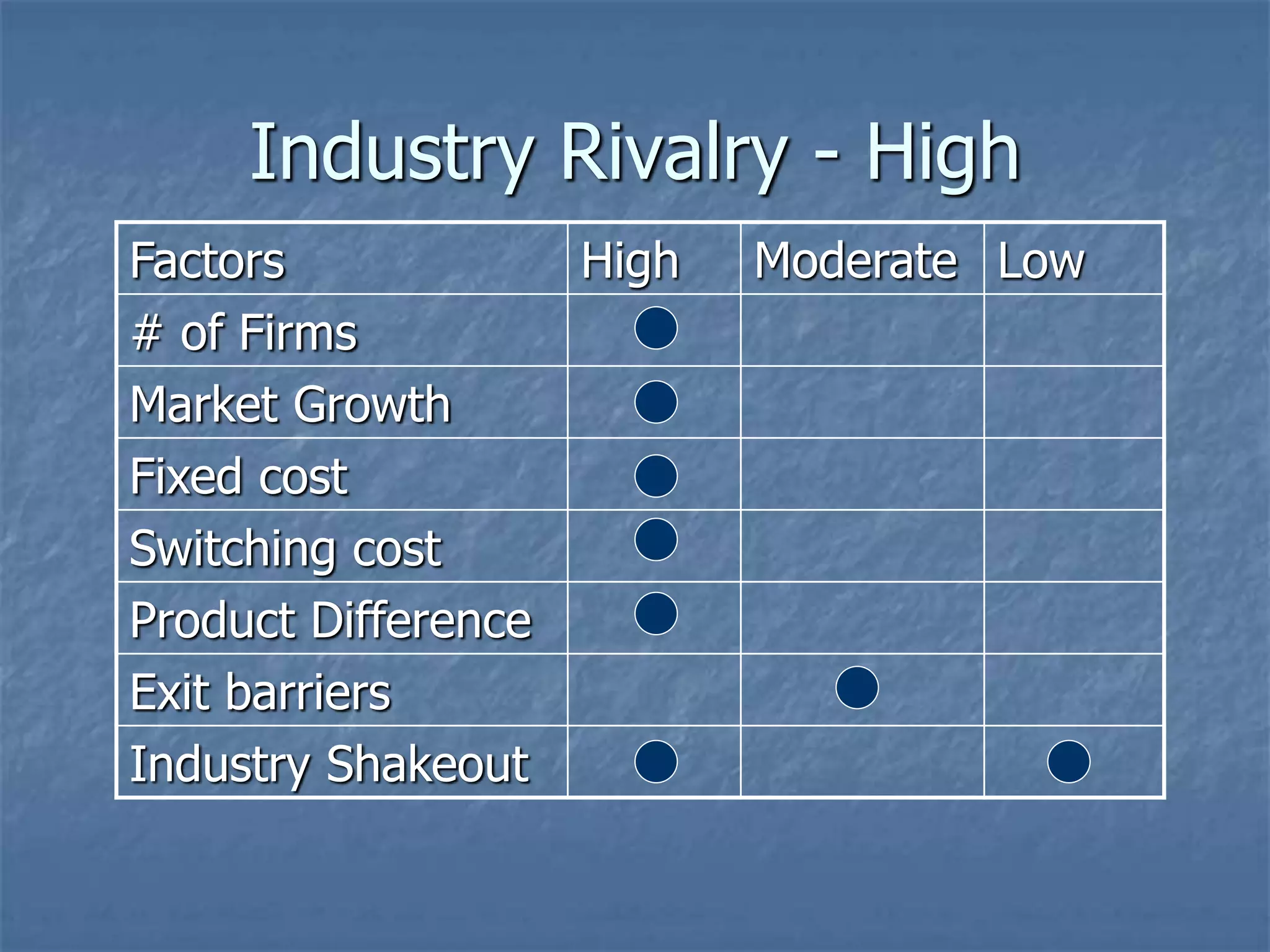

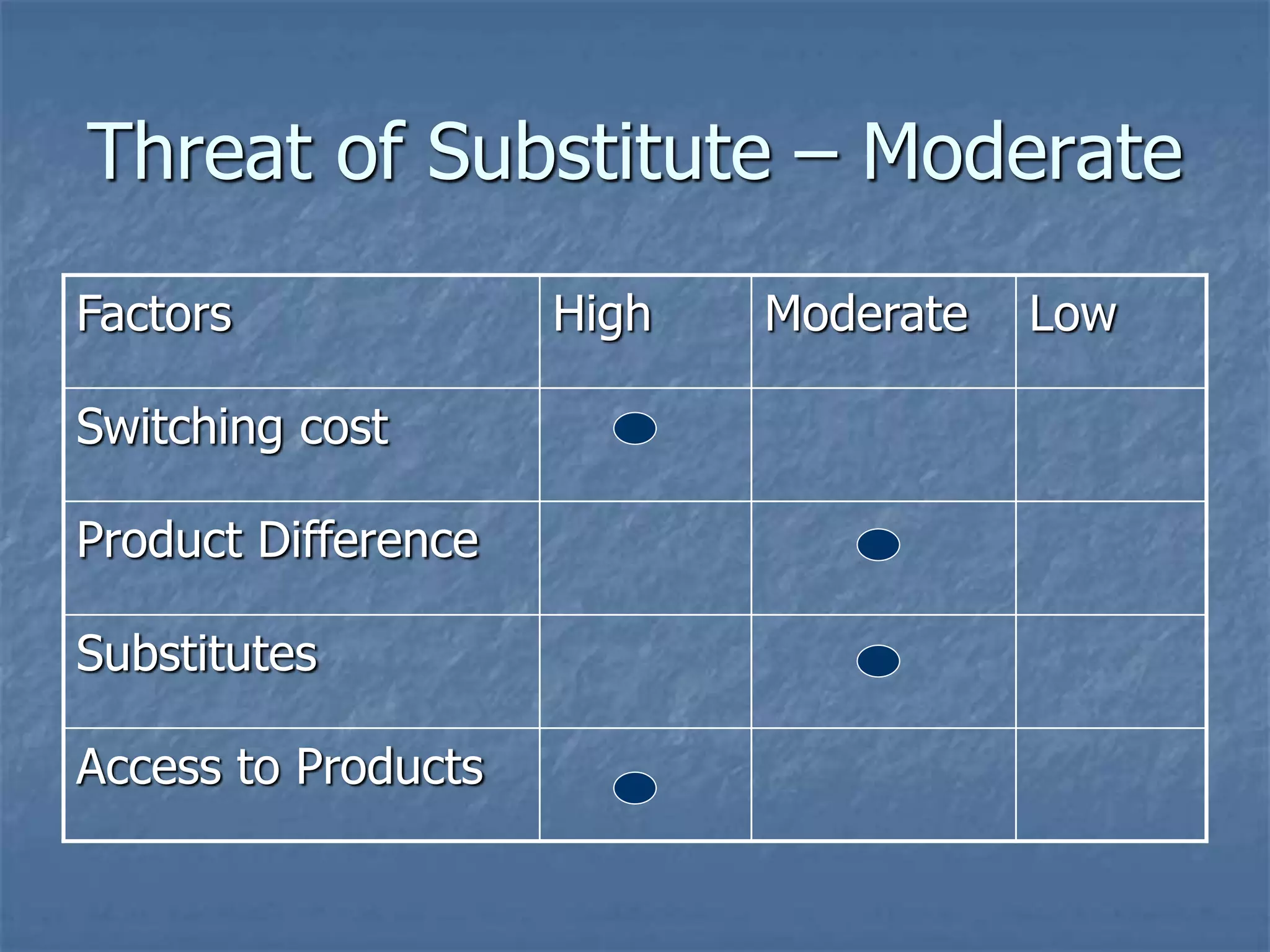

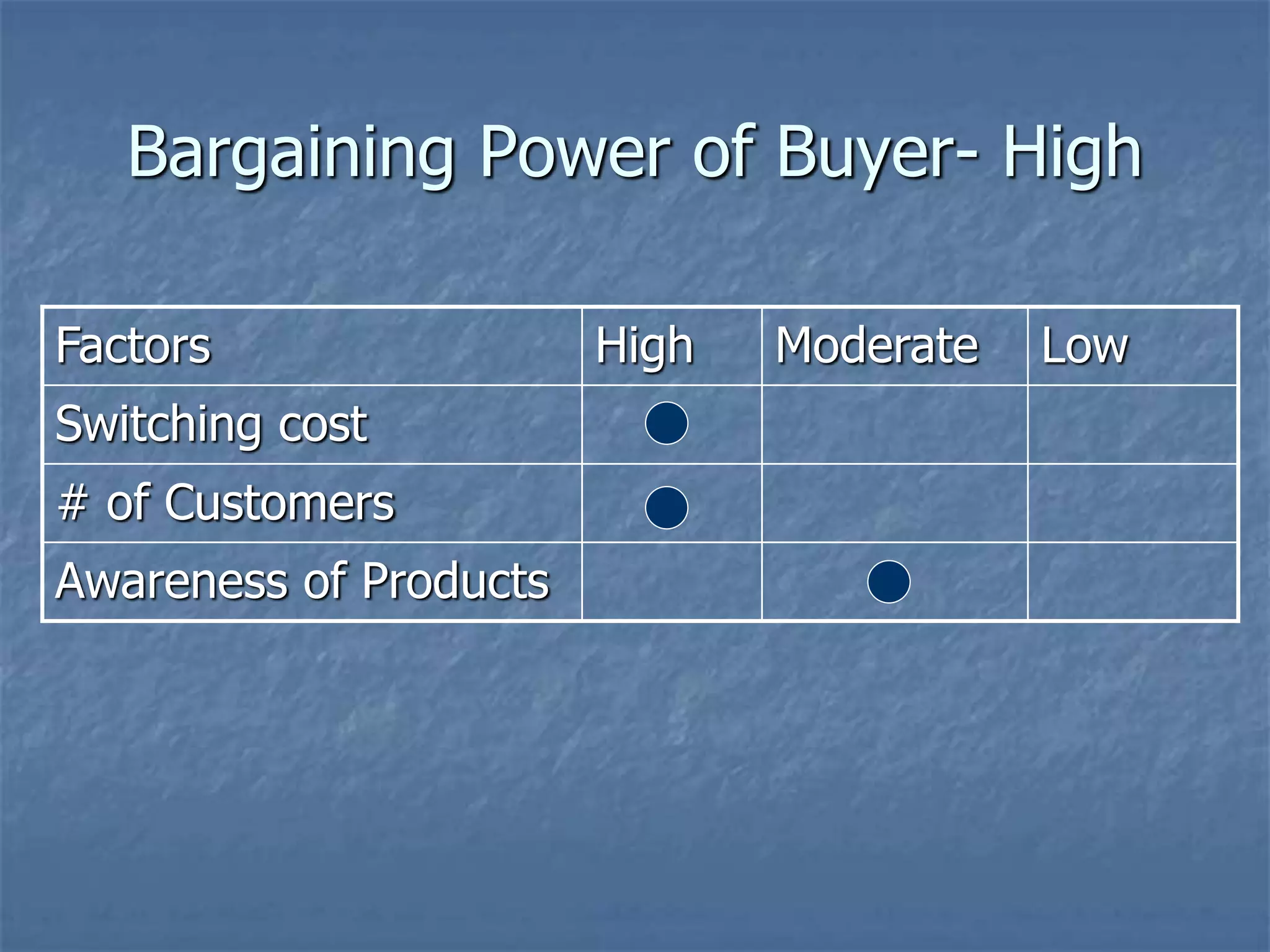

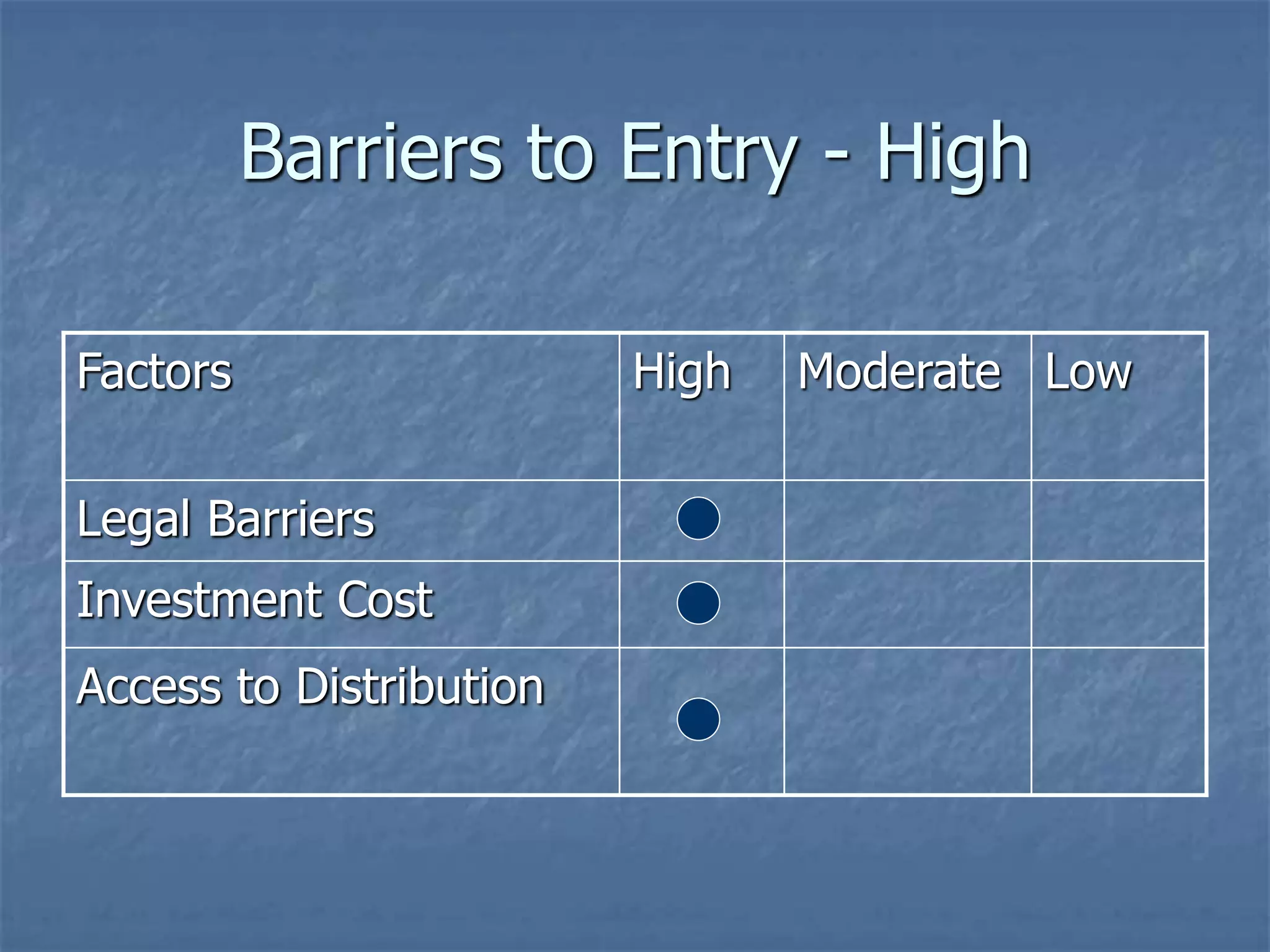

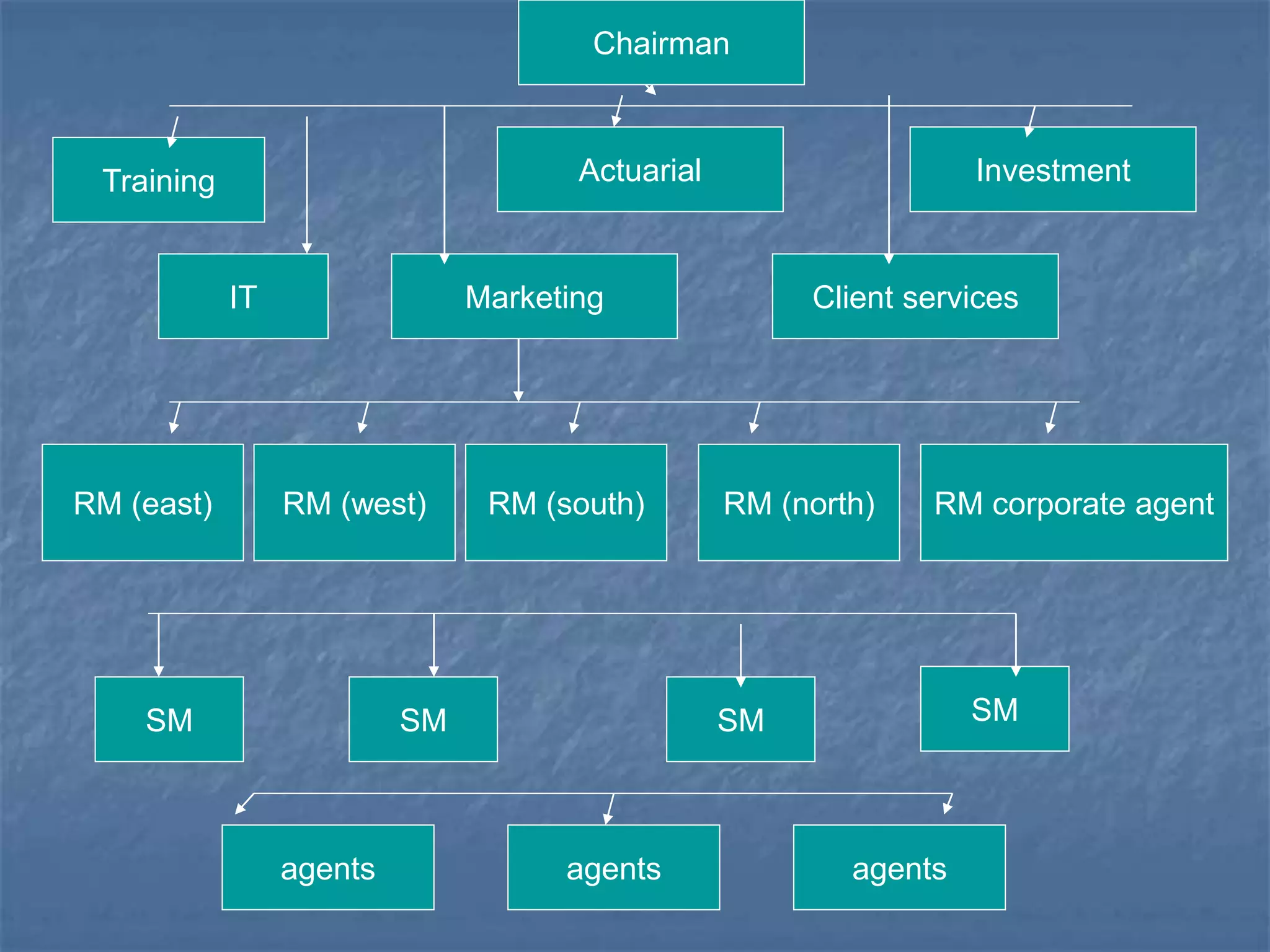

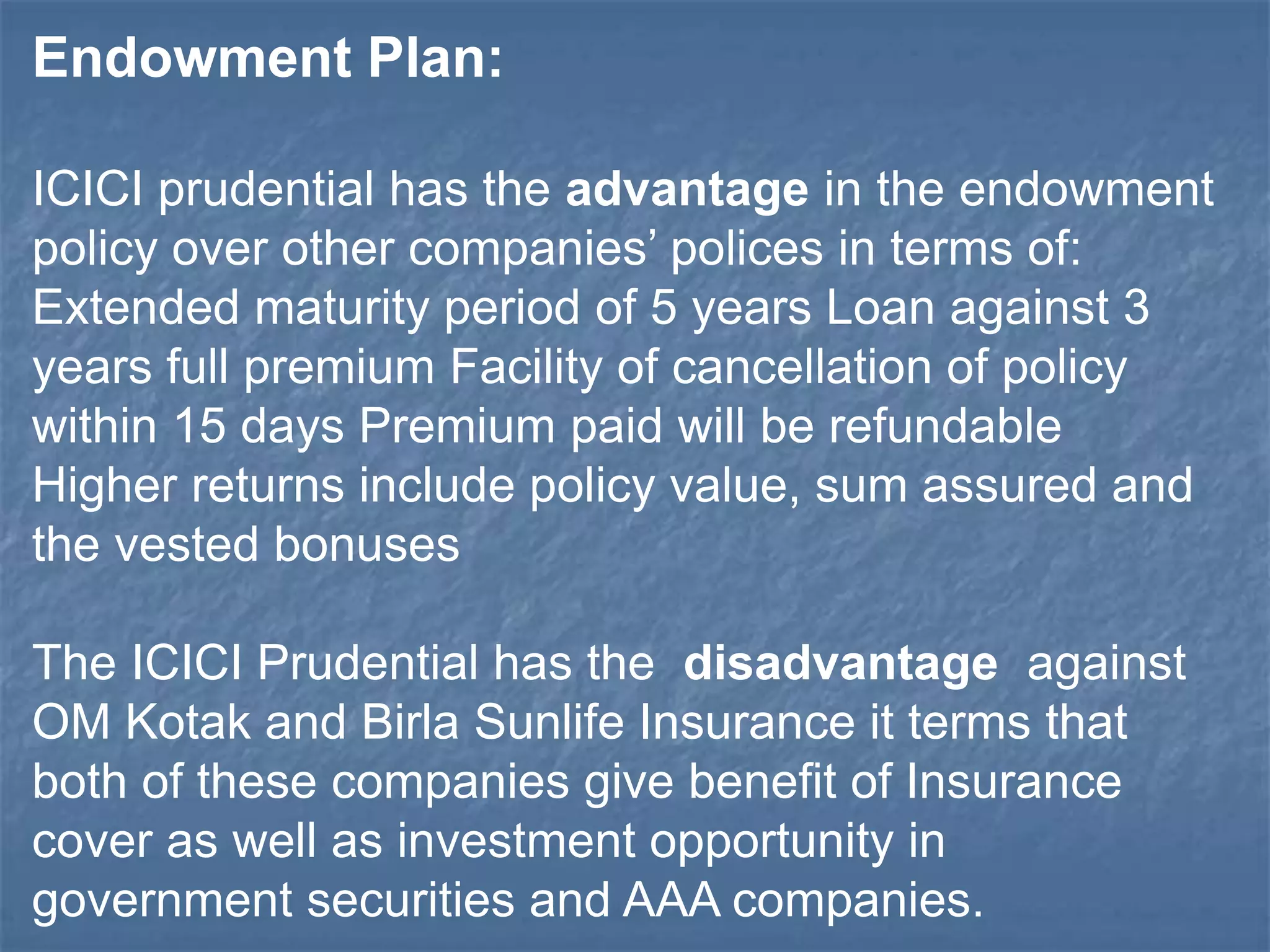

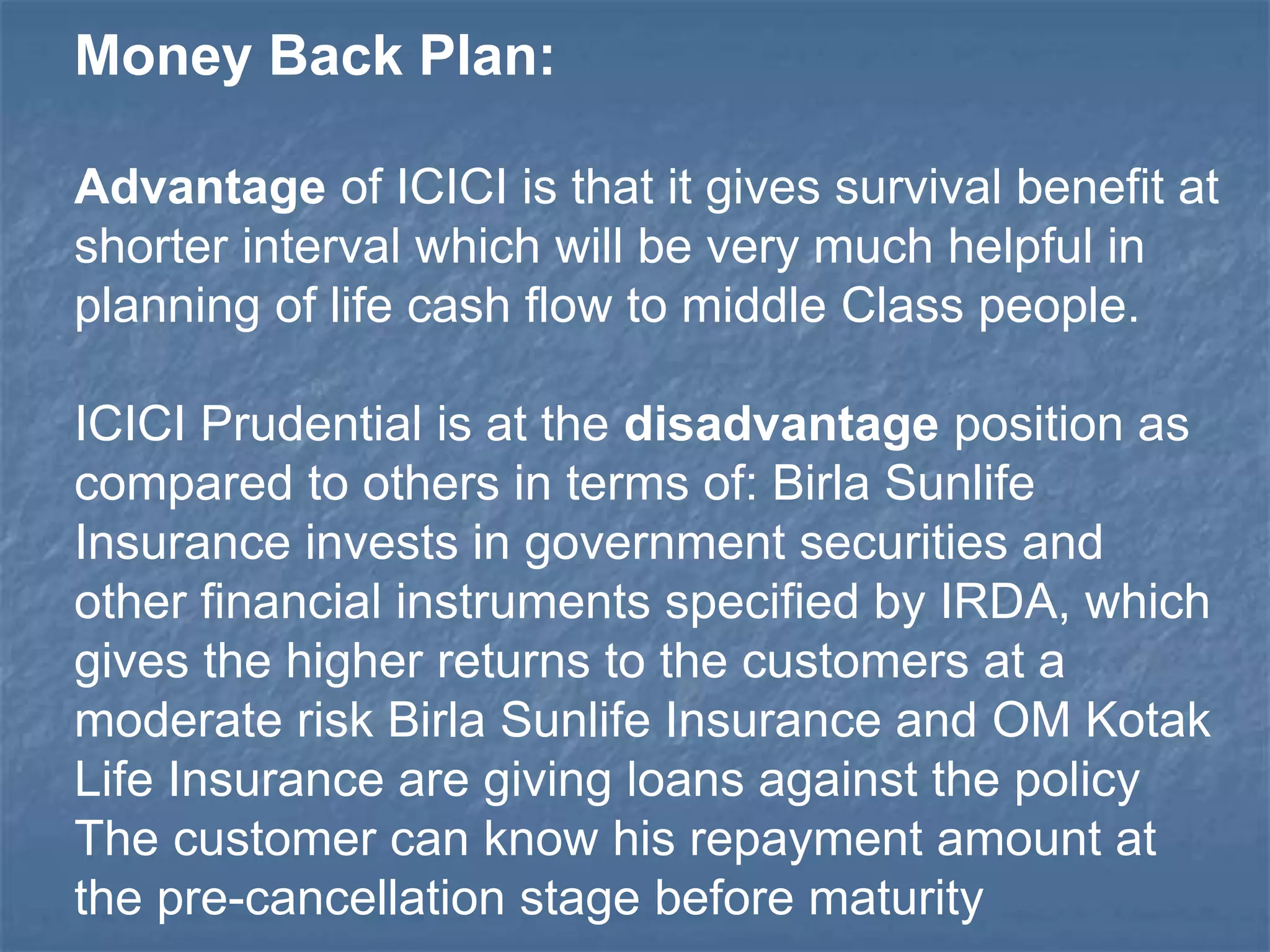

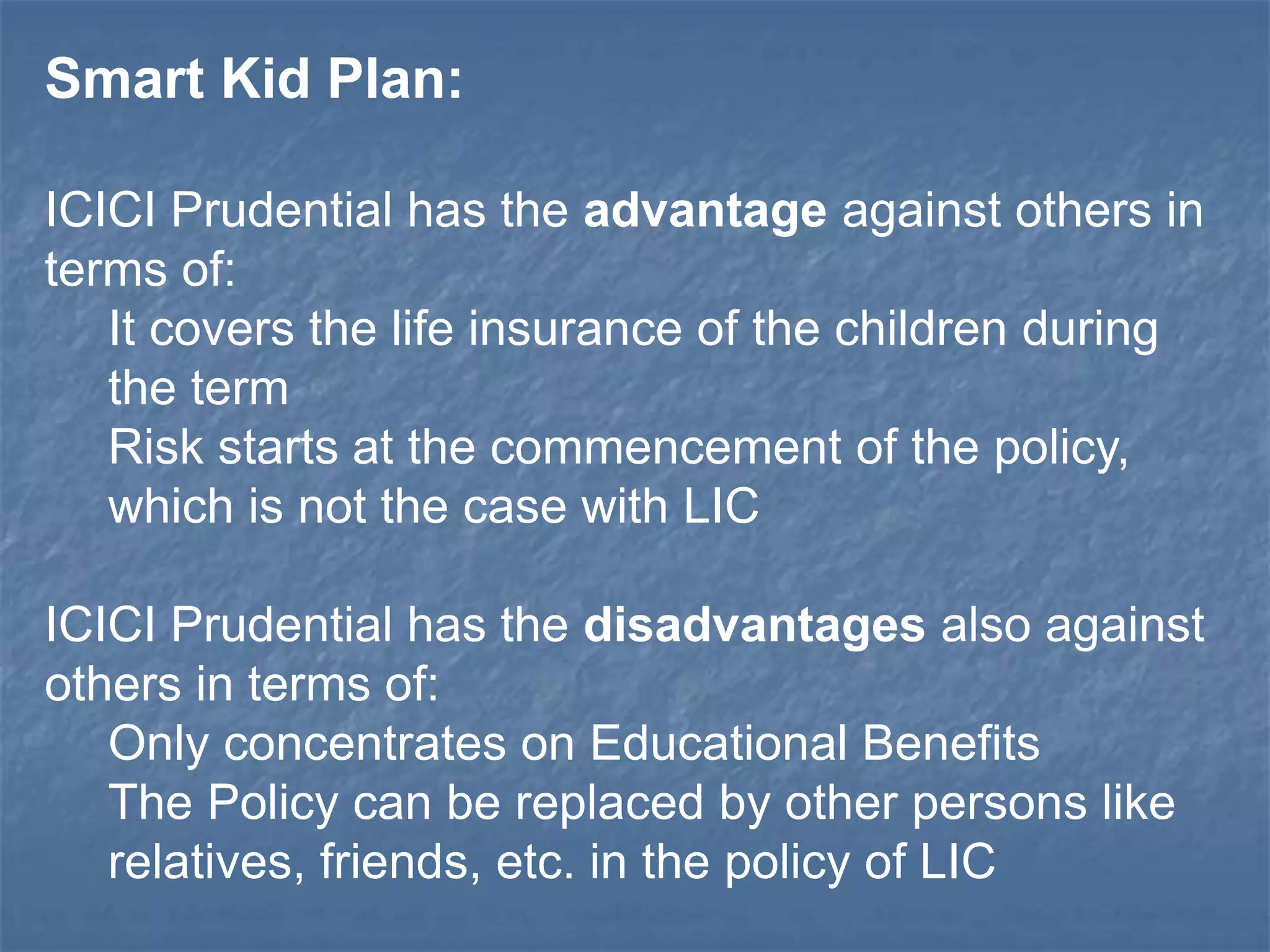

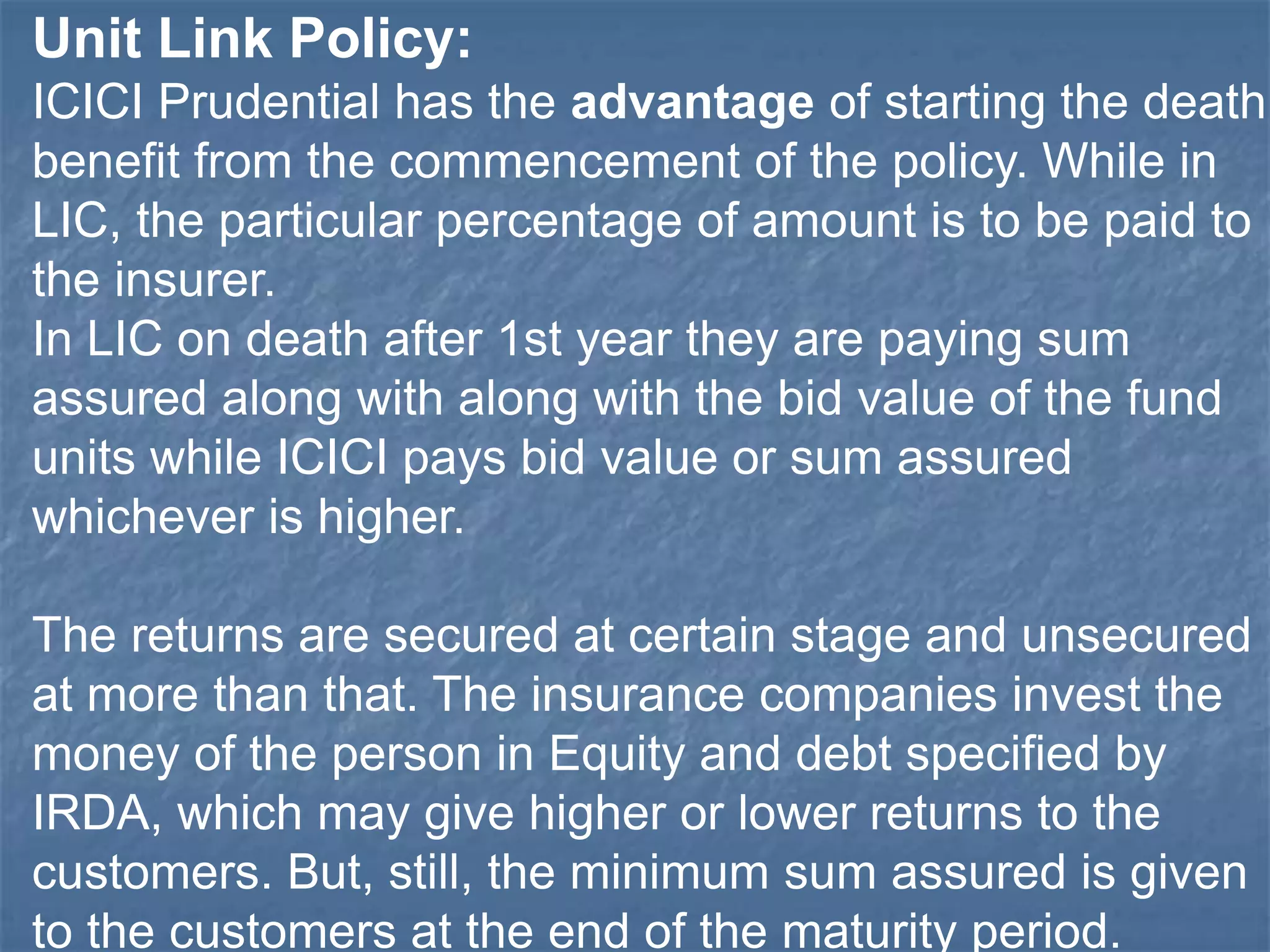

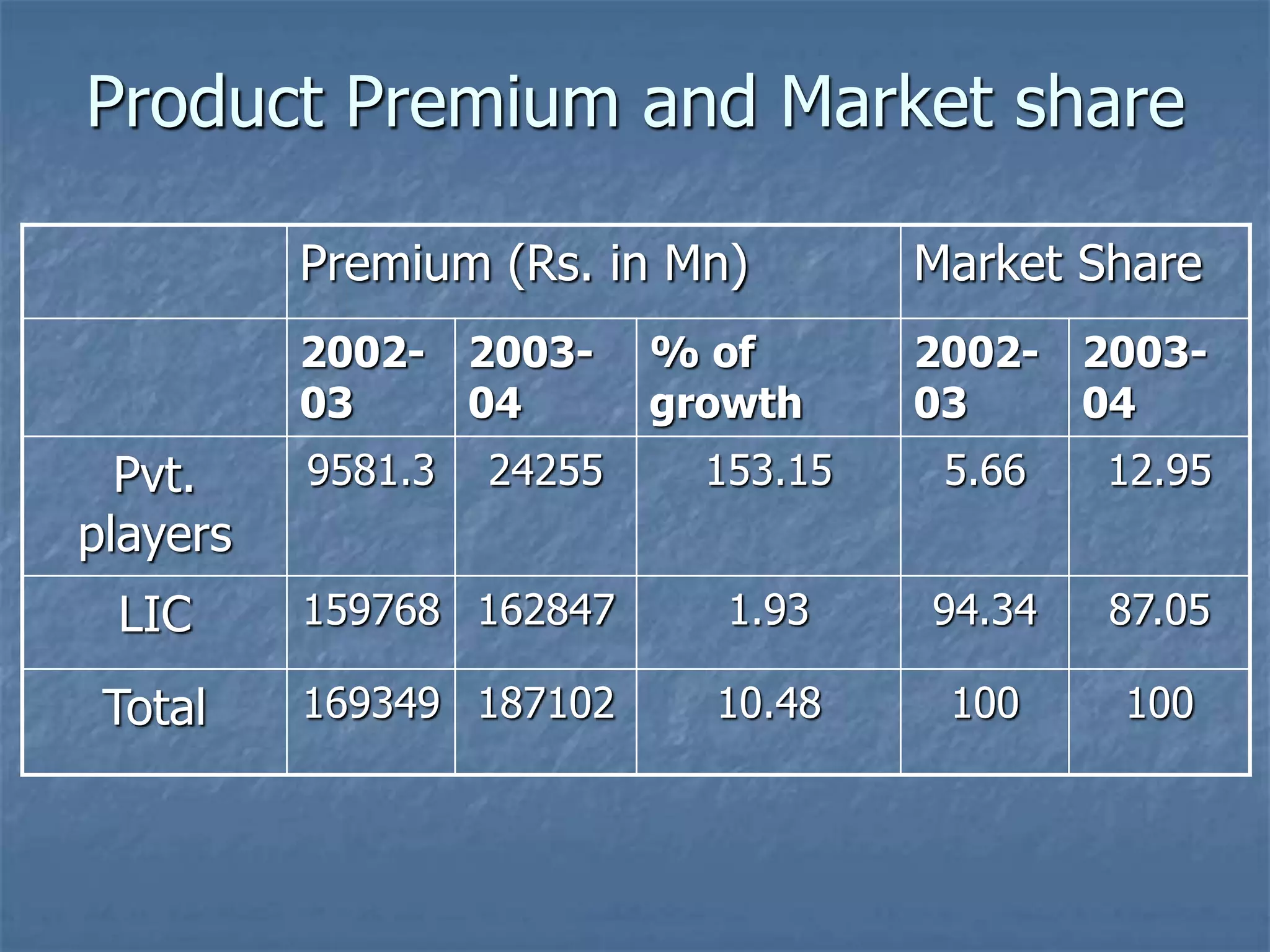

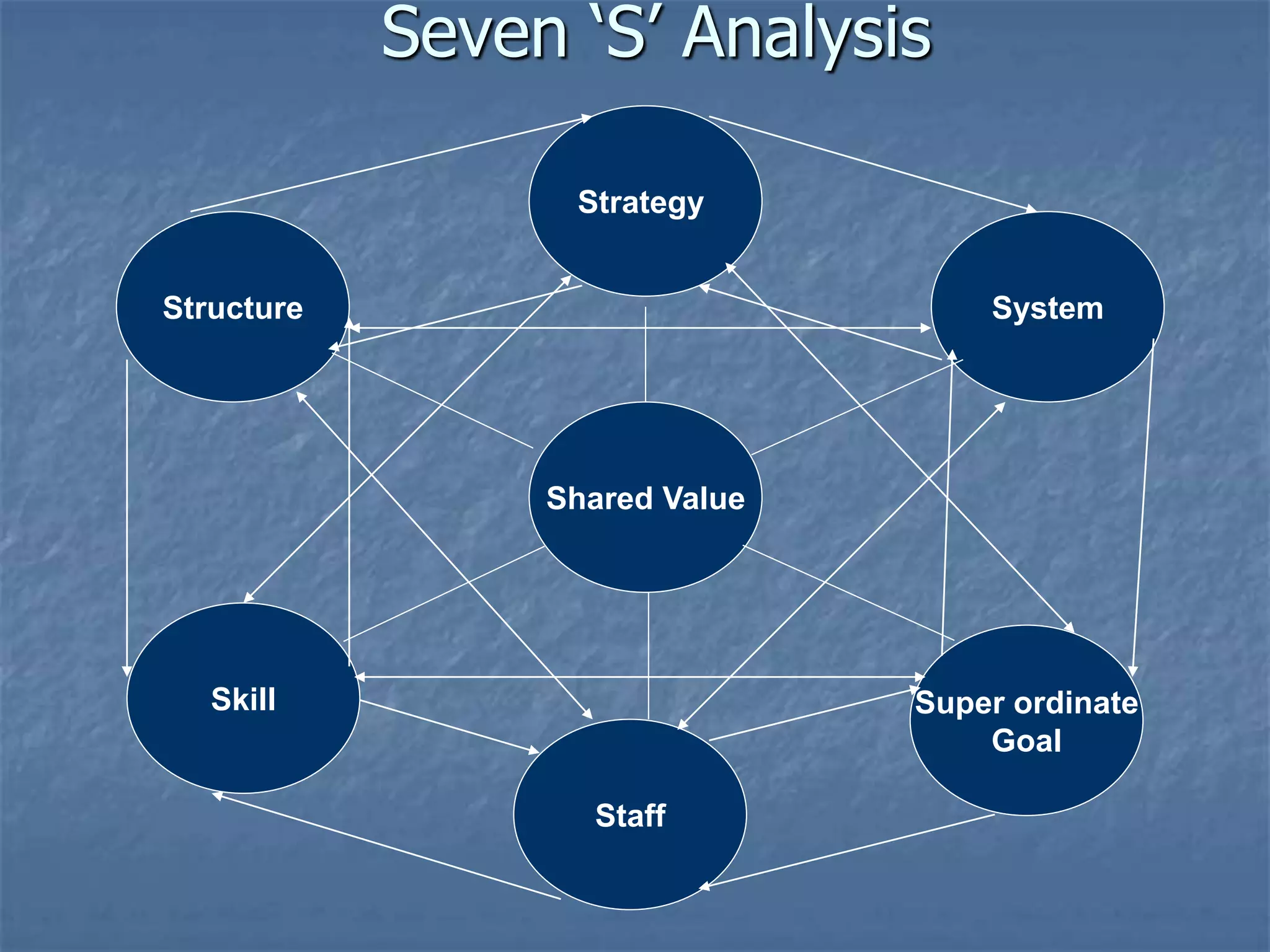

The document provides a strategic analysis and SWOT examination of ICICI Prudential Life Insurance, detailing the life insurance industry's context, historical growth, regulatory environment, and competitive landscape in India. It outlines various aspects of ICICI Prudential's insurance processes, products, and market positioning compared to competitors while highlighting the company's strengths, weaknesses, opportunities, and threats. The conclusion discusses strategies for corporate growth and market expansion for ICICI Prudential within the insurance sector.